Case Background

Peoples Gas

System, Inc. (PGS or Company) is a wholly-owned subsidiary of TECO Gas

Operations, Inc., which is a subsidiary of TECO Energy, Inc., which is a

wholly-owned subsidiary of Emera United States Holdings, Inc., which is a

wholly-owned subsidiary of Emera Incorporated. PGS owns and operates natural

gas distribution facilities in Florida and provides service to 470,000

customers in 39 of Florida’s 67 counties. On January 1, 2023, PGS ceased to be

a division of Tampa Electric Company and was spun-off into its own entity. As a

new entity, PGS ceased obtaining long-term debt capital from its affiliate,

Tampa Electric Company, and issued its own debt on December 19, 2023. The

Company’s current rates were approved by Order No. PSC-2023-0388-FOF-GU, issued

December 27, 2023 (2023 Rate Case Order), which included approval of the

Long-Term Debt Cost Rate True-Up Mechanism (LTDR True-Up Mechanism).

On February 2,

2024, PGS filed its petition to implement the aforementioned LTDR True-Up

Mechanism. The LTDR True-Up Mechanism allows the Company to make a one-time

adjustment to its estimated cost of long-term debt for the projected test year

ending December 31, 2024, to reflect the actual embedded cost of PGS’s

inaugural long-term debt issuance in its revenue requirement and rates.

In its petition,

PGS is seeking approval of an increase of the long-term debt cost rate from

5.54 percent to 5.64 percent, which would increase the weighted average cost of

capital from 7.02 percent to 7.05 percent, and thereby increase the incremental

base rate revenue increase approved in the 2023 Rate Case Order by $874,085.

The Company also requested Commission approval of the updated base rates and

charges and associated tariffs, effective for the first billing cycle of June

2024. PGS also requested the Commission specify the amount of incremental

revenue requirement from January 1, 2024, to the effective date of the

Company’s updated 2024 tariffs to be deferred by the Company for recovery

through the Cast Iron/Bare Steel Replacement Rider for 2025 as approved in the

2023 Rate Case Order.

During the

review process, staff issued two data requests to PGS. The first data request

was issued on February 13, 2024, and the Company’s response was received on

February 23, 2024.

The second data request was issued on February 29, 2024, and a response

was received on March 11, 2024. In Order No. PSC-2024-0090-PCO-GU, the

Commission suspended the proposed tariffs. The Commission has jurisdiction over this

matter pursuant to Sections 366.03, 366.04, 366.05, 366.06, and 366.076,

Florida Statutes (F.S.)

Discussion

of Issues

Issue 1:

Should the Commission approve PGS's request to

increase the cost rate for long-term debt from 5.54 percent to 5.64 percent for

the test year ending December 31, 2024?

Recommendation:

Yes. The Commission should approve an increase in

the cost rate for long-term debt from 5.54 percent to 5.64 percent for the test

year ending December 31, 2024. (Souchik)

Staff Analysis:

The LTDR True-Up Mechanism was approved by the

Commission in the 2023 Rate Case Order and allows PGS to make a one-time adjustment

to the Company’s forecasted long-term debt cost rate after its inaugural

long-term debt issuance. In

the 2023 Rate Case Order, the Commission approved a long-term debt cost rate of

5.54 percent. PGS

completed its inaugural long-term debt issuance on December 19, 2023, by

issuing a total of $925 million of long-term debt in the following amounts and

maturities: $350 million at five years, $350 million at ten years, and $225

million at thirty years. The embedded cost rate of the three debt issuances,

including debt issuing expense, is 5.64 percent.

Staff reviewed the Company’s calculation of 5.64 percent for the embedded cost

of long-term debt in Exhibit One attached to its petition and verified its

accuracy. PGS used the same methodology to calculate the actual long-term debt

cost rate of 5.64 percent that was approved by the Commission in the 2023 Rate

Case Order.

In early 2023, PGS forecasted to issue approximately $825

million of long-term debt on September 30, 2023, and expected approximately

$910 million of intercompany debt to be outstanding at the time the

intercompany loan with Tampa Electric Company was paid off.

Ultimately, PGS issued $100 million more than forecasted based on the amount of

intercompany debt outstanding at the time of the Company’s inaugural long-term

debt issuance (December 19, 2023). In response to staffs second data request,

PGS explained that the purpose for the additional $100 million was to satisfy

the combined intercompany long-term and short-term debt outstanding of $956

million. After

staff’s review of PGS’s implementation of the LTDR True-Up Mechanism, staff

believes the Company complied with the Commission’s 2023 Rate Case Order, and therefore,

staff recommends the Commission approve PGS’s request to increase its cost rate

for long-term debt from 5.54 percent to 5.64 percent for the test year ending

December 31, 2024.

Issue 2:

Should the Commission approve PGS's request to

increase the weighted average cost of capital from 7.02 percent to 7.05 percent

for the test year ending December 31, 2024?

Recommendation:

Yes. The Commission should approve an increase in

the weighted average cost of capital from 7.02 percent to 7.05 percent for the

test year ending December 31, 2024. (Souchik)

Staff Analysis:

By updating the forecasted long-term debt cost rate

of 5.54 percent with the actual cost rate of 5.64 percent, and making no other

changes to PGS’s capital structure approved by the Commission in the 2023 Rate

Case Order, the weighted average cost of capital increased from 7.02 percent to

7.05 percent. The balance of long-term debt in the updated capital structure is

unchanged from the balance of $830,722,209 approved by the Commission in the

2023 Rate Case Order. Staff reviewed the Company’s revised capital structure in

Exhibit Two attached to its petition and verified it’s calculated correctly

pursuant to the 2023 Rate Case Order.

Therefore, staff recommends the Commission approve PGS’s request to increase

the weighted average cost of capital from 7.02 percent to 7.05 percent for the

test year ending December 31, 2024.

Issue 3:

Should the Commission approve PGS's request to

increase the incremental base rate revenue requirement approved in the 2023

Rate Case Order from $117,839,527 to $118,713,612 for the test year ending

December 31, 2024?

Recommendation:

Yes. The Commission should approve an increase in

the incremental base rate revenue requirement approved in the 2023 Rate Case

Order from $117,839,527 to $118,713,612 for the test year ending December 31,

2024. (Andrews, Souchik)

Staff Analysis:

In the 2023 Rate Case Order, the Commission approved

PGS’s incremental base rate revenue requirement of $117,839,527 based on an overall

rate of return of 7.02 percent.

Updating the 7.02 percent overall rate of return to 7.05 percent, the

incremental revenue requirement increased to $118,713,612. This

equates to an increase of $874,085 or 0.74 percent. Staff reviewed PGS’s

updated incremental base rate revenue increase calculations in Exhibit Three

attached to its petition and verified it was calculated correctly pursuant to

the 2023 Rate Case Order.

Therefore, staff recommends the Commission approve an increase in the amount of

the incremental base rate revenue requirement from $117,839,527 to $118,713,612

for the test year ending December 31, 2024.

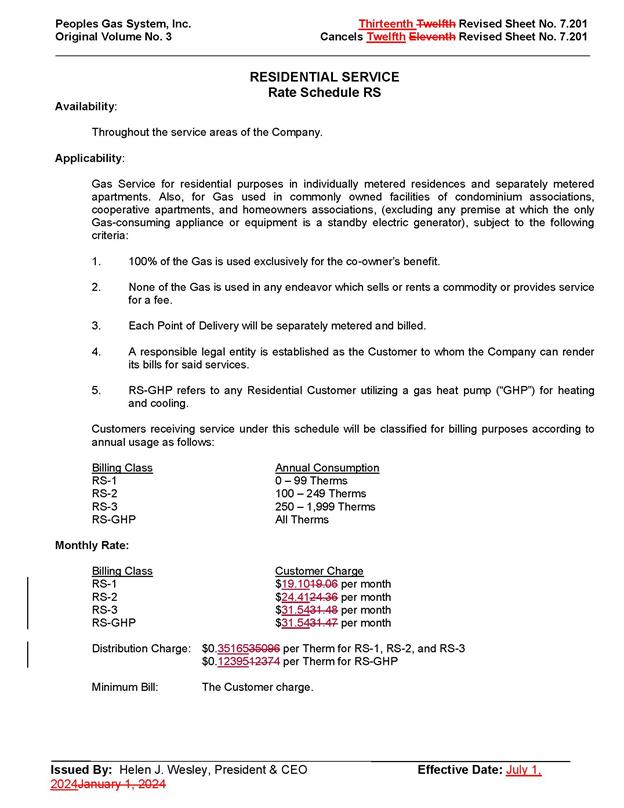

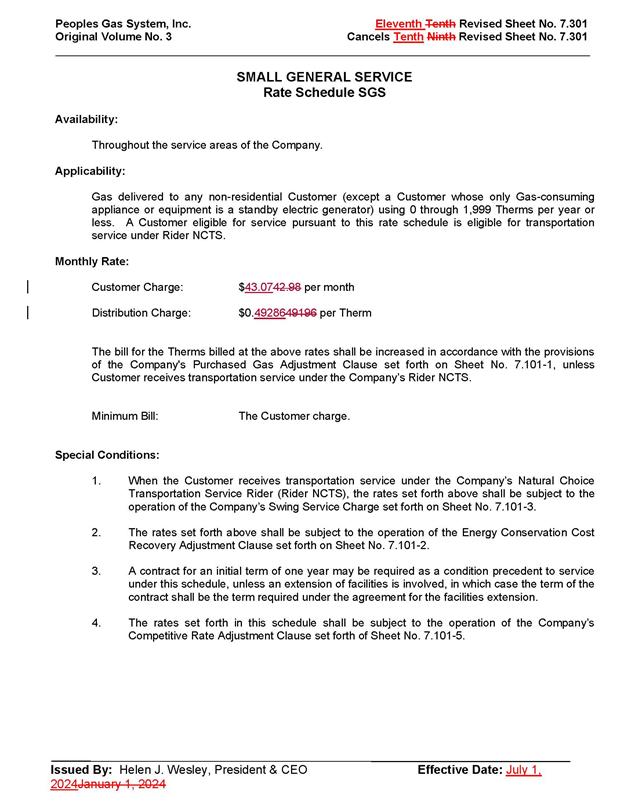

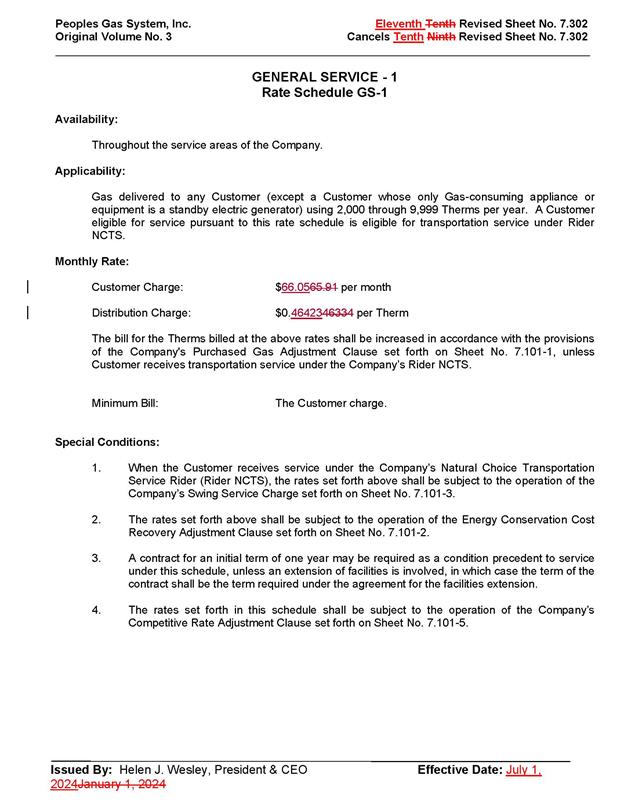

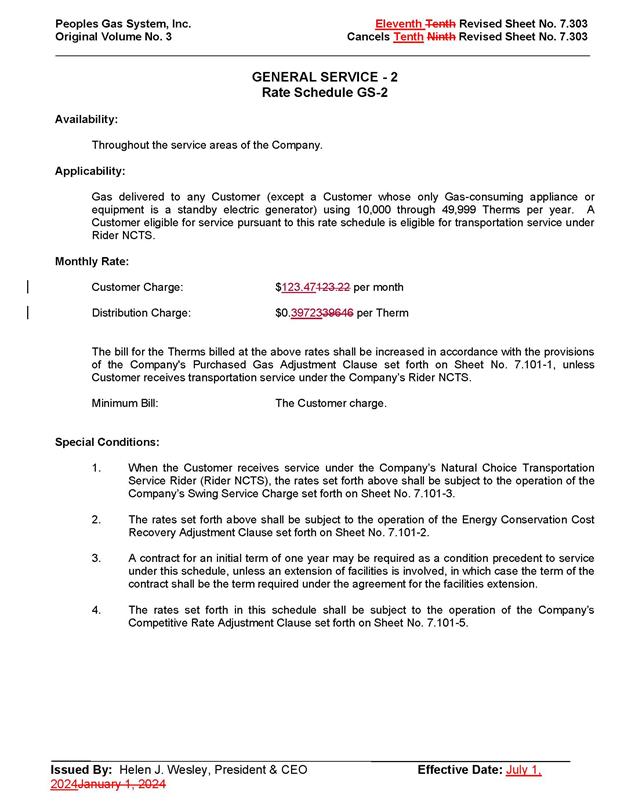

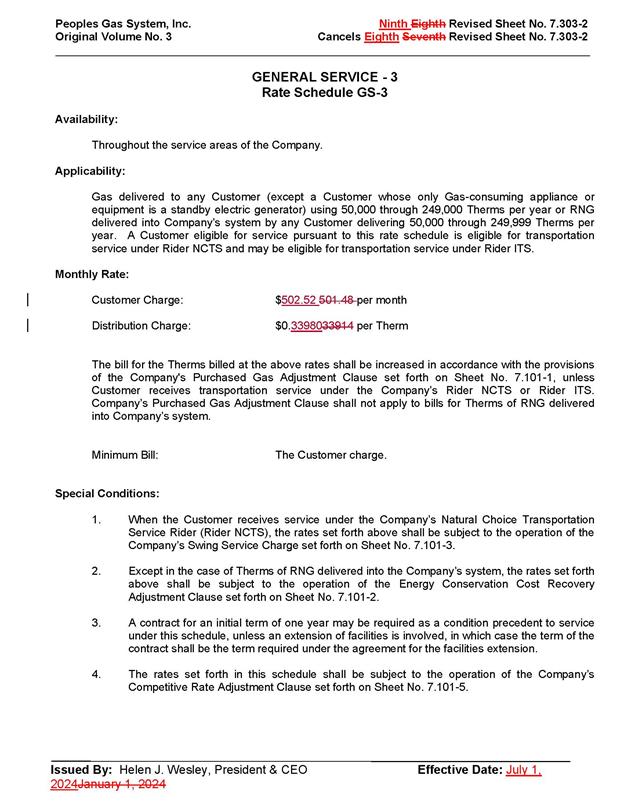

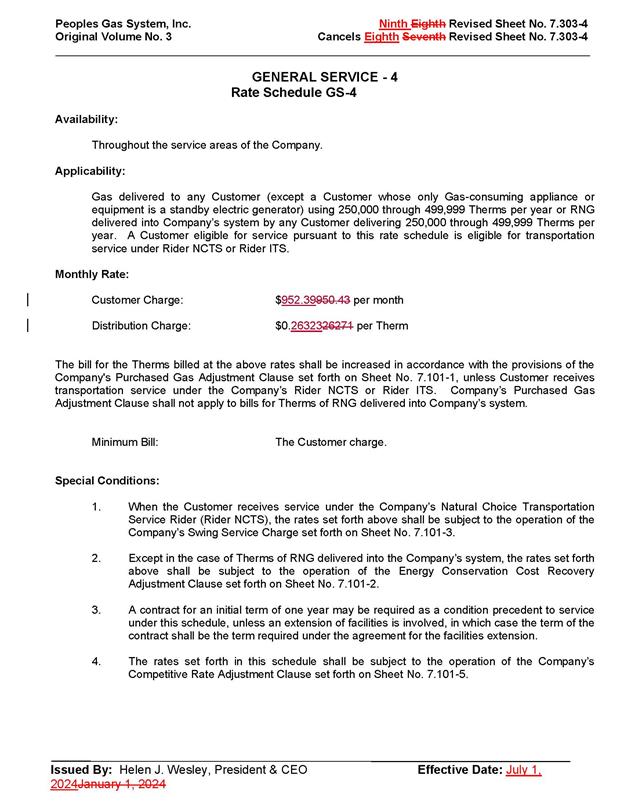

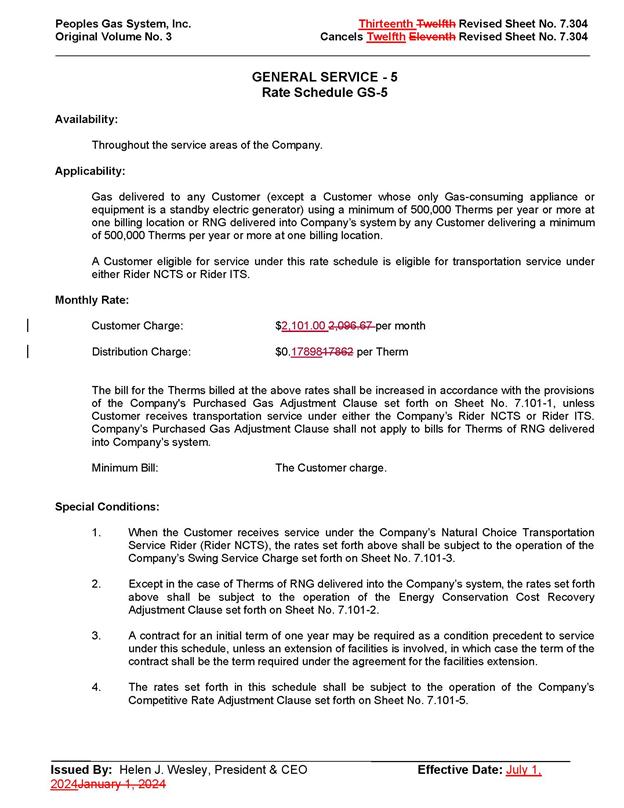

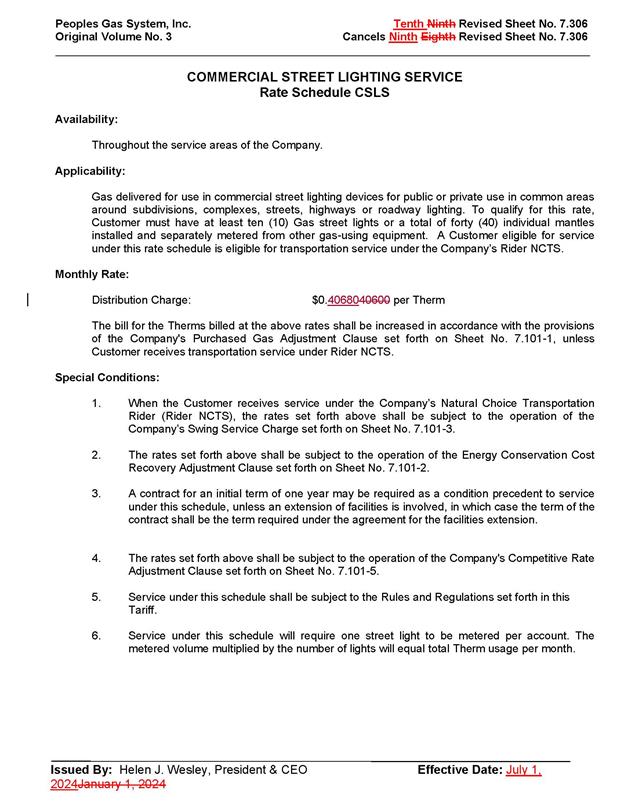

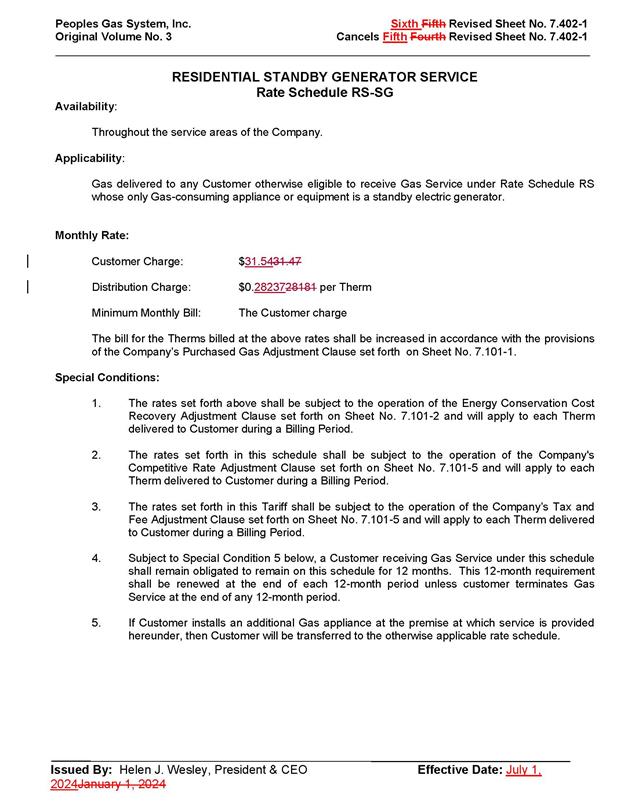

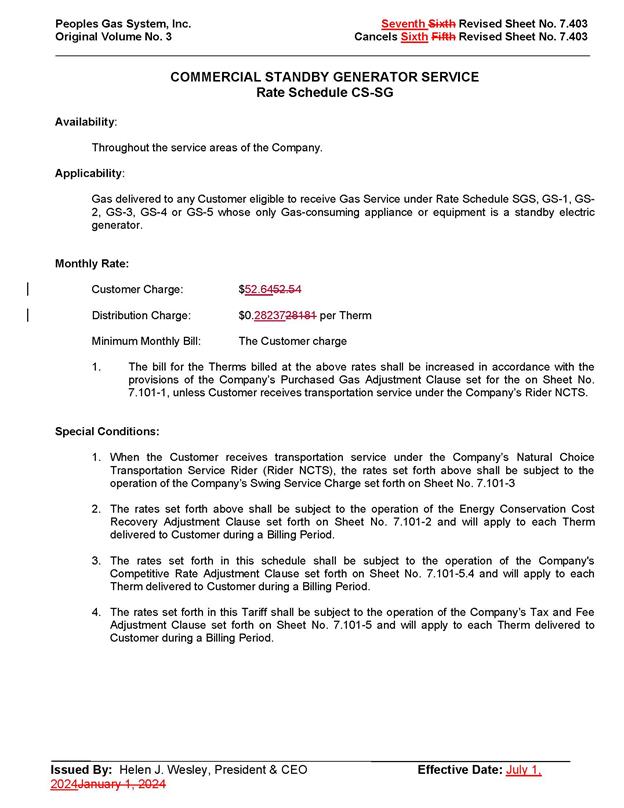

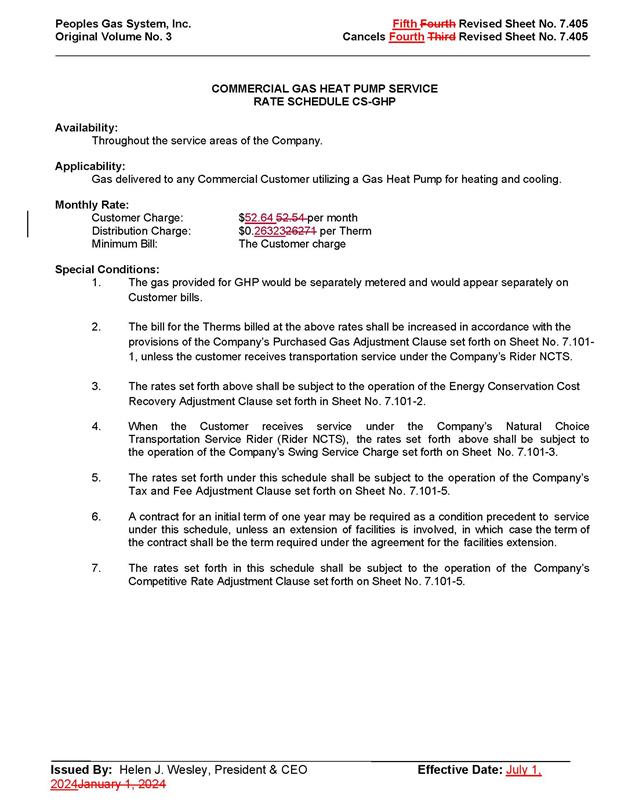

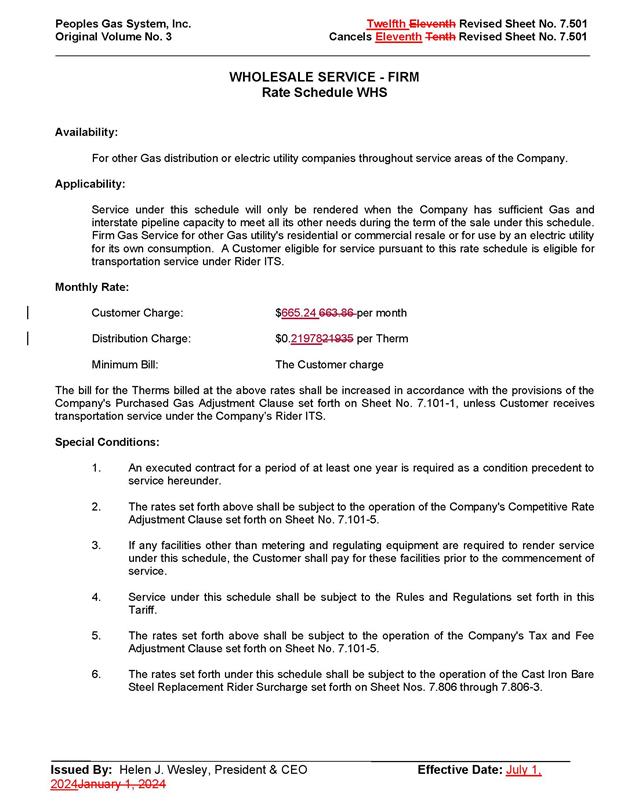

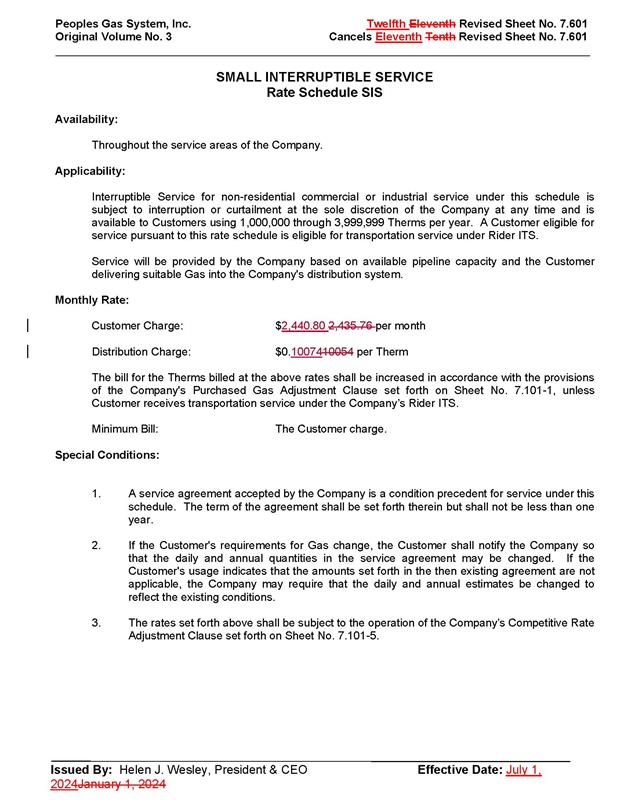

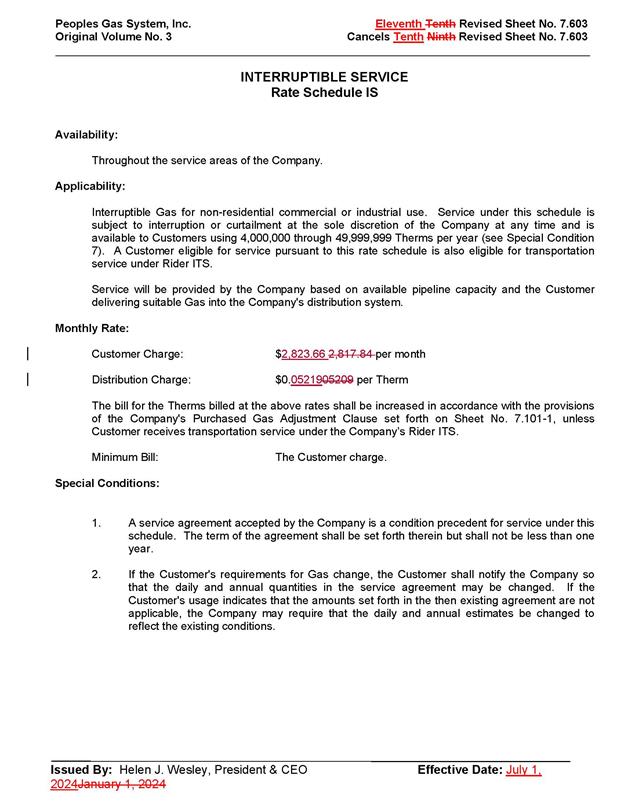

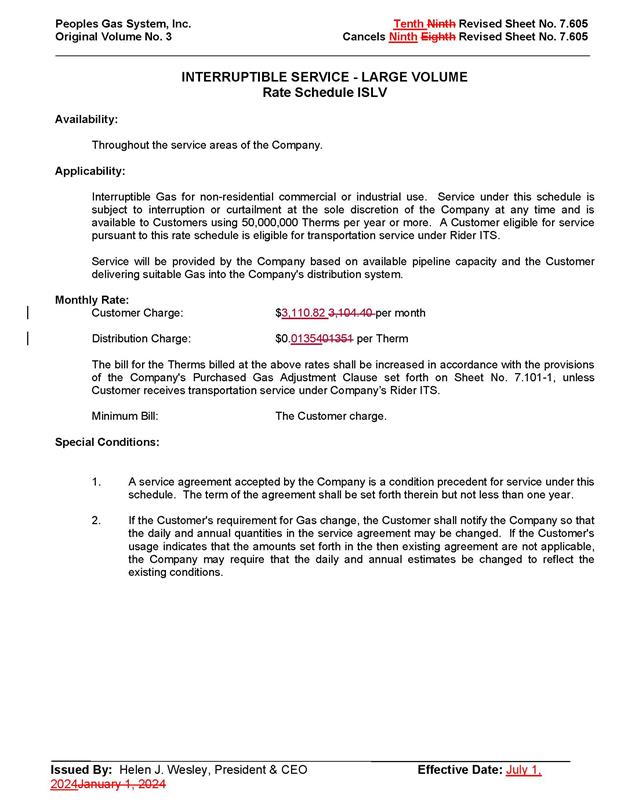

Issue 4:

Should the Commission approve PGS’s request to

update its base rates, charges, and tariffs reflected in Attachment A attached

to this recommendation, with an effective date of July 1, 2024?

Recommendation:

Yes. If the Commission approves Issue 3, PGS’s request

to update its base rates, charges, and tariffs reflected in Attachment A to

this recommendation, should go into effect with the first billing cycle in July

1, 2024. (Guffey)

Staff Analysis:

As discussed in Issue 3, PGS requested to increase

the incremental base rate revenue increase from $117,839,527 to $118,713,612

for the test year ending December 31, 2024, which results in an increase of

$874,085. PGS allocated this amount to the monthly customer charge and

distribution charge in all its rate classes as shown in Exhibit Four of the

petition. A residential customer in the RS-2 rate schedule, using 14 therms per

month would see a bill increase of $0.06, from $29.27 to $29.33, excluding

clause factors and taxes.

In response to staff’s second data request, PGS stated

that it intends to notify its customers of the rate changes at least 30 days

prior to their effective date, via bill inserts, email notification for

electronic bill customers and the PGS website.

Staff has reviewed the proposed customer notice, which was provided in response

to staff’s second data request.

PGS requested that

the proposed tariffs be effective with the first billing cycle in June 2024 or

soon thereafter. Staff has reviewed the proposed tariffs, calculations of the

revised base rate charges and PGS’s responses to data requests and recommends

that they be approved and be effective with the first billing cycle in July

2024.

Issue 5:

Should the Commission approve PGS’s request to defer

recovery of the incremental revenue requirement for the six-month period from

January 1, 2024, through June 30, 2024, through the Cast Iron/Bare Steel

Replacement Rider for 2025?

Recommendation:

Yes. Pursuant to the 2023 Rate Case Order, the

Commission should approve PGS’s request to defer recovery of the incremental

revenue increase for the six-month period from January 1, 2024, through June 30,

2024, to the Cast Iron/Bare Steel Replacement Rider for 2025. The Company should include the actual

incremental amount for recovery in the 2024 Cast Iron/Bare Steel Replacement

Rider docket. (Souchik)

Staff Analysis:

In the 2023

Rate Case Order, the Commission approved PGS’s proposal that for the time

period between when the new approved base rates went into effect (January 1,

2024) and the implementation date of the LTDR True-Up Mechanism adjusted base

rates (first billing cycle of July 2024), the Company will defer the rate

impact of the LTDR True-Up Mechanism to its balance sheet for refund or

collection through the Cast Iron/Bare Steel Replacement (CI/BSR) Rider in the

subsequent year if the amount of the LTDR True-Up Mechanism is greater than

$500,000. As discussed in Issue 3, the impact of the LTDR True-Up Mechanism on

the incremental revenue increase is $874,085. Therefore, the recovery of the

incremental revenue requirement for the six-month period from January 1, 2024,

through June 30, 2024, should be recovered through the CI/BSR Rider for 2025.

Therefore, staff recommends the Commission approve PGS’s request to defer

recovery of the incremental revenue increase for the six-month period from

January 1, 2024, through June 30, 2024, to the CI/BSR Rider for 2025. The

Company should include the actual incremental amount for recovery in the 2024 CI/BSR

Rider docket.

Issue 6:

Should this docket be closed?

Recommendation:

Yes. If Issues 1 through 5 are approved and a

protest is filed within 21 days of the issuance order, the tariff should remain

in effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order. (M.

Thompson)

Staff Analysis:

Yes. If Issues 1 through 5 are approved and a

protest is filed within 21 days of the issuance order, the tariff should remain

in effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order.