Discussion

of Issues

Issue 1:

Should the Commission approve DEF’s calculation of

the tax savings associated with the IRA for 2023?

Recommendation:

Yes. The Commission should approve DEF’s

calculations of the net tax savings of $56 million for 2023 resulting from the

Company’s election to use Production Tax Credits (PTCs) instead of Investment

Tax Credits (ITCs) as allowed by the IRA. (Cicchetti)

Staff Analysis:

Effective January 1, 2022, the IRA expanded federal

income tax benefits for renewable energy by allowing owners of solar projects

which begin construction before 2025 the option to elect to receive PTCs

instead of ITCs. DEF has elected to use PTCs instead of ITCs because it

provides a greater tax benefit and greater customer savings. The application of

PTCs to DEF’s solar facilities results in net tax savings of $56 million. The

net tax savings is comprised of $34.7 million from the generation of PTCs, $7.0

million from the net change in DEF’s weighted average cost of capital (WACC)

due to replacing ITCs with PTCs, and $14.3 million from applying the revenue

expansion factor.

There are two adjustments to DEF’s WACC as a result of

replacing the ITCs with PTCs: 1) the removal of the ITCs and 2) the addition of

a deferred tax asset (DTA). DEF has proposed to flow back the full value of

PTCs generated in 2023 but will not have sufficient income to be able to use

these credits to reduce its taxes payable until sometime in the future,

currently estimated to be no sooner than 2027.

Consequently, DEF has recorded a DTA in the amount of the 13-month

average balance of the accumulated PTCs. Staff reviewed DEF’s calculations in

the direct testimony of Witness Olivier filed on October 17, 2022, in the

instant docket, and believes they are reasonable and appropriate. Based on the

aforementioned, staff recommends the Commission approve DEF’s calculations of

net tax savings of $56 million for 2023 resulting from the Company’s election

to use PTCs instead of ITCs as allowed by the IRA.

Issue 2:

Should the Commission approve DEF’s proposed process

for flowing the tax reform impacts to DEF's customers?

Recommendation:

Yes. Staff recommends the Commission approve a base

rate reduction of $56 million starting with the first billing cycle of January

2023 and allow DEF to credit customers for the actual 2022 tax savings impact

in the next Capacity Cost Recovery (CCR) Clause filing (expected in March 2023).

(Cicchetti)

Staff Analysis:

As discussed in Issue 1, DEF’s application of PTCs

has reduced its 2023 jurisdictional adjusted revenue requirement by $56

million. Pursuant to Paragraph 18(b) of the 2021 Settlement, DEF is obligated

to adjust base rates within 120 days of the latter of the enactment date or

effective date of a change in tax law. The IRA was effective August 16, 2022,

and December 16, 2022 is 120 days from the effective date. DEF proposes to

adjust base rates with the first billing cycle for January 2023 so that the tax

savings base rate change will be effective with the first billing cycle of the

month and to align the tax savings base rate change with other changes that

will be occurring January 2023. The PTC change in the IRA is retroactive to

January 1, 2022. Consequently, DEF proposes to credit customers for the actual

2022 tax savings in its next CCR filing (expected in March 2023). This is

consistent with Paragraph 18(b) of the 2021 Settlement which states:

Any effects of tax reform on retail revenue

requirements from the effective date through the date of the base rate

adjustment shall be flowed back or collected from customers through the CCR

Clause on the same basis used in any rate adjustment.

Staff has reviewed the Company’s calculation of the net

tax savings from the IRA and recommends the Commission approve a base rate

reduction of $56 million starting with the first billing cycle of January 2023

and allow DEF to credit customers for the actual 2022 tax savings impact in the

next Capacity Cost Recovery (CCR) Clause filing (expected in March 2023).

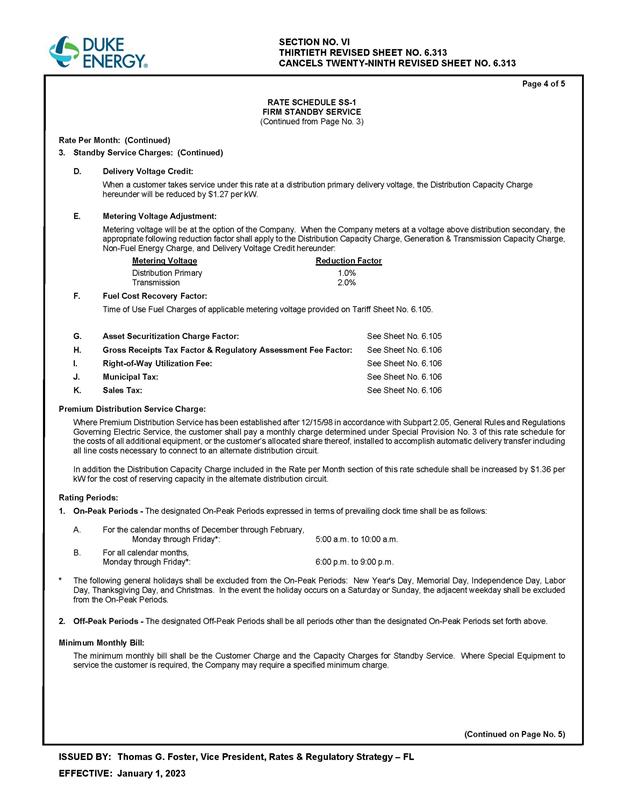

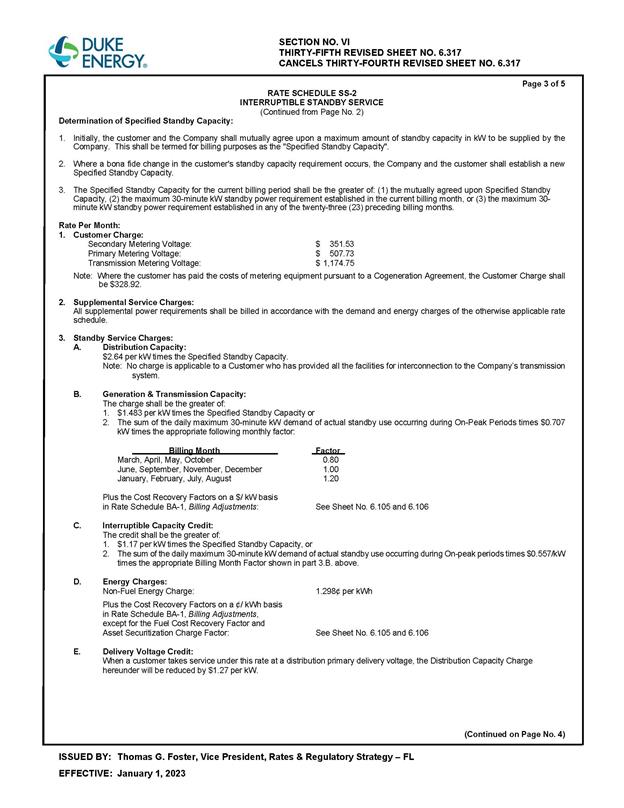

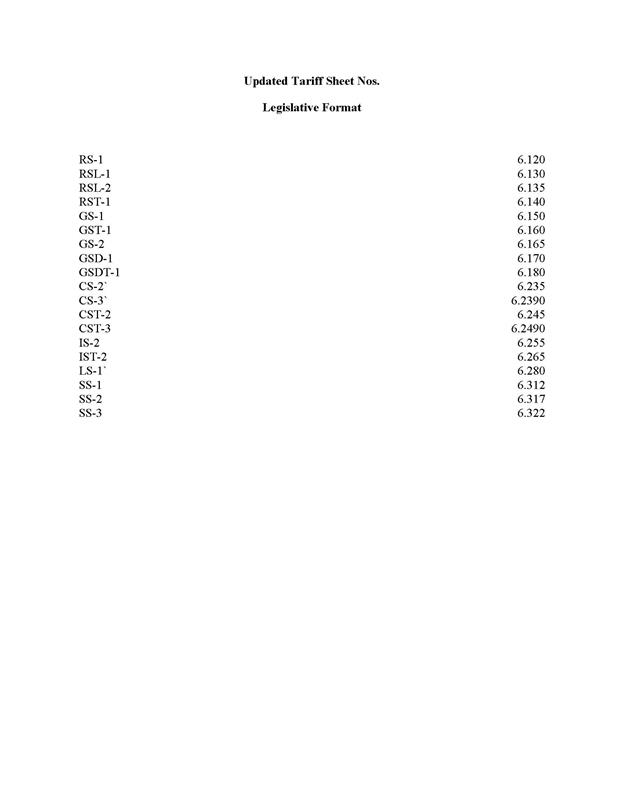

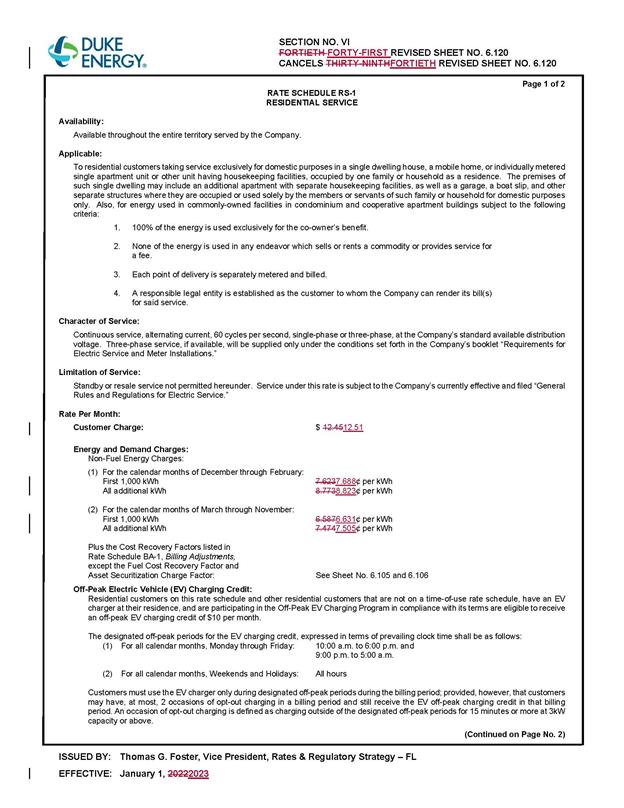

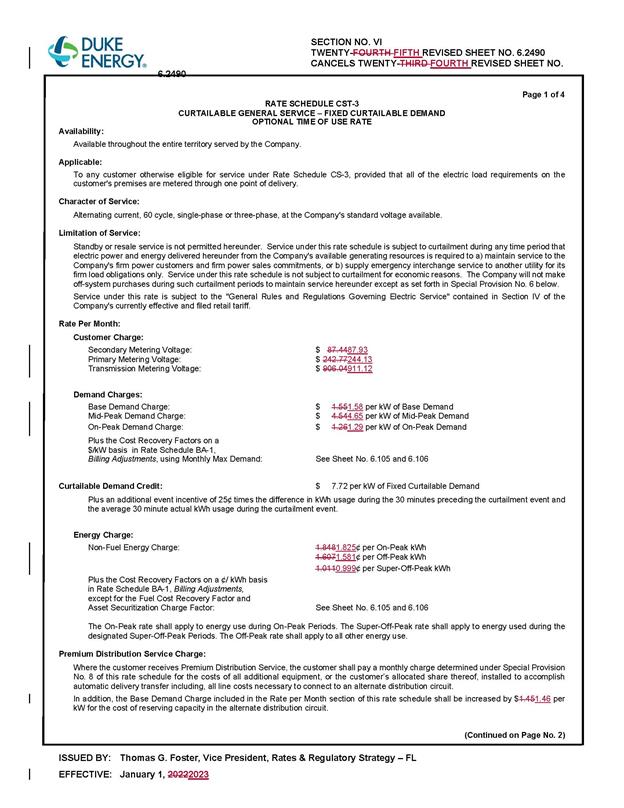

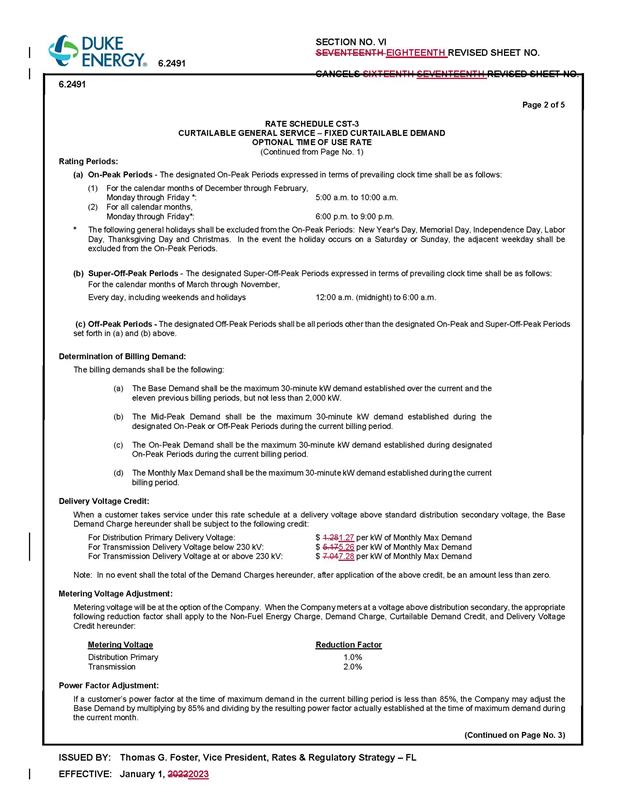

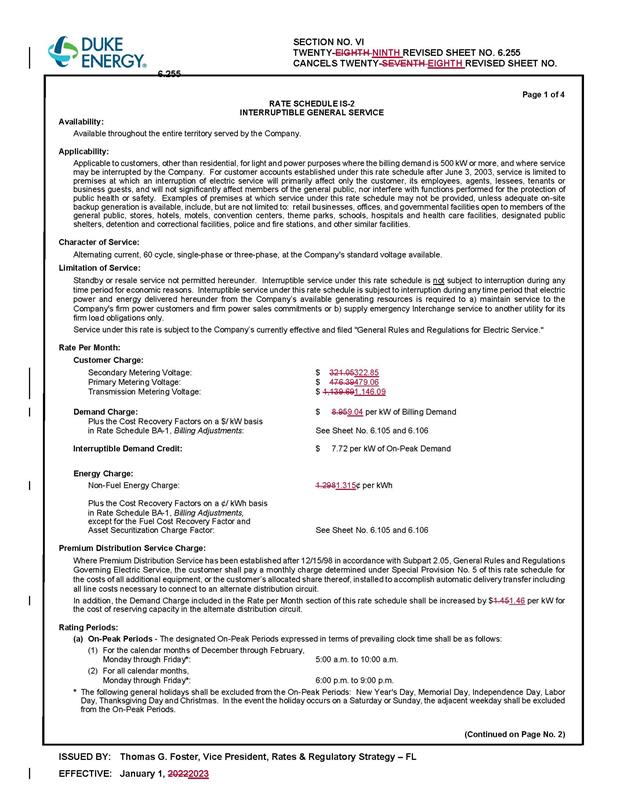

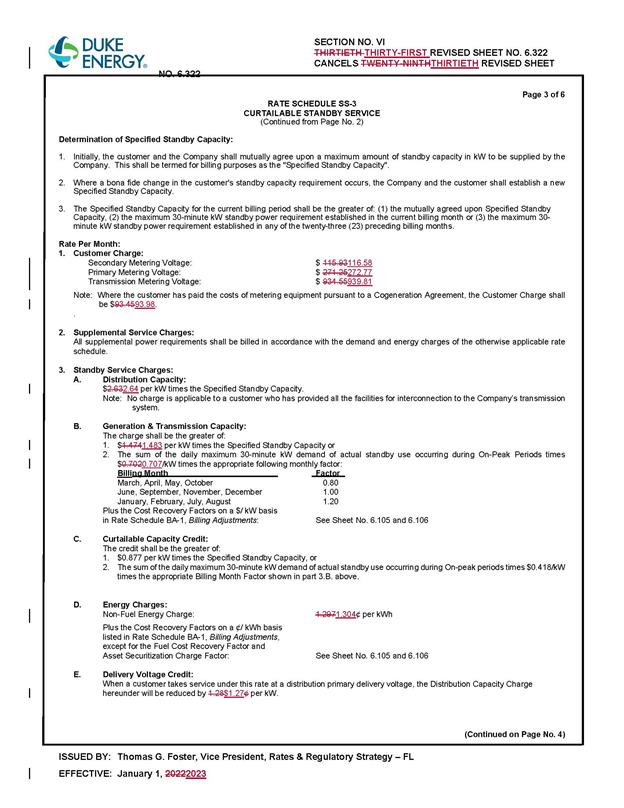

Issue 3:

Should the Commission give staff approval to

administratively approve DEF’s revised tariffs which reflect and implement the

multi-year base rate increase, ROE trigger, SoBRA (Duette) true-up, and the IRA

base revenue decrease effective January 2023?

Recommendation:

Yes. The Commission should give staff administrative

authority to approve DEF’s revised tariffs which reflect and implement the

multi-year base rate increase, ROE trigger, SoBRA (Duette) true-up, and the IRA

base revenue decrease effective January 2023. (Guffey)

Staff Analysis:

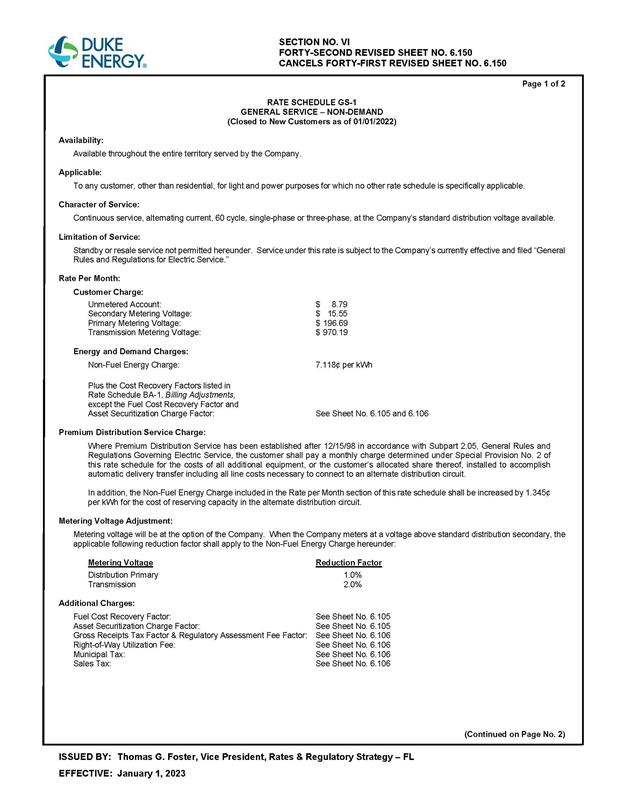

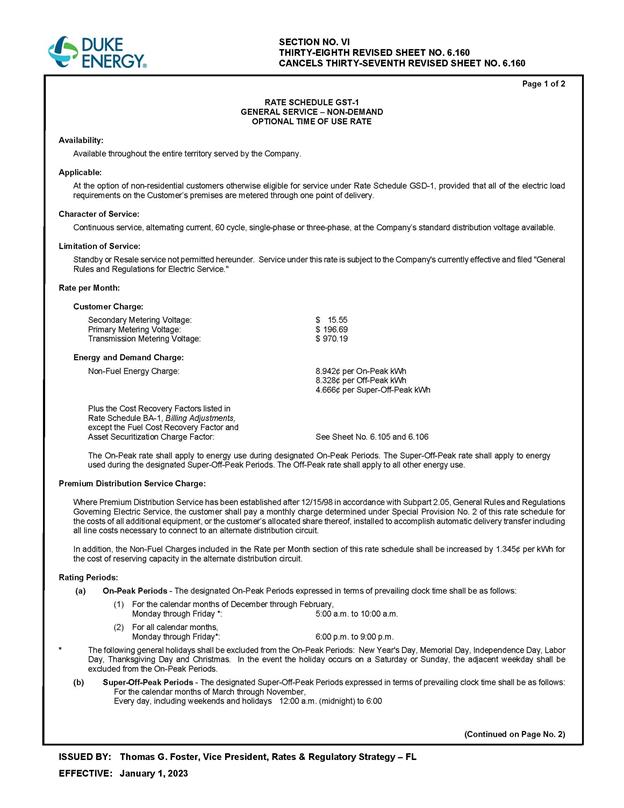

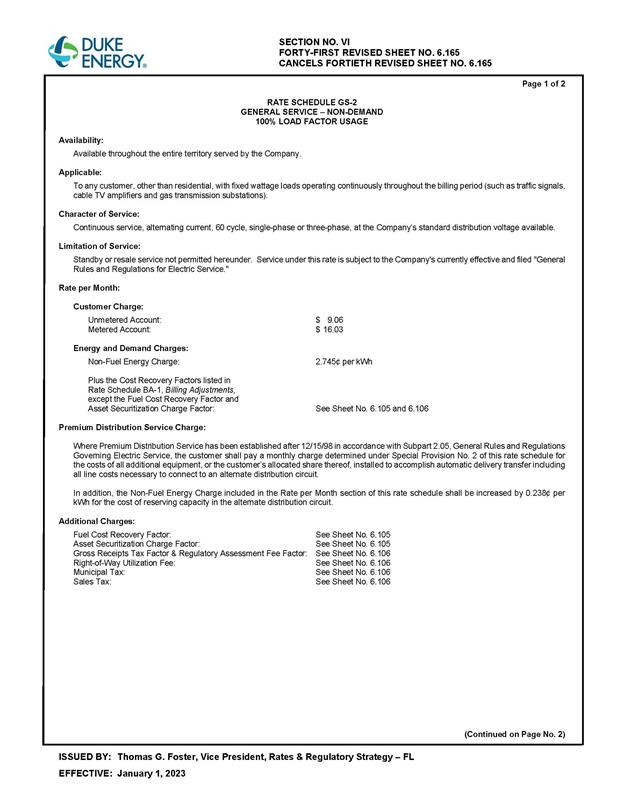

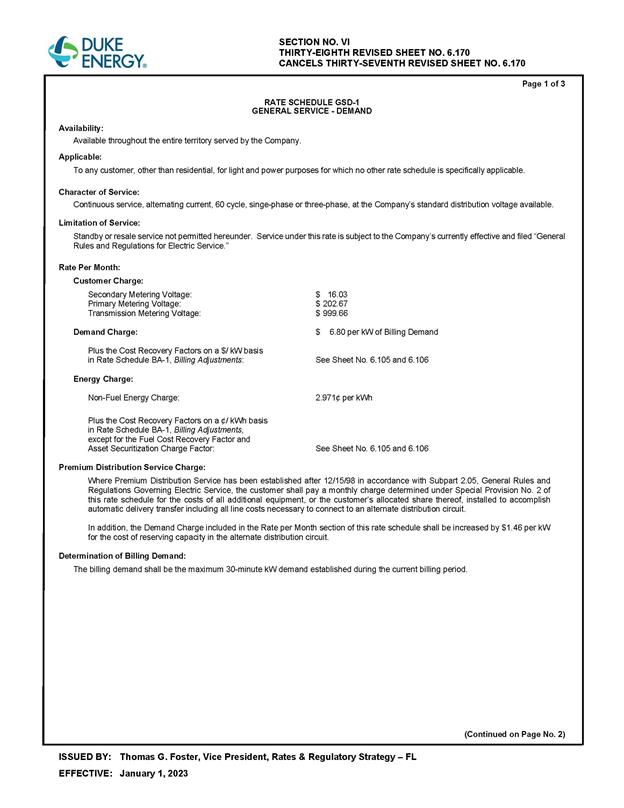

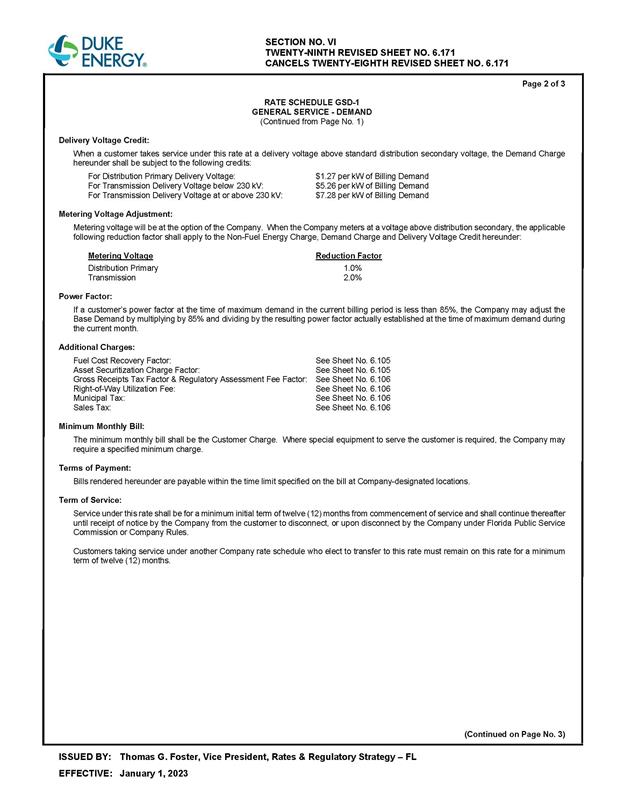

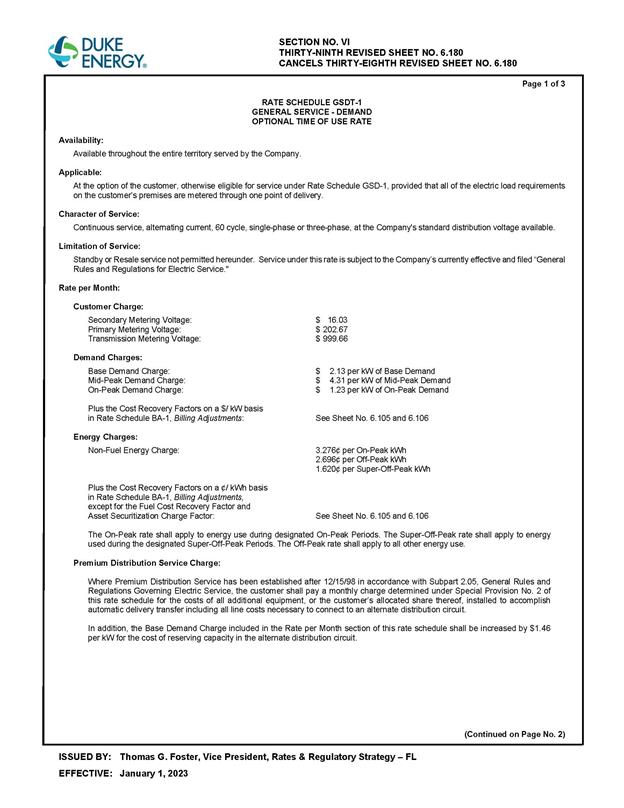

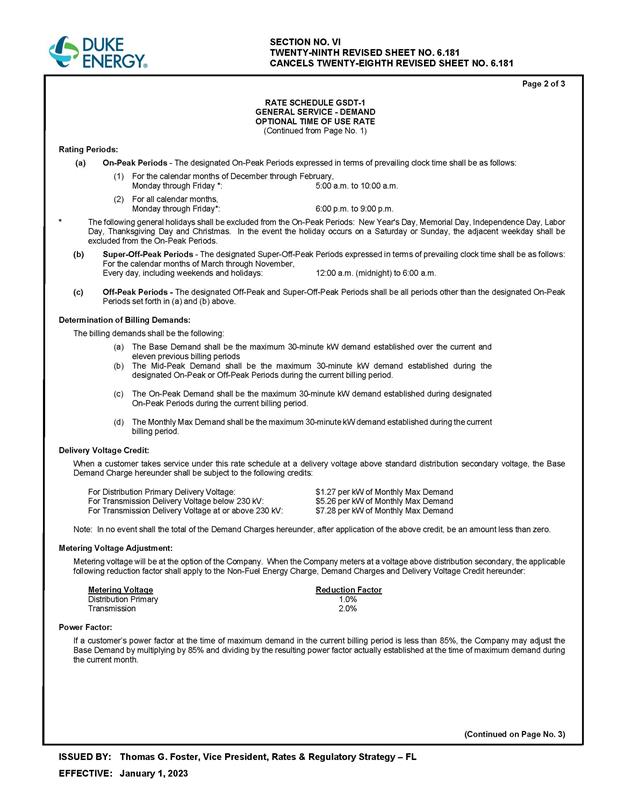

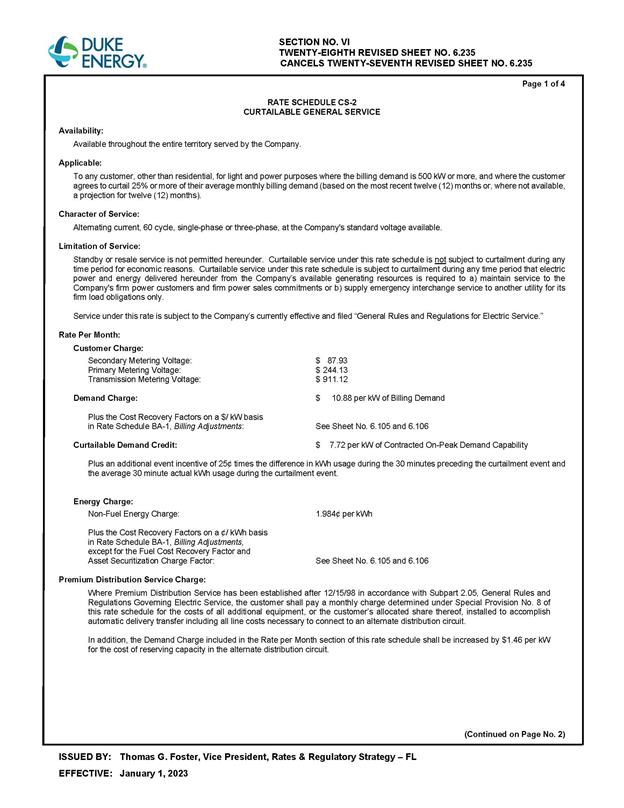

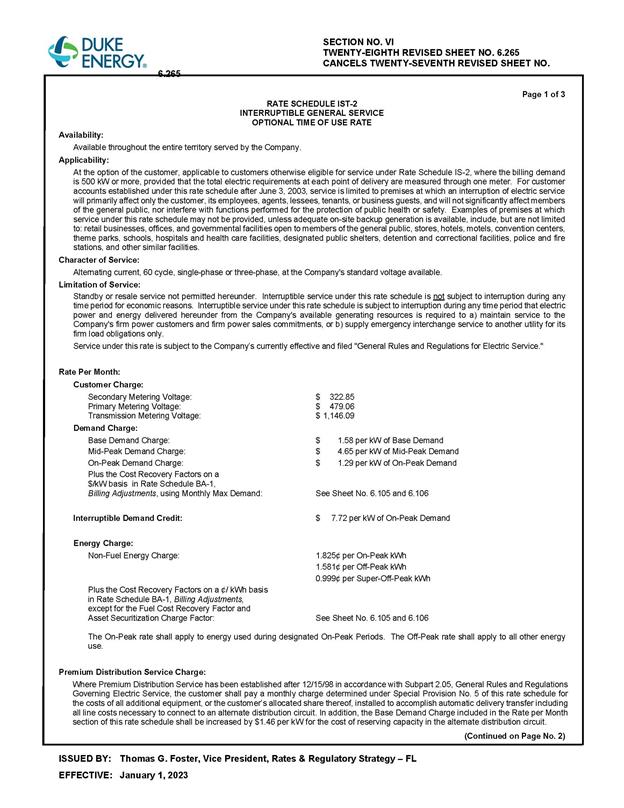

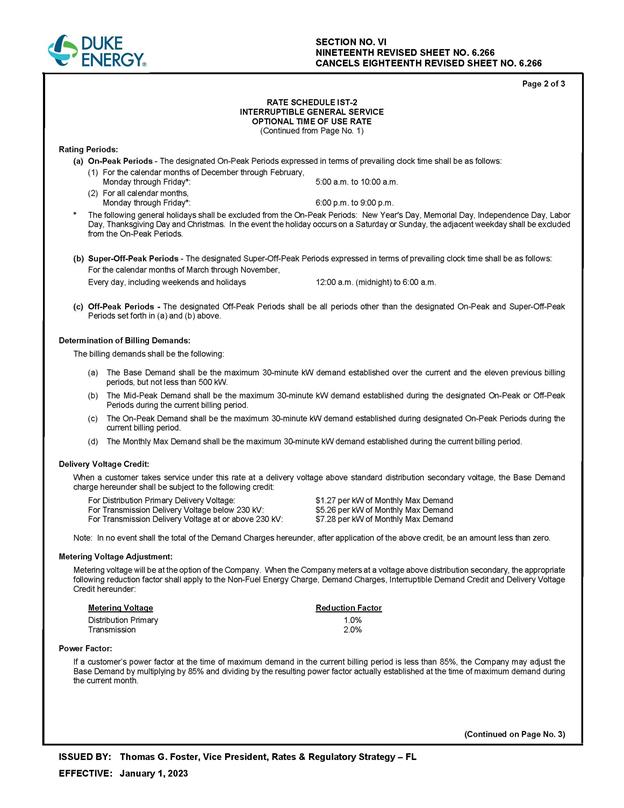

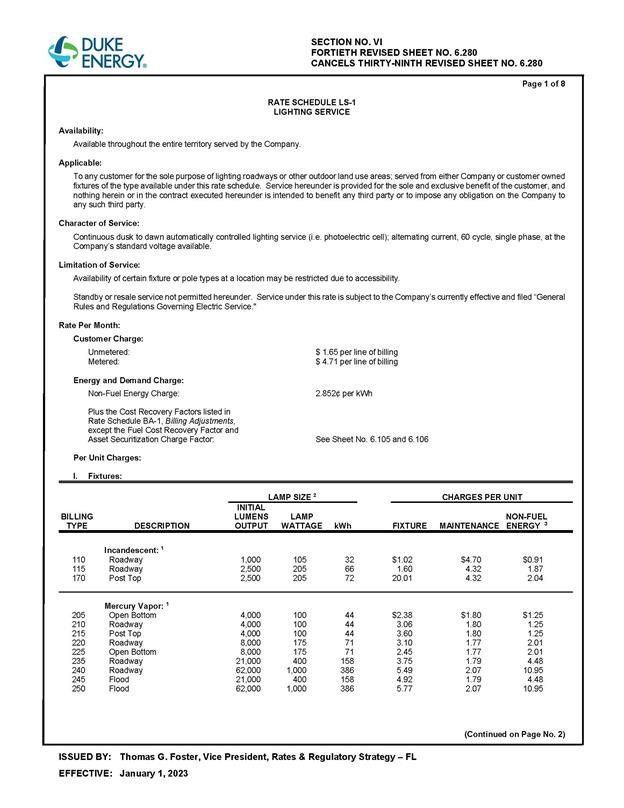

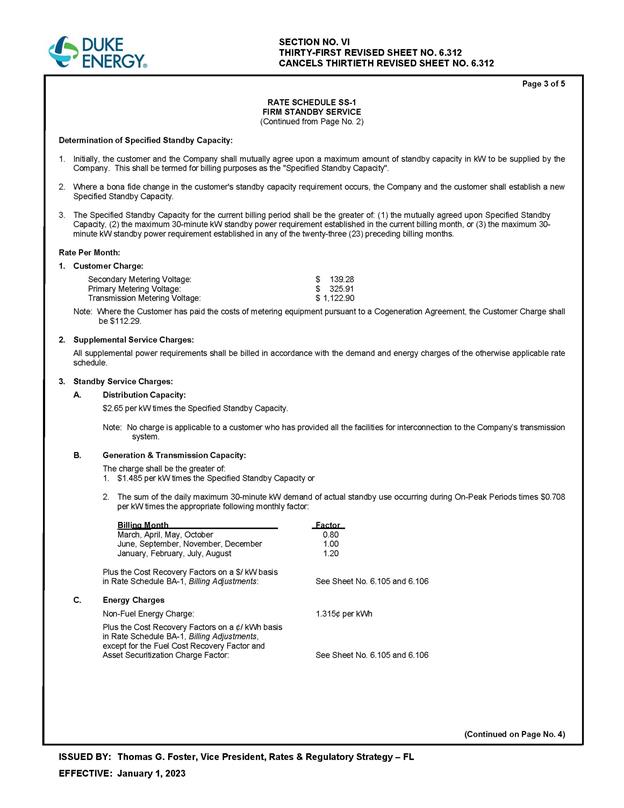

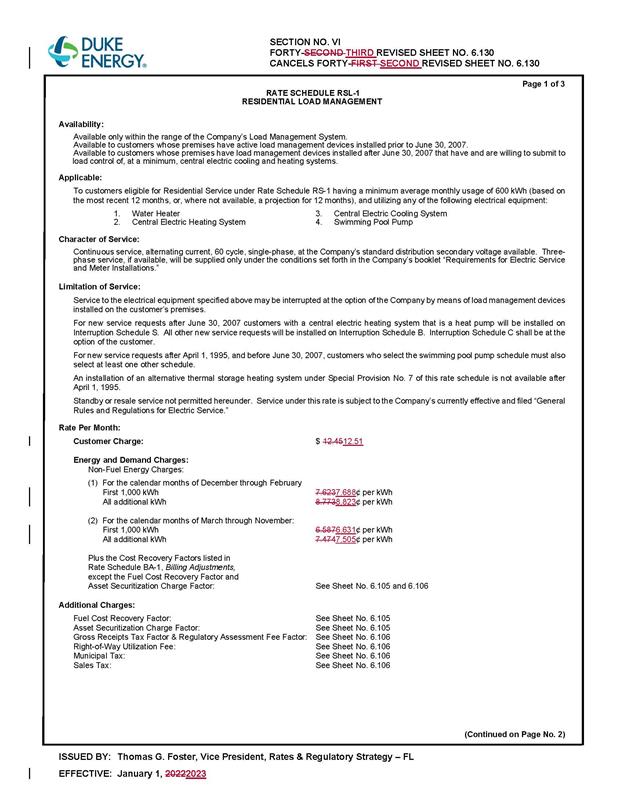

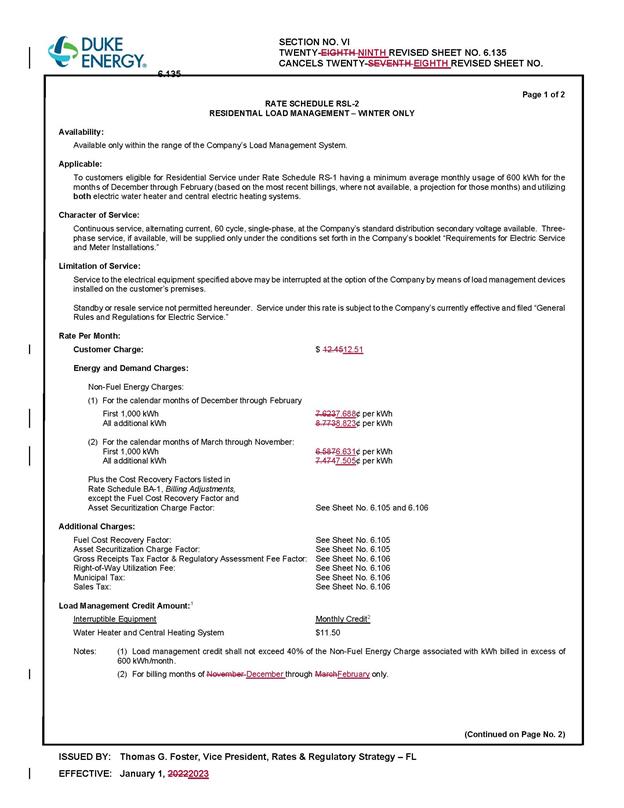

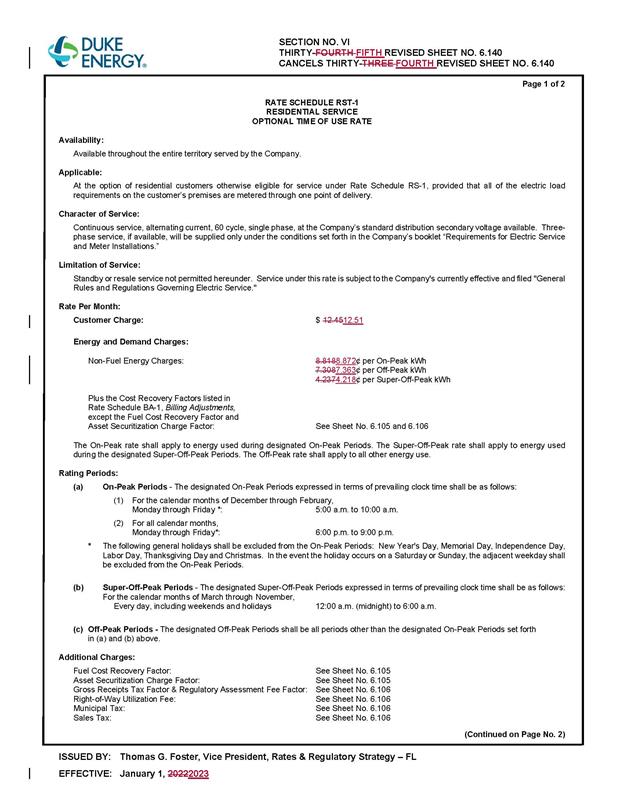

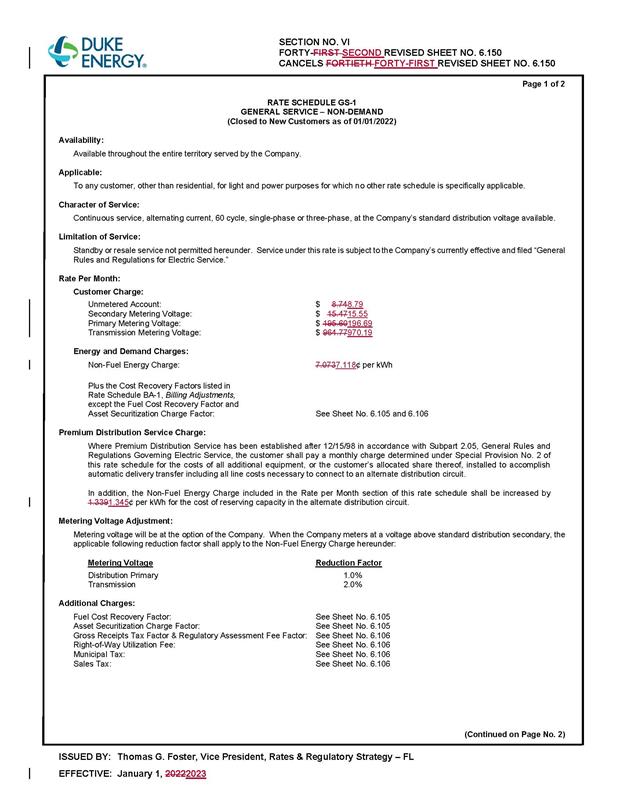

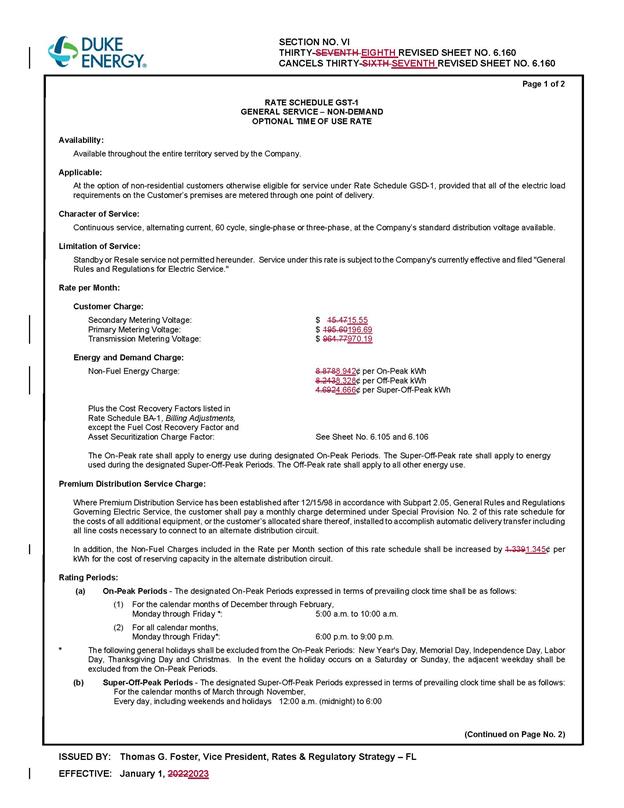

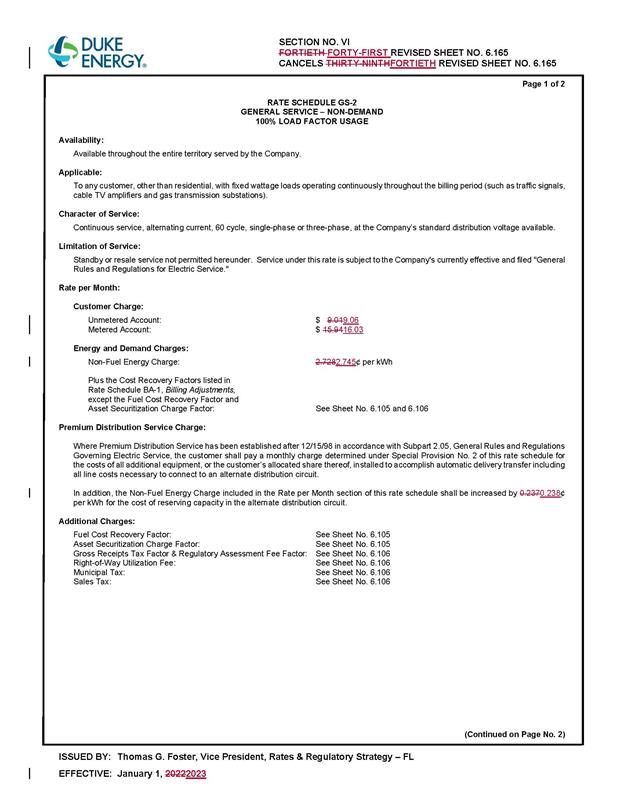

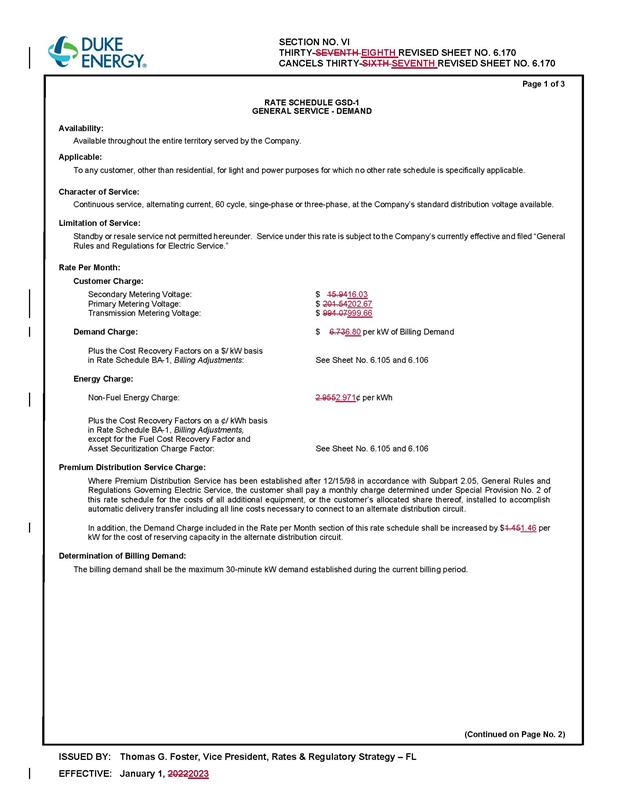

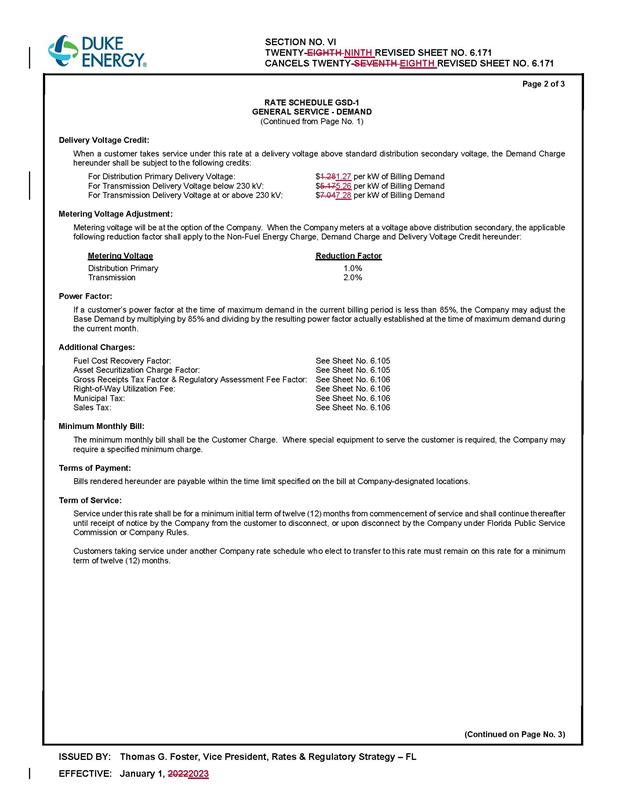

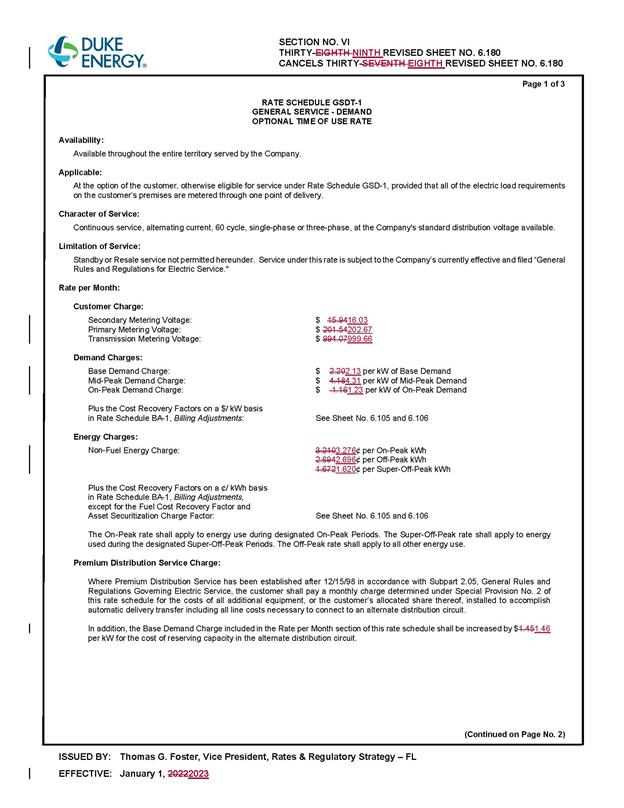

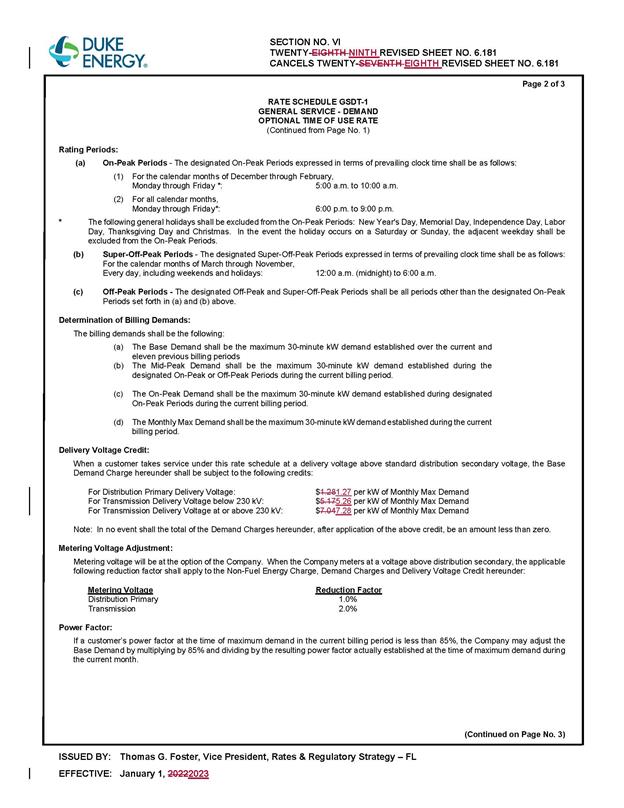

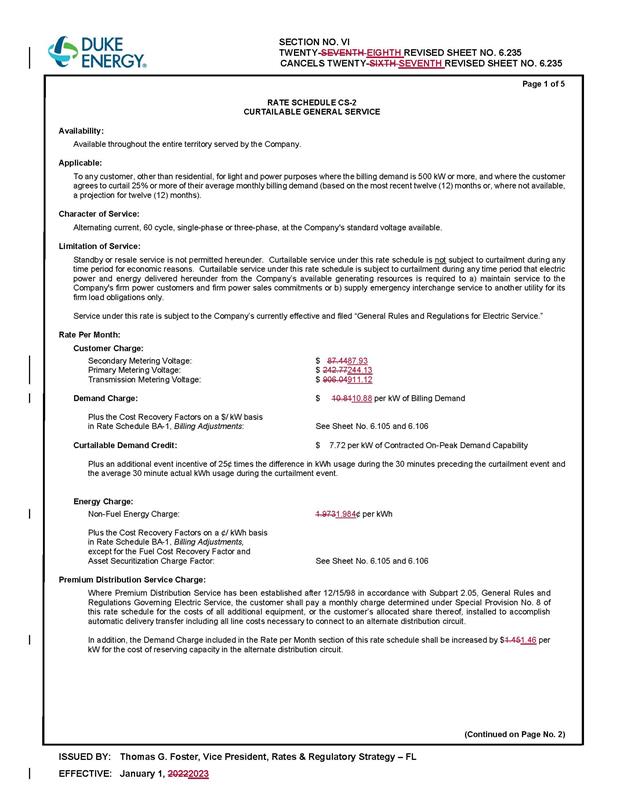

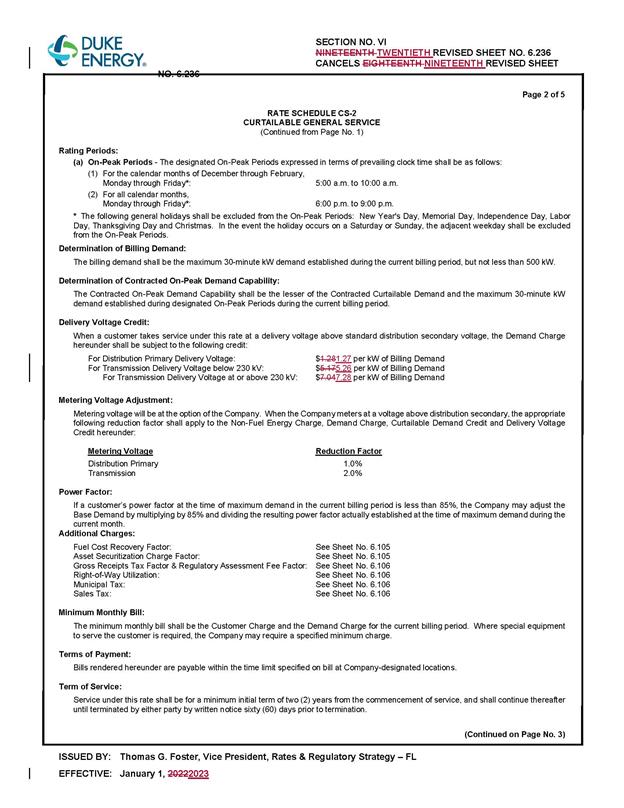

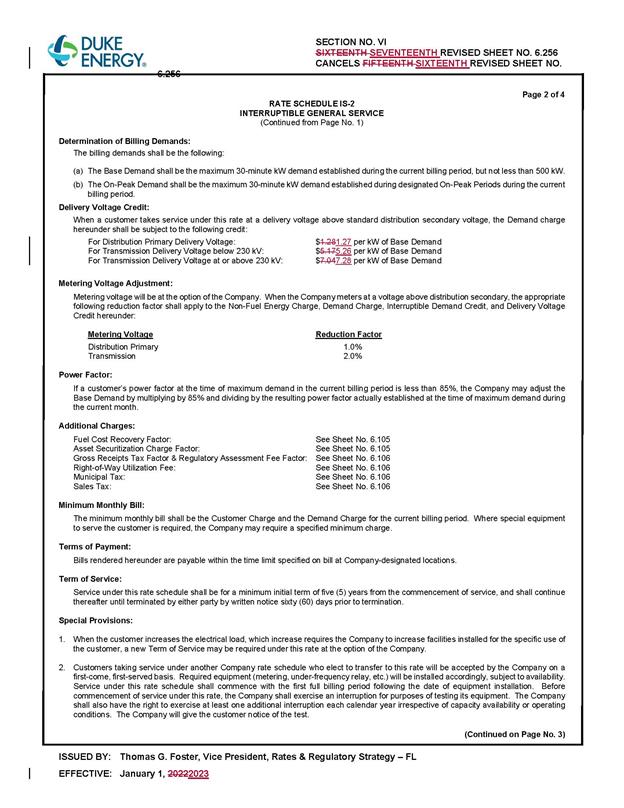

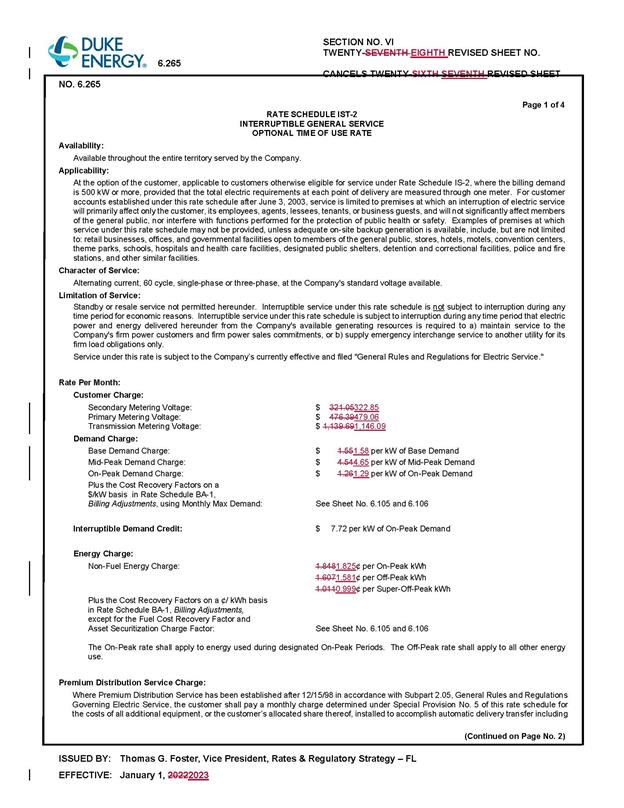

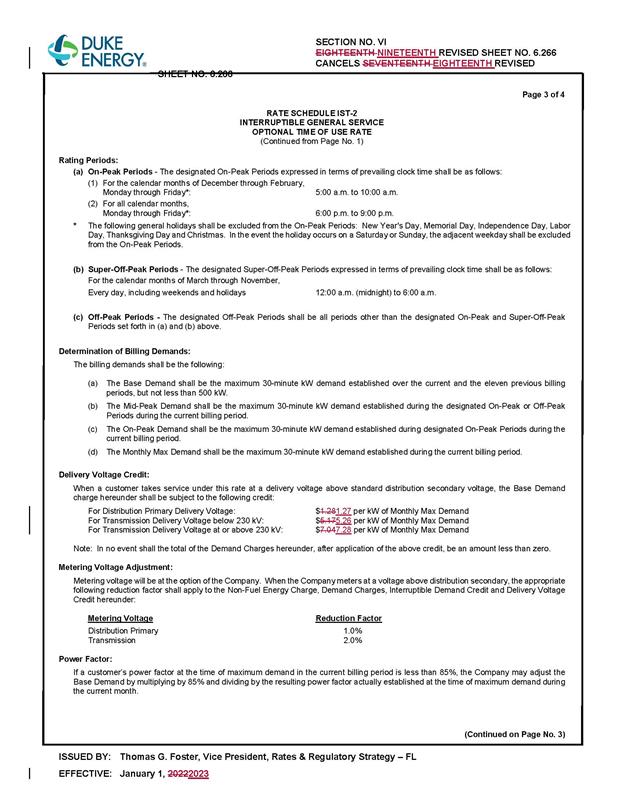

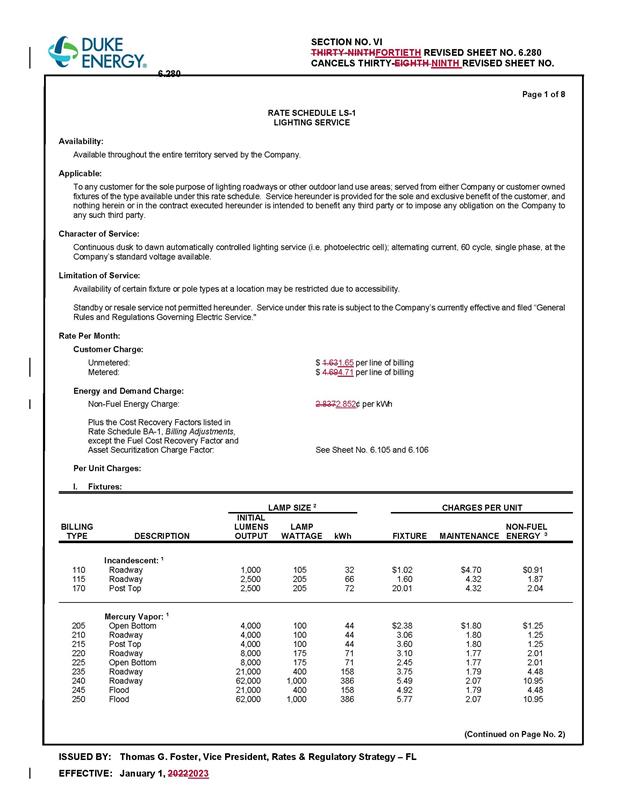

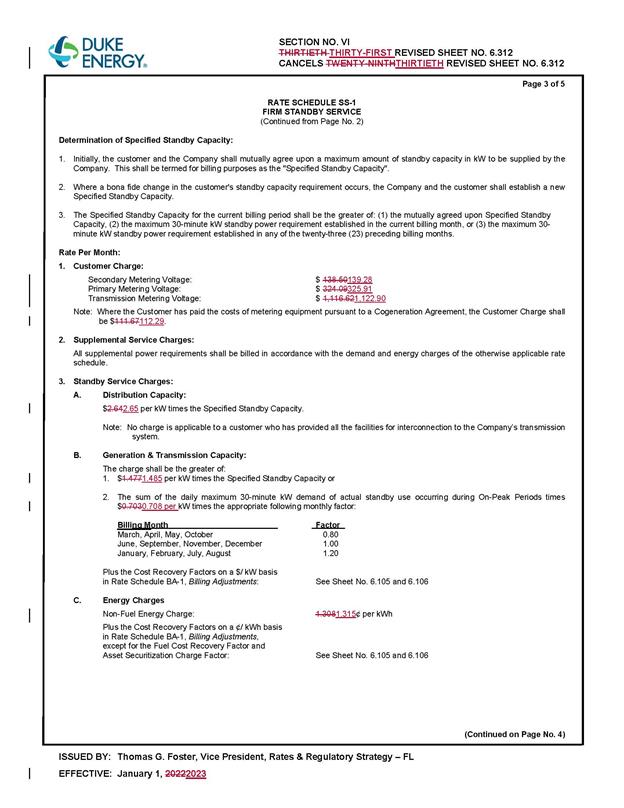

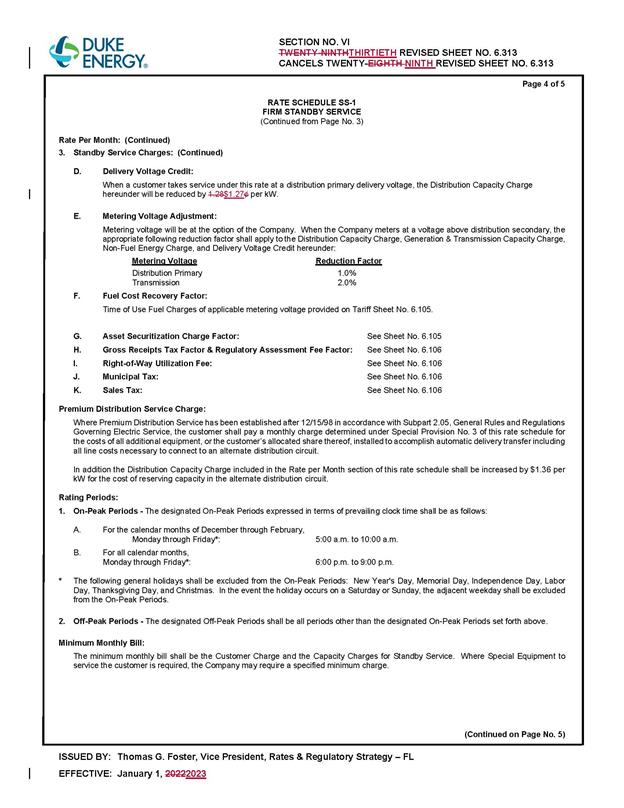

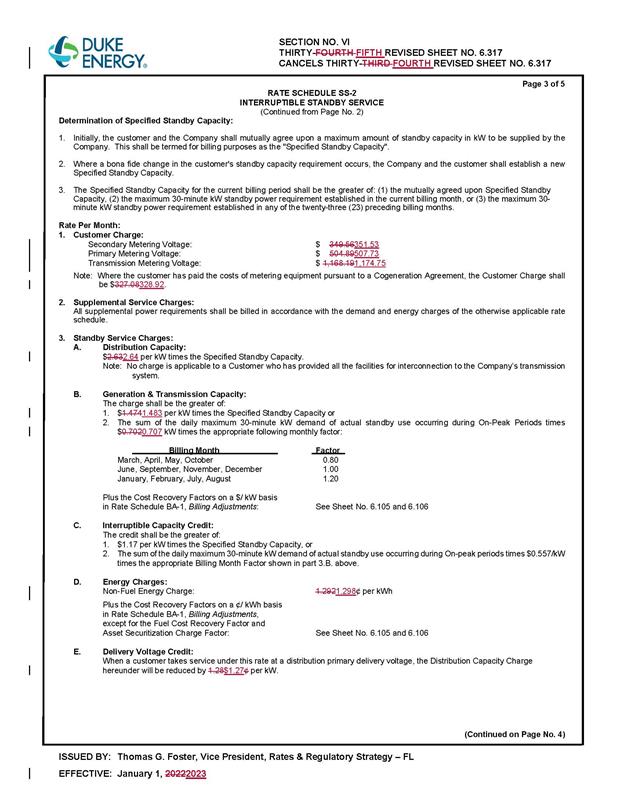

In its petition, DEF requested that the Commission

give staff authority to administratively approve tariffs reflecting base rates

for all customer classes to be effective January 2023. On October 27, 2022, DEF

filed tariffs in this docket that reflect previous Commission-approved base

rate changes and implement the proposed IRA base revenue decrease at issue in

this docket. Witness Olivier, in her direct testimony, discusses and summarizes

in Exhibit MJO-3 the four base rate changes effective January 2023.

The Commission has previously approved the following base

rate changes effective January 2023. First, in Order No. PSC-2021-0202A-AS-EI,

the Commission approved a 2023 multi-year base rate increase of $48.9 million

in DEF’s base rates.

Second, consistent with Order No. PSC-2017-0451-AS-EU, DEF calculated adjusted

base rates to reflect the Duette Solar Base Rate Adjustment (SoBRA) true-up.

The SoBRA true-up results in a $1.1 million decrease in base rates.

Finally, in Order No. PSC-2022-0357-FOF-EI, the

Commission approved an annual base revenue increase of $24.4 million to reflect

the ROE trigger provisions of the 2021 Settlement Agreement.

The calculation of the IRA adjustment factor of (2.095)

percent is shown in Exhibit MJO-2 of the petition and the adjustment factor has

been applied in a uniform manner to the base rates for all rate classes. The

IRA adjustment factor was calculated by dividing the $56 million reduction by

the 2023 projected $2,671.1 million retail base revenue sales of

electricity.

Staff has reviewed DEF’s tariff sheets and supporting

documentation for accuracy. The Commission should give staff administrative

authority to approve DEF’s revised tariffs which reflect and implement the

multi-year base rate increase, ROE trigger, SoBRA (Duette) true-up, and the IRA

base revenue decrease effective January 2023.

Issue 4:

Should this docket be closed?

Recommendation:

Yes. At the conclusion of the protest period, if no

protest is filed, this docket should be closed upon the issuance of a

consummating order. If a protest is filed within 21 days of the issuance of the

order, the tariffs should remain in effect, subject to adjustments pending the

resolution of the protest. (Stiller)

Staff Analysis:

At the conclusion of the protest period, if no protest

is filed, this docket should be closed upon the issuance of a consummating

order. If a protest is filed within 21 days of the issuance of the order, the

tariffs should remain in effect, subject to adjustments pending the resolution

of the protest.