|

State of Florida

|

Public Service Commission Capital Circle Office Center ● 2540 Shumard

Oak Boulevard -M-E-M-O-R-A-N-D-U-M- |

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Teitzman) |

||

|

FROM: |

Division of Economics (McClelland, Hampson, Hudson) Division of Accounting and Finance (Vogel, Norris) Office of the General Counsel (Stiller, Crawford) |

||

|

RE: |

|||

|

AGENDA: |

07/09/24 – Regular Agenda – Tariff Filing – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

|||

On January 24, 2020, St. Joe Natural Gas Company (SJNG or Company)

filed its petition to

recover incremental

storm restoration costs related to Hurricane Michael through a temporary

storm cost recovery surcharge. SJNG’s service area includes Mexico Beach and Port St. Joe, and its natural gas distribution system sustained

significant damage

as a result of Hurricane Michael. The

Company requested the recovery of $381,512 in incremental storm costs, as it

had incurred incremental costs of $321,012 and projected $60,500 in remaining

costs to complete the restoration of its gas system. The Office of Public

Counsel (OPC) subsequently filed a notice of intervention in the docket, as

acknowledged by Order No. PSC-2020-0066-GU, issued March 2, 2020.

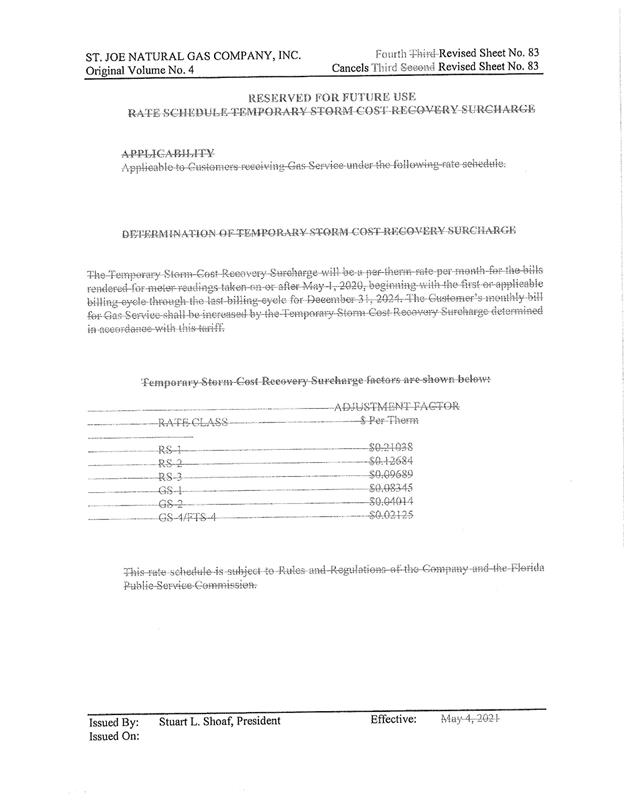

On April 20, 2020, the Commission issued an order approving the collection of an interim storm cost recovery surcharge over a period of 48 months.[1] On February 19, 2021, SJNG filed a request to approve final costs based on an actual amount of $402,720 in incremental storm restoration costs. Shortly thereafter, the Company and OPC filed a Joint Petition for Approval of Stipulation and Settlement (Settlement Agreement), which the Commission approved by Order No. PSC-2021-0196-AS-GU.[2]

The Settlement Agreement permitted the Company to recover a total of $330,115 in storm costs through the surcharge that had been previously approved on an interim basis, by Order No. PSC-2020-0117-PCU-GU. The surcharge was to extend through December 2024, at which time it would cease, with any under or over-recovery handled through the Natural Gas Conservation Cost Recovery Clause. At the conclusion of the surcharge, SJNG would record $77,761 associated with the remaining life value of lost capital assets in a regulatory asset and recover the amount over a period of 10 years through an increase to the Company’s base rates, with an anticipated implementation of January 1, 2025.

On May 30, 2024, SJNG filed a letter stating that as of May 2024 the Company has recovered more than the amount permitted in the Settlement Agreement. SJNG is requesting to terminate the storm cost recovery surcharge early, as it has collected the agreed-upon amount, and will handle any over or under-recovery consistent with the Settlement Agreement. The Company subsequently also provided an update of the current and projected over-recovery amounts.[3] The Company has also filed a Fourth Revised Sheet No. 83 reflecting termination of the surcharge, which is included as Attachment A to this recommendation.

This docket was closed June 2, 2021, when the Commission entered Order No. PSC-2021-0196-AS-GU approving the Settlement Agreement. On June 4, 2024, staff requested that this docket be reopened for the Commission to consider the requests made in the Company’s May 30, 2024 letter.

On June 12, 2024, the Company’s legal counsel provided clarification on the process to increase base rates for the recovery of the remaining $77,762 through a regulatory asset. Counsel confirmed that the regulatory asset would be addressed as a base rate increase to be implemented in January 2025 as set forth in the Settlement Agreement, and would remain separate and apart from SJNG’s pending base rate proceeding in Docket No. 20240046-GU. Accordingly, this recommendation addresses only the Company’s request for early termination of the surcharge tariff.

The Commission has jurisdiction over this matter pursuant to Sections 366.04, 366.05, and 366.06, Florida Statutes (F.S.).