Discussion

of Issues

Issue 1:

Should the Commission modify DEF’s currently authorized

fuel cost recovery factors for the purpose of incorporating its projected 2024

fuel cost reduction?

Recommendation:

Yes. Staff recommends the Commission authorize

adjustments to DEF’s fuel cost recovery factors for the purpose of

incorporating the Company’s currently projected 2024 fuel cost reduction.

Accordingly, DEF’s 2024 fuel cost recovery factors should be reduced by $233,496,431.

(G. Kelley, Zaslow, Higgins)

Staff Analysis:

DEF participated in the Commission’s most-recent

fuel hearing which took place on November 1, 2023. The fuel order stemming from

this proceeding set forth the Company’s fuel and capacity cost recovery factors

effective with the first billing cycle of January 2024. Following

the issuance of the fuel order, the Company has subsequently updated its 2024

fuel cost projection. DEF now projects its 2024 fuel-related costs to be

approximately $233 million (net) lower than estimated in September 2023.[4] This

reduction is primarily due to lower assumed prices for natural gas. The main

factors influencing the decline in actual and projected natural gas prices in

2024 are elevated quantities of natural gas in storage and milder weather

compared to previous years.[5]

DEF Fuel and Purchased Power

Mid-Course Correction

DEF filed

for a mid-course correction of its fuel charges on April 8, 2024.

The Company’s MCC Petition and supporting documentation satisfies the filing

requirements of Rule 25-6.0424(1)(b), F.A.C.

The

Company developed its proposed mid-course correction factors using twelve

months of forecasted sales data, or from June 2024 through May 2025. The

factors proposed in this proceeding are currently contemplated to be charged for

seven months in 2024. As is typical procedure, later this year newly developed

12-month-applicable factors will be proposed for authorization to begin with

the first billing cycle of January 2025.

Actual Period-Ending 2023 Fuel Cost

Recovery Position

Through

its February 27, 2023, amended mid-course correction filing, DEF initially

projected a period-specific 2023 over-recovery of fuel costs in the amount of

$710,224,788. By its

revised actual/estimated filing and in compliance with Order No.

PSC-2023-0112-PCO-EI, the projected period-specific 2023 over-recovery of fuel

costs was amended by $119,078,499. This resulted in a projected period-specific

2023 over-recovery of $829,303,287 and a total true-up under-recovery of

($554,889,752). However,

the Company under-recovered (i.e., “less period over-recovery”) this amount by

($19,202,150) as its actual fuel cost recovery position at the end of 2023 is

an under-recovery of ($574,091,902).

This approximate ($19.2) million difference is proposed for inclusion in rates

through the instant proceeding.

Decreased

pricing for natural gas is the primary driver of the approximate $829 million

period over-recovery of 2023 fuel costs discussed above. More specifically, the

Company estimated an annual delivered natural gas cost of $8.07 per million

British thermal unit (MMBtu) in its first fuel cost projection of 2023.

However, as indicated in the Company’s December 2023 A-Schedule, DEF’s average

2023 cost of natural gas was $4.16 per MMBtu, representing a difference of 48.5

percent. Natural

gas-fired generation comprised approximately 85.5 percent of DEF’s generation

mix in 2023.

Projected 2024 Fuel Cost Recovery

Position

DEF’s 2024

fuel-related revenue requirement has decreased substantially since the filing

of its last cost projection in September 2023.

More specifically, the results of this updated estimate are a reduction in DEF’s

estimated 2024 fuel-related costs in the amount of $252,698,582. As mentioned

above, the 2023 remaining period-specific under-recovery of ($19,202,150) is proposed

for collection through new 2024 rates. Thus, the proposed net or decremental

amount for inclusion into 2024 rates is $233,496,431.

The

primary factor driving the change in projected 2024 fuel costs is lower assumed

pricing for natural gas. More specifically, the underlying market-based natural

gas price data used for the 2024 fuel cost projection was sourced on August 11,

2023.

This underlying data was used to produce an estimated average delivered 2024

natural gas cost of approximately $5.19 per MMBtu.

However, indicated in its MCC Petition, DEF now estimates its average cost of

natural gas in 2024 will be $3.99 per MMBtu, representing a decrease of 23.1

percent. The

updated cost estimate was based on natural gas futures/prices sourced on March

12, 2024, or roughly seven months later than the previous estimate used to set

current rates. Natural

gas-fired generation is projected to comprise approximately 81.3 percent of DEF’s

generation mix in 2024.

Recovery Period and Interest Premium

As

proposed, the accounting period for the 2024-applicable portion of the

over-recovery is seven months, or beginning June 2024 and ending December 2024.[20] Jurisdictional

sales from June 2024 through May 2025 in the amount of 40,548,317 (meter)

megawatt-hours were used to develop the mid-course correction factors proposed

for approval in this proceeding.

DEF

utilized the 30-day AA Financial Commercial Paper Rate published by the U.S.

Federal Reserve to determine its actual 2023 and 2024 (January and February)

interest amounts.

The projected 2024 monthly interest rate was assumed for all forward months by using/holding

constant the actual February 2024 interest rate of 0.442 percent (monthly).

Mid-Course Correction Percentage

Following

the methodology prescribed in Rule 25-6.0424(1)(a), F.A.C., the mid-course

percentage is equal to the estimated end-of-period total net true-up, including

interest, divided by the current period’s total actual and estimated

jurisdictional fuel revenue applicable to period, or $233,496,431 / $1,509,155,533.

This calculation results in a mid-course correction level of approximately 15.5

percent at December 31, 2024.

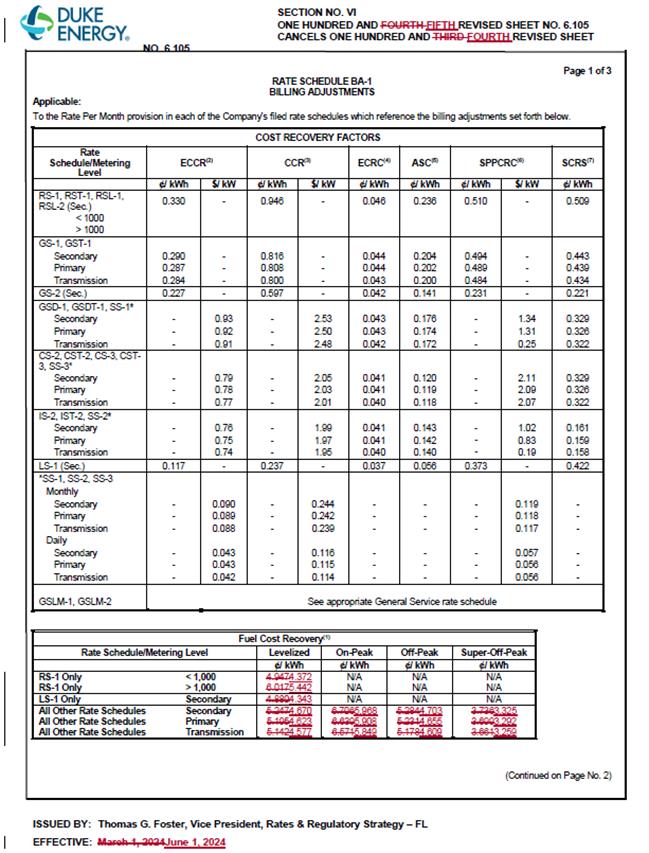

Fuel Factor

DEF’s

currently-approved annual levelized fuel factor beginning with the first

January 2024 billing cycle is 5.239 cents per kilowatt-hour (kWh).

The Company is requesting to decrease its currently approved 2024 annual

levelized fuel factor beginning June 2024 to 4.663 cents per kWh, a decrease of

approximately 11.0 percent.

Bill Impacts

In Table

1-1 below, the bill impact of the mid-course correction on a residential

customer using 1,000 kWh of electricity a month is shown. Following Table 1-1,

staff discusses the impacts of the mid-course correction on non-residential

customers.

|

Table 1-1

Duke Energy Florida,

LLC

|

|

Monthly Residential

Billing Detail for the First 1,000 kWh

|

|

Invoice Component

|

Currently Approved Charges

May 2024

($)

|

Proposed

Charges

Beginning

June 2024

($)

|

Difference

($)

|

Difference

(%)

|

|

Base Charge

|

$81.19

|

$81.19

|

$0.00

|

0.0%

|

|

Fuel Charge

|

49.47

|

43.72

|

(5.75)

|

(11.6%)

|

|

Capacity Charge

|

9.46

|

9.46

|

0.00

|

0.0%

|

|

Conservation

Charge

|

3.30

|

3.30

|

0.00

|

0.0%

|

|

Environmental

Charge

|

0.46

|

0.46

|

0.00

|

0.0%

|

|

Storm

Protection Plan Charge

|

5.10

|

5.10

|

0.00

|

0.0%

|

|

Storm

Restoration Surcharge

|

5.09

|

5.09

|

0.00

|

0.0%

|

|

Asset

Securitization Charge

|

2.36

|

2.36

|

0.00

|

0.0%

|

|

Gross Receipts

Tax

|

4.15

|

4.00

|

(0.15)

|

(3.6%)

|

|

Total

|

$160.58

|

$154.68

|

($5.90)

|

(3.7%)

|

Source: Document No.

01668-2024.

DEF’s

currently approved total residential charge for the first 1,000 kWh of usage

for May 2024 is $160.58. If the Company’s mid-course correction is approved,

then the current total residential charge for the first 1,000 kWh of usage beginning

in June will be $154.68, a decrease of 3.7 percent. For non-residential

customers, DEF reported that bill decreases based on average levels of usage

for small-size commercial customers would be 3.6 percent, 4.5 percent for

medium-size commercial customers, 4.8 percent for large-size commercial

customers, and 7.0 percent for industrial customers.

Optional Period

Staff

investigated the effect on monthly bills of shortening the period proposed for

developing rates from 12 to 7 months. For rate-setting purposes, the total base

over-recovery is the same under the 7-month and 12-month scenarios; however,

the impact of the 7-month scenario can be characterized as a greater reduction

in the monthly fuel charge over a shorter period of time.

Table 1-2

below shows the bill impact to a residential customer using 1,000 kWh of electricity

a month associated with this optional period scenario described in this section

of the recommendation.

|

Table 1-2

Duke Energy Florida,

LLC

|

|

Optional Monthly

Residential Billing Detail for the First 1,000 kWh

|

|

Invoice Component

|

Currently Approved Charges

May 2024

($)

|

Optional Charges

Beginning

June 2024

($)

|

Difference

($)

|

Difference

(%)

|

|

Base Charge

|

$81.19

|

$81.19

|

$0.00

|

0.0%

|

|

Fuel Charge

|

49.47

|

39.86

|

(9.61)

|

(19.4%)

|

|

Capacity Charge

|

9.46

|

9.46

|

0.00

|

0.0%

|

|

Conservation

Charge

|

3.30

|

3.30

|

0.00

|

0.0%

|

|

Environmental

Charge

|

0.46

|

0.46

|

0.00

|

0.0%

|

|

Storm

Protection Plan Charge

|

5.10

|

5.10

|

0.00

|

0.0%

|

|

Storm

Restoration Surcharge

|

5.09

|

5.09

|

0.00

|

0.0%

|

|

Asset

Securitization Charge

|

2.36

|

2.36

|

0.00

|

0.0%

|

|

Gross Receipts

Tax

|

4.15

|

3.90

|

(0.25)

|

(6.0%)

|

|

Total

|

$160.58

|

$150.72

|

($9.86)

|

(6.1%)

|

Source: Document No. 01787-2024.

DEF’s

proposed fuel charge decrease results in a residential charge for the first

1,000 kWh of energy sales of 4.372 cents per kWh. This factor produces a

corresponding monthly fuel charge of $43.72. With respect to the optional

period scenario, the associated residential factor would be 3.986 cents per

kWh.

This would result in a fuel charge of $39.86 for the first 1,000 kWh of energy

usage. The estimated decrease in the monthly first-tier residential fuel charge

under this scenario is approximately $9.61 (opposed to the as-filed proposal of

$5.75), or going from $43.72 to $39.86. In percentage terms, the total bill decrease

would be approximately 6.1 percent under the optional period scenario.

For

non-residential customers, based on average levels of usage and specific rate

schedules, DEF reported that bill decreases for small-size commercial customers

would be 5.8 percent, 7.2 percent for medium-size commercial customers, 7.6

percent for large-size commercial customers, and 11.3 percent for industrial

customers.

The

hypothetical tariff associated with this optional period scenario was provided

in response to Staff’s First Data Request (Response No. 10). However,

the tariff was not included as an attachment to this recommendation.

Summary

DEF’s MCC

Petition indicates a need for its fuel cost recovery factors to be revised.

More specifically, the Company’s underlying 2024 projected fuel-related revenue

requirement has been reduced by $252,698,582. Additionally, the Company

proposes to incorporate its 2023 period-specific final under-recovery of ($19,202,150)

into the current period. Thus, DEF’s current fuel cost recovery factors should

be reduced by $233,496,431. Sales from June 2024 through May 2025 should be

used to develop the revised/mid-course correction fuel factors. The revised fuel

cost recovery factors associated with staff’s recommendation are shown on

Appendix A.

Conclusion

Staff recommends the

Commission authorize adjustments to DEF’s fuel cost recovery factors for the

purpose of incorporating the Company’s currently projected 2024 net fuel cost

reduction. Accordingly, DEF’s 2024 fuel cost recovery factors should be reduced

by $233,496,431.

Issue 2:

If approved by the Commission, what is the appropriate

effective date for DEF’s revised fuel cost recovery factors?

Recommendation:

The fuel cost recovery factors, as shown on Appendix

A, should become effective with the first billing cycle of June 2024. (P.

Kelley, Hampson, Brownless, Sandy)

Staff Analysis:

Over

the last 20 years in the Fuel Clause docket, the Commission has considered the

effective date of rates and charges of revised fuel cost factors on a

case-by-case basis. The Commission has approved rate decreases to be effective

less than 30 days after the date of the Commission vote because the rate

decrease was in the customers’ best interest to be implemented as soon as

possible. In its

MCC Petition, DEF proposes to decrease its 2024 fuel factors beginning with the

first billing cycle of June 2024.

In

response to Staff’s First Data Request, DEF indicated that it would provide a

message on June customer bills that will include a link to the Company’s

website explaining the proposed rate decrease. Further,

on April 8, 2024, an email notification was sent to large account customers

explaining the proposal. A press release was also issued by the Company on that

same day informing its customers and general public of the potential

adjustments related to the mid-course correction proposal.

Conclusion

Staff recommends that the fuel cost recovery factors, as

shown on Appendix A, become effective with the first billing cycle of June

2024.

Issue 3:

Should this docket be closed?

Recommendation:

No. The 20240001-EI docket is an on-going proceeding

and should remain open. (Brownless, Sandy)

Staff Analysis:

The fuel docket is an on-going proceeding and should

remain open.