†Case Background

Florida

Public Utilities Company (FPUC or Company) filed a test year notification

letter with the Commission on June 18, 2024, in which the Company indicated its

intent to seek a permanent increase in its rates and charges based on a test

year ending December 31, 2025, and a request for an interim rate increase.† On August 22, 2024, FPUC filed its petition

for an increase in base rates, as well as minimum filing requirements schedules

(MFRs) and the direct testimony of 10 witnesses.† The Company is engaged in business as a

public utility providing electric service as defined in Section 366.02, Florida

Statutes (F.S.), and is subject to the jurisdiction of the Florida Public

Service Commission (Commission). FPUC serves approximately 18,100 retail

customers in Calhoun, Liberty, and Jackson counties in the Companyís Northwest

Division and approximately 15,000 retail customers in Nassau County in its

Northeast Division.

FPUC requested

an increase in base rates to generate an additional $12,593,450 in annual

revenues. The requested increase, according to FPUC, will provide the Company

with an opportunity to earn a rate of return of 6.89 percent on the Company's

plant and property used to serve its customers and a return on equity of 11.30

percent. The Company based its request on a 13-month average rate base of

$150,053,096 for the projected test year ending December 2025.

FPUC stated in

its petition that the requested test year period ending December 31, 2025, is

the most relevant period upon which the Companyís operations should be analyzed

for purposes of establishing rates for the period in which the new rates will

be in effect. The Company further stated that this period will be indicative of

its actual revenues, expenses, and investment during the first 12 months that

the new rates will be in effect. The Commission last granted FPUC an

approximately $3.75 million rate increase by Order No. PSC-14-0517-S-EI.†††

In

its petition, FPUC also requested an interim rate increase in its base rates

and charges to generate $1,812,869

in additional gross revenues until the permanent rates become effective.† The Company has based its interim request on

a historical test year ended December 31, 2023. In its petition, FPUC stated

that it will hold any revenues collected, subject to refund, with interest at a

rate determined pursuant to Rule 25-6.0435(3), Florida Administrative Code (F.A.C.)

and that it be allowed to collect the interim increase subject to a corporate

undertaking.†

On

September 4, 2024, the Office of Public Counsel (OPC) filed its notice of

intervention in this docket and the Order acknowledging the intervention was

issued on September 5, 2024. On September 4, 2024, FPUC filed revisions

to MFR Schedules B-2 and G-3 to correct a reference to the prior rate case

order. No numeric values were changed.

This

recommendation addresses FPUCís interim rate increase request and the

suspension of the requested permanent rate increase.† The Commission has jurisdiction over this

request for a rate increase and interim rate increase under Sections 366.06 and

366.071, F.S.

Discussion

of Issues

Issue 1:

Should the request for a permanent increase in rates

and charges be suspended for FPUC?

Recommendation:

Yes. Staff recommends that the requested permanent

increase in rates and charges be suspended for FPUC. (Guffey)

Staff Analysis:

Staff recommends that the requested permanent

increase in rates and charges be suspended for FPUC to allow staff time to

analyze the case. During the analysis to date, staff issued its first data

request to FPUC on September 12, 2024 for which the responses are due on

September 26, 2024. Staff will be issuing additional data requests to the

Company during the review process. On August 27, 2024, the Company was advised

that the Commission will conduct an audit for which the formal review report is

expected to be issued on November 13, 2024. Additionally, staff is finalizing

the review of the Companyís Minimum Filing Requirements and the review letter

to the Company will be issued on or by September 20, 2024. In light of the

ongoing activities in this rate case and pursuant to Section 366.06(3), F.S.,

the Commission may withhold consent to the operation of all or any portion of a

new rate schedule, delivering to the utility requesting such a change, a

reason, or written statement of good cause for doing so within 60 days. Staff

believes that the reasons stated above are good cause consistent with the

requirements of Section 366.06(3), F.S.

Issue 2:

Is FPUCís proposed interim rate base appropriate?

Recommendation:

Yes. FPUCís proposed rate base of $116,666,956 for

the interim historical test year ended December 31, 2023, is appropriate. (G.

Kelley, Higgins)

Staff Analysis:

In its filing, the Company proposed an interim

13-month average rate base of $116,666,956 for the period ended December 31,

2023. Pursuant to Section 366.071(5)(a), F.S., the Company is permitted to

elect either an average or year-end rate base to calculate its interim revenue

request. Staff has reviewed the rate base adjustments made in the current

interim filing for consistency with the rulings made in the Companyís last rate

case order. Based on

staffís preliminary review, FPUC made the applicable and appropriate

adjustments consistent with the previous rate case. Therefore, staff recommends

that $116,666,956 is the appropriate amount of rate base for the 2023 interim

historical test year ended December 31, 2023. The associated calculations are

shown on Attachment A.

Issue 3:

Is FPUCís proposed interim return on equity and

overall rate of return appropriate?

Recommendation:

Yes. The appropriate interim return on equity for

FPUC should be 9.25 percent and overall rate of return should be 4.95 percent.

(Ferrer)

Staff Analysis:

Pursuant to Section 366.07(2)(a), F.S., the

appropriate return on equity (ROE) for purposes of determining an interim rate

increase is the minimum of the Companyís currently authorized ROE range. FPUCís

authorized ROE and range is 10.25 percent plus or minus 100 basis points. The

Commission set the return and range by Order No. PSC-14-0517-S-EI.

For its interim request, the Company appropriately used an ROE of 9.25 percent.

Staff recommends the capital structure of FPUC for the

historical 13-month average test year reflect an ROE of 9.25 percent, resulting

in an overall cost of capital of 4.95 percent. Attachment B details the

calculations of the overall cost of capital.

Issue 4:

Is FPUCís proposed interim test year net operating

income appropriate?

Recommendation:

Yes. The appropriate interim test year ended

December 31, 2023, net operating income for FPUC should be $4,429,839. (G.

Kelley, Higgins)

Staff Analysis:

The proposed interim test year net operating income

(NOI) for FPUC of $4,429,839 is the 12-month amount for the historical test

year ended December 31, 2023. Staff has reviewed the NOI adjustments made in

the current interim filing for consistency with the rulings made in the Companyís

last rate case. Based on

staffís preliminary review, FPUC made the applicable and appropriate

adjustments consistent with the previous rate case. The associated calculation

is shown on Attachment A.

Issue 5:

Is FPUCís proposed interim net operating income

multiplier appropriate?

Recommendation:

No. The appropriate interim net operating income

multiplier should be 1.3496. (G. Kelley, Higgins)

Staff Analysis:

On MFR Schedule G-18, the Company calculated a NOI

multiplier of 1.3477. This multiplier is based on a revenue expansion factor of

74.2015 percent, formulated using a 21 percent Federal Income Tax rate, a 5.50

percent state income tax rate, a 0.5227 percent bad debt rate, and a 0.0848

percent factor for regulatory assessment fees. However, the Companyís proposed

interim bad debt rate includes projected data. The proposed interim bad debt

rate reflects the average of the 2023 historical test year, the 2024 prior

year, and the 2025 projected test year. Staff believes only historical data

should be considered for determining an interim bad debt rate. Thus, staff

re-calculated an interim bad debt rate based on a three-year historical average

of calendar years 2021, 2022, and 2023. This resulted in an average bad debt

rate of 0.6628 percent. Therefore, staff recommends that 1.3496 is the

appropriate NOI multiplier. The NOI multiplier calculation is shown in Table

5-1.

Table

5-1

Interim NOI Multiplier

|

Description

|

|

|

Revenue Requirement

|

100.000%

|

|

Less Regulatory Assessment Fee

|

0.0848%

|

|

Less Staff Calc. Bad Debt Rate

|

0.6628%

|

|

Net Before Income Taxes

|

99.252%

|

|

Less State Income Tax @ 5.5%

|

5.459%

|

|

Net Before Federal Income Tax

|

93.794%

|

|

Less Federal Income Tax @ 21%

|

19.697%

|

|

Revenue Expansion Factor

|

74.097%

|

|

NOI Multiplier (100/74.097)

|

1.3496

|

Issue 6:

Should FPUCís requested interim revenue increase be

granted?

Recommendation:

Yes. The appropriate interim revenue increase for

FPUC should be $1,812,869. (G. Kelley, Higgins)

Staff Analysis:

FPUC requested interim rate relief in the amount of

$1,812,869. As discussed in Issue 5, staff is recommending an adjustment to the

NOI multiplier. The application of the revised NOI multiplier results in a new

interim revenue increase of $1,815,448, for a difference of $2,579. However,

staff recommends that the increase be limited to only the Companyís requested

interim amount of $1,812,869.

Staff believes the Companyís requested revenue increase

would allow FPUC an opportunity to earn an overall rate of return of 4.95

percent. The overall rate of return of 4.95 percent is calculated using a

return on equity of 9.25 percent which is the bottom of FPUCís currently

authorized range.

After a determination on the permanent rate increase has

been made, the interim revenue will be reviewed to determine if any portion

should be refunded to customers. The calculation of the interim revenue

increase is shown in Table 6-1.

Table 6-1

Interim Revenue Increase

|

Description

|

|

|

Jurisdictional Adjusted Rate Base

|

$116,666,956

|

|

Overall Rate of Return

|

4.95%

|

|

Jurisdictional Net Operating Income Requested

|

$5,775,014

|

|

Jurisdictional Adjusted Net Operating Income

|

$4,429,839

|

|

Revenue Deficiency

|

$1,345,175

|

|

As-Filed Net Operating Income Multiplier

|

1.3477

|

|

Interim Revenue Increase

|

$1,812,869

|

|

Base Rate Revenues

|

$24,525,209

|

|

Recommended Percentage Increase

|

7.39%

|

Issue 7:

Should FPUCís proposed interim rates and associated

tariffs be approved?

Recommendation:

Yes, FPUCís proposed interim rates and associated

tariffs as shown in Attachment C should be approved. The interim rates should

be made effective for all meter readings occurring on or after 30 days from the

date of the Commission vote. In addition, pursuant to Rule 25-22.0406(8),

F.A.C., the Company should provide notice to customers of the revised rates.

The notice must be approved in advance by staff and provided to the customers

with the first bill containing the new rates. (Guffey)

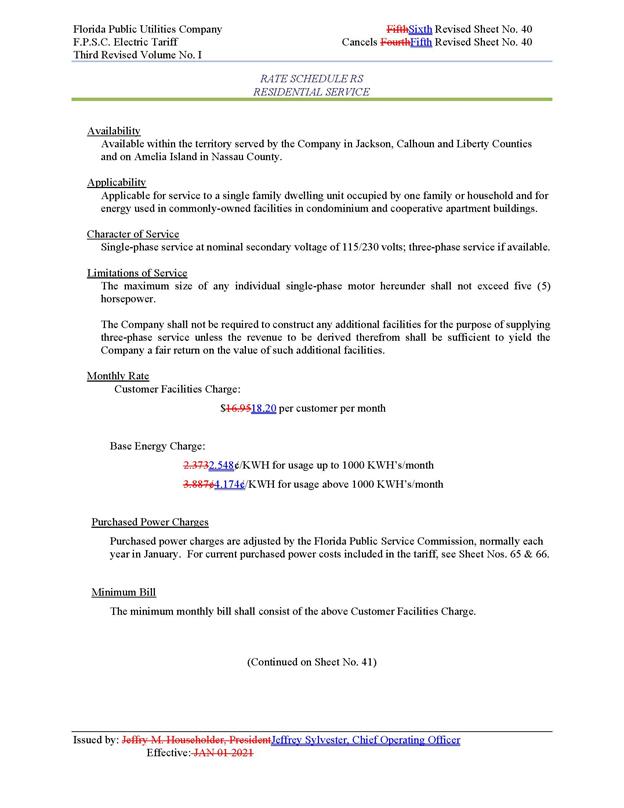

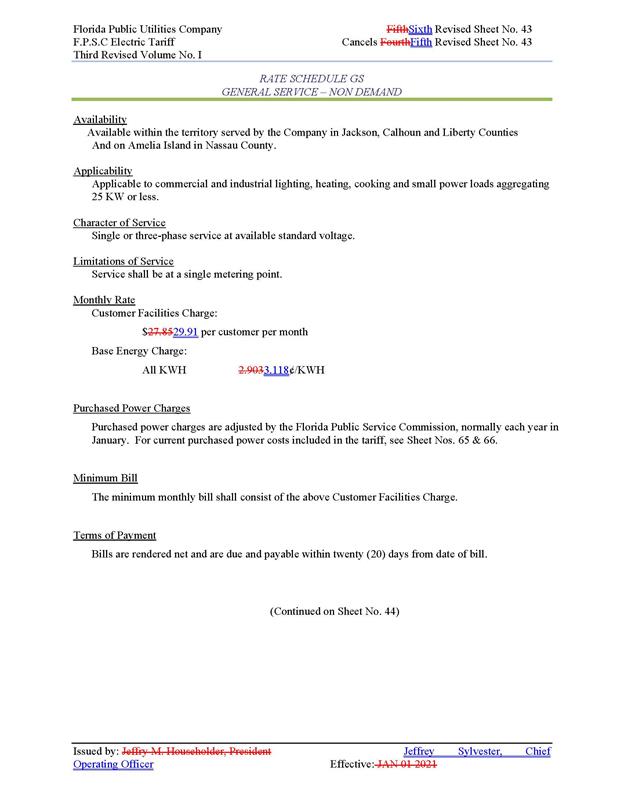

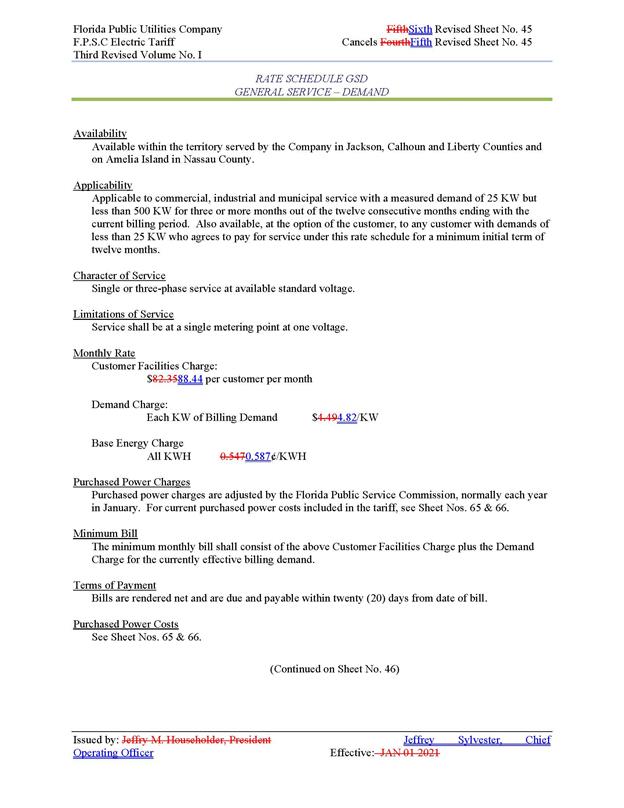

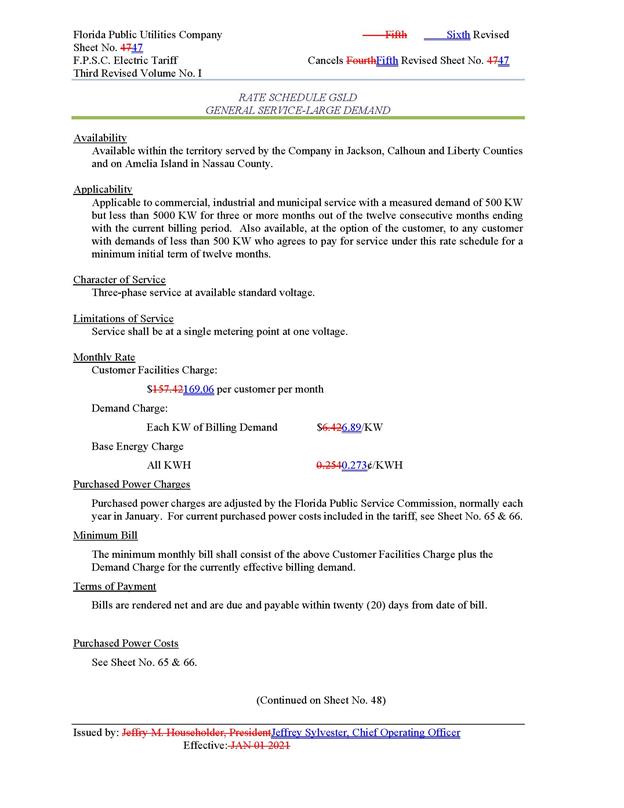

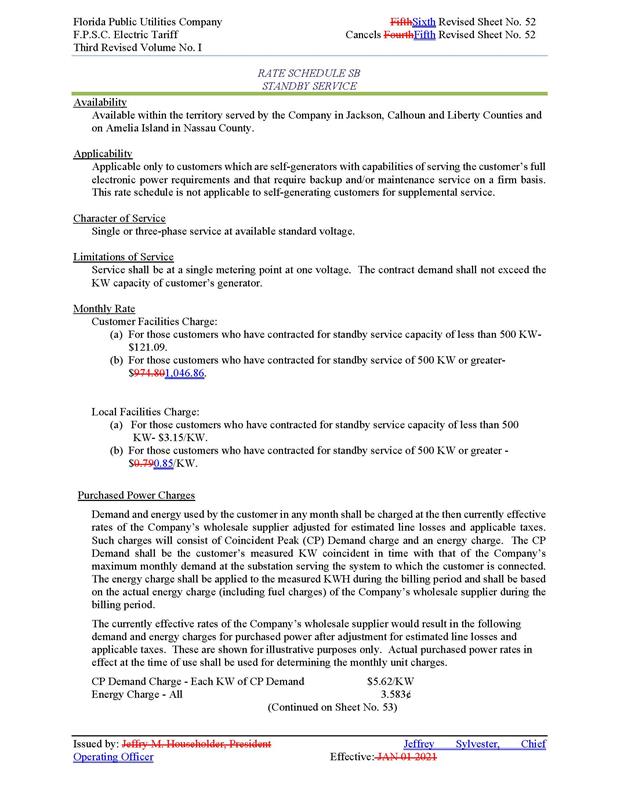

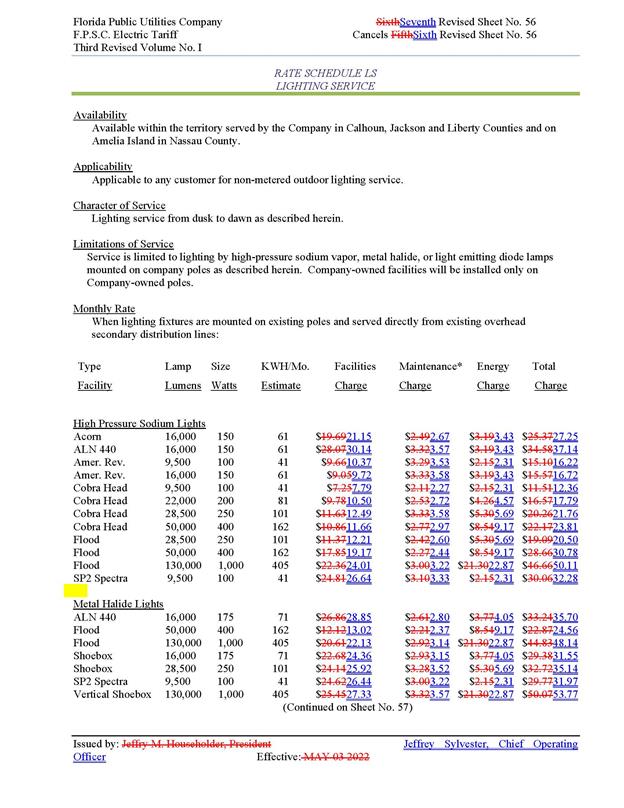

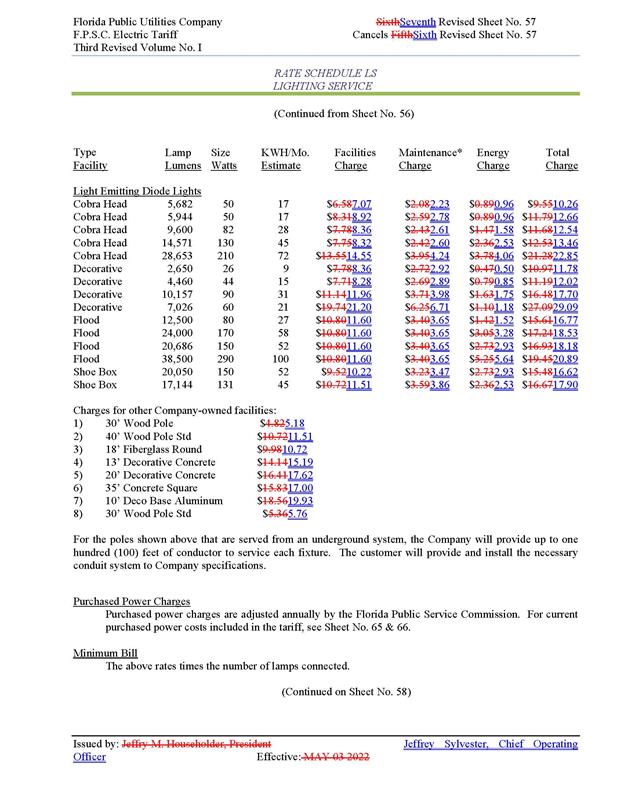

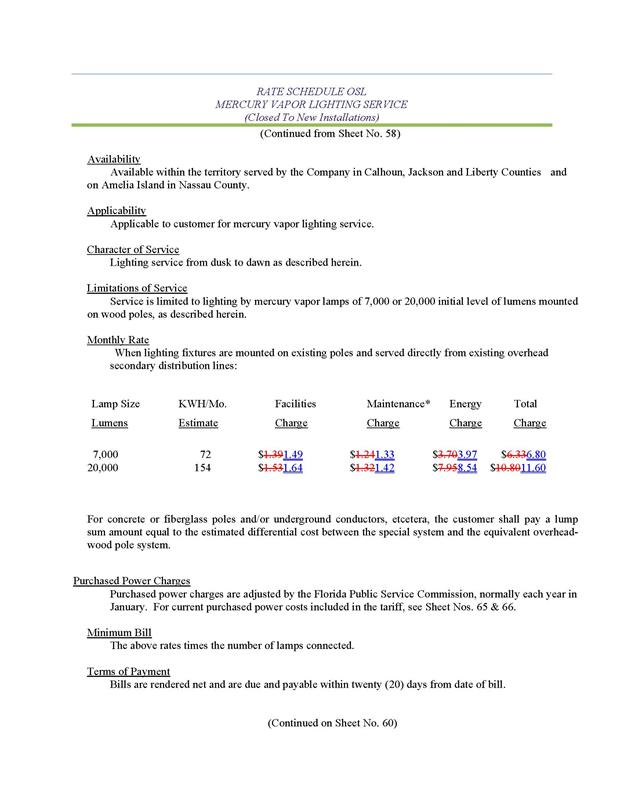

Staff Analysis:

As discussed in Issue 6, staff recommends that the

appropriate interim revenue increase is $1,812,869. The interim rates should be

made effective for all meter readings occurring on or after 30 days from the

date of the Commission vote. MFR Schedule G-20 demonstrates that the proposed

interim revenue increase was applied uniformly to all existing rate classes, as

required by Rule 25-6.0435, F.A.C. Attachment C to the recommendation provides

the proposed interim tariff sheet Nos. 40, 43, 45, 47, 50, 52, 56, 57, and 61. Pursuant

to Rule 25-22.0406(8), F.A.C., the Company should provide notice to customers

of the revised rates. The notice must be approved in advance by staff and

provided to the customers with the first bill containing the new rates.

Issue 8:†

†What is the

appropriate security to guarantee the amount subject to refund?

Recommendation:

The appropriate security to guarantee the funds

collected subject to refund is a corporate undertaking. (Ferrer)

Staff Analysis:

Staff recommends that all funds collected subject to

refund be secured by a corporate undertaking. The criteria for a corporate

undertaking include sufficient liquidity, ownership equity, profitability, and

interest coverage to guarantee any potential refund. FPUC requested an interim

revenue increase of $1,812,869. Based on an estimated eight-month collection

period of interim rates, staff calculated the estimated amount of revenues that

would be collected to be $1,208,579. Pursuant to Rule 25-6.0435, F.A.C.,

Interim Rate Relief, interim rate relief collected is subject to refund pending

final order in the permanent rate relief request. Such increase shall be

subject to a corporate undertaking or under bond as authorized by the

Commission and any refund shall be made with an interest factor determined by

using the 30-day commercial paper rate. Staff estimated the interest on the

estimated amount collected is $21,580. The estimated amount that should be

protected and guaranteed is $1,230,159. Staff reviewed FPUCís three most recent

annual reports filed with the Commission (2023, 2022, and 2021) to determine if

the Company can support a corporate undertaking to guarantee the funds

collected during the interim collection period. FPUCís financial information

demonstrates the Company has acceptable levels of liquidity, ownership equity,

and interest coverage to support a potential refund of $1,230,159.

Staff believes FPUC has adequate resources to support a

corporate undertaking in the amount recommended of $1,230,159. Based on this

analysis, staff recommends that a corporate undertaking of $1,230,159 is

acceptable. This brief financial analysis is only appropriate for deciding if

the Company can support a corporate undertaking in the amount requested and

should not be considered a finding regarding staffís position on other issues in

this proceeding.

Issue 9:

Should this docket be closed?

Recommendation:

No. This docket should remain open to process the

revenue increase request of the Company. (Brownless)

Staff Analysis:

This docket should remain open pending the

Commissionís final resolution of the Companyís requested rate increase.