Case Background

On August 16,

2023, Tampa Electric Company (TECO or Company) filed a petition to implement

the 2024 Generation Base Rate Adjustment (GBRA) provisions pursuant to its 2021

rate case Stipulation and Settlement Agreement (settlement agreement). The

Commission previously approved the settlement agreement in Order No.

PSC-2021-0423-S-EI (settlement order). In Order No. PSC-2022-0434-TRF-EI, the

Commission approved TECO’s 2023 GBRA provision of the 2021 settlement

agreement.

The GBRA

provisions of the settlement order and agreement provide for an increase in

base rates to reflect the 2024 GBRA amount of $21,376,909, effective with the

first billing cycle of January 2024. In this petition, TECO proposed to

increase the GBRA amount to $21,689,323 to reflect the updated 10.20 percent

mid-point return on equity (ROE) allowed by a trigger provision of the 2021 settlement

agreement and approved by the Commission on August 16, 2022, in Docket No.

20220122-EI. The Company also noted that it was

evaluating the tax provisions of the Inflation Reduction Act (IRA) to address

impacts of the IRA on the 2024 GBRA, consistent with paragraphs 4(c) and 11 of

the settlement agreement. The IRA, which became effective August 16, 2022, does

not contain a federal income tax rate change applicable to TECO, but it does

allow for the substitution of the existing investment tax credit for solar

generating facilities with a new production tax credit.

During the

review process, staff issued a data request to TECO on September 7, 2023, for

which the responses were received on September 14, 2023. On October 2, 2023,

staff held an informal telephonic meeting with the parties to the 2021

settlement agreement to discuss TECO’s filing in this docket. The legislative

version of the proposed tariffs is Attachment A to this recommendation. This is

staff’s recommendation on the proposed tariffs. The Commission has jurisdiction

over this matter pursuant to Sections 366.04, 366.05, and 366.06, Florida

Statutes (F.S.)

Discussion

of Issues

Issue 1:

Should the Commission approve the updated 2024 GBRA

amount of $21,689,323?

Recommendation:

Staff recommends approving TECO’s updated 2024 GBRA

amount of $21,689,323 with the requirement that the Company file updated 2023

and 2024 GBRAs, adjusted to reflect IRA impacts, by April 1, 2024. (Mason,

Norris)

Staff Analysis:

As discussed in the Case Background, subparagraphs

4(a) and (b) of the 2021 settlement agreement provide that TECO’s base rates

will increase by $21,376,909 effective with the first billing cycle in January

2024. The

calculation of this GBRA amount was based on the authorized return on equity

(ROE) mid-point of 9.95 percent as specified in subparagraph 2(a). However,

subparagraph 4(d) states that if the Company’s authorized ROE mid-point changes

by operation of subparagraph 2(b) prior to the effective date of the rate

adjustment specified in subparagraph 4(b), the calculation of the 2024 GBRA

amount shall be updated to reflect the new authorized ROE.

As memorialized in Order No. PSC-2022-0322-FOF-EI, the

Commission approved TECO’s petition to implement the ROE trigger provisions of

subparagraph 2(b) of the 2021 settlement agreement.

As a result, the Company’s authorized ROE midpoint was increased by 25

basis points from 9.95 percent to 10.20 percent, effective as of July 1, 2022,

for all regulatory purposes. In its petition to implement the 2024 GBRA, TECO

provided a calculation updating the GBRA amount to $21,689,323 to reflect the

Company’s 10.20 percent authorized ROE mid-point. The updated amount is correct

based on staff’s review of the Company’s calculations.

When the Commission approved TECO’s 2023 GBRA last year,

the Company said it was in discussions with the Office of Public Counsel (OPC)

regarding the process for updating the 2023 GBRA to reflect the impact of the

IRA. As reflected in Order No. PSC-2022-0434-TRF-EI, TECO agreed to collect the

rate increase reflected in the 2023 GBRA subject to refund, so that the 2023

GBRA could go into effect with the first billing cycle of January 2023. The

Company would refund the difference between the 2023 GBRA, as approved by the

Commission, and the 2023 GBRA as adjusted for the IRA, once the 2023 GBRA

adjusted for the IRA has been approved by the Commission.

Staff requested an update on this process, as there has

not been a revised filing for the 2023 GBRA, and the impacts of the IRA would

also adjust the 2024 GBRA. The Company indicated that it is still in the process

of discussing the impacts of the IRA on the 2023 and 2024 GBRAs with OPC. As

such, TECO is requesting the Commission consider staff’s recommendation now so

the 2024 GBRA can go into effect with the first billing cycle of January 2024.

As was the case with the 2023 GBRA, the Company agrees to collect the rate

increase reflected in the 2024 GBRA subject to refund. The Company will refund

the difference between the 2024 GBRA as approved by the Commission, and the 2024

GBRA as adjusted for the IRA once the 2024 GBRA adjusted for the IRA has been

approved by the Commission.

In light of the extended timeframe for addressing the

impacts of the IRA, staff recommends approving TECO’s updated 2024 GBRA amount

of $21,689,323 with the requirement that the Company file updated 2023 and 2024

GBRAs, adjusted to reflect IRA impacts, by April 1, 2024.

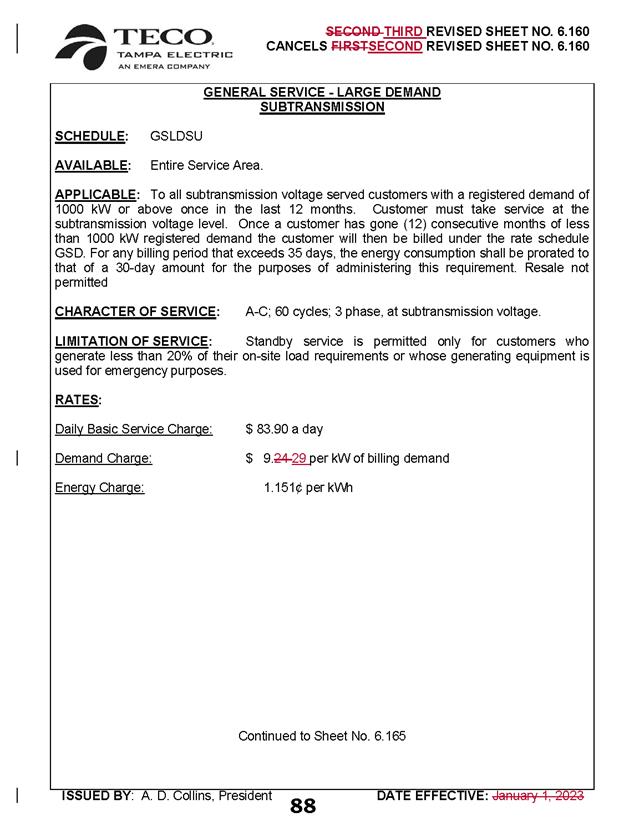

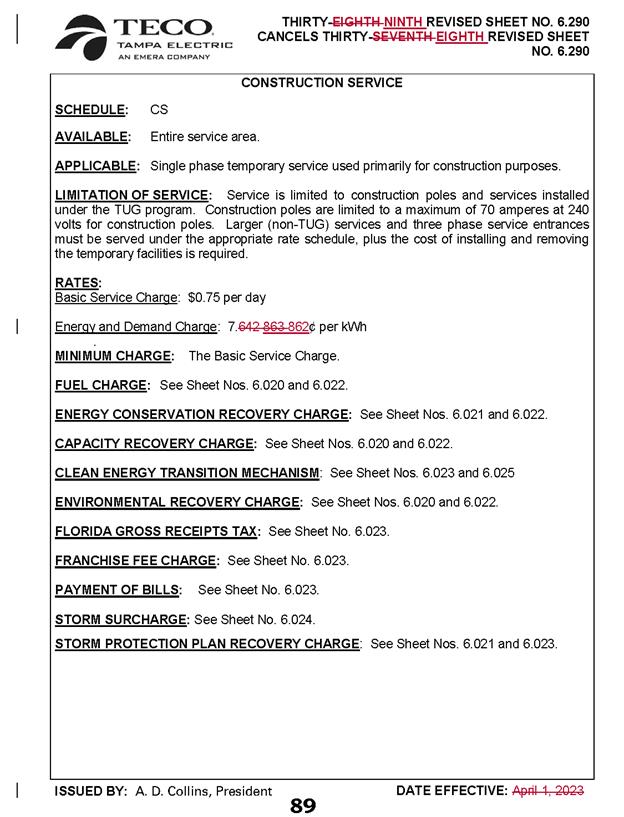

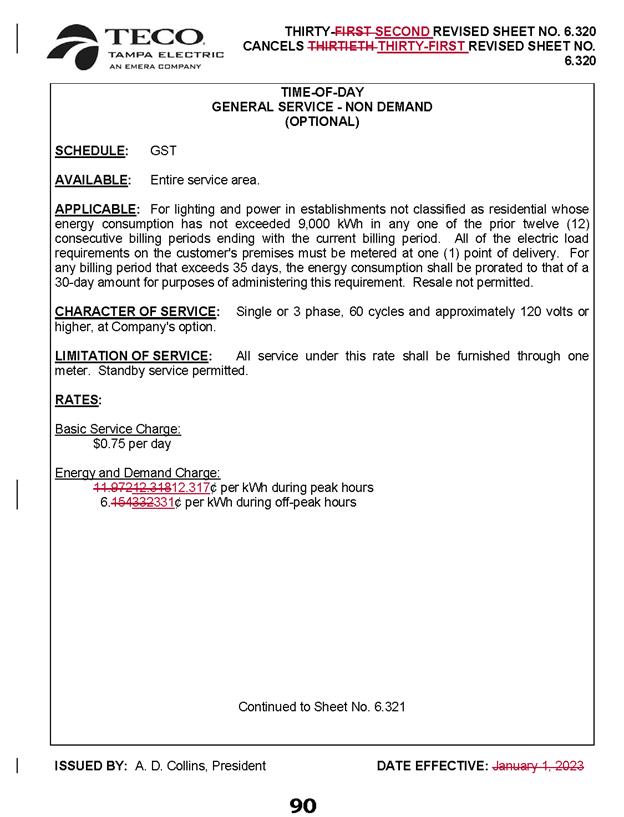

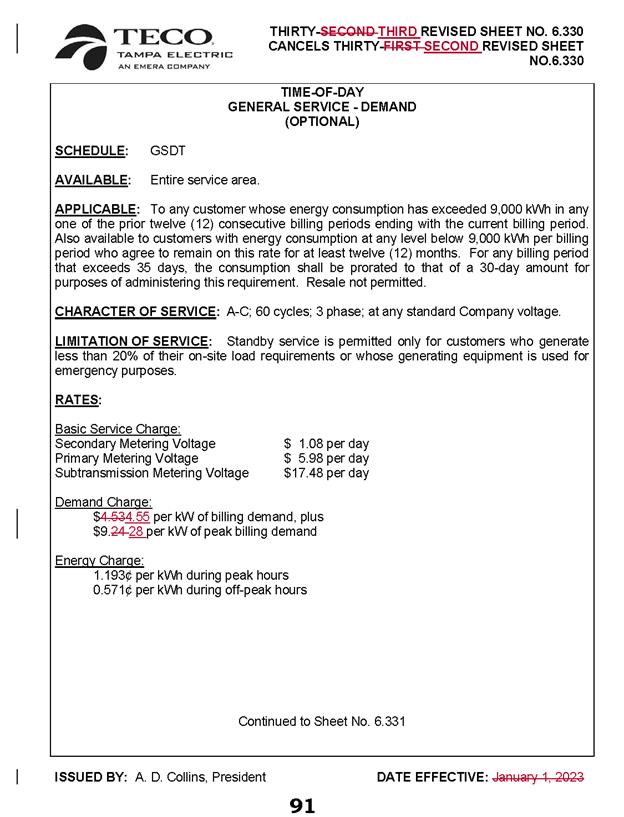

Issue 2:

Should the Commission approve TECO's revised tariffs

to implement the GBRA increase effective January 2024?

Recommendation:

Yes, the Commission should approve TECO’s revised

tariffs to implement the GBRA increase effective with the first billing cycle

of January 2024 as approved in the settlement order. (Guffey, Lang)

Staff Analysis:

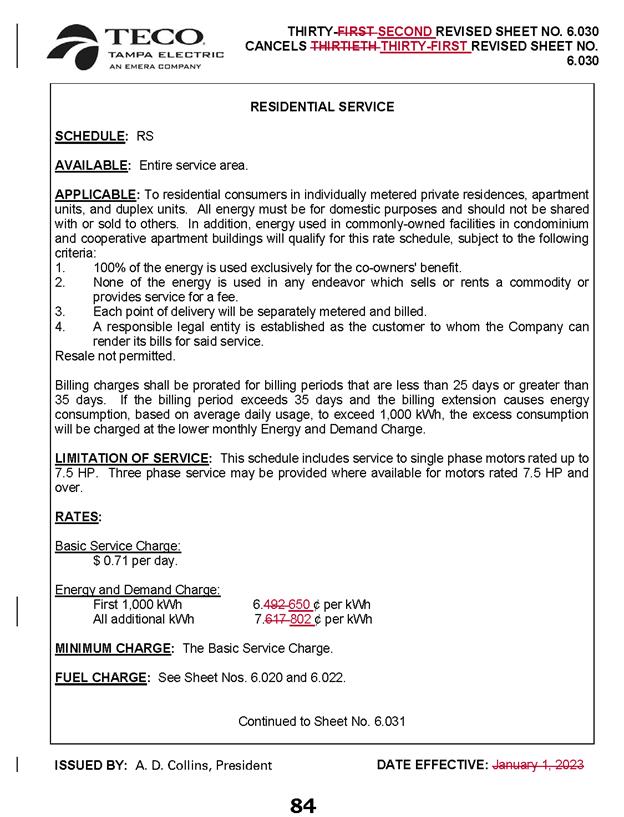

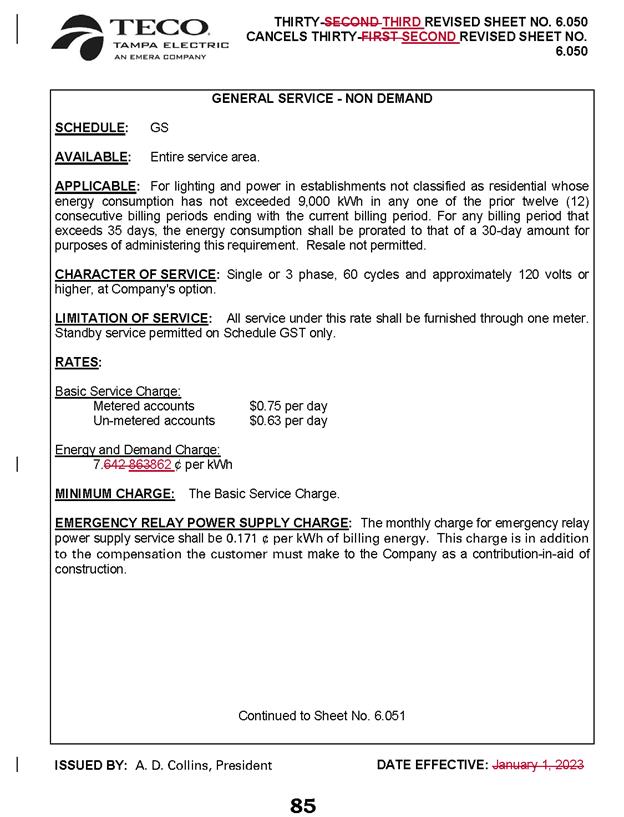

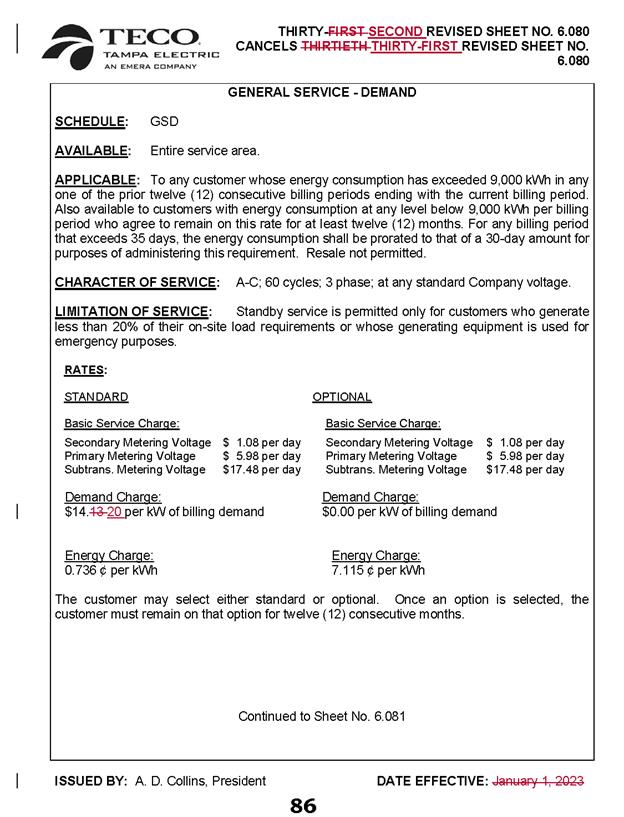

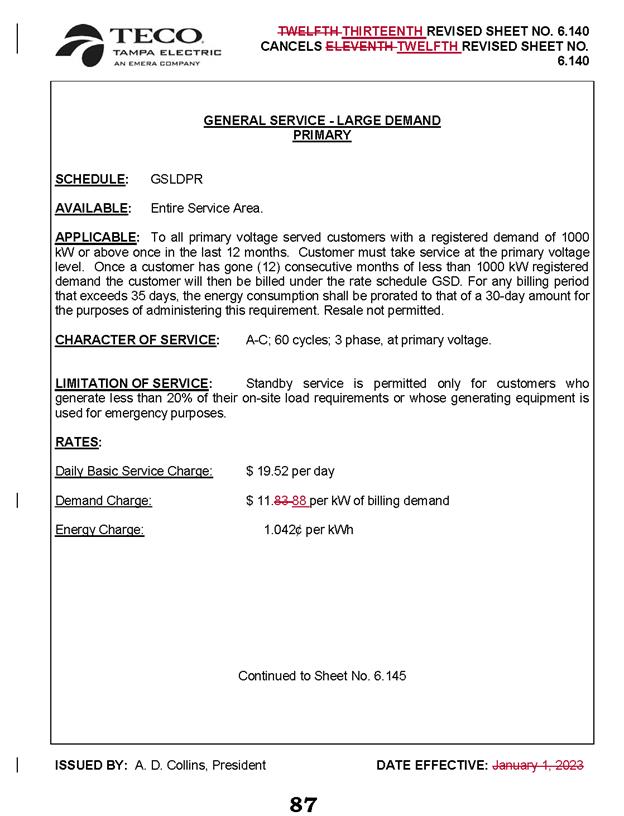

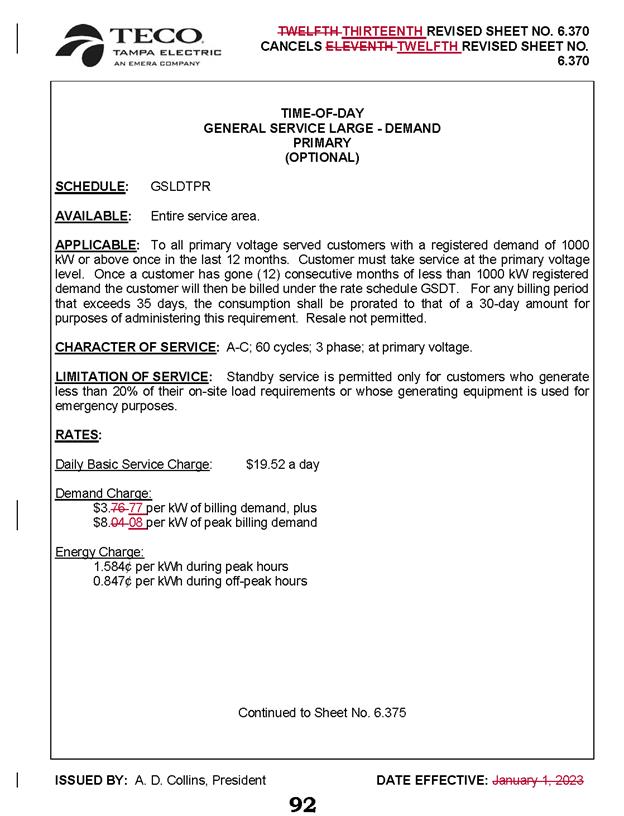

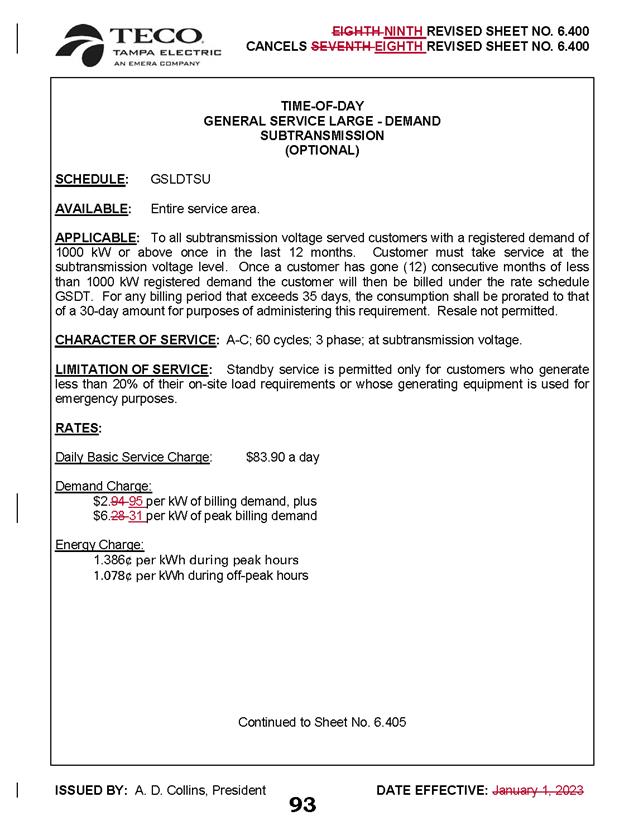

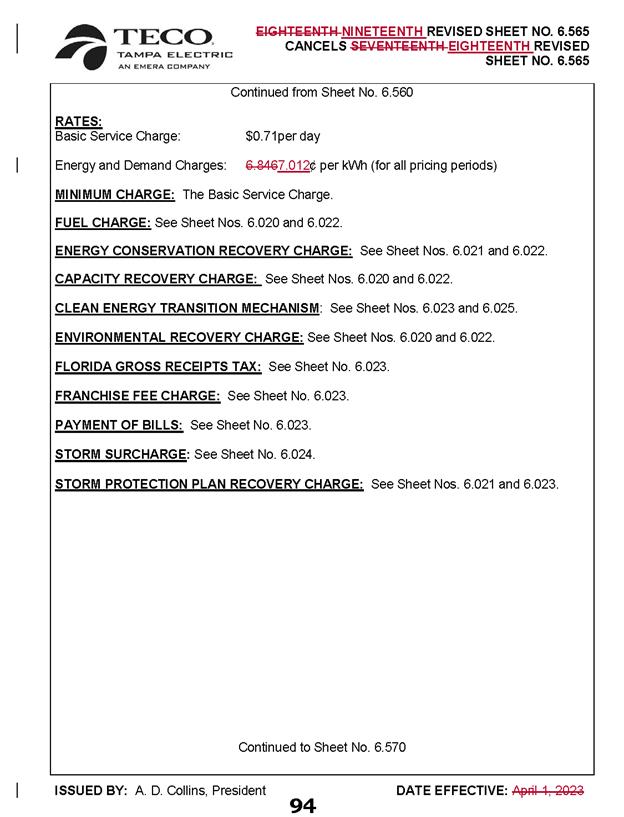

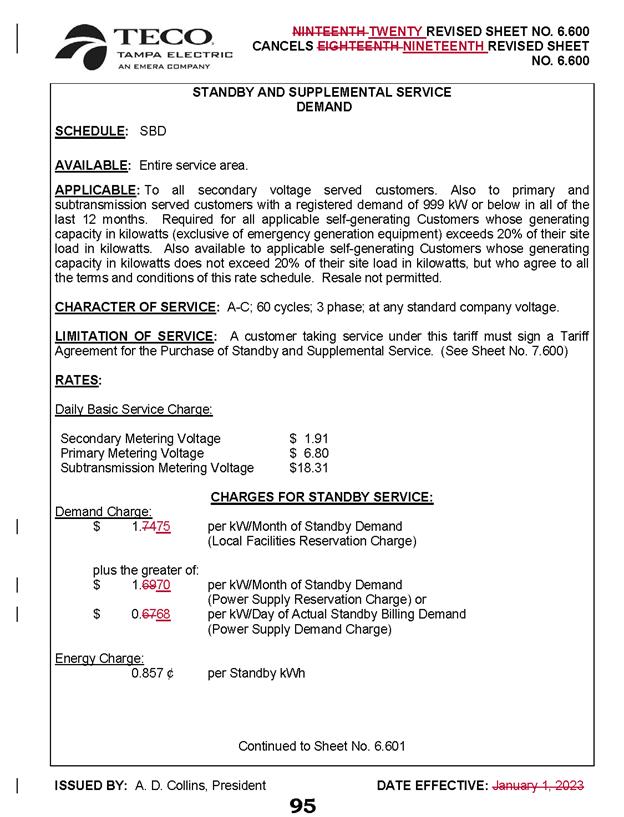

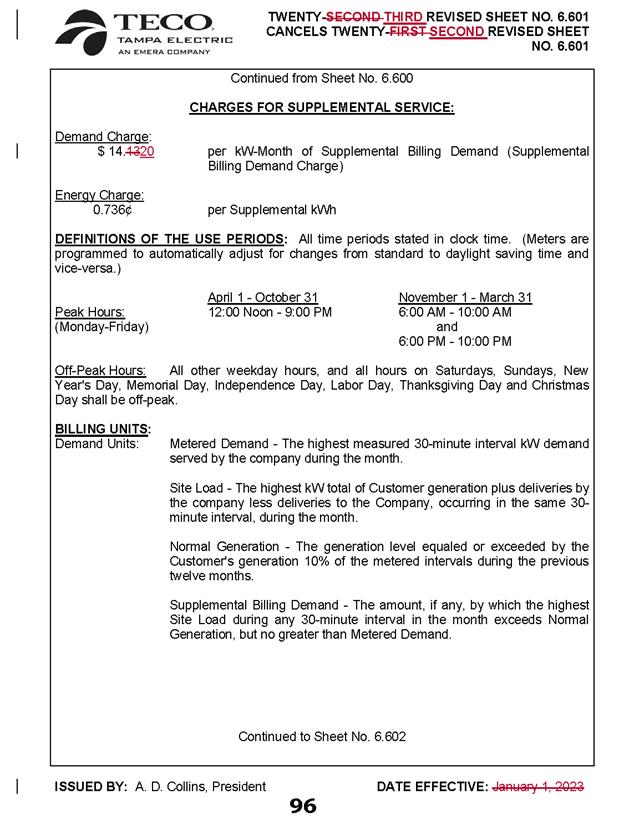

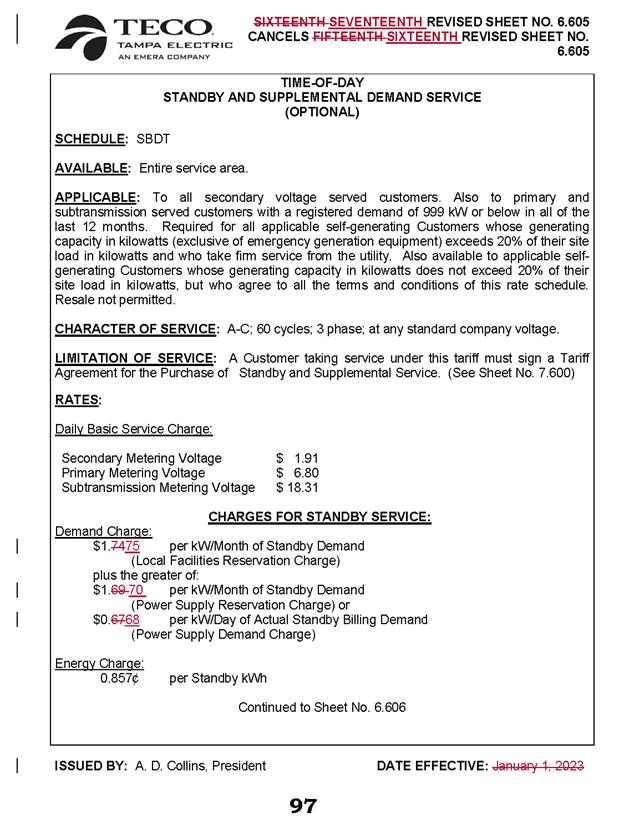

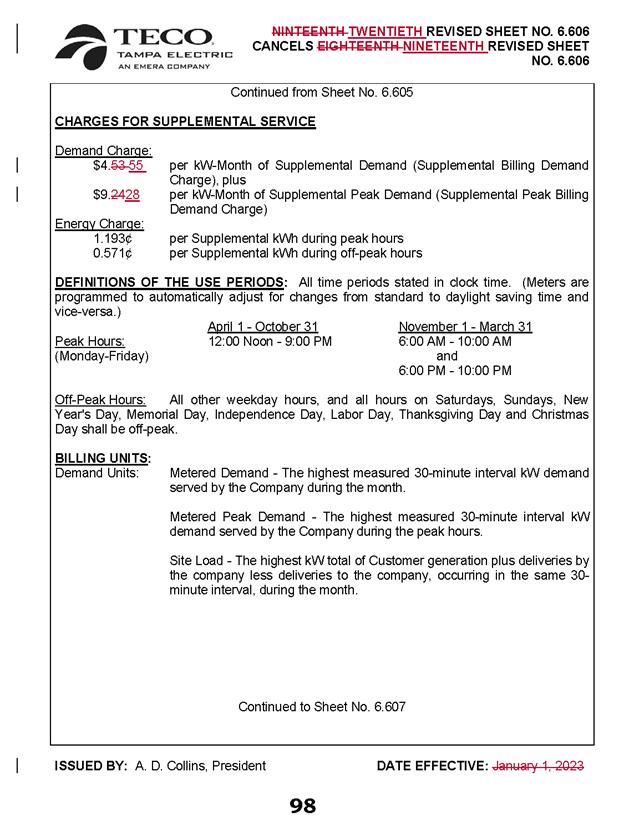

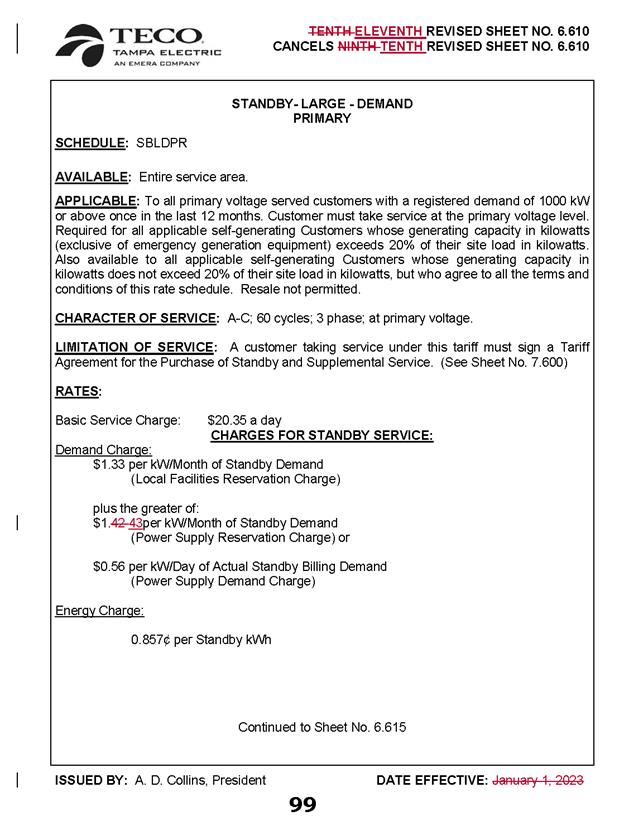

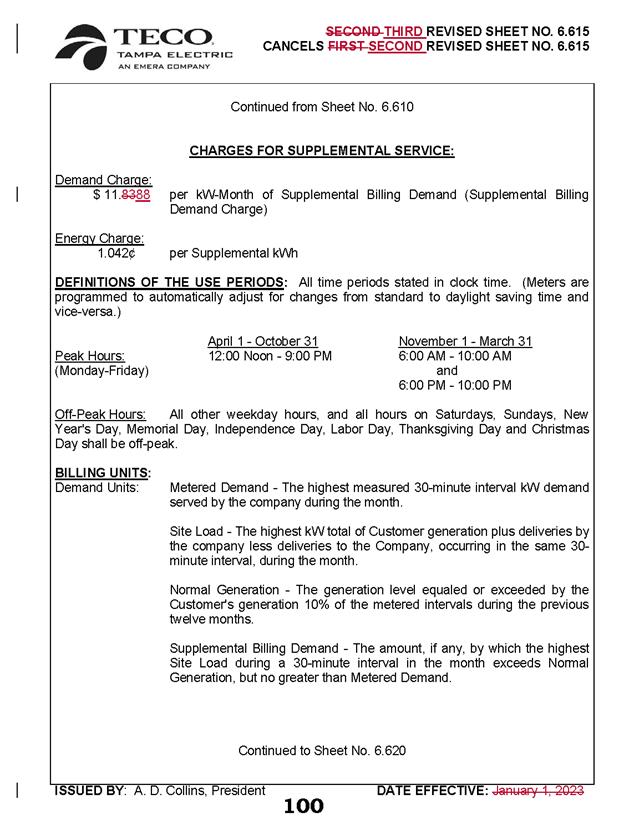

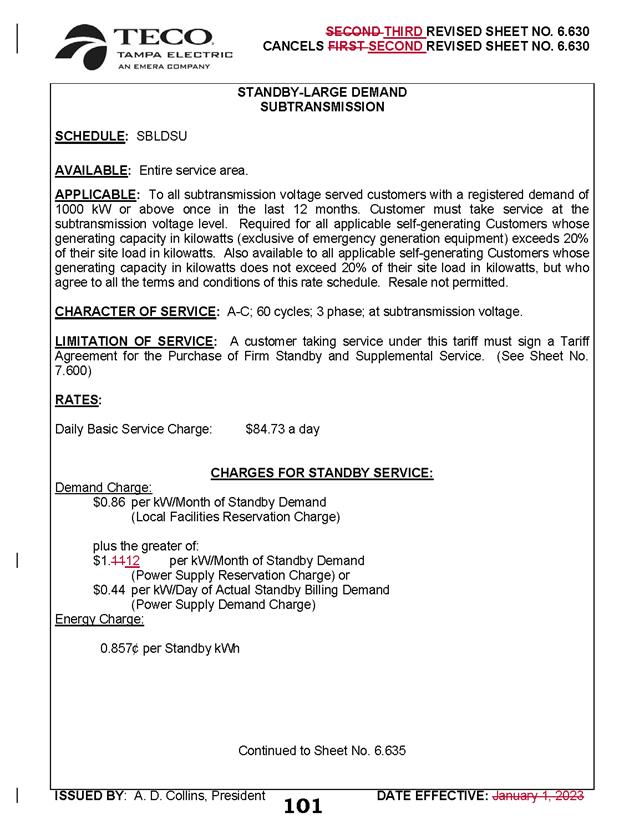

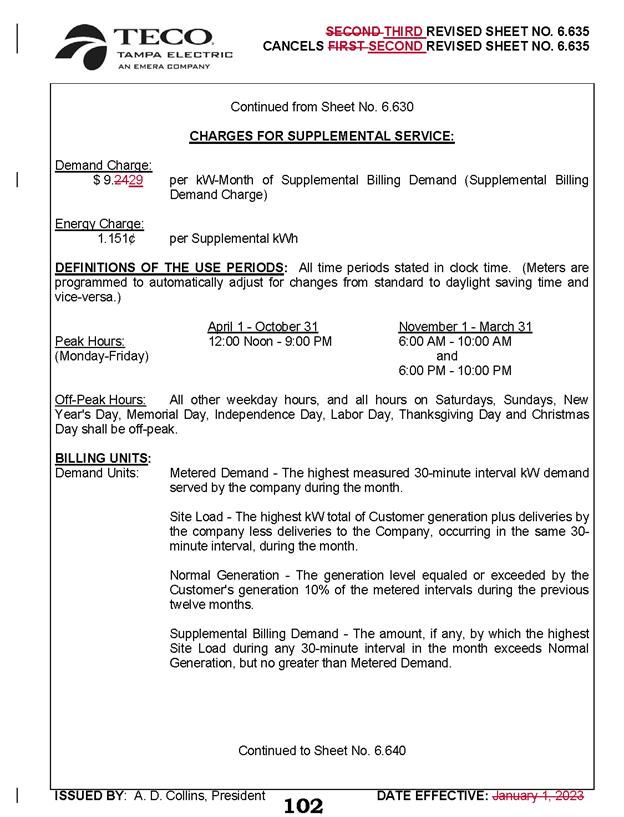

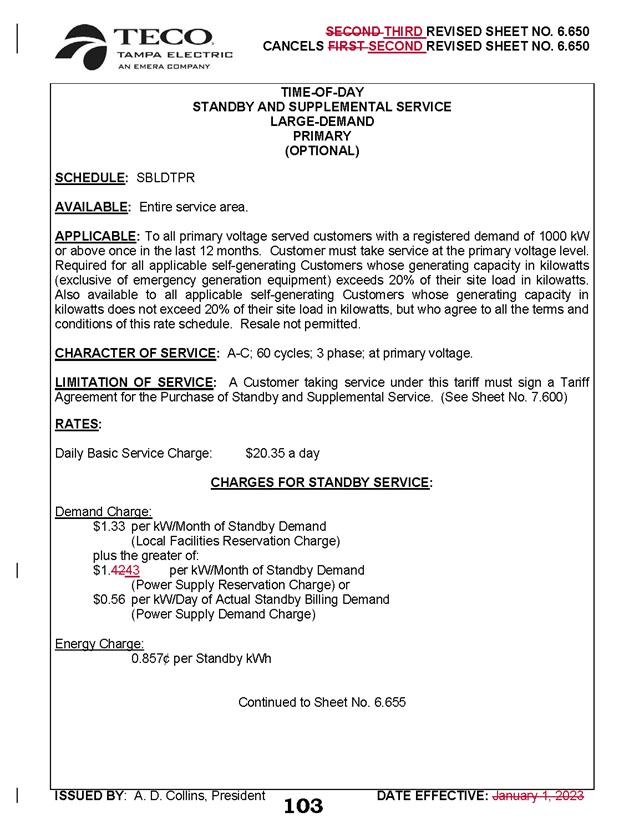

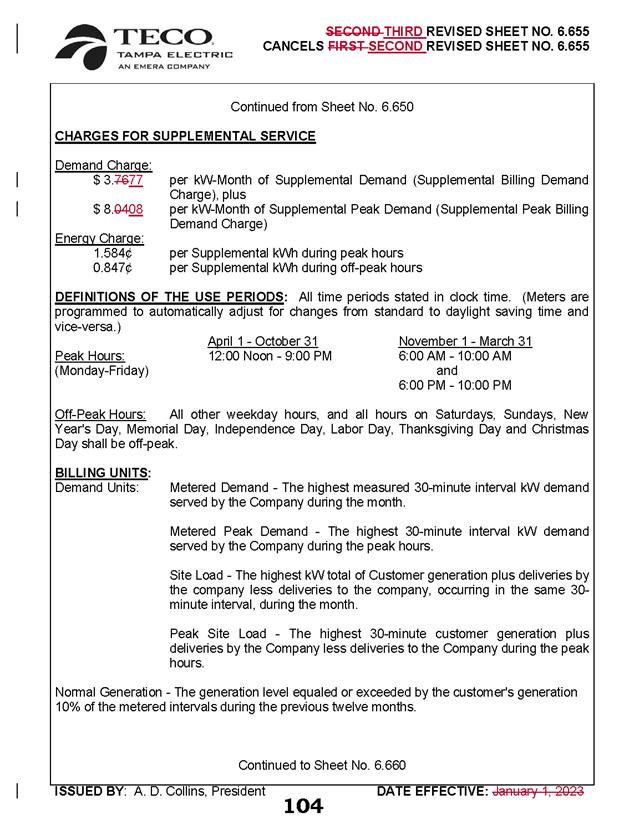

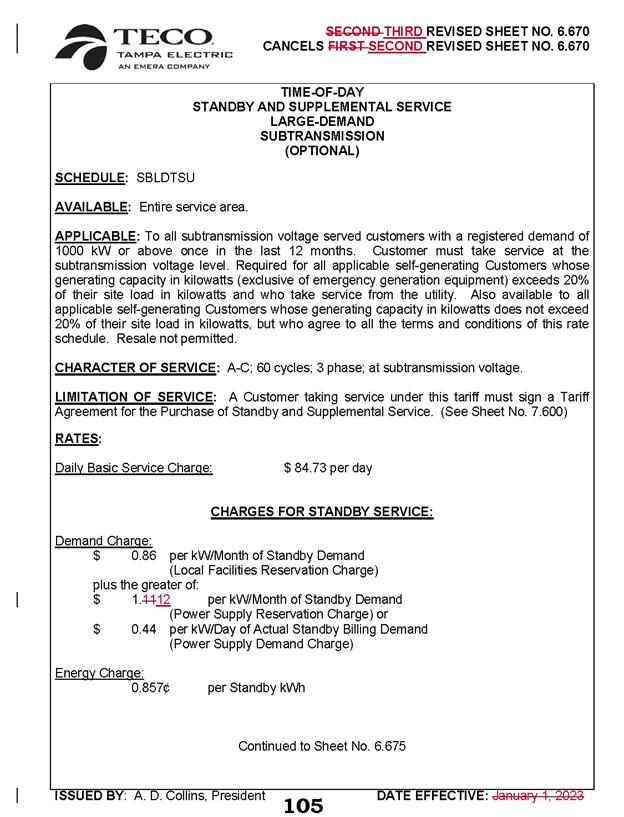

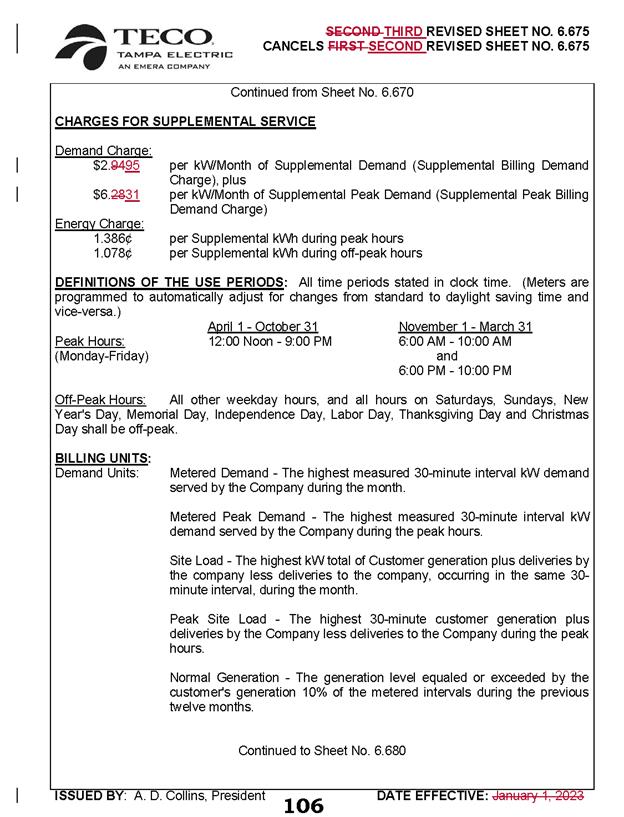

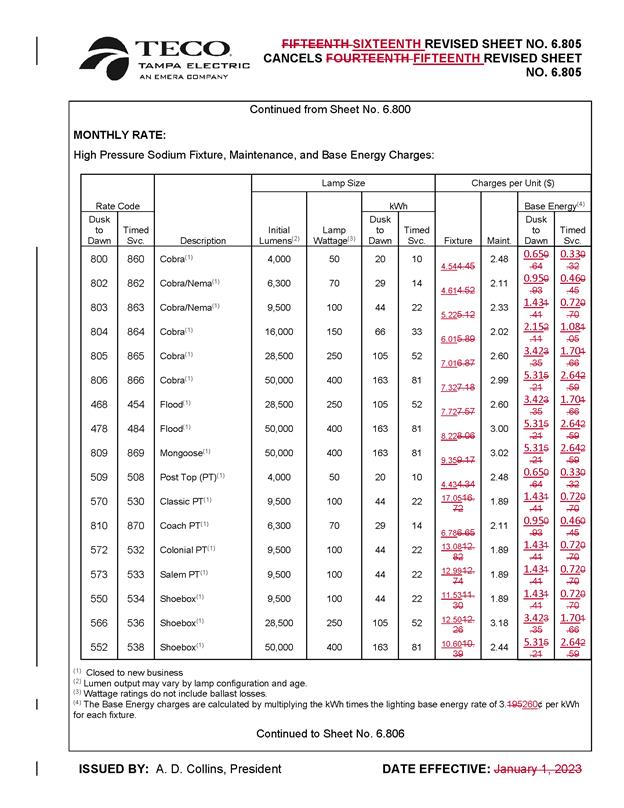

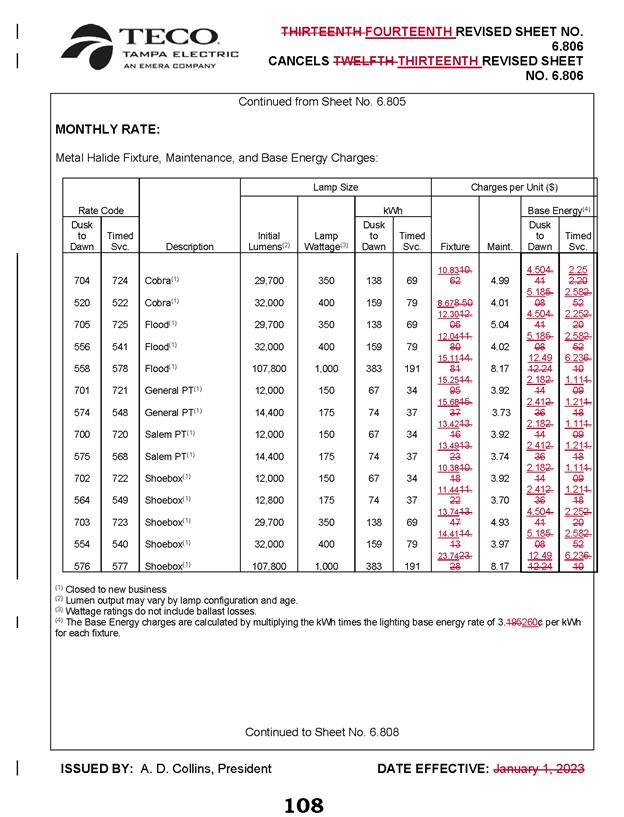

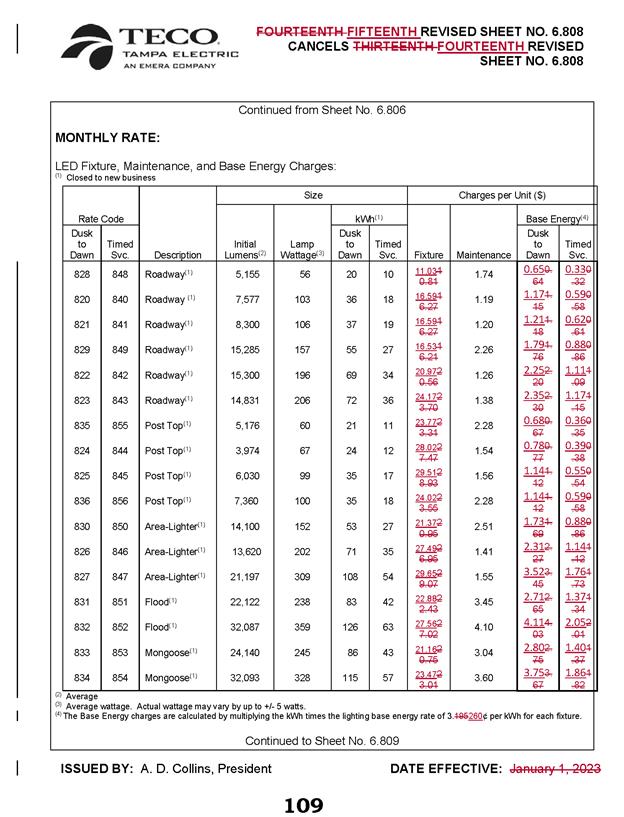

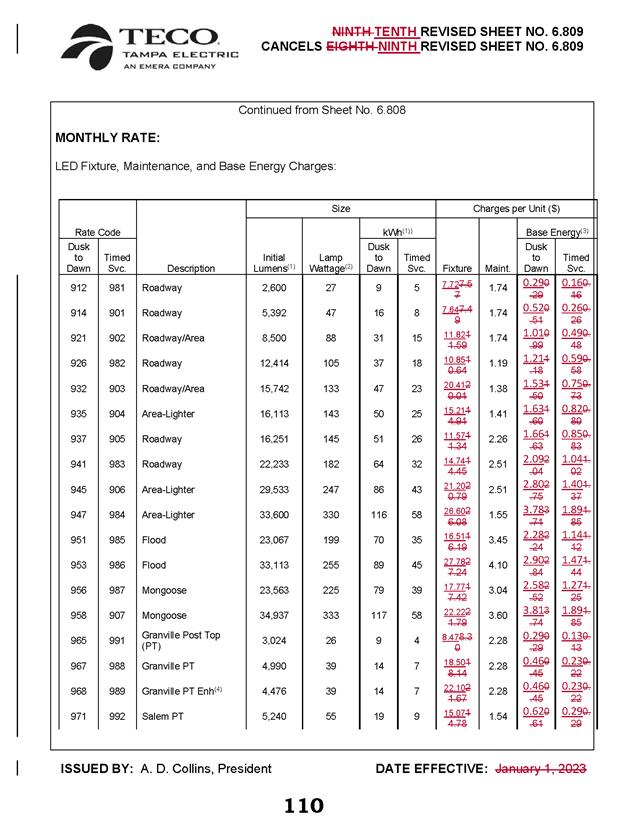

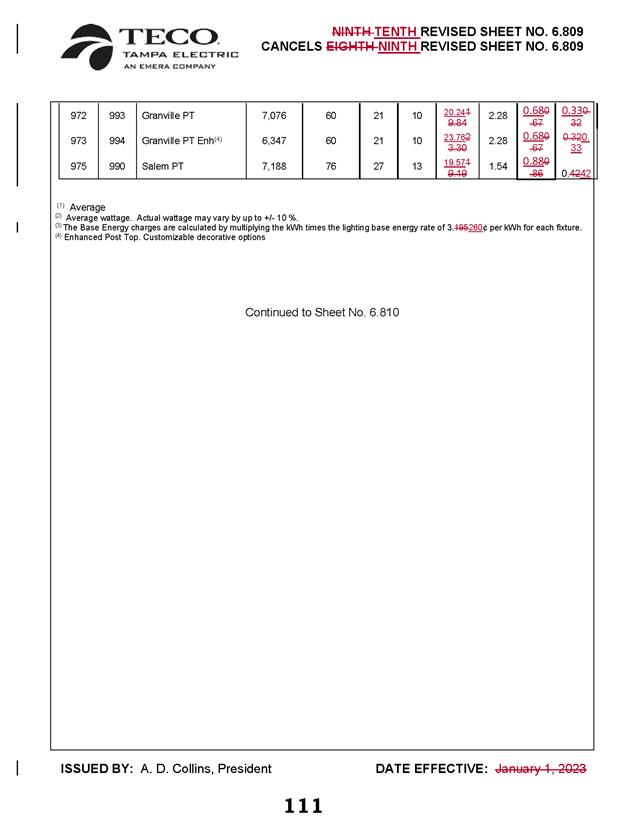

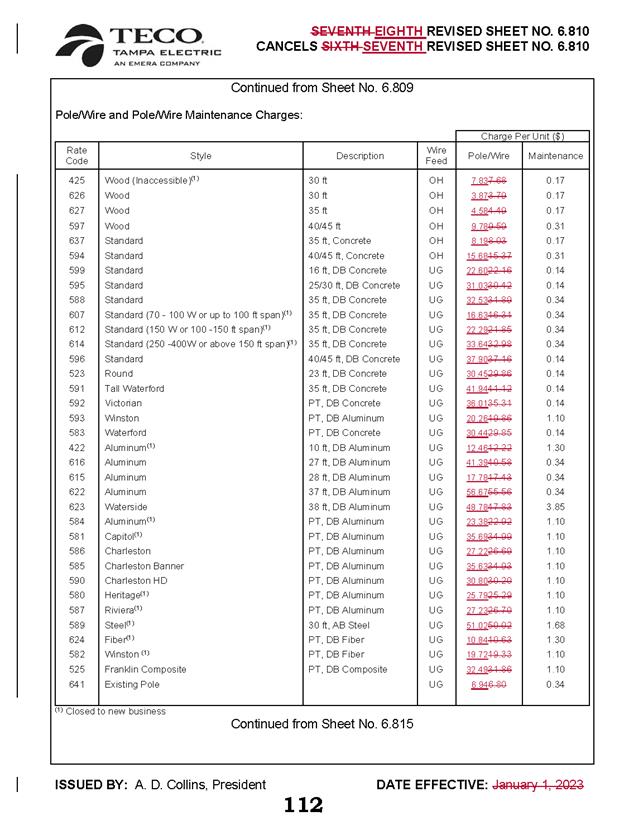

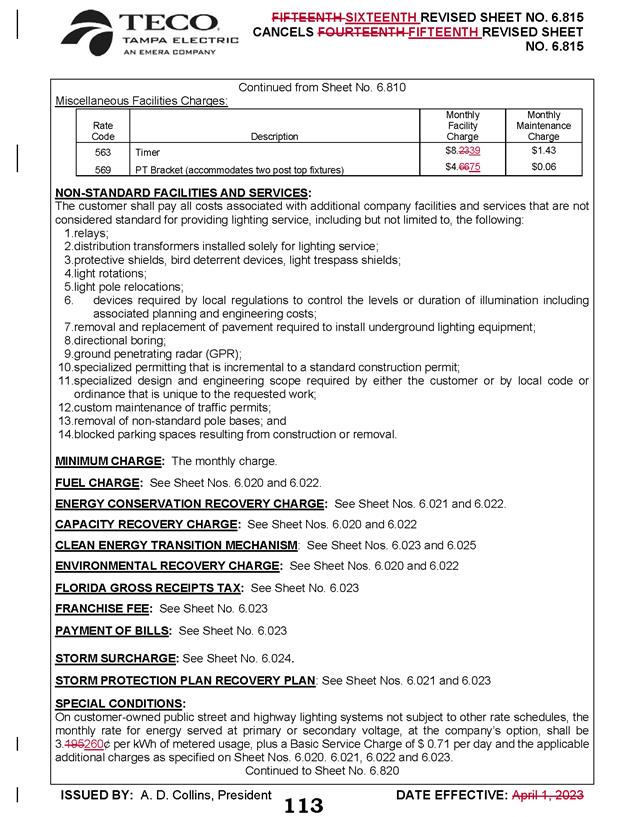

TECO’s petition includes the proposed tariff sheets,

the allocation of the revenue increase to the various rate classes and

calculations showing the revenue from the sale of electricity by rate schedule

under current and proposed rates. A residential customer who uses 1,000

kilowatt-hours (kWh) per month will see an increase of $1.58 on the base rate portion of their monthly bill as a

result of the GBRA increase.

Subparagraph 4(e) of the settlement agreement, which

addresses the GBRA increase and was approved by Order No. PSC-2021-0423-S-EI,

states:

… the GBRAs shall be reflected on customer bills by

allocating each GBRA revenue requirement to rate classes as shown in Exhibit K

and demand and energy base rate charges shall be increased on an equal

percentage basis (to the extent practicable) within each class to recover the

allocated revenue requirement increase for each class, and shall be calculated

based upon the billing determinants used in the company’s

then-most-current-ECCR filing with the Commission for the twelve months

following the effective date of any respective GBRA. For GSD, GSLDPR, and

GSLDSU rate classes, the increase will be recovered exclusively based on demand

charges.

TECO’s most current Energy Conservation Cost Recovery

Clause (ECCR) filing in Docket No. 20230002-EG was filed on August 4, 2023.

Staff has confirmed that the billing determinants used in calculating the

proposed GBRA base rate charges are consistent with the billing determinants in

TECO’s most recent ECCR filing and are in compliance with the language of the

settlement agreement.

Staff has also reviewed TECO’s proposed 2024 GBRA tariff

sheets and supporting documentation. The calculations are accurate and reflect

the language of the approved settlement agreement. The Commission should

approve TECO’s tariff rate changes to implement the updated GBRA increase of $21,689,323

due to the ROE trigger provision in the settlement agreement. Pursuant to the

settlement order, the rate changes should become effective with the first billing

cycle of January 2024. TECO should notify its customers of the approved new

rates by way of bill notification in the December 2023 billing cycle.

Issue 3:

Should this docket be closed?

Recommendation:

No. If Issues 1 and 2 are approved and a protest is

filed within 21 days of the issuance of the order, the tariffs should remain in

effect, with any revenues held subject to refund, pending resolution of the

protest. This docket should remain open in order for TECO to file updated 2023

and 2024 GBRAs, adjusted to reflect IRA impacts, by April 1, 2024. (Dose)

Staff Analysis:

If Issues 1 and 2 are approved and a protest is

filed within 21 days of the issuance of the order, the tariffs should remain in

effect, with any revenues held subject to refund, pending resolution of the protest.

This docket should remain open in order for TECO to file updated 2023 and 2024

GBRAs, adjusted to reflect IRA impacts, by April 1, 2024.