|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

November 21, 2023

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Office of the General Counsel (Rubottom,

Dike) SMC

Deputy Executive Director,

Administrative (Lynn) ACL

Division of Economics (McNulty, Hampson, Kunkler)

EJD

|

|

RE:

|

Docket No. 20230115-EU – Proposed amendment

of Rule 25-6.0131, F.A.C., Regulatory Assessment Fees; Investor-owned

Electric Companies, Municipal Electric Utilities, Rural Electric

Cooperatives.

|

|

AGENDA:

|

12/05/23 – Regular Agenda – Rule Proposal – Interested Persons May

Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Administrative

|

|

CRITICAL DATES:

|

None

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

Rule

25-6.0131, Florida Administrative Code (F.A.C.), Regulatory Assessment Fees; Investor-owned

Electric Companies, Municipal Electric Utilities, Rural Electric Cooperatives,

implements the Commission’s statutory mandate to collect a fee, known as a

regulatory assessment fee (RAF), from each regulated electric company under the

jurisdiction of the Commission as provided in Sections 350.113 and 366.14,

Florida Statutes (F.S.). Specifically, the rule establishes filing requirements

and a rate at which the RAF should be calculated for investor-owned electric

utility companies (IOUs), municipal electric utilities, and rural electric

cooperatives.

Statutory

History

In

Section 350.113, F.S., the Legislature established RAFs as the exclusive

funding mechanism for the Commission. Each

utility or company regulated by the Commission is required to pay a RAF, and collected

RAFs are credited to the Florida Public Service Regulatory Trust Fund (PSC

Trust Fund). Monies from the PSC Trust Fund are to be

used in the operation of the Commission and are withdrawn according to the

Commission’s budget that is set annually by the Legislature.

Each

utility or company under the Commission’s jurisdiction is required to pay a RAF

every six months, and the RAF must be based upon the company’s gross operating

revenues for the preceding six-month period. The Legislature did not prescribe the rate

at which the RAF must be calculated from a company’s revenues, but it did

provide statutory guidance the Commission must follow in establishing and

managing RAF rates through rulemaking. First, the RAF for each industry must,

to the extent practicable, be related to the cost of regulating that industry;

the Commission must therefore endeavor to establish a RAF rate for each

regulated industry that is sufficient to cover the cost of regulating the

utilities or companies in that industry. Second, the RAF rate may not exceed a

maximum rate established by the Legislature for each industry. Third, RAFs collected from one industry

may not be used to subsidize the regulatory costs of another industry.

History

of Commission RAFs for Electric Utilities

Prior

to 1980, the Legislature controlled RAFs directly by statute and set a separate

RAF rate for each industry regulated by the Commission. However, in 1980 the Legislature enacted a

statute that provided a maximum RAF rate for each industry and left it to the

Commission to establish specific RAF rates through agency rulemaking. To implement this change enacted by the

Legislature in the statutory scheme related to RAFs, the Commission adopted its

original RAF rules, including for electric utilities, in 1980 through emergency

rulemaking and adopted them as permanent rules later

that year.

Rule

25-6.0131, F.A.C., was adopted by the Commission in 1983 to replace the

original RAF rules for electric utilities. The RAF rate for municipal electric

utilities and rural electric cooperatives has not been updated since it was

originally established by the Commission in 1980. The RAF rate for IOUs has been amended

five times since it was adopted in 1980, but has not been updated since 1999.

Temporary

Exemption from SERC and Legislative Ratification Requirements

In 2010, the

Legislature amended Section 120.541, F.S., to require agencies to prepare a

statement of estimated regulatory costs (SERC) for any rule that will have an

adverse impact on small business or that is likely to directly or indirectly

increase regulatory costs in excess of $200,000 in the aggregate within one

year after implementation. Since the statute was amended in 2010, Section

120.541, F.S., has also required legislative ratification of all proposed

agency rules that exceed $1 million in regulatory cost impact within a 5-year

period after implementation. During the 2023 legislative session,

however, the Legislature granted the Commission a one-year exemption from the

SERC and ratification requirements for rules amended to increase RAF rates.

Because

of the size of the industries regulated by the Commission, any meaningful

increase in RAFs will trigger ratification. The lengthy time and uncertainty

introduced by the legislative ratification requirement, coupled with the time

required for rulemaking and the additional time required to realize the

collection of RAFs, have prevented the Commission from managing RAF revenues

through rulemaking in any industry since 2010.

Other Procedural

Issues

A Notice of Rule

Development for Rule 25-6.0131, F.A.C., appeared in the September 12, 2023,

edition of the Florida Administrative Register, Vol. 49, No. 177. Staff held a

rule development workshop on September 27, 2023. Participating in the workshop

were the Office of Public Counsel and Tampa Electric Company. No post-workshop

comments were filed.

This

recommendation addresses whether the Commission should propose the amendment of

Rule 25-6.0131, F.A.C., Regulatory Assessment Fees; Investor-owned Electric

Companies, Municipal Electric Utilities, Rural Electric Cooperatives. The

Commission has jurisdiction pursuant to Sections 120.54, 350.113, 366.05, and 366.14,

F.S.

Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rule 25-6.0131,

F.A.C., Regulatory Assessment Fees; Investor-owned Electric Companies,

Municipal Electric Utilities, Rural Electric Cooperatives?

Recommendation:

Yes, the Commission should propose the amendment of

Rule 25-6.0131, F.A.C., as set forth in Attachment A. The Commission should

also certify that Rule 25-6.0131, F.A.C., is a rule the violation of which

would be a minor rule violation pursuant to Section 120.695, F.S. (Rubottom, Lynn,

McNulty).

Staff Analysis:

Rule 25-6.0131, F.A.C., implements the Commission’s

statutory mandate to establish and collect RAFs from electric utilities. The

purpose of this rulemaking is to update the rate at which RAFs are calculated

for electric utilities to accurately reflect the cost of regulation.

Current Situation and Future Projections

The Commission’s overall cost of regulation has exceeded

its collected RAF revenues in seven of the last eleven years. In recent years,

Commission management has used internal cost controls to mitigate the

difference in revenues and expenditures. However, recent legislative changes

and mandates have increased the Commission’s costs,

and staff projects that without any offsetting increase in revenues, the annual

deficit will increase significantly over the next three to five years. (Table

1-1).

Table 1-1

Source: Commission Staff

Projected deficits in the electric industry are

particularly concerning. Regulation of electric IOUs accounts for the largest

share of the Commission’s total regulatory workload and therefore of the

Commission’s total expenditures. Looking at FY 26/27, staff calculates that the

projected cost of regulating IOUs will be $18,233,324 and that the projected

RAF revenues from IOUs, based on the current RAF rate of 0.00072, will be

$15,473,309, resulting in a projected shortfall of $2,760,015.

When the Commission’s revenues consistently do not match

expenditures, the PSC Trust Fund is depleted over time as deposits fail to

replace the agency’s annual operating budget appropriated by the Legislature.

Under current RAF rates and the projected annual budget deficit described above,

staff projects that the PSC Trust Fund balance will decline substantially over

the next few years. (Table 1-2).

Table 1-2

Source:

Commission Staff

The current status and near-term projections of the PSC

Trust Fund balance and of the Commission’s annual revenues and expenditures in

the electric industry demonstrate a need to raise agency revenues by increasing

RAF rates for IOUs.

Calculation of Recommended RAF Rates for Electric

Companies

In order to calculate a new RAF rate that would address

the projected shortfall in the Commission’s budget for the electric industry,

staff first determined how much additional revenue is needed to cover the cost

of regulation. For IOUs, and separately for municipal and cooperative utilities,

staff looked at projections for FY 26/27 and performed the following

calculation to determine the projected revenue deficit:

Cost of Regulation

– (Utility Gross Revenues x Current RAF Rate) = Revenue Deficit

For electric IOUs in FY 26/27, staff projected a cost of

regulation of $18,233,324 and utilities’ aggregate gross revenues of $21,490,706,756.

Applying the current RAF rate of 0.00072, staff projected a deficit of

$2,760,015. Staff

calculated that increasing the RAF rate for electric IOUs from 0.00072 to

0.000848 would result in an increase of nearly $2.8 million in Commission revenues

for FY 26/27, covering the projected shortfall.

For municipal and cooperative electric utilities in FY

26/27, staff projected a cost of regulation of $849,208 and utilities’

aggregate gross revenues of $8,573,862,477. Applying the current RAF rate of

0.00015625, staff projected a surplus of $490,458. Staff

calculated that decreasing the RAF rate for municipal electric utilities and

rural electric cooperatives from 0.00015625 to 0.00009905 would result in a

decrease of nearly $500,000 in Commission revenues for FY 26/27, avoiding the

projected surplus.

Therefore, staff recommends that the RAF rate for electric

IOUs be increased from 0.00072 to 0.000848. The new rate would be well below

the statutory RAF cap of 0.00125,

and the impact of the new RAF rate on individual IOU customers, based on a

residential monthly bill for 1,000 kilowatt-hours (kWh), would come to an

increase of approximately $0.02. (Table 1-3 below).

Staff also

recommends that the RAF rate for municipal electric utilities and rural electric

cooperatives be decreased from 0.00015625 to 0.00009905. The new rate will be

below the statutory RAF cap of 0.00015625,

and the impact of the new RAF rate on individual municipal and cooperative

customers, based on a residential monthly bill for 1,000 kWh, would come to a

decrease of approximately $0.01. (Table 1-3 below).

Table 1-3

|

|

IOUs

|

Munis/Coops

|

|

Statutory RAF Cap

|

0.00125

|

0.00015625

|

|

Current RAF Rate

|

0.00072

|

0.00015625

|

|

Recommended RAF Rate

|

0.000848

|

0.00009905

|

|

Impact on Customers

(Based on Residential Bill at 1,000 kWh)

|

$0.02

|

-$0.01

|

Source: Commission Staff

Recommended Amendments to Rule 25-6.0131, F.A.C.

Staff recommends that the Commission amend Rule 25-6.0131,

F.A.C., including the forms incorporated by reference, as set forth in

Attachment A. Updated RAF rates, as detailed above, are the only substantive

amendments staff is recommending to Rule 25-6.0131, F.A.C. Other recommended

amendments to the rule are non-substantive, designed to provide consistency and

clarity to the rule language.

Minor Violation Rules Certification

Pursuant

to Section 120.695, F.S., for each rule filed for adoption, the agency head

shall certify whether any part of the rule is designated as a rule the

violation of which would be a minor violation. Rule 25-6.0131, F.A.C., is on

the Commission’s minor violation rule list because violation of the rule would

not result in economic or physical harm to a person or adverse effects on the

public health, safety, or welfare and would not create a significant threat of

such harm. The proposed amendments to the rule would not alter the likelihood

or risk of such harms in the event of a violation. Thus, if the Commission

proposes the amendment, staff recommends that the Commission certify that Rule

25-6.0131, F.A.C., is a rule the violation of which would be a minor violation

pursuant to Section 120.695, F.S.

Statement of Estimated Regulatory Costs

As discussed above, rules adopted by the Commission during

the 2023-2024 fiscal year to implement Sections 350.113 and 366.14, F.S., are

not subject to the SERC requirement of Section 120.541, F.S.

Therefore, no SERC has been prepared.

Conclusion

Based on the foregoing, staff recommends that the

Commission propose the amendment of Rule 25-6.0131, F.A.C., as set forth in

Attachment A. In addition, staff recommends that the Commission certify that

Rule 25-6.0131, F.A.C., is a rule the violation of which would be a minor rule

violation pursuant to Section 120.695, F.S. If the Commission proposes the

amendment, staff notes that each electric company’s next RAF payment following

the effective date of the amended rule will be calculated using the new RAF rate

applied to the company’s gross operating revenues for the entire six-month

period in which the amended rule becomes effective.

Issue 2:

Should this docket be closed?

Recommendation:

Yes, if no requests for hearing or JAPC comments are

filed, the rule should be filed for adoption with the Department of State, and

the docket should be closed. (Rubottom).

Staff Analysis:

If no requests for hearing or JAPC comments are

filed, the rule should be filed with the Department of State for adoption, and

the docket should be closed. Staff notes that if there are no requests for

hearing or JAPC comments filed, the rule will be filed for adoption on

approximately January 9, 2024, and will become effective on approximately

January 29, 2024.

25-6.0131

Regulatory Assessment Fees; Investor-owned Electric Companies, Municipal

Electric Utilities, Rural Electric Cooperatives.

(1) As applicable and as provided in

Section 350.113, F.S., and Section 366.14, F.S., each company, utility,

or cooperative shall remit to the Commission a fee based upon its gross

operating revenue. This fee shall be referred to as a regulatory assessment

fee. Regardless of the gross operating revenue of a company, utility, or

cooperative, a minimum annual regulatory assessment fee of $25 shall be

imposed.

(a) Each investor-owned electric

company shall pay a regulatory assessment fee in the amount of 0.000848 .00072

of its gross operating revenues derived from intrastate business,

excluding sales for resale between investor-owned electric companies public

utilities, municipal electric utilities, and rural electric cooperatives or

any combination thereof.

(b) Each municipal electric utility and

rural electric cooperative shall pay a regulatory assessment fee in the amount

of 0.00009905 0.00015625 of its gross operating revenues derived

from intrastate business, excluding sales for resale between investor-owned

electric companies public utilities, municipal electric utilities,

and rural electric cooperatives or any combination thereof.

(2) Regulatory assessment fees are due

each January 30 for the preceding period or any part of the period from July 1

until December 31, and on July 30 for the preceding period or any part of the

period from January 1 until June 30.

(3) If the due date falls on a

Saturday, Sunday, or a holiday, the due date is extended to the next business

day. If the fees are sent by registered mail, the date of the registration is

the United States Postal Service’s postmark date. If the fees are sent by

certified mail and the receipt is postmarked by a postal employee, the date on

the receipt is the United States Postal Service’s postmark date. The postmarked

certified mail receipt is evidence that the fees were delivered. Regulatory

assessment fees are considered paid on the date they are postmarked by the

United States Postal Service or received and logged in by the Commission’s

Division of Administrative and Information Technology Services in Tallahassee.

Fees are considered timely paid if properly addressed, with sufficient postage

and postmarked no later than the due date.

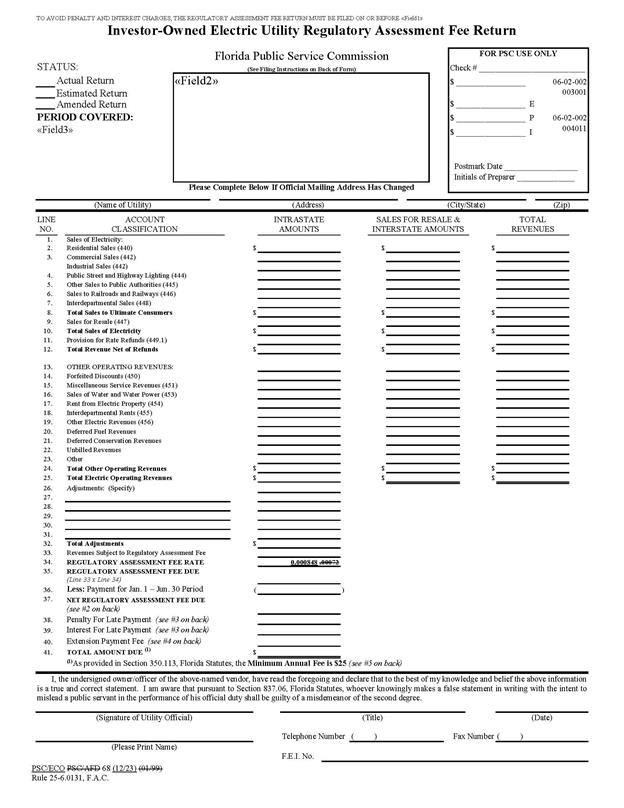

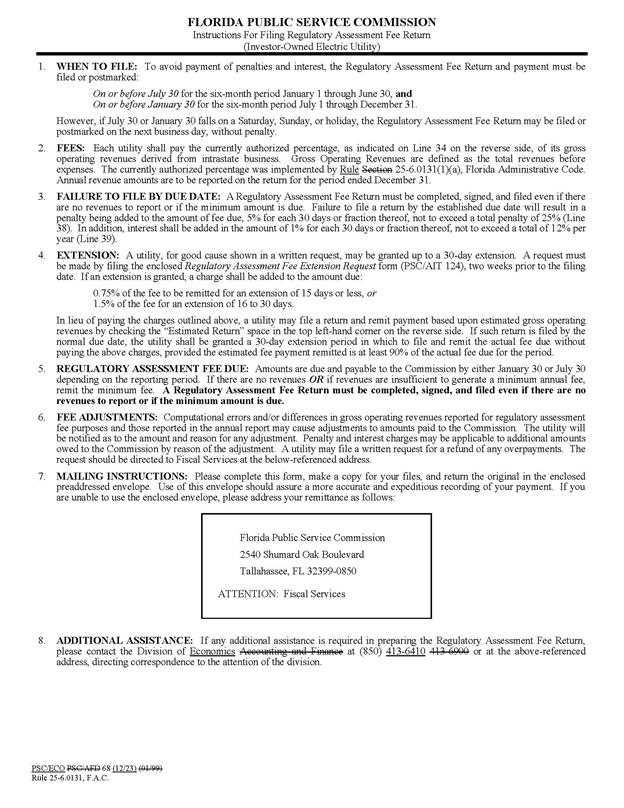

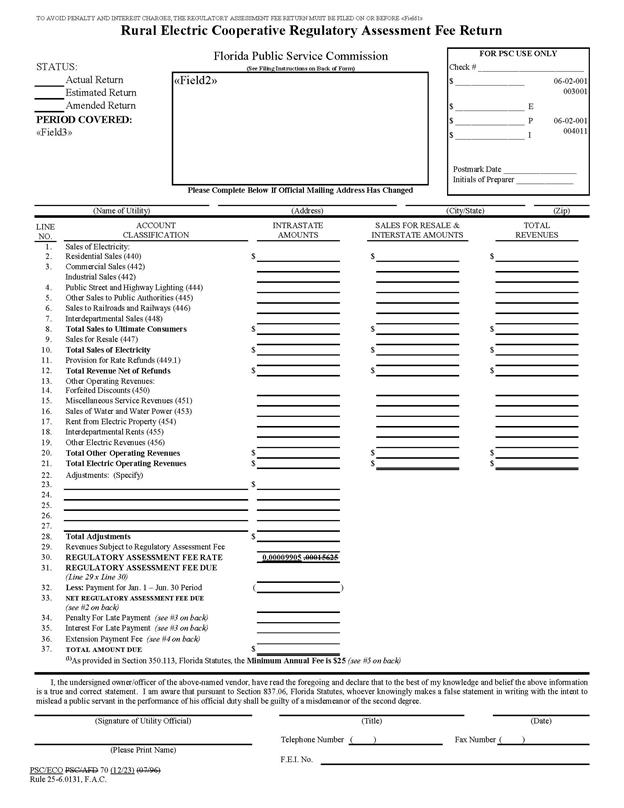

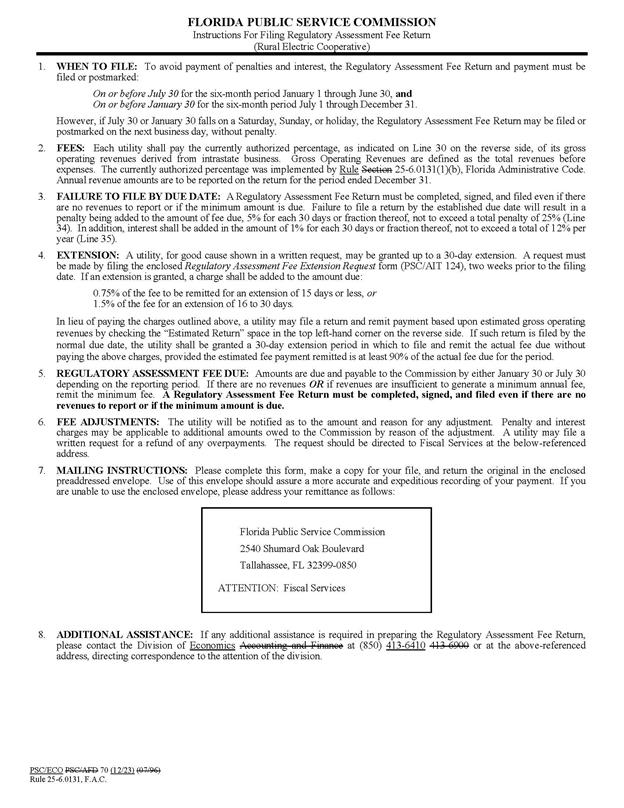

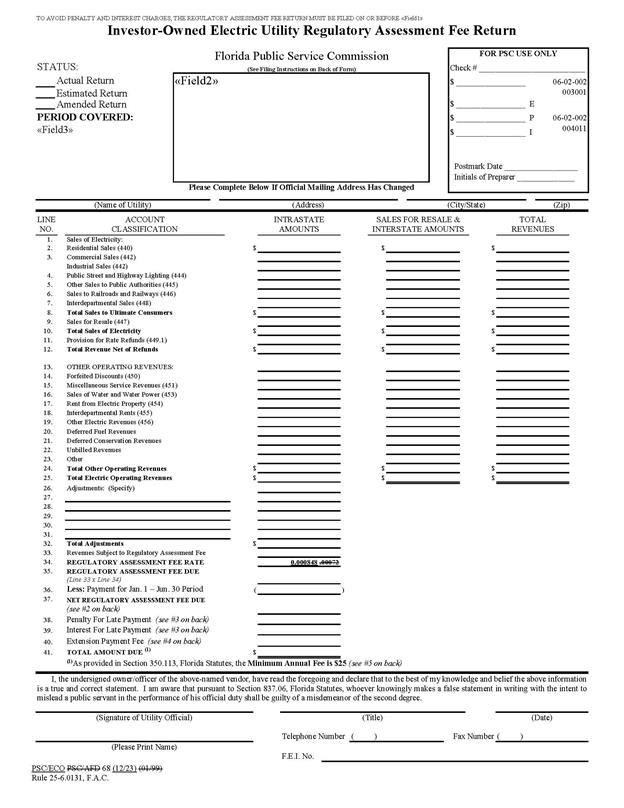

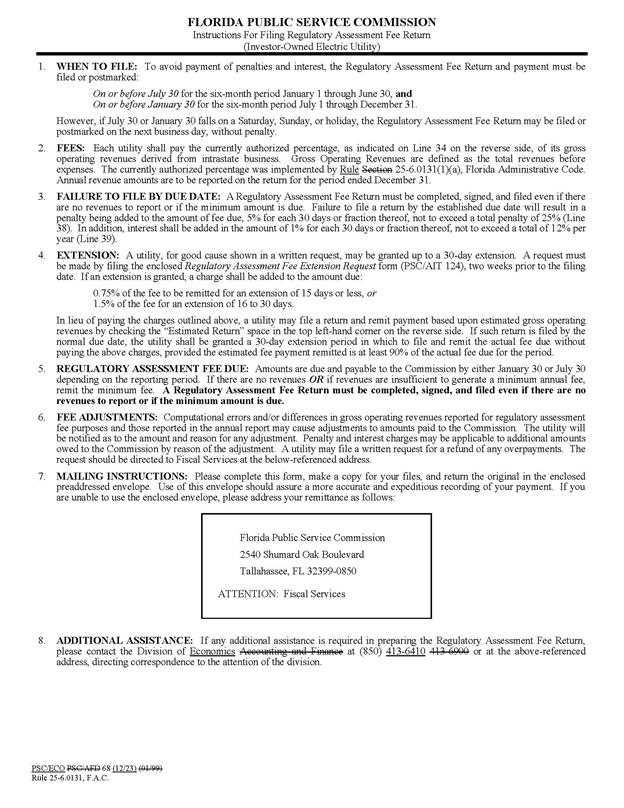

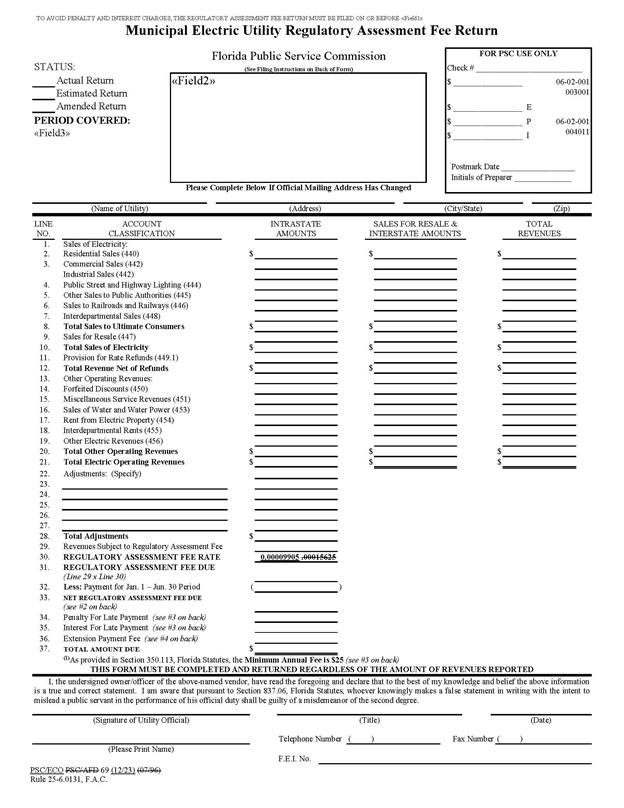

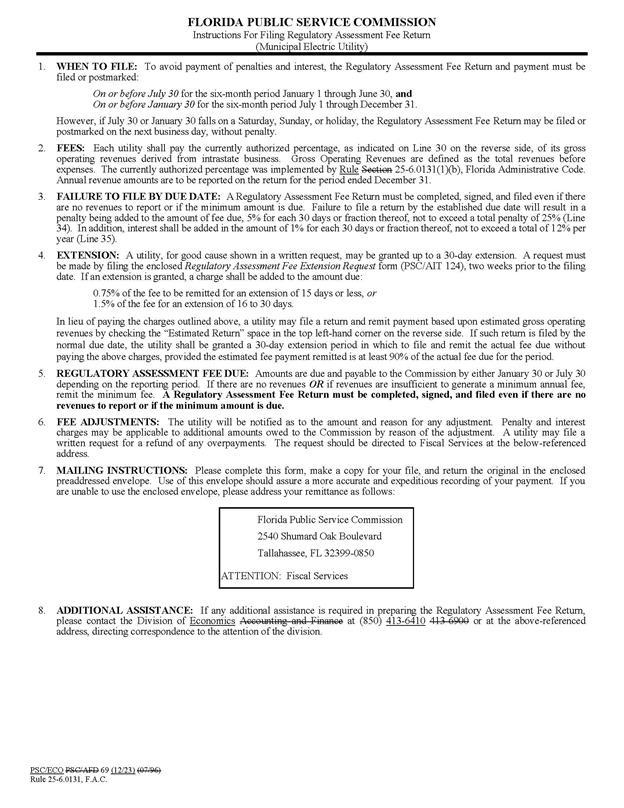

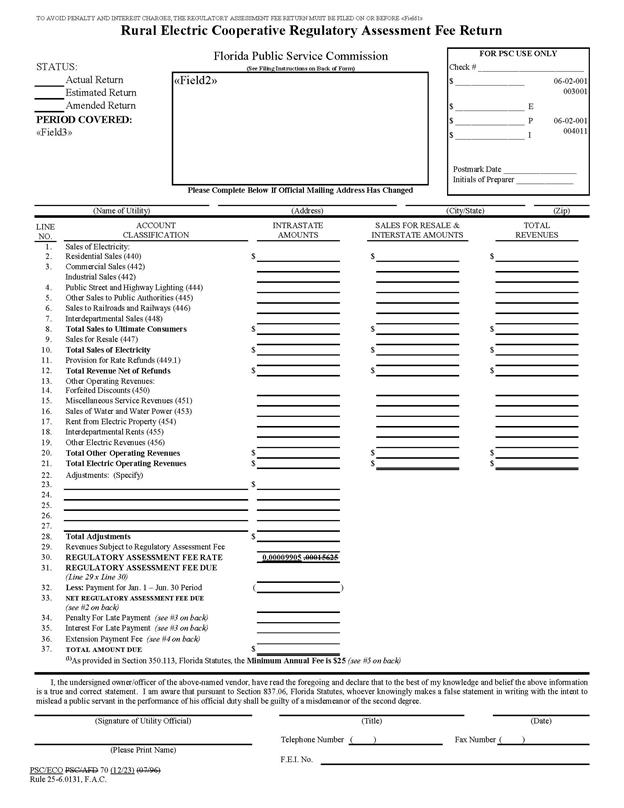

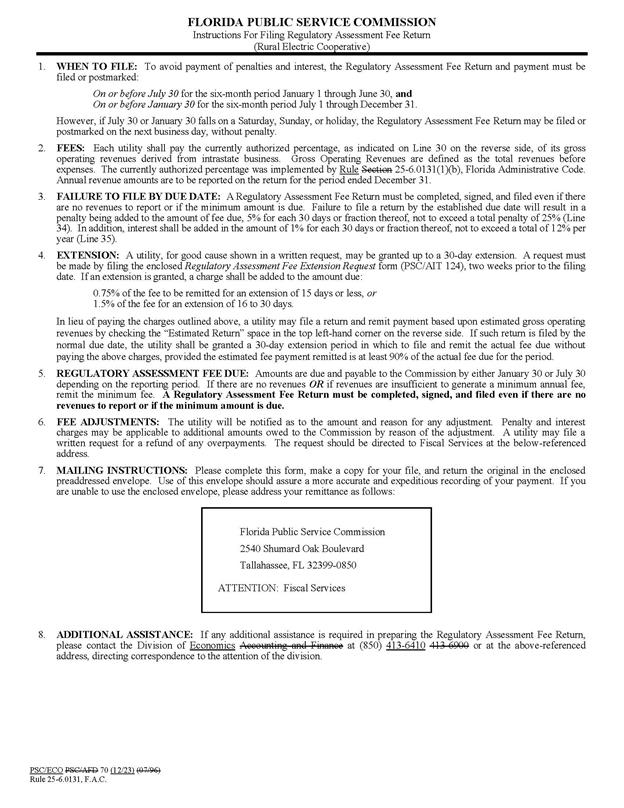

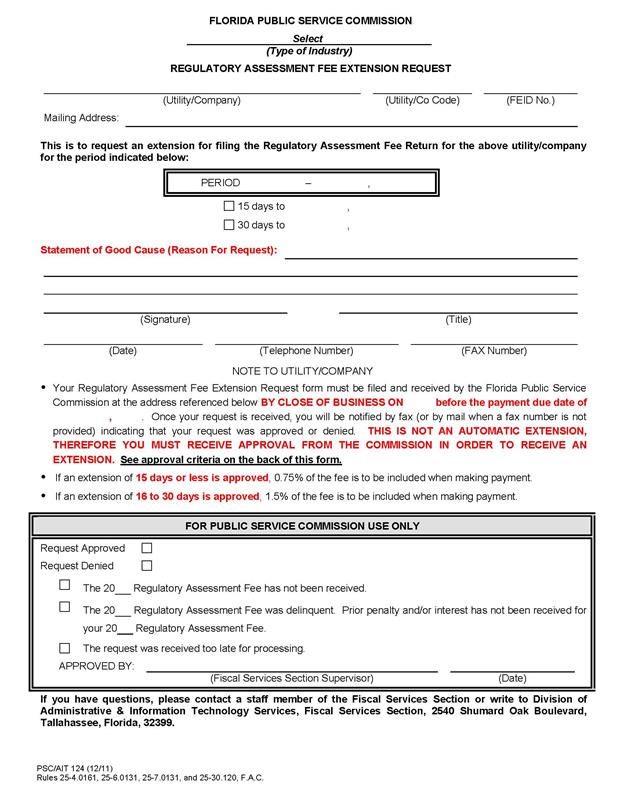

(4) Commission Form PSC/ECO PSC/AFD

68 (12/23) (01/99), entitled “Investor-Owned Electric Utility

Regulatory Assessment Fee Return,”; is available at [new

hyperlink] http://www.flrules.org/Gateway/reference.asp?No=Ref-02610;

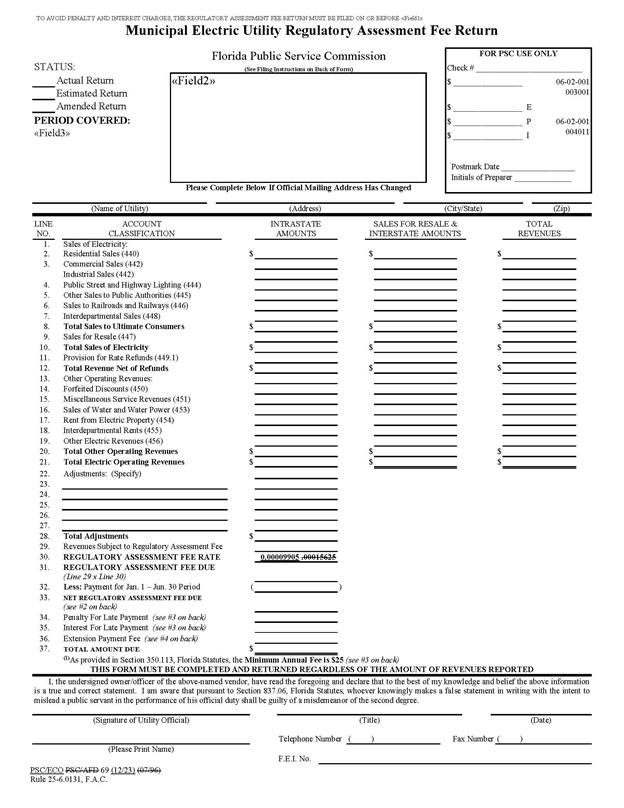

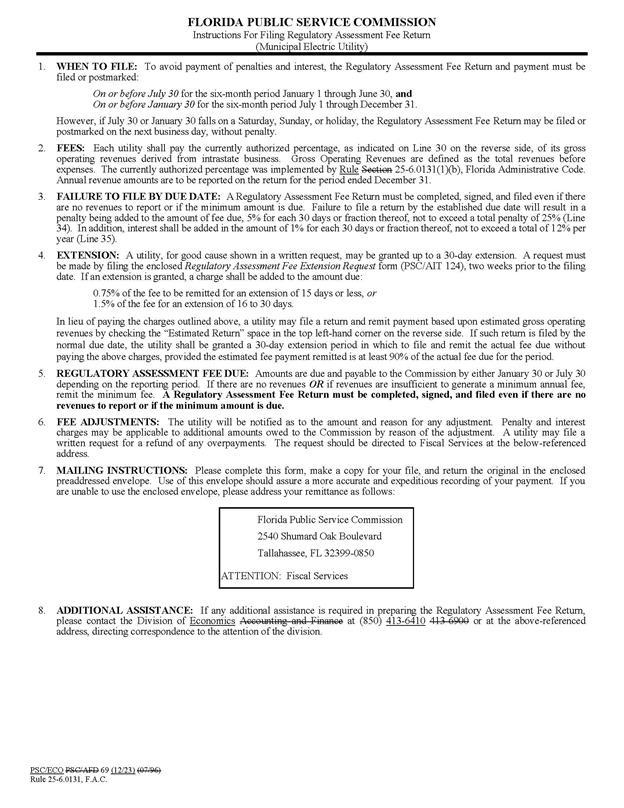

Commission Form PSC/ECO PSC/AFD 69 (12/23) (07/96),

entitled “Municipal Electric Utility Regulatory Assessment Fee Return,”

is available at [new hyperlink] http://www.flrules.org/Gateway/reference.asp?No=Ref-02611;

and Commission Form PSC/ECO PSC/AFD 70 (12/23) (07/96),

entitled “Rural Electric Cooperative Regulatory Assessment Fee Return,”

is available at [new hyperlink] http://www.flrules.org/Gateway/reference.asp?No=Ref-02612.

These forms are incorporated into this rule by reference and may be also be

obtained from the Commission’s Division of Administrative and Information

Technology Services. The failure of a company, utility, or

cooperative to receive a return form shall not excuse the company,

utility, or cooperative from its obligation to timely remit the

regulatory assessment fees.

(5) Each company, utility, or

cooperative shall have up to and including the due date in which to:

(a) Remit the total amount of its fee;

or

(b) Remit an amount which the company,

utility, or cooperative estimates is its full fee.

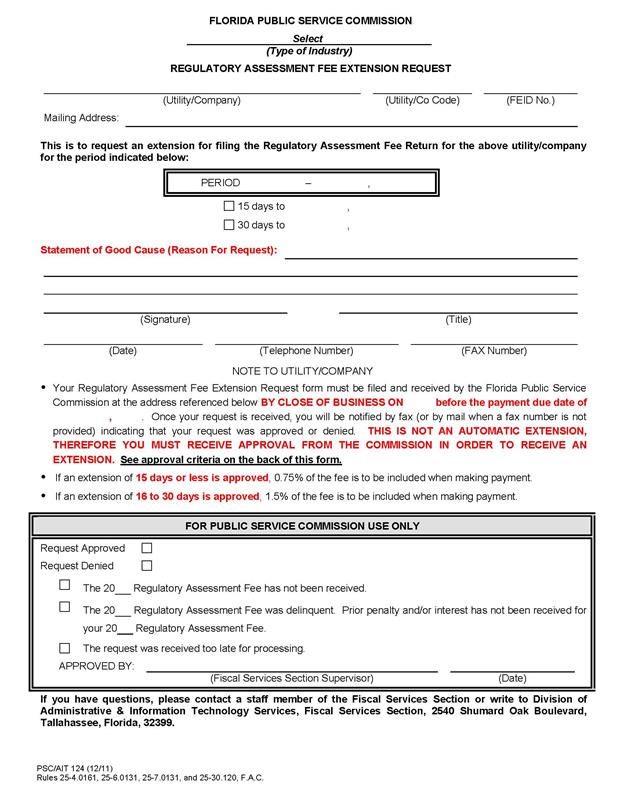

(6) Where the company, utility, or

cooperative remits less than its full fee, the remainder of the full fee shall

be due on or before the 30th day from the due date and shall, where the amount

remitted was less than 90 percent of the total regulatory assessment fee,

include interest as provided by paragraph (8)(b) of this rule.

(7) A company, utility, or

cooperative may request either a 15-day or a 30-day extension of its due

date for payment of regulatory assessment fees or for filing its return form by

submitting to the Division of Administrative and Information Technology

Services Commission Form PSC/AIT 124 (12/11), entitled “Regulatory

Assessment Fee Extension Request,” which is incorporated into this rule by

reference and is available at: http://www.flrules.org/Gateway/reference.asp?No=Ref-02620.

This form may also be obtained from the Commission’s Division of Administrative

and Information Technology Services.

(a) The request for extension must be

received by the Division of Administrative and Information Technology Services

at least two weeks before the due date.

(b) The request for extension will not

be granted if the company, utility, or cooperative has any unpaid

regulatory assessment fees, penalties, or interest due from a prior period.

(c) Where a company, utility, or

cooperative receives an extension of its due date pursuant to this rule, the

entity shall remit a charge as set out in Section 350.113(5), F.S., in addition

to the regulatory assessment fee.

(8) The delinquency of any amount due

to the Commission from the company, utility, or cooperative pursuant to the

provisions of Section 350.113, F.S., and this rule, begins with the first

calendar day after any date established as the due date either by operation of

this rule or by an extension pursuant to this rule.

(a) A penalty, as set out in Section

350.113(4), F.S., shall apply to any such delinquent amounts.

(b) Interest at the rate of 12 percent

per annum shall apply to any such delinquent amounts.

Rulemaking Authority

350.127(2), 366.05 FS. Law Implemented 350.113, 366.14 FS. History–New 5-18-83,

Amended 2-9-84, Formerly 25-6.131, Amended 6-18-86, 10-16-86, 3-7-89, 2-19-92,

7-7-96, 1-1-99, 5-7-13, .