Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rule

25-30.0371, F.A.C., Acquisition Adjustments?

Recommendation:

Yes. The

Commission should propose the amendment of Rule 25-30.0371, F.A.C.,

as set forth in Attachment A. The

Commission should certify the rule as a minor violation rule. (Sunshine, Cicchetti,

Guffey)

Staff Analysis:

The purpose of this rulemaking is to amend Rule

25-30.0371, F.A.C., to update and clarify the rule. Based upon stakeholder

responses and comments received at and from the workshops to

examine the Commission’s regulatory policies and practices in the water

and wastewater industries in Florida, staff recommends the Commission propose

the amendment of Rule 25-30.0371, F.A.C., as set forth in Attachment A. Staff is recommending a substantial revision

of the current rule.

The proposed amendments to the rule provide greater

regulatory certainty and clarity to the acquisition adjustment process. This includes establishing separate

regulatory pathways for utilities to seek approval of a positive acquisition

adjustment that are dependent upon the condition of the utility to be acquired. Regulatory requirements for a “non-viable”

utility mimic the traditional purpose of the rule, to incentivize the

acquisition of “troubled systems” that are in financial distress or unable to

provide safe service. In addition, the

rule amendments also provide an additional pathway for a positive acquisition

adjustment if a utility seeks to acquire a “viable” system that is otherwise

providing safe service and is in a financially healthy position if the

acquisition results in net economic and quality of service benefits to

customers.

The recommended rule amendments provide necessary

definitions to effectuate these new processes for viable and non-viable

utilities; establish when an acquiring utility may petition the Commission to receive

an acquisition adjustment; when and under what circumstances an acquisition

adjustment will be allowed for the acquisition of either a viable or non-viable

utility; enumerate the required contents of a petition; delineate the factors

the Commission will consider in determining whether to allow an acquisition

adjustment; determine when the amortization period for an acquisition

adjustment will begin; confirm the Commission’s existing authority to review an

acquisition adjustment; establish that a negative acquisition adjustment will

no longer be included in rate base; and provide a necessary notice provision to

ensure customers of the acquiring utility and the acquired utility are made

aware of the filing of a petition for an acquisition adjustment and advised

that they may file a motion to intervene in any proceeding on the petition.

Below is a detailed explanation of each section of staff’s

recommended rule amendments, including stakeholder comments on the specific draft

rule provisions.

Subsection (1) – Definitions

This

subsection provides specific definitions for the terms “acquisition

adjustment,” “positive acquisition adjustment,” and “negative acquisition

adjustment.” Staff also recommends adding a definition for “good cause,” which will

clarify when a utility may be granted an extension of the 3-year period to

petition for an acquisition adjustment as provided in subsection (3) and (4) of

the amended rule.

Of

particular note are staff’s recommended definitions of “non-viable utility” and

“viable utility” in paragraphs (1)(e) and (f) of the draft rule, which set

forth the status of an acquired utility for purposes of determining which

process an acquiring utility must follow when petitioning the Commission for an

acquisition adjustment, with acquisition of a “non-viable utility” following

the requirements of subsection (3) of the draft rule and a “viable utility”

following the requirements of subsection (4) of the draft rule.

A

“non-viable utility,” as defined, means a utility that is either: (1) currently

unable, or is projected to be unable, to provide and maintain safe, adequate,

and reliable service and facilities to its customers within the next 5 years

due to a history of enforcement or compliance actions by regulatory agencies

based on violations of primary, or exceedance of secondary, water quality

standards or other health, safety, and environmental standards; and

insufficient investment, repair, or maintenance of assets or an inability to

acquire and maintain adequate managerial, operational, financial, or technical

capabilities to ensure safe and reliable service to its customers; or (2) is

insolvent, meaning it is unable to pay its debts. A “viable utility,” is defined as all

utilities that are not non-viable.

Stakeholder Comments

The inclusion of secondary water quality standards,

as well as utility insolvency, within the definition of “non-viable utility,”

as provided in subparagraphs (1)(e)1.a. and 2., were discussed at the workshops

and raised in post-workshop comments.

Inclusion of Secondary Water Quality

Standards

OPC asserted secondary

water quality standards should not be included in the definition of “non-viable

utility,” as there are no Commission orders actually revoking a utility’s

certificate due to secondary water quality standards, which OPC believes will result

in the unintended consequence of classifying otherwise viable utilities as

non-viable utilities and thereby lowering the burden of proof for a positive

acquisition adjustment. OPC additionally

commented it could support the addition of secondary water quality

violations to the definition of a non-viable utility by tying secondary

standards to those which interfere with the customer’s ordinary use and

enjoyment of water service such as black water or sulfur taste, which are the

same standards considered by the Commission for return on equity adjustments in

the rate-setting process.”

CSWR, in response, stated whether the

Commission has ever revoked a utility’s certificate for failing to comply with

secondary water standards has no relevance to whether that criteria should be

removed given that compliance with secondary standards is an element to be

considered in fixing rates, and a failure to comply with those standards is

indicative of a non-viable utility because it is unable to provide safe and

reliable service.

SWS, in response to the definition for

“non-viable utility,” suggested “in addition to primary water quality

standards, the Commission should consider secondary quality standards as

required or ordered by the Commission or an appropriate agency, and applicable

wastewater or other environmental and safety standards. This treatment aligns

with the treatment of water utilities during a rate case.”

Staff recommends inclusion of secondary

water standards within the definition of “non-viable utility,” as it aligns

with the treatment of water utilities during a rate case and certain utilities

may lack the resources to adequately address secondary water quality standards. OPC’s suggestion for the amended rule to be

more explicit in the description of secondary standards is not necessary and

may actually detract from compliance with all secondary water quality

standards.

Definition of Insolvent Utilities

Regarding insolvent utilities, OPC suggested

the inclusion of the phrase “or with the financial assistance of its

parent company” after the word “utility,” as there are several small utilities

that reflect net operating losses on their annual reports on a standalone basis

and/or their parent is the only reason the utilities are able to pay all their

debts and make plant improvements.

Additionally, OPC recommends “the rule should include an objective

measure for determining whether the acquired utility is insolvent or unable to

service its debt obligations, such as a debt service coverage ratio of less

than 1 or some other certain level or measure. This change would ensure that

financial distress to the owners of the acquired utility was real and not just

a matter of the way books are kept.”

CSWR, in response, states “[w]hether there is a parent

that can provide financial support does not change the fact that the utility is

operating in an unsustainable manner because it cannot meet the financial

obligations attendant to providing utility service.”

Staff agrees with CSWR and recommends approval of the rule

language in subsections (1), which defines one of the two means of establishing

when a utility is non-viable, i.e., a utility that is insolvent or unable to

service its debt. OPC’s suggestion of

incorporating a more explicit definition of insolvency such as a debt service coverage

ratio of less than 1 is not recommended because it is just one of potentially

many factors that may need to be considered depending on the circumstances.

Subsection (2) - Petition

This subsection provides the process by which a

water or wastewater utility may petition the Commission to establish an

acquisition adjustment, for either a viable or non-viable utility, to include

some or all of a positive acquisition adjustment in the acquired utility’s rate

base; provides that an acquiring utility may seek such approval at the time of transfer

of the certificate of authorization or anytime within 3 years from Commission’s

transfer order; authorizes a utility to request an extension of the 3-year

period for good cause; and provides the petition may be made as a separate

filing or as part of a rate proceeding.

Stakeholder Comments

OPC suggested the 3-year time period should not

be included, reasoning “the customers of the utility deserve to know how

their rates will change due to a positive acquisition adjustment at the time of

transfer, and that the customers’ point of entry to object to a transfer is

when the transfer is before the Commission for approval, not at a future time.” OPC further reasoned “there is potential risk

exposure to customers by not addressing an acquisition at the time of the

transfer. If the acquiring utility is later denied a portion or all of its

requested positive acquisition adjustment, it could result in a utility

management decision to divest the acquired assets and/or delay planned plant

improvements, leaving captive customers in limbo and creating the opposite

effect of worsening service.” Lastly,

OPC suggested the acquiring utility be required to submit its petition in

conjunction with its transfer application.

CSWR stated an acquiring utility should have the option of

filing a request for an acquisition adjustment at the time of transfer or at a

later date after the approval of the transfer, believing that a utility should

have the opportunity to operate a system for a period of time after closing to

identify needed improvements and to present a more complete picture of the

benefits to be realized by the acquisition, adding that allowing a request for

an acquisition adjustment to be made after a transfer does not harm customers

who will still have the ability to object to an acquisition adjustment when a

utility files a request for an adjustment.

SWS stated the timing of application for an

acquisition adjustment being limited to 3 years from the transfer is an

arbitrary and unnecessary structure that could add to the regulatory burden of

the parties to the extent that requiring a filing by a certain date, as opposed

to the preferred timing of inclusion in a subsequent base rate case, does not

support administrative efficiency and the more natural demonstration of

benefits based on evidence available and commonly presented in a ratemaking

proceeding. However, nothing in the

amended rule prevents a utility from filing its petition as a part of a rate

case proceeding within 3 years of the transfer.

Staff agrees with the rationale of CSWR

which supports a reasonable timeframe to seek an acquisition adjustment after

the time of transfer. The acquiring

utility should have the flexibility to submit its petition at the time

of transfer or anytime within 3 years thereafter as three years is a reasonable

time for the utility to operate the acquired system after transfer and closing

and identify needed improvements to present

a more accurate and complete picture of the benefits to be realized from the

acquisition. Three years is also appropriate because data tends to get stale

after 3 years. OPC’s concern of

potential exposure to customers if an acquisition is not addressed at the time

of transfer is without merit as the recommended rule language requires the

acquiring utility to provide notice to customers in advance of the proceeding

considering the inclusion of an acquisition adjustment. In addition, the

recommended rule requires a CPVRR analysis to support the projected 5-year rate

impact on customers in the case of the acquisition of viable systems. Finally,

the recommended rule codifies the Commission’s existing authority to review and

prospectively reduce or remove a positive acquisition adjustment if the

Commission finds that customer benefits did not materialize or subsequently

changed within 5 years of the order approving the acquisition adjustment.

Subsection (3) – Positive Acquisition

Adjustments for Non-Viable Utility

This subsection sets forth factors the Commission will

consider for a utility to be allowed a full or partial positive acquisition

adjustment for a non-viable utility; factors considered in determining whether

an acquired utility’s customers benefit; and the information the acquiring

utility must file in its petition for a positive acquisition adjustment. It should be noted that a utility is not

required to meet all of the factors enumerated in paragraph (3)(a); rather, the

rule simply sets out the specific factors the Commission will consider in

determining whether the acquired utility customers benefit and give whatever

weight it believes is appropriate to the factors based on the record of the

hearing.

Paragraph (3)(b) of the draft rule encompasses what

information staff believes should be contained in the utility’s petition for an

acquisition adjustment for a non-viable utility. Staff has crafted the language in paragraph

(3)(b) to align with the factors in paragraph (3)(a), which the Commission will

consider in determining whether the acquired utility customers benefit from the

requested acquisition adjustment. Staff

recommends the information the utility must file with its petition include:

·

the amount of acquisition adjustment and

amortization period requested;

·

how acquisition was part of an arms-length transaction;

·

the contract of sale, estimated cost of fees,

and closing costs;

·

calculation of book value and composite

remaining life of assets purchased;

·

whether acquired utility is solvent; description

of acquiring utility’s managerial, operational, financial, or technical

capabilities to furnish and maintain safe and adequate service and facilities

over the next 5 years;

·

any regulatory actions issued by governmental

agencies regarding provision of acquired

utility’s service(s) over the past 5 years;

·

acquired utility’s annual capital investments

and operations and maintenance expenses over the past 5 years;

·

5-year projected impact on cost of service to

acquired utility customers;

·

any planned infrastructure additions and

maintenance to improve acquired utility’s quality of service or compliance with

environmental regulations;

·

any engineering studies or appraisals done

regarding the purchase; and

·

how the acquiring utility has greater access to

capital than the acquired utility, if applicable.

Stakeholder Comments

This subsection was debated by the stakeholders at the

workshops and in post-workshop comments. OPC stated the recommended rule

removes the longstanding “extraordinary circumstances” and “negative

acquisition adjustment” policies, which it says were designed to balance all of

the provisions of the public interest, suggesting that if those previous lines

of safeguard protections for customers are removed, the rule must be modified

in a way that places fair and equitable surrogate safeguards for customers of

both viable and non-viable utilities purchased by acquiring utilities.

OPC opposes the proposed rule because it fails to provide

customer safeguards and creates an incentive for acquiring utilities to

willfully grow their rate base through acquisitions via premium purchase prices

above net book values (“NBV”) that would serve to economically enrich utility

shareholders on the backs of captive utility customers through increased rates

in the future, despite the purported non-economic qualitative benefits that

customers would be receiving from the acquiring utility.

OPC asserts that Florida is an original cost state, and the rule appears to move Florida away from cost-based

regulation to a form of market-based regulation, without any discernable

guidelines, solely for the benefit of acquiring utilities. The rule thus

unfairly discriminates against existing regulated utilities who are fulfilling

their part of the compact and already providing satisfactory quality of service

to their customers.

SWS disagreed with OPC, arguing that

its comments do not address or provide practical solutions for the very real

concern that struggling utilities are not incented to transfer their systems

before or while experiencing service or financial issues. Allowing greater flexibility in the setting

of acquisition adjustments will incentivize owners of non-viable systems to

pursue a transfer for a reasonable price, which is not only in the best

interest of owners of the non-viable system, but is also in the best interest

of the customers of the non-viable system as a result of being taken over by a

capable utility operator for the long-term. SWS lastly suggests:

The Commission should be incentivizing

acquisitions before ‘extraordinary circumstances’ come to pass – struggling

systems that lack long-term viability should have an incentive to divest to a

utility with more competent management, operations, and finances. The

Commission’s policies and [r]ules should reflect this and incentivize – for

buyer and seller – acquisitions of non-viable systems.

CSWR supported the proposed rule amendments,

as they “retain the Commission’s flexibility to consider other potential benefits,

and an acquiring utility is not required to show all the listed benefits in order

to receive a full or partial adjustment.”

Staff recommends approval of the

rule language in subsection (3), as it has the effect of incentivizing

non-viable utilities to transfer their troubled systems to viable utilities;

incentivizes viable utilities to pursue such transfers at a reasonable price;

and provides flexibility to the Commission to consider various potential

customer benefits. The recommended rule makes clear under what circumstances a

positive acquisition adjustment can be allowed for a non-viable system.

Furthermore, the Commission has the discretion to determine, based on the

record of the hearing, if qualitative factors indicate the acquisition will be

to the customers’ benefit. Staff disagrees with OPC’s concern about a

lack of safeguards because the recommended rule codifies the Commission’s

existing authority to review and prospectively reduce or remove a positive

acquisition adjustment if the Commission finds that customer benefits did not

materialize or subsequently changed within 5 years of the order approving the

acquisition adjustment. Staff

believes the recommended rule language will allow for acquisitions when it is

in everyone’s best interest, even when there are not extraordinary

circumstances.

Subsection (4) – Positive Acquisition Adjustments for Viable Utility

This subsection provides the

requirements that must be demonstrated by an acquiring utility to be allowed a

full or partial positive acquisition adjustment for a viable utility; the

factors the Commission will consider in determining whether acquired utility customers

benefit; and the information that the acquiring utility must file in its

petition for a positive acquisition adjustment.

This subsection further requires that when an

acquiring utility purchases a viable system and seeks approval of a positive acquisition

adjustment, it must demonstrate that the purchase was made as part of an

arms-length transaction and that the transaction incorporating a full or

partial acquisition adjustment is projected to provide a positive cumulative

present value of the revenue requirements (CPVRR) customer benefit over a

5-year period from the date of acquisition.

In the event the CPVRR does not result in an objective positive customer

benefit, the recommended rule amendments provide the Commission will consider

specified factors in determining whether to allow an acquisition adjustment. By operation of math, the inclusion of any

amount of acquisition adjustment in the determination of revenue requirement

will place upward pressure on customer rates, all other elements held constant.

In order for the Commission to make an informed decision whether to approve a

requested acquisition adjustment, it must have reliable information from the

acquiring utility regarding the magnitude of the impact on customer rates.

Based on comments received from the stakeholders, staff believes the 5-year

period for the CPVRR analysis strikes an appropriate balance between obtaining

this relevant and necessary information while not being overly burdensome on

the acquiring utility.

To

assist the Commission in the determination of whether the CPVRR results in a

positive customer benefit over the 5-year period, the acquiring utility must

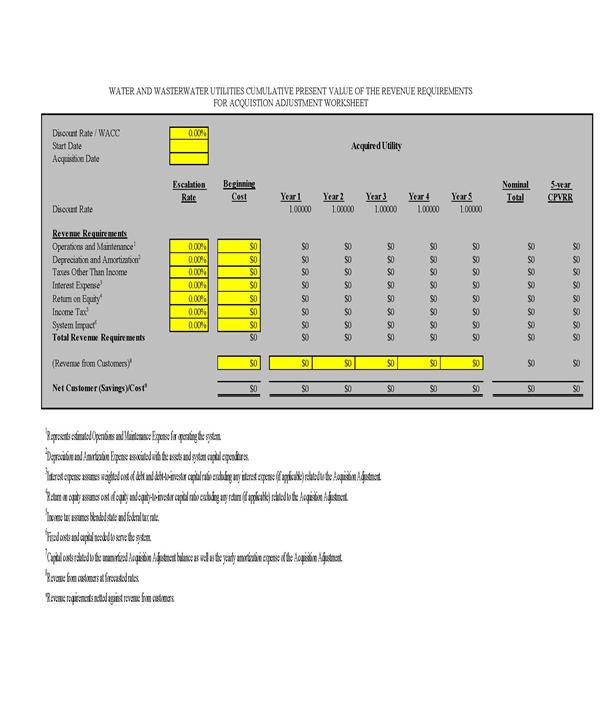

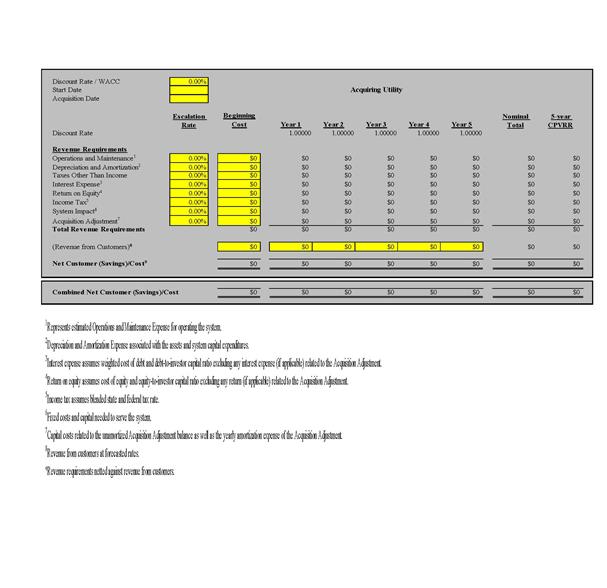

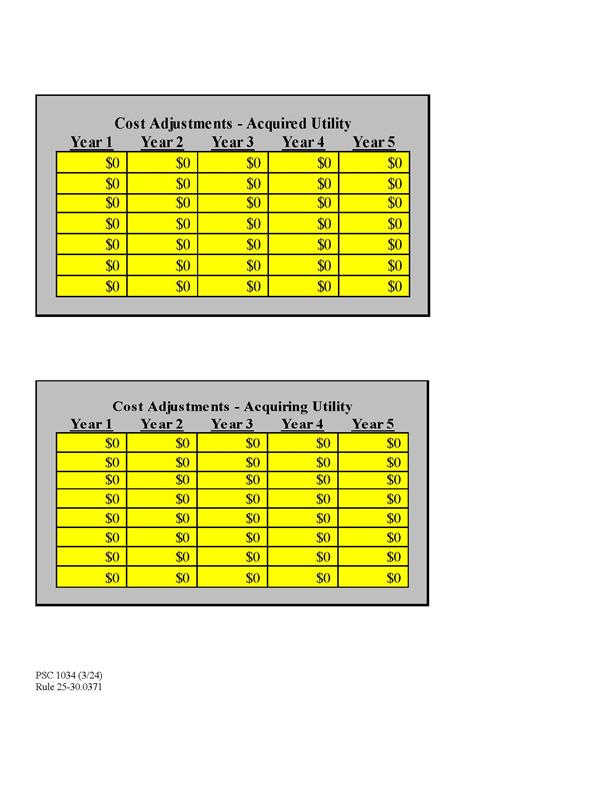

file a CPVRR in the form of a spreadsheet with its petition. Rule 25-30.0371(4)(b)6., F.A.C., creates a form

titled, “Water and/or Wastewater Utilities Cumulative

Present Value of the Revenue Requirements for Acquisition Adjustment Worksheet”

that may be completed by a viable utility acquiring another viable system and that

may be included in its petition for a positive acquisition adjustment unless the

acquiring utility decides to provide its own CPVRR in an Excel spreadsheet with

the data and information included in the CPVRR analysis, along with providing the

spreadsheet formulas intact and all supporting data and assumptions used in the

spreadsheet.

Paragraph

(4)(b) of the draft rule encompasses what information staff believes should be

contained in the utility’s petition for an acquisition adjustment for a viable

utility. Staff has crafted the language

in paragraph (4)(b) to align with the factors in paragraph (4)(a), which the

Commission will consider in determining whether the acquired utility customers

benefit from the requested acquisition adjustment. Staff recommends that the information the

utility must file with its petition include:

·

the amount of acquisition adjustment and

amortization period requested;

·

how acquisition was part of an arms-length

transaction;

·

the contract of sale, estimated cost of fees,

and closing costs;

·

calculation of book value and composite

remaining life of assets purchased;

·

CPVRR in spreadsheet form or Excel spreadsheet

with data and information included in CPVRR analysis with all supporting data

and assumptions used;

·

description of anticipated improvements or

planned infrastructure additions and maintenance by the acquiring utility;

·

description of anticipated cost savings from the

acquisition;

·

5-year projected impact on cost of service to

acquired utility customers; and

·

any engineering studies or appraisals done

regarding purchase.

Stakeholder Comments

None

of the stakeholders objected to the concept of a CPVRR being required to

substantiate the projected 5-year rate impact or disputed the Commission’s need

to obtain the information the CPVRR provides; however, SWS raised its concern

that the CPVRR limits the calculation of benefits to a 5-year window.

OPC also supported a CPVRR projected 5-year

rate impact, stating that, “[t]he objective standard of a 5-year CPVRR analysis

must be applicable for all positive acquisition adjustments in order to

demonstrate offsetting economic customer savings in the public interest.” However, it also asserted that “it would be impossible to demonstrate that

any qualitative benefits outweigh the potential rate impact to customers, absent a positive CPVRR benefit for customers

over a 5-year period.

SWS suggested the CPVRR “presents a formulaic, limited

calculation of benefits to customers that omits relevant and valuable

qualitative benefits that the acquirer can bring to the acquired customers,”

adding “[t]he Commission’s considerations or criteria to approve a transaction,

and any applicable acquisition adjustment, should consider all relevant aspects

of the acquisition. SWS further

suggested that a CPVRR does not account for the potential array of scenarios

that may be presented and limits the calculation of benefits to a 5-year window,

adding that in many acquisitions, especially of viable systems, the cost

efficiency opportunities that come from integration of the utilities may take

time, and costs to effectuate the integration will likely come before

benefits.”

CSWR

suggested a full or partial acquisition adjustment “should still be

allowed if there are other qualitative benefits such as improved customer

service, improved monitoring and reporting of and response to health and safety

requirements, or improved billing, record keeping and compliance with

regulatory reporting requirements.”

Staff recommends approval of the

rule language in subsection (4), as it will provide viable utilities the

flexibility to seek a positive acquisition adjustment if the CPVRR

quantitatively establishes a positive customer benefit, as well as providing

flexibility for when the CPVRR does not result in a positive customer benefit. It does so by providing the Commission the

ability to weigh other factors described in subparagraphs (4)(a)1.-6., which demonstrate

a positive customer benefit.

Subsection (5) – Amortization

Period for a Positive Acquisition Adjustment

This subsection amends the date upon which a

positive acquisition adjustment will begin by providing that the Commission

will set the amortization period in the order approving a positive acquisition

adjustment, which will begin either on the date of the approving order or on

the date the sale closes, whichever occurs last.

Stakeholder Comments

OPC stated that since the rule

became effective in 2002, no utility has raised the concern that the

amortization should not start until after closing. In response, SWS stated the Commission has

never approved a positive acquisition adjustment since the rule became

effective, which OPC publicly acknowledged is correct.

SWS supports the language in the recommended proposed

rule, stating it provides for flexibility should the acquiring utility request

a deferral of the approval of the transfer, or if the Commission were to only

provisionally approve the acquisition adjustment at the time of acquisition

approval. SWS further added that

amortization before closing would be inconsistent with the matching of

amortization of the adjustment with the acquired system assets’ depreciation.

CSWR stated this section is to address the

circumstance where the closing of a transfer takes place after an acquisition

adjustment is approved.

Staff

recommends approval of the rule language in subsection (5), for

both internal consistency within the amended rule, as well as to address the

circumstance where the closing of a transfer may take place after an

acquisition adjustment is approved.

Subsection (6) – Subsequent

Review of Acquisition Adjustments

This subsection recognizes the Commission’s

authority to review a positive acquisition adjustment if it finds customer

benefits did not materialize or subsequently changed within 5 years of the date

of the order approving the positive acquisition adjustment.

Staff

recommends approval of the recommended rule language in subsection (6), as it recognizes

the Commission’s existing authority and flexibility to review an acquisition

adjustment on a case-by-case basis, as well as providing the Commission flexibility

to address on a case-by-case basis, depending on the evidence in the record of

the hearing and the appropriateness of an acquisition adjustment in light of

whether customer benefits materialized as projected or subsequently changed

within 5 years of the approval of the acquisition adjustment (thus enabling the

Commission to modify an acquisition adjustment accordingly).

Subsection (7) – Negative

Acquisition Adjustment

This

subsection eliminates the provisions of the current rule regarding negative

acquisition adjustments. The amended

rule provides that a negative acquisition adjustment will not be included in

rate base.

Stakeholder Comments

OPC

believes that a negative acquisition adjustment should remain in the rule. OPC asserted the current policy benefits

customers with a lower rate base if the purchase price is equal to or less than

80 percent of the net book value. OPC

lastly asserted that the current rule balances the interest of the acquiring

utility and its customers, particularly where the acquired utility has been

neglected, thus selling below book value and causing customers to pay for

improvements.

CSWR

agrees with the amended language advising “[t]he imposition

of a negative acquisition adjustment does not align with the goal of

encouraging beneficial acquisitions. Elimination of the negative adjustment

does not harm customers. It encourages

the acquiring utility to negotiate for a lower price, and the additional

earnings provide a resource that could be used to reinvest in the acquired

system.” CSWR further noted:

As Staff has pointed out that no other state imposes a

negative acquisition adjustment and that there is a lack of parity in the

treatment of rate base in a transfer situation in that the rate base of the

existing utility carries over to the acquiring utility unless the acquiring

utility pays less that the existing rate base. Imposition of a negative

adjustment discourages an acquiring utility to negotiate the lowest price or

from acquiring a small troubled system at all.

Furthermore, allowing the acquiring utility to earn on the seller’s

actual rate base provides an additional source of revenue that could be used to

reinvest in the utility.

SWS opined there are serious concerns with

maintaining negative acquisition adjustments, noting “the proposed rule does

not appear to contemplate scenarios that include a seller with a negative book

value (negative rate base). Uncertainty on the treatment of such acquisitions

inevitably will limit the ability and incentive for well-managed utilities to

acquire these systems, constraining the seller’s market for buyers and

resulting in missed opportunities for consolidation and regionalization of

water and wastewater systems in the State.”

Staff recommends approval of the

rule language in subsection (7). Continuing

to apply negative acquisition adjustments, as defined, in rate base has the negative

effect of limiting the ability of, and thereby disincentivizing, viable

utilities from acquiring non-viable systems, as well as constraining the

seller’s market for buyers, resulting in missed opportunities for consolidation

and regionalization of water and wastewater systems in Florida. Furthermore, denying the net book value of a

system to a purchaser, notwithstanding a purchase price lower than net book

value, is not consistent with original cost-based accounting.

Subsection (8) – Notice

This subsection requires, at the time an

acquiring utility files its petition, to provide a draft notice for review by

Commission staff. Commission staff will

review the draft notice within 7 days, and once approved, the acquiring utility

must provide the notice, in the manner directed in the rule, to OPC and to each

customer and owner of property located within the service area for both the

acquiring utility and to customers of the utility being acquired. The recommended rule language permits the

acquiring utility to combine this notice with the notice of Application for

Authority to Transfer and provides what the notice must contain, thereby

allowing the acquiring utility to avoid duplication of efforts.

Staff

recommends approval of the language in subsection (8), as a notice requirement

safeguards the due process rights of both the acquiring and acquired utility

customers by requiring the notice provide a statement that any customer

substantially affected by the petition may file a motion to intervene in

accordance with Rule 28-106.205, F.A.C.

Minor Violation Rule Certification

Pursuant to Section 120.695, F.S., for each rule

filed for adoption, the agency head shall certify whether any part of the rule

is designated as a rule the violation of which would be a minor violation. Under

Section 120.695(2)(b), F.S., a violation of a rule is minor if it does not

result in economic or physical harm to a person or adversely affect the public

health, safety, or welfare or create a significant threat of such harm. Rule

25-30.0371, F.A.C., should be listed as a minor violation rule by the Commission.

This rule is a minor violation rule because the violation of this rule would

not result in economic or physical harm to a person, cause an adverse effect on

the public health, safety, or welfare, or create a significant threat of such

harm. Violations of Rule 25-30.0371, F.A.C., would be minor violations.

Therefore, for the purposes of filing the rule for adoption with the Department

of State, staff recommends that the Commission certify Rule 25-30.0371, F.A.C.,

as a minor violation rule.

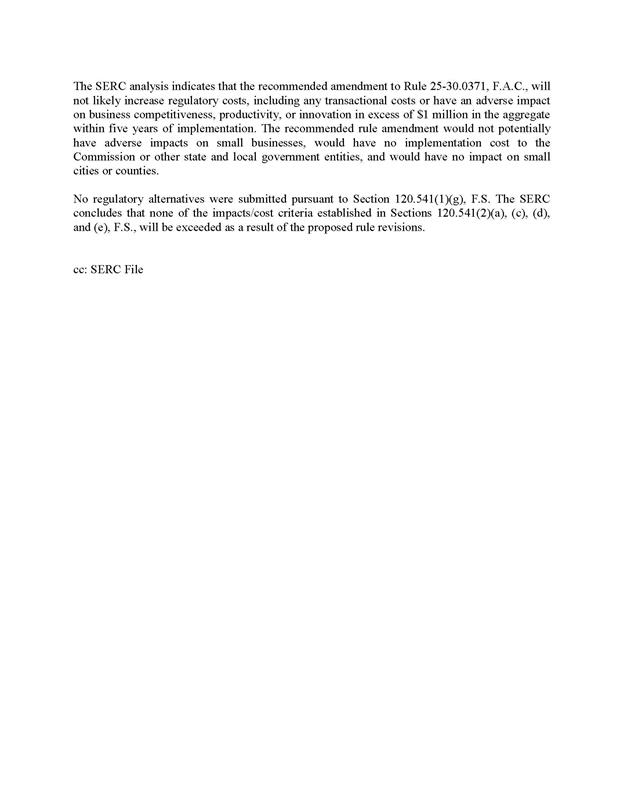

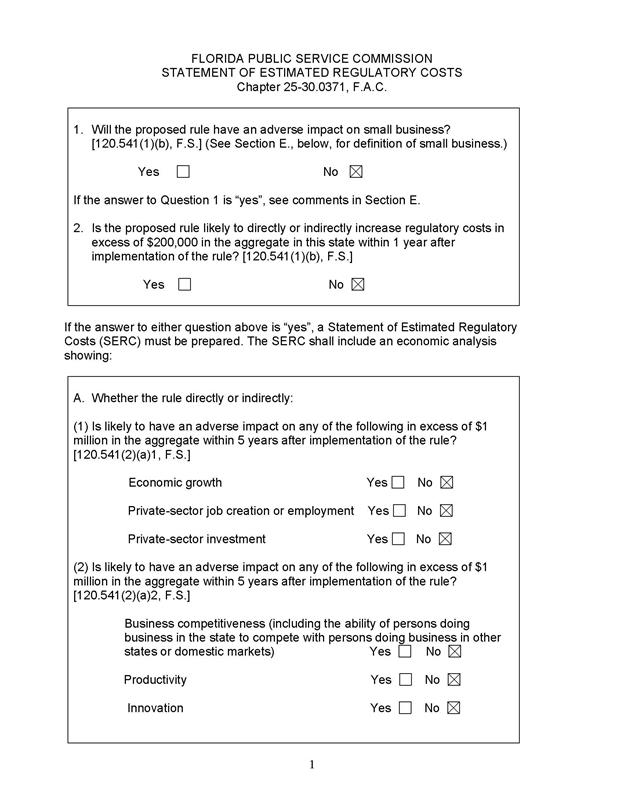

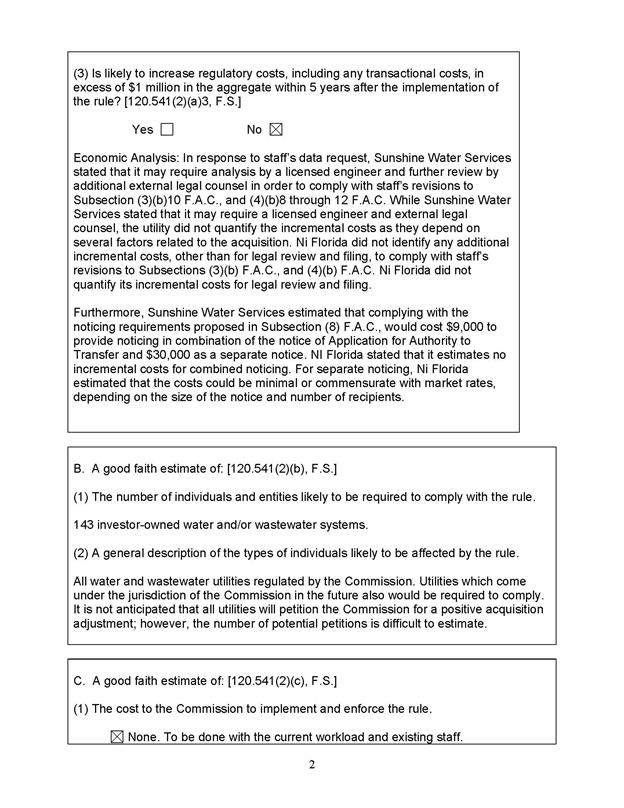

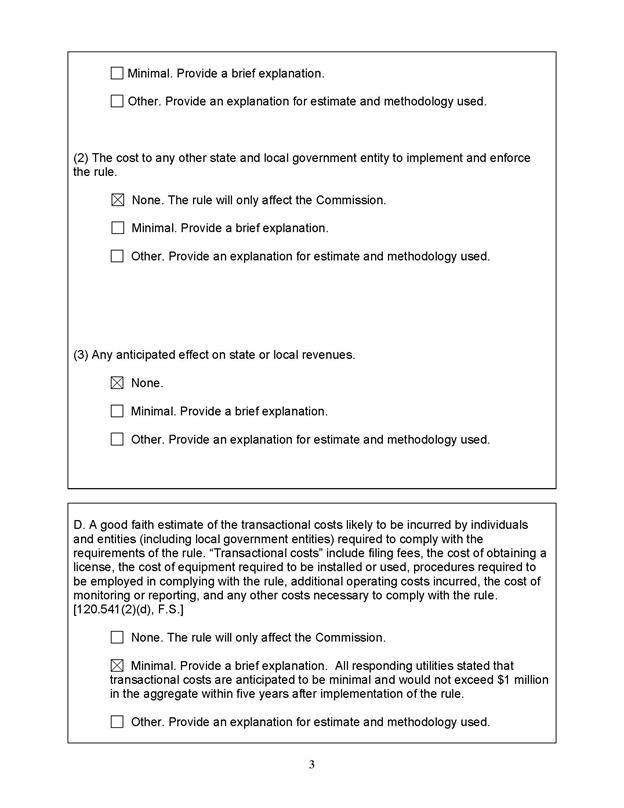

Statement of Estimated Regulatory Costs

Section 120.54(3)(b)1., F.S., encourages

agencies to prepare a Statement of Estimated Regulatory Costs (SERC) before the

adoption, amendment, or repeal of any rule. A SERC was prepared for this

rulemaking and is appended as Attachment B. As required by Section

120.541(2)(a)1., F.S., the SERC analysis includes whether the amended rule is

likely to have an adverse impact on economic growth, private sector job

creation or employment, or private sector investment in excess of $1 million in

the aggregate within five years after implementation.

The

SERC concludes that the amended rule will likely not directly or indirectly

increase regulatory costs in excess of $200,000 in the aggregate in Florida

within one year after implementation. Further, the SERC concludes that the amended

rule will not likely increase regulatory costs, including any transactional

costs, or have an adverse impact on business competitiveness, productivity, or

innovation, in excess of $1 million in the aggregate within five years of

implementation. Thus, pursuant to Section 120.541(3), F.S., the rule does not

require legislative ratification.

Further, the SERC concludes that the amended rule will not likely

have an adverse impact on economic growth, private-sector job creation or

employment, private sector investment, business competitiveness, productivity,

or innovation in excess of $1 million in the aggregate within five years of

implementation. Thus, the amended rule does not require legislative

ratification pursuant to Section 120.541(3), F.S.

In

addition, the SERC states that the amended rule would have no adverse impact on

small businesses, would have no implementation or enforcement costs on the

Commission or any other state or local government entity, and would have no

impact on small cities or small counties. The SERC states that there will be no

transactional costs likely to be incurred by individuals and entities required

to comply with the requirements. None of the impact/cost criteria established

in Section 120.541(2)(a), F.S., will be exceeded as a result of the amended rule.

Conclusion

Based on the foregoing, staff recommends the

Commission should propose the amendment of Rule 25-30.0371, F.A.C., as set

forth in Attachment A. Staff further recommends the Commission certify Rule

25-30.0371, F.A.C., as a minor violation rule.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no

requests for hearing or JAPC comments are filed, the rule should be filed for

adoption with the Department of State, and the docket should be closed.

(Sunshine)

Staff Analysis:

If no requests for hearing or JAPC comments are

filed, the rule should be filed for adoption with the Department of State, and

the docket should be closed.

25-30.0371 Acquisition Adjustments.

(1) Definitions Definition. For

the purpose of this rule, the following definitions apply: an

acquisition adjustment is defined as the difference between the purchase price

of utility system assets to an acquiring utility and the net book value of the

utility assets. A positive acquisition adjustment exists when the purchase

price is greater than the net book value. A negative acquisition adjustment

exists when the purchase price is less than the net book value.

(a) “Acquisition adjustment”

means the difference between the purchase price of utility system assets to an

acquiring utility and the net book value of the acquired utility’s assets.

(b) “Good cause” means a

showing of financial hardship, unforeseen events, or other events outside the

utility’s control.

(c)

“Positive acquisition adjustment” means the purchase price is greater than the

net book value.

(d) “Negative acquisition

adjustment” means the purchase price is less than the net book value.

(e) “Non-viable utility”

means a utility that meets either of the following subparagraphs:

1. A utility that is currently unable or is projected to be

unable to provide and maintain safe, adequate, and reliable service and

facilities to its customers over the 5-year period following the date of

acquisition due to:

a. A history of enforcement or compliance actions by

federal, state, or local regulatory agencies based on violations of primary or

exceedance of secondary water quality standards or other health, safety, and

environmental standards; and

b. Insufficient investment, repair, maintenance of assets or

an inability to acquire and maintain adequate managerial, operational,

financial, or technical capabilities to ensure safe and reliable service to its

customers; or

2. A utility that is

insolvent, i.e., unable to pay debts.

(f) “Viable utility” means all utilities that are not

non-viable as defined in paragraph (1)(e) of this rule.

(2) Petition. A utility that acquires another utility may

petition the Commission to establish an acquisition adjustment under either

subsection (3) or subsection (4) of this rule to include some or all of a

positive acquisition adjustment in the acquired utility’s rate base. A utility

may seek approval of a positive acquisition adjustment at the time the utility

seeks approval to transfer the certificate of authorization or anytime within 3

years of the issuance date of the Commission order approving the transfer of

the certificate of authorization. The utility may request an extension of the

3-year period, which must include a statement of good cause. The petition for a

positive acquisition adjustment may be made as a separate filing or as part of

a rate proceeding.

(3)(2) Positive Acquisition Adjustments for Non-Viable Utility.

A positive acquisition adjustment shall not be included in rate base absent

proof of extraordinary circumstances. Any entity that believes a full or

partial positive acquisition adjustment should be made has the burden to prove

the existence of extraordinary circumstances. In determining whether extraordinary

circumstances have been demonstrated, the Commission shall consider evidence

provided to the Commission such as anticipated improvements in quality of

service, anticipated improvements in compliance with regulatory mandates,

anticipated rate reductions or rate stability over a long-term period,

anticipated cost efficiencies, and whether the purchase was made as part of an

arms-length transaction. Amortization of a positive acquisition adjustment

shall be pursuant to paragraph (4)(a) below.

(a) A full or partial positive acquisition adjustment will

be allowed if it is demonstrated that the acquired utility meets the definition

of non-viable utility under paragraph (1)(e) of this rule; that the purchase

was made as part of an arms-length transaction; and that customers from the

acquired utility will benefit from the acquisition. In determining whether the

acquired utility customers benefit, the Commission will consider the following

factors:

1. Anticipated improvements in quality of service;

2. Anticipated improvements in compliance with water or

wastewater regulatory requirements;

3. Anticipated impacts on the cost of providing service

over the next 5 years from the date of acquisition;

4. Anticipated cost efficiencies, including any economies

of scale;

5. Ability to attract capital at reasonable cost; and

6. The professional and experienced managerial, financial,

technical, and operational resources of the acquiring utility.

(b) Contents of Petition. The acquiring utility must file

the following information in its petition:

1. The amount of the acquisition adjustment requested;

2. The amortization period requested;

3. An explanation of how the acquisition was made as part

of an arms-length transaction;

4. The contract of sale, including the estimated cost of

the fees and transaction closing costs to be incurred by the acquiring utility;

5. A calculation of the net book value of the acquired

utility including the composite remaining life of the assets purchased;

6. A statement as to whether the acquired utility is

insolvent or unable to service its debt obligations;

7. A description of the acquiring utility’s managerial,

operational, financial, or technical capabilities to furnish and maintain safe

and adequate service and facilities over the next 5 years from the date of

acquisition;

8. Any notices of violation, consent decrees or other

regulatory actions issued by a federal, state, regional, or local agency

regarding the provision of the acquired utility’s water or wastewater service

over the past 5 years from the date of acquisition, including any notices of violation

of primary or notices of exceedances of secondary water quality standards;

9. The acquired

utility’s annual capital investments and operations and maintenance expenses

over the past 5 years from the date of acquisition;

10. Any planned infrastructure additions and maintenance by

the acquiring utility to improve the acquired utility’s quality of service or

compliance with environmental regulations;

11. Any engineering studies or appraisals the acquiring

utility procured pertaining to the purchase of the acquired utility;

12. The 5-year projected impact on the cost of providing

service to the customers of the utility system being acquired, including the

impact of any operation and maintenance cost savings and economies of scale

expected to result from the acquisition transaction, the impact of the cost of

any plant infrastructure additions, and the impact of the acquisition

adjustment; and

13. An explanation as to how the acquiring utility has

greater access to capital than the acquired utility, if applicable.

(3) Negative Acquisition Adjustments. If the

purchase price is greater than 80 percent of net book value, a negative

acquisition adjustment will not be included in rate base. When the purchase

price is equal to or less than 80 percent of net book value, a negative acquisition adjustment shall be included in rate

base and will be equal to 80 percent of net book value less the purchase price.

Amortization of a negative acquisition adjustment shall be pursuant to

subparagraph (4)(b)1. or (4)(b)2. below.

(4) Positive Acquisition Adjustments for Viable Utility.

(a) A full or partial positive acquisition adjustment will

be allowed if the acquiring utility demonstrates that the purchase was made as

part of an arms-length transaction and the transaction incorporating the full

or partial positive acquisition adjustment is projected to provide a positive

cumulative present value of the revenue requirements (CPVRR) customer benefit

over a 5-year period from the date of acquisition. If the CPVRR does not result

in a positive customer benefit over the 5-year period, the Commission will

consider the following factors in determining whether to allow a full or

partial acquisition adjustment:

1. Anticipated improvements in quality of service and

compliance with any regulatory requirements;

2. Anticipated rate reductions or rate stability over the

next 5 years from the date of acquisition;

3. Anticipated cost savings;

4. Increased ability to attract capital at reasonable cost;

5. Lower overall cost of capital; and

6. Additional professional and experienced managerial,

financial, technical, and operational resources.

(b) Contents of Petition. The acquiring utility must file

the following information in its petition:

1. The amount of the acquisition adjustment requested;

2. The amortization period requested;

3. An explanation of how the acquisition was made as part

of an arms-length transaction;

4. The contract of sale, including the estimated cost of

fees and transaction closing costs to be incurred by the acquiring utility;

5. A calculation of the net book value of the acquired

utility including the composite remaining life of the assets purchased;

6. A CPVRR in

the form of a spreadsheet. Form PSC 1034 (3/24), entitled “Water and/or

Wastewater Utilities Cumulative Present Value of the Revenue Requirements for

Acquisition Adjustment Worksheet,” which is incorporated by reference in this

rule and is available at [hyperlink], is an example CPVRR that may be completed

and included in the acquiring utility’s petition to comply with this

subparagraph. The form may also be obtained from the Commission’s website,

www.floridapsc.com;

7. An Excel spreadsheet with the data and information

included in the CPVRR analysis with the spreadsheet formulas intact;

8. All supporting data and assumptions used in the CPVRR

spreadsheet;

9. A description of any anticipated improvements or planned

infrastructure additions and maintenance by the acquiring utility;

10. A description, including any supporting data, of any

anticipated cost savings resulting from the acquisition;

11. The 5-year projected rate impact on the customers of

the utility system being acquired, including the rate impact of any cost

efficiencies and economies of scale expected to result from the acquisition transaction,

the rate impact of the cost of any plant infrastructure additions, and the rate

impact of the acquisition adjustment; and

12. Any engineering studies or appraisals the acquiring

utility procured pertaining to the purchase of the acquired utility.

(4) Amortization Period.

(a) In setting the amortization period for a Commission

approved positive acquisition adjustment pursuant to subsection (2), above, the

Commission shall consider evidence such as the composite remaining life of the

assets purchased and the condition of the assets purchased. Amortization of the

acquisition adjustment shall begin on the date of issuance of the order

approving the transfer of assets.

(b) The appropriate period over

which to amortize a Commission approved negative acquisition adjustment

pursuant to subsection (3), above, shall be determined as follows:

1. If the purchase price is

greater than 50 percent of net book value, the negative acquisition adjustment

shall be amortized over a 7-year period from the date of issuance of the order

approving the transfer of assets. In this case, the negative acquisition

adjustment shall not be recorded on the books for ratemaking purposes or used

for any earnings review unless the purchaser files for a rate increase pursuant

to Section 367.081(2), 367.0814, 367.0817 or 367.0822, F.S., that will be

effective during the amortization period.

2. If the purchase price is 50

percent of net book value or less, the negative acquisition adjustment shall be

amortized from the date of issuance of the order approving the transfer of

assets as follows:

a. 50 percent of the negative

acquisition adjustment shall be amortized over a 7-year period; and

b. 50 percent of the negative

acquisition adjustment shall be amortized over the remaining life of the

assets.

(5) Amortization Period for a Positive Acquisition

Adjustment. The Commission will set the amortization period in the order

approving the positive acquisition adjustment.

Amortization of the acquisition adjustment will begin on the date of

issuance of the order approving the positive acquisition adjustment or on the

date the sale closes, whichever occurs last.

(6) Nothing herein removes the Commission’s existing

authority to review a positive acquisition adjustment if the Commission finds

that customer benefits did not materialize or subsequently changed within 5

years of the date of the order approving the positive acquisition adjustment.

(7) Negative Acquisition Adjustment. A negative acquisition

adjustment will not be included in rate base.

(8) Notice. At the time the petition is

filed with the Commission, the acquiring utility must provide a draft notice

for review by Commission staff. Commission staff will review the draft notice

within 7 days. Once staff has approved the notice, the acquiring utility must

provide notice by regular mail to the Office of Public Counsel and by regular

mail or personal service to each customer and owner

of property located within the service area for both the acquiring utility and

the utility being acquired, to the extent the utilities’ customers are within

the Commission’s jurisdiction. The notice required by this rule may be combined

with the notice of Application for Authority to Transfer issued pursuant to

Rule 25-30.030, F.A.C. The notice must contain:

(a) Title: Notice of Utility’s Petition to Establish an

Acquisition Adjustment;

(b) A statement that

the utility has filed a petition with the Commission to establish an

acquisition adjustment for either a viable or a non-viable utility system;

(c) The date the petition was filed with the Commission;

(d) The docket number associated with the petition;

(e) A statement of the 5-year projected rate impact or the

anticipated effect of the requested acquisition adjustment on rates for the

next five years;

(f) A statement that the utility’s petition is available on

the Commission’s website;

(g) The acquiring utility’s address, telephone number, and

business hours; and

(h) A statement that any customer substantially affected by

the petition may file a motion to intervene in accordance with Rule 28-106.205,

F.A.C.

Rulemaking Authority 350.127(2),

367.121(1)(f) FS. Law Implemented 367.071(5), 367.081(2)(a), 367.121(1)(a), (b)

FS. History–New 8-4-02, Amended 11-22-10.