Discussion

of Issues

Issue 1:

Should the Commission approve cost recovery of the

negotiated purchased power agreement between Pasco and TECO?

Recommendation:

Yes, the fixed energy priced agreement should be

approved. However, in order to minimize risks to ratepayers, all transmission

costs above the negotiated cost cap contained in the agreement and future costs

associated with renewable energy credits should not be approved for cost

recovery at this time. (Davis)

Staff Analysis:

Pasco proposes to sell 21 MW from its WTE facility (with

an option to increase up to 25 MW when planned facility upgrades are completed)

of firm capacity and energy at a 92 percent monthly availability to TECO for a

term from January 1, 2025, through December 31, 2034. The date of planned

facility upgrades are not known at this time. The facility will use municipal

solid waste as its primary fuel, a source of renewable energy pursuant to Section

366.91(2)(e), F.S. The price structure in the contract has no capacity payment,

but an “all-in” confidential dollars per megawatt-hour (MWh) energy rate

payment. The initial rate is fixed for the first 5 years and steps up to a

higher energy price in years 6-10.

The contract has two notable features relating to

transmission and renewable energy credits (RECs). Regarding transmission, as

the Pasco WTE Facility is interconnected and located within DEF’s service

territory, it will require use of a portion of DEF’s transmission capacity to

deliver energy to a delivery point with TECO. Traditionally, a QF such as Pasco

would request this service and pay DEF for the transmission service pursuant to

Rule 25-17.0889, Florida Administrative Code (F.A.C.). However, Section 5 of

the PPA makes TECO responsible for requesting and securing the required transmission

service from DEF and for paying all costs including potential transmission

studies, system upgrades if needed, and transmission capacity fees based on

DEF’s Open Access Transmission Tariff (OATT). TECO’s monthly payments to Pasco

would be reduced by the amount of the transmission expenses incurred below the

negotiated cost cap. In essence, such treatment would assign the cost of

transmission service to Pasco, consistent with Rule 25-17.0889, F.A.C. However,

any transmission expenses above the cost cap, including transmission studies

and system upgrades, would be paid by TECO and potentially recovered through

the Fuel and Purchased Power Cost Recovery Clause (Fuel Clause).

The other notable feature relates to RECs. RECs are tradeable

renewable energy credits, which can be certified to represent the production of

energy from a renewable power source typically in increments of 1 MWh. An

entity can purchase a REC in order to retire it to either meet a regulatory

requirement (such as a state or federal renewable portfolio standard) or to

otherwise claim the environmental aspects of the energy produced. TECO will

receive the RECs associated with the energy purchased through the contract at

no cost, with some caveats. These caveats include two main components: (1) if

federal or state legislation establish a value for RECs, TECO would be required

to pay the larger of these two values to Pasco; and (2) if Pasco is able to

find a third party buyer, TECO would be required to sell them to the third

party and provide the proceeds to Pasco or purchase the RECs themselves, in a

de facto right of first refusal arrangement. In the latter scenario, REC

payments would also be applied to the transmission cost cap, potentially

reducing amounts paid by TECO.

Rule 25-17.0832(3), F.A.C., states that in reviewing

negotiated firm capacity and energy contracts for the purpose of cost recovery,

the Commission shall consider factors relating to the contract that would

impact the utility's customers, including: need for power by purchasing utility

and/or Florida utilities statewide, the cost-effectiveness of the contract,

security provisions for early payments, and performance guarantees associated

with the facility. These factors are evaluated below.

Need for Power

Based on TECO’s 2022 Ten-Year Site Plan (TYSP), the next

planned capacity addition that could be avoided is a natural gas-fired

reciprocating engine, rated at 18.7 MW with an in-service date of January 1,

2028. Therefore, the PPA’s firm capacity of 21 MW could defer the construction

of the future generation unit for the duration of the PPA. As TECO is projected

to rely upon natural gas for up to 85 percent of its energy during the contract

period, according to its 2022 TYSP, the PPA would improve the Company’s fuel

diversity by increasing the contribution of renewable resources. Therefore,

staff believes the proposed negotiated contract will enhance TECO's system

reliability and increase TECO’s fuel diversity.

Cost-Effectiveness

Rule 25-17.0832(3)(b), F.A.C., states in part that the

Commission should consider whether the cumulative present worth of payments to

a QF are no greater than the cumulative present worth of the purchasing

utility's avoided cost of capacity and energy. In its petition, TECO stated

that the estimated benefits of the PPA ranged from $4.3 million to $11.4

million on a net present value (NPV) basis. The reason for the savings are primarily

reduced fuel, with other avoided costs including deferred generation capital,

fixed O&M, and deferred natural gas transport. The break-even point for the

cost-effectiveness of the PPA occurs in the first year of the contract for both

the low and high savings range. The range is dependent upon when or if the

facility upgrades from 21 MW to 25 MW, and the analysis includes the impact of

system benefits from the avoided capacity and fuel, versus the costs of the PPA

energy payments and DEF transmission costs. In response to Staff’s First Data

Request, TECO stated that the cost-effectiveness was based on the Company’s

2021 TYSP, not the 2022 TYSP which was filed April 1, 2022, well before the

filing of TECO’s petition. As a result, staff requested a revised analysis

using the Company’s 2022 TYSP and the most recent available fuel forecasts. In

response to Staff’s Data Request, TECO provided that the cost-effectiveness now

ranged from $1.2 million to $9.0 million on a NPV basis. The reason for the

savings for this range is the same as the previous range. The break-even point

occurs in the first year for the 21 MW scenario and the third year for the 25

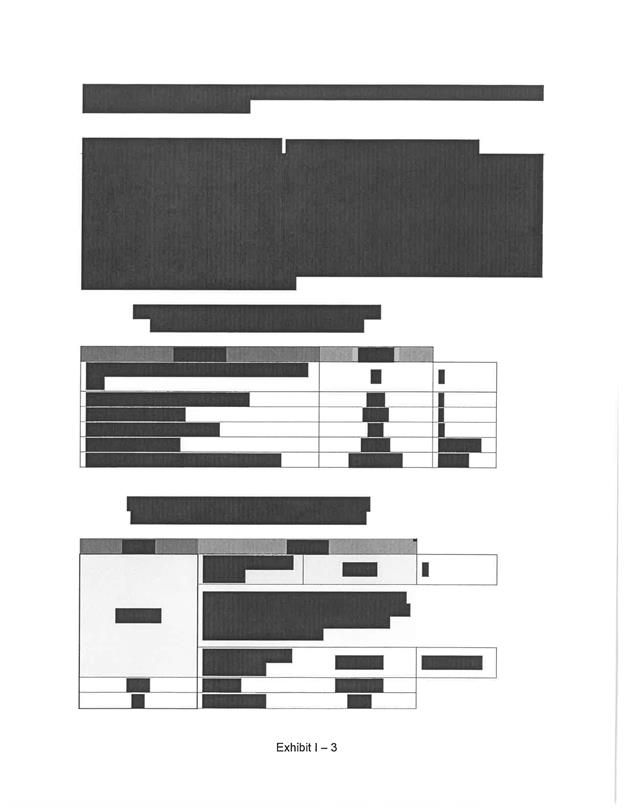

MW scenario. Table 1-1 summarizes the cost-effectiveness scenarios reviewed by

staff for the PPA.

Table 1-1

PPA Savings Scenarios

|

Scenario

|

Savings ($million)

|

|

|

High (21 MW)

|

Low (25 MW)

|

|

Petition: 2021 TYSP and Fuel Forecast

|

$11.4

|

$4.3

|

|

Revised: 2022 TYSP and 01/23 Fuel Forecast

|

$9.0

|

$1.2

|

|

|

|

|

Source: TECO’s Response to Staff’s First Data Request.

Economic Risks

Because the PPA includes fixed energy rate payments, the

rates are not allowed to float with changes to TECO’s system fuel costs. This

allocates all the risk of fuel price fluctuations from the Pasco WTE Facility

to TECO’s ratepayers. For example, if fuel costs do not escalate as quickly as

projected in the cost-effectiveness analyses, it may result in a loss to

customers. Conversely, if fuel costs escalate faster, customers would see an

increased benefit. Regardless, TECO would remain obligated to pay the

contracted rate and may seek to recover the costs from the ratepayers through

the Fuel Clause, subject to Commission review.

In a previous docket, the Commission has expressed

concerns regarding fixed price contracts. In

Docket No. 20110090-EQ, the Commission noted in its approval of a Progress

Energy Florida, Inc. (PEF) PPA that also featured fixed energy rates for the

duration of the contract, that:

While the company does not make

a return on purchased power, it is responsible for protecting the ratepayers

during negotiations with renewable power providers and should include terms and

conditions that minimize risk to the company’s general body of ratepayers. By

using fixed prices for all components of the contract, risks associated with

fuel price fluctuations are shifted to the ratepayers, and away from the

renewable generator. PEF should strive in its

future negotiations to be diligent in protecting its ratepayers from undue or

excessive risk. Notwithstanding the benefits of a negotiated purchase

power agreement, in negotiating future contracts and to protect the ratepayers,

utilities and companies should strive to adhere to Rule 25-17.250, F.A.C., in

that only a portion of the base energy costs associated with the avoided unit

shall be fixed, and prospectively, utilities should strive not to established a

“100 percent fixed” or a majority fixed base energy cost.

An example of this risk posed to ratepayers is highlighted

in the revised analysis requested by staff, with TECO noting a decrease in its

fuel projections as part of its midcourse correction. Changes in forecasts,

including fuel savings and other factors such as transmission rates and

deferred capacity, reduced the NPV benefit as shown in Table 1-1.

The proposed PPA also exposes ratepayers to a new form of

risk associated with transmission costs. The typical purchased power agreement

assumes all transmission costs are carried by the QF. For example, in TECO’s Standard

Offer Contract, the QF is solely responsible for all cost to provide

transmission to the point of interconnection with TECO. As

discussed above, the PPA assigns the cost of securing transmission service to

TECO. The costs are then passed along to Pasco up to the negotiated cost cap.

Based on the analysis provided by TECO, transmission costs above the cost cap

are projected to be incurred by TECO no earlier than in year 4 of the 10-year

contract, with transmission costs higher if Pasco is able to deliver at a

higher output (up to 25 MW pursuant to the PPA). TECO describes the

transmission cost risk as having decreased between filing its petition and the

revised analysis requested by staff, as DEF’s transmission cost forecast was

lower than used in the petition’s analysis. However, the transmission cost

above the negotiated cost cap remains a risk to ratepayers.

While the contract is projected to be cost-effective based

on the assumed transmission cost risks in TECO’s analysis, if the PPA is

approved this cost could be passed on to the ratepayers since the costs are

incurred by TECO as part of the PPA. In response to Staff’s Second Data Request,

Questions Nos. 7 through 9, TECO stated that it would not seek recovery for

costs for transmission studies, upgrades and associated administrative costs

with arranging transmission services.

This still leaves ratepayers potentially liable for any transmission costs

associated with DEF’s OATT above the cost cap. To be consistent with Rule

25-17.0889, F.A.C. and to prevent adding any transmission risks to ratepayers,

staff recommends that all costs associated with transmission services above the

cost cap should not be eligible for cost recovery at this time.

Renewable Energy Credits

Based on the proposed PPA, TECO will receive RECs when

purchasing power through the contract at no cost to TECO, except under certain

circumstances. If a monetary value is established by a state or federal

government entity, the higher of the established governmental monetary values

will be used as a basis of payment to Pasco. If no governmental monetary value

is established, then Pasco has the option to market the RECs to a third party

buyer. However, if Pasco is successful in finding a third party buyer, TECO has

a de facto right of first refusal. Under this scenario, TECO would either pay

the market price or sell the RECs to a third party buyer, and turn the proceeds

over to Pasco. At this time, there is no federal or state legislation requiring

the purchase of RECs. Staff recommends that the Commission’s approval of the

PPA not be considered as approval of any future REC purchases pursuant to the

PPA, but that TECO be required to demonstrate the need for their purchase if it

seeks cost recovery in the future.

Security and Performance Guarantees

Security in this contract include provisions to ensure

repayment of firm capacity and energy payments in the event that the qualifying

facility fails to deliver firm capacity and energy pursuant to the terms and

conditions of the contract. Rule 25-17.0832(3)(c), F.A.C., requires the

Commission to consider if such security is adequate for the contract. The QF is

an existing facility which eliminates the risk of early “all-in” energy (which

includes capacity) payments due to construction delays. However, the contract

begins in year 2025 and the avoided unit is scheduled for 2028 implementation.

If the QF defaults during this time period, the contract includes a termination

payment table for determining compensation to TECO.

Performance guarantees, as included in this contract,

detail how a QF is to operate and require financial penalties or other remedies

should it fail to do so within the contract's terms and conditions. Rule

25-17.0832(3)(d), F.A.C., requires the Commission to consider whether the

utility's ratepayers will be protected by the contract's terms. Staff has

reviewed the performance guarantees contained in the negotiated contract and believes

they are adequate. These protections include a lower energy rate payment if

Pasco WTE facility does not provide a monthly energy availability of at least

92 percent at TECO-DEF service territory boundary. Also, if the Pasco WTE Facility

has an availability less than 70 percent for any 6-months in a calendar year

during the contract, this failure will be considered a default which means TECO

can recover costs of obtaining replacement power from Pasco.

Conclusion

Based on TECO’s most recent planning assumptions, the

fixed-price purchased power agreement is projected to provide TECO’s customers

NPV benefits that range from $1.2 to $9.0 million over a ten year period. However,

in order to minimize risks to ratepayers, all transmission costs above the

negotiated cost cap contained in the agreement and future costs associated with

renewable energy credits should not be approved for cost recovery at this time.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. This docket should be closed upon issuance of a

Consummating Order unless a person whose substantial interests are affected by

the Commission's decision files a protest within 21 days of the issuance of the

proposed agency action. (Thompson)

Staff Analysis:

This docket should be closed upon issuance of a

Consummating Order unless a person whose substantial interests are affected by

the Commission's decision files a protest within 21 days of the issuance of the

proposed agency action.