|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

November 21, 2024

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Division of Engineering (Thompson, Davis,

Ellis, King, Sanchez, Wooten) TB

Office of the General

Counsel (Imig, Harper, Rubottom) AEH

Division of Accounting & Finance (Cicchetti) ALM

|

|

RE:

|

Docket No. 20240012-EG – Commission review

of numeric conservation goals (Florida Power & Light Company).

|

|

AGENDA:

|

12/03/24 – Regular Agenda – Post-Hearing Decision –

Participation is Limited to Commissioners and Staff

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Graham

|

|

CRITICAL DATES:

|

01/01/25 – Pursuant to section 366.82(6), F.S., the

Commission must review conservation goals at least every five years. New

conservation goals must be set by January 1, 2025.

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Background

Pursuant to the

Florida Energy Efficiency and Conservation Act (FEECA), the Commission must adopt appropriate goals

to increase the efficiency of energy consumption, reduce and control the growth

rates of electric consumption and weather-sensitive peak demand, increase the

conservation of expensive resources, and encourage development of demand-side

renewable energy resources.

The Commission

implements FEECA for electric utilities through Rule 25-17.0021, Florida

Administrative Code (F.A.C.) Pursuant to that rule, the Commission establishes

annual kilowatt (KW) and kilowatt-hour (KWh) goals for Residential and Commercial/Industrial

customer classes.[2] The goals are based on (1) an assessment

of the technical potential of available conservation and efficiency measures,

and (2) an estimate of the total cost-effective KW and KWh savings reasonably

achievable through demand-side management (DSM) programs in each utility’s

service area over a ten-year period.[3] The goals are annual targets for

conservation, with KW goals relating to seasonal—summer and winter—demand

savings, and annual KWh goals relating to annual energy savings. Pursuant to

section 366.82(6), F.S., the Commission must review the goals of each utility

subject to FEECA at least every five years. Goals were last established for

Florida Power & Light Company (FPL) in 2019 by Order No.

PSC-2019-0509-FOF-EG.[4] Therefore, new goals must be established

for FPL by January 1, 2025.

On January 5,

2024, this docket was established to review and adopt conservation goals for FPL.

By the Order Consolidating Dockets and Establishing Procedure, Order No.

PSC-2024-0022-PCO-EG, issued January 23, 2024, the dockets were consolidated

for purposes of hearing, a tentative list of issues was set forth, and

controlling dates were established. On April 2, 2024, FPL filed its petition

for approval of numeric conservation goals, along with supporting testimony and

exhibits. At an informal meeting between parties and

Commission staff on June 27, 2024, additional issues were identified, and the

final issue list was set for hearing by the Prehearing Order, Order No.

PSC-2024-0293-PHO-EG, issued August 2, 2024. On August 5, 2024, joint stipulations

were filed that fully resolved all disputed issues, as set forth on pages 3-4

of Attachment A.[6]

Pursuant to

Notice, and in accordance with Rule 28-106.209, F.A.C., the Commission held an

evidentiary hearing on August 8, 2024, at which it considered whether to accept

the stipulations. By a bench vote, the Commission approved stipulations on

Issues 1-9 and 11-14 and, with respect to Issue 10, allowed FPL to file a

post-hearing brief.

This

recommendation addresses the remaining Issue 10, which deals with FPL’s

proposed heating, ventilation, and air conditioning (HVAC) on-bill tariff

option (“HVAC On-Bill”), an expansion to the company’s existing On Call®

DSM program (“On Call®”). Specifically, Issue 10 states:

Is FPL’s

proposed HVAC On-Bill option for its existing Residential On-Call program with

its associated HVAC Services Agreement (proposed Tariff sheets 9.858 through

9.866) a regulated activity within the jurisdiction of the Commission? If not,

should the savings associated with FPL’s HVAC On-Bill option and HVAC Services

Agreement be removed from its conservation goals?

The ultimate issue

to be determined is whether the estimated savings associated with FPL’s

proposed HVAC On-Bill option should be counted toward establishing FPL’s

conservation goals. If the HVAC On-Bill option is not within the Commission’s

jurisdiction, the associated savings should be removed from FPL’s proposed

goals.

As a fallout to

the Commission’s decision on Issue 10, Issue 12, which deals with what goals

should be established for FPL, must be revisited. The Commission has

jurisdiction over this matter pursuant to sections 366.80 through 366.82, F.S.

Undisputed Facts in the Record

Existing HVAC Programs for FPL Customers

FPL currently

offers several DSM programs for residential customers as part of its FEECA

plan. For example, FPL offers a “Residential HVAC Program” that provides

customers a rebate for installing a high-efficiency HVAC system. (EXH 152) FPL customers can also participate in the

“Residential Load Management (On Call®)” program (“On Call®”),

a demand response program that provides participating customers with bill

credits in exchange for granting FPL the right to periodically control

customer-owned HVAC, water heating, and pool pump appliances. (TR 120-21; EXH

152) Additionally, FPL’s unregulated affiliate

company, FPL Energy Services (“FPLES”), offers HVAC financing options to

customers inside and outside FPL’s service territory. For example, FPLES offers

a traditional HVAC financing arrangement under which ownership would transfer

to the customer upon installation of the HVAC unit. (EXH 154, MPN E289) FPLES

also offers a “Stress Free AC” program, an HVAC leasing option under which

FPLES retains ownership of the HVAC unit and provides ongoing maintenance

services for the unit. (EXH 154, MPN E289; EXH 228, MPN E4149-51)

FPL’s Proposed HVAC On-Bill Option

In Issue 10, FPL

is requesting the Commission include in its conservation goals the estimated

savings associated with the HVAC On-Bill option, a new DSM measure proposed by

FPL as an expansion of its existing On Call® program. The proposed

HVAC On-Bill option would allow customers to acquire a new

HVAC unit through a separate tariff agreement and, after making all payments

required by the agreement, to take ownership of the unit. (TR 121) FPL would

offer participating customers the option of a 10-, 12-, or 15-year term,

dependent on the life of the particular HVAC’s warranty. (EXH 151, MPN E149) Under

the HVAC On-Bill option, FPL would own and maintain the HVAC unit for the

duration of the term, and the monthly charge would cover the capital cost of

the HVAC equipment plus all maintenance and repairs of the unit for the

duration of the agreement. Additionally, participating customers would be

required to remain subject to FPL’s On Call® load management program

for the duration of the HVAC On-Bill term—a minimum of 10 years. (EXH 156)

What is unique

about FPL’s proposed HVAC On-Bill option compared to its other HVAC financing

and service offerings discussed above is that the On-Bill option would combine

into a single DSM measure two distinct activities: (1) the provision of a new

HVAC unit (installation, maintenance, title transfer, etc.); and (2) the

provision of load management services (HVAC load control device, management,

and load control credits). (FPL BR 11) Participating customers would receive a

new HVAC unit as well as the load management equipment. Also unlike FPL’s other

DSM programs, HVAC On-Bill option does not require that the new HVAC unit

replace an older, less efficient unit, nor does it require that the new unit

exceed minimum appliance efficiency standards. (EXH 154, MPN E238)

As proposed, the

HVAC On-Bill option would require a participating customer to make levelized,

monthly payments over the term of the 10-15 year agreement that cover three

main categories of projected program costs:

1.

Capital Cost: HVAC and load control equipment and

installation, information technology and billing system architecture;

2.

Operations and Maintenance Expense: ongoing maintenance

and labor, information technology support, customer service and billing

support; and

3.

Load Management Credit: reduction in the total cost to

be collected in exchange for the right to control the HVAC units during peak

periods.

(FPL BR 14)

The capital

costs would include a return on FPL’s investment through a return on

unrecovered investment using the Commission-approved weighted average cost of

capital and a return of capital through depreciation expense. (EXH 151, MPN

E151) FPL estimates that for a minimum efficiency HVAC unit costing FPL $8,000,

a participant would pay a total of approximately $19,400, or 240% of the unit’s

original cost, over the term of their HVAC On-Bill agreement. (EXH 154, MPN

E290)

All costs

associated with the HVAC On-Bill option, including those identified above,

would initially be recovered from the general body of ratepayers through the

Energy Conservation Cost Recovery (“ECCR”) clause. (FPL BR 14; TR 122) The program revenues received from

participating customers would also flow through the ECCR clause in order to

offset the program expense. (EXH 151, MPN E151) The HVAC On-Bill option is

designed so that the monthly payments received from a participant would

eventually cover all costs of that agreement and fully reimburse the general

body of ratepayers. Even if the agreement is terminated early, the participant

would be required to pay a “Termination Fee” that includes the unrecovered

capital costs and any advance payment of monthly load management credits. (EXH

156; EXH 151, MPN E154) However, FPL clarified

that in the event of any under- or over-recovery of program expenses associated

with a single participant’s agreement, “FPL will adjust pricing for new program

participants” to help ensure that under-recovered costs are recovered from

program participants and not from the general body of ratepayers.” (EXH 154,

MPN E237-38)

The HVAC On-Bill

agreement provides that FPL would retain title and ownership of the HVAC unit

during the term of the agreement until a participant elects to take title to

the HVAC unit from FPL after making all the payments required by the agreement.

(EXH 156; EXH 151, MPN E154) The participant could

also pursue a “Customer Purchase Option” in the case of early termination,

under which they would take title from FPL upon payment of the Termination Fee.

(EXH 156) FPL expects that the majority of HVAC

On-Bill agreements would result in transfer of title and ownership to the HVAC

unit from FPL to the customer once the service agreement terms are completed.

(EXH 228, MPN E4218)

Discussion of Issues

Issue 10:

Is FPL’s proposed HVAC On-Bill option for its

existing Residential On-Call program with its associated HVAC Services

Agreement (proposed Tariff sheets 9.858 through 9.866) a regulated activity

within the jurisdiction of the Commission? If not, should the savings

associated with FPL’s HVAC On-Bill option and HVAC Services Agreement be

removed from its conservation goals?

Recommendation:

No, FPL’s proposed HVAC On-Bill option is not within

the jurisdiction of the Commission because it appears to include the sale of HVAC

units as defined by Florida law. Additionally, the program would consider

profit and loss from such sales in rates charged to customers, and appears to

mix non-jurisdictional appliance sales with jurisdictional FEECA investments

for ratemaking purposes, which Chapter 366, F.S., appears not to allow. Further,

staff recommends that the proposed stipulation offered by FPL does not answer

the question at issue. As such, staff recommends that the Commission not

approve the proposed stipulation language, and recommends that the savings

associated with the HVAC On-Bill option and HVAC Services Agreement be removed

from FPL’s conservation goals. (Rubottom, Thompson)

Staff

Analysis:

Summary of Staff’s Analysis

While staff agrees with the parties to the extent that

FPL’s proposed HVAC On-Bill option would allow

customers to access new HVAC equipment in a way that passes the Commission’s

cost-effectiveness tests, staff disagrees that the measure should be

included in FPL’s proposed DSM goals for the following reasons, which are

discussed more fully below:

·

Section 672.106(1), F.S., defines a “sale” as

“the passing of title from the seller to the buyer for a price.” FPL’s

provision of a new HVAC unit under the HVAC On-Bill option appears to meet that

definition because FPL would transfer title to the HVAC unit from FPL to the

participating customer in exchange for fulfillment of all payment obligations.

·

Section 366.05(2), F.S., provides that “[n]o

profit or loss shall be taken into consideration by the commission from the

sale of [appliances] in arriving at any rate to be charged for service by any

public utility.” The HVAC On-Bill option appears to consider profit or loss

from the sale of HVAC units in rates charged for service, because both the

participants and the general body of ratepayers would pay (1) a return on

equity on the capital cost of the HVAC units; and (2) any potential under- or

over-recovery of the original cost of units from prior agreements.

·

Florida law requires the Commission to ensure

that a utility’s ratepayers do not subsidize non-jurisdictional activity. See Sections 366.04(1), 366.05(9),

366.093(1), F.S. The Commission has long considered the sale of appliances to

be a non-utility activity, describing it as “non-jurisdictional” or

“non-utility investment.” Thus, the HVAC On-Bill’s mixing of non-jurisdictional

HVAC sales with jurisdictional FEECA load control investments appears to be

contrary to Florida law and Commission practice.

For these reasons, as discussed in more detail below, staff

recommends the Commission find that the HVAC On-Bill option is not within the

jurisdiction of the Commission and remove the savings associated with the HVAC

On-Bill option from FPL’s conservation goals.

Preliminary Matters

Prior to addressing the substance of the HVAC On-Bill

option and the merits of FPL’s argument, there are several preliminary matters

raised by FPL that relate to the procedural posture of the case.

Due

Process

FPL suggests in its post-hearing brief, although it did

not do so at the hearing, that due process concerns are raised by the fact that

the Commission asked it to file a post-hearing brief to support its position on

Issue 10 when all other parties have stipulated the issue. FPL states that

staff did not file testimony or take a position on the issue, and that FPL

“must try to anticipate and preemptively address a staff recommendation . . .

that will be issued after FPL files its post-hearing brief.” (FPL BR 8)

(emphasis in original)

Staff submits that the Commission’s action did not raise

any due process concerns for the following reasons:

·

The circumstances of this case are no different

from any other case before the Commission. Because the utility bears the burden

of proof, the substance of staff’s recommendation depends upon the evidence and

arguments the utility presents to the Commission. Staff is not required to take

a position on the issues in order to make a recommendation to the Commission

once all evidence has been collected and reviewed.

·

As the Florida Supreme Court has stated, “[t]he

fundamental requirements of due process are satisfied by reasonable notice and

a reasonable opportunity to be heard.” Citizens

v. Fla. Pub. Serv. Comm’n, 146

So. 3d 1143, 1154 (Fla. 2014) (quoting Fla.

Pub. Serv. Comm'n v. Triple “A” Enters., Inc., 387 So. 2d 940, 943 (Fla. 1980)).

Far from being denied due process, the Commission afforded FPL an additional

opportunity to be heard and meet its burden of proof by filing a post-hearing

brief in support of its position.

·

Issue 10 was identified and added to the

preliminary issue list on June 27, 2024, at the informal meeting between FPL,

Commission staff, and other parties, and staff conducted extensive discovery on

the issue. Moreover, at the hearing, the Commission extracted Issue 10 from the

other, stipulated issues so FPL could have an additional opportunity to address

those concerns.

Because FPL was given reasonable notice and an opportunity

to be heard, and has not been prejudiced in any way, the Commission did not err

when it asked FPL to file a brief on Issue 10 before it received staff’s

recommendation. As such, there is no due process concern with how the

Commission chose to address Issue 10.

Appropriate

Standard of Review

FPL also asks the Commission to consider its position on

Issue 10 as part of a comprehensive “settlement” of its goalsetting case, in

light of the fact that it reached stipulations on all issues with the

intervening parties. (FPL BR 4) FPL requests the Commission to apply the

standard of review applicable to rate case settlements and consider whether the

agreement, taken as a whole, is in the “public interest.” Id. (citing Floridians

Against Increased Rates v. Clark, 371 So. 3d 905, 910 (Fla. 2023)).

Staff disagrees with FPL’s conclusion that the Commission

is precluded from considering and deciding Issue 10 separately and distinctly

from other stipulated issues already approved by the Commission. The

Commission’s practice is to treat a stipulation as a proposed resolution of a

distinct issue in a case, and a proposed settlement agreement as resolving the

case as a whole.

Additionally, at the hearing, rather than taking one vote

to approve the parties’ agreement as a whole, as it would have done with a

settlement agreement, the Commission voted to resolve distinct issues,

approving the stipulated positions on Issues 1-9 and 11-14 but not Issue 10.

(TR 20) At that time, FPL did not refer to the stipulations as a “settlement,”

and it did not oppose staff’s recommendation to allow parties to file

post-hearing briefs on Issue 10.

Because the parties filed stipulations rather than a

settlement agreement, and because the Commission explicitly treated Issue 10 as

separate and distinct from the other stipulated issues, staff recommends that

the Commission make factual and legal findings as necessary to resolve Issue

10.

The

Proposed Stipulation on Issue 10 Does Not Answer the Question at Issue

Because the question of whether FPL’s proposed

conservation goals are appropriate depends in part on whether FPL’s potential

programs are within the Commission’s jurisdiction, Issue 10 asks whether FPL’s

HVAC On-Bill option is an activity within the jurisdiction of the Commission.

However, the proposed stipulation on Issue 10 does not answer that question.

The parties’ stipulation on Issue 10 states:

The Parties stipulate and agree that the record

supports a Commission finding that FPL’s proposed HVAC On-Bill option expands

the existing On Call® load-management program to allow greater customer access

to new energy-saving HVAC equipment in a way that also passes the RIM cost

effectiveness test, and should be included in FPL’s proposed DSM Goals.

While this language includes proposed findings of fact

relevant to determining whether the HVAC On-Bill option would be effective in

furthering the objectives of FEECA, it does not address whether the DSM measure

is within the jurisdiction of the Commission.

Therefore, because the stipulation does not answer the question at issue, staff

recommends that the Commission not approve the proposed stipulation language.

Nevertheless, FPL presented arguments in its post-hearing

brief that addressed Issue 10. Therefore, this recommendation will provide

staff’s analysis and recommendation on the merits of Issue 10, addressing as

necessary the evidence and arguments presented by FPL.

Staff’s Analysis

Pursuant to section 366.82(2), F.S., the Commission must

evaluate whether the goals requested by FPL are appropriate. Issue 10 addresses

whether the HVAC On-Bill option is within the jurisdiction of the Commission as

required by FEECA, and, as a fall out question, whether the estimated savings associated

with the program are appropriate to include in FPL’s conservation goals.

1. Defining the Proposed Activity: The HVAC

On-Bill Option Includes the Sale of HVAC Units.

In order to

determine whether the HVAC On-Bill option is within the Commission’s

jurisdiction, the Commission must examine the nature of the activity involved

in the measure, not merely FPL’s characterization of the activity. See, e.g., Florida Power & Light Co. v. Albert Litter Studios, Inc., 896

So. 2d 891, 893 (Fla. 1st DCA 2005) (stating that “it is the nature of the

relief sought, not the language of the complaint, that ultimately determines

which tribunal has jurisdiction over the claim”).

FPL’s

proposed HVAC On-Bill option would combine into a single DSM measure two

distinct categories of activity: (1) the provision of a new HVAC unit

(installation, maintenance, title transfer, etc.); and (2) load management

services (HVAC load control device, management, and load control credits).

(FPL BR at 11) There is no question that the load control aspect of HVAC

On-Bill is within the Commission’s jurisdiction, as it is explicitly authorized

under FEECA and is in fact already available to customers through FPL’s existing

On Call® program. See Section

366.82(7), F.S.; (EXH 228, MPN E4133) However, the HVAC-related aspect of the

measure is, as characterized by FPL, “innovative” for a utility conservation plan

under FEECA. (TR 121; EXH 228, MPN E4134[19])

Staff’s

understanding of the legal nature of the HVAC services offered under the HVAC

On-Bill option differs from that of FPL, leading to opposite conclusions on the

question of whether the program is within the Commission’s jurisdiction.

Section 672.106(1), F.S., defines the term “sale” as “the

passing of title from the seller to the buyer for a price.” The

HVAC On-Bill option agreement provides that:

·

The participating customer would pay FPL an

agreed-upon monthly price for the term of the agreement. (TR 121; EXH 156)

·

Upon payment of all obligations required by the

agreement, a participant would have the right to take title to the HVAC unit

from FPL. (EXH 151, MPN E154; EXH 156)

Put simply, the HVAC On-Bill tariff allows the participant

to take title to the HVAC unit upon making all required payments. Therefore,

because the transaction includes FPL passing the HVAC unit title to customers

in exchange for a price, the transaction appears to meet the definition of a

“sale” under section 672.106(1), F.S.

In discovery, FPL agreed that if a participant exercises

the “Customer Purchase Option” under the HVAC Services Agreement, “title to the

HVAC unit passes from FPL to the participant in exchange for . . . the ‘purchase

option price.’” (EXH 154, MPN E284) Thus,

FPL seemingly agreed with staff that under certain scenarios, its conduct

pursuant to the HVAC Services Agreement meets the definition of a “sale” as

defined by section 366.05(2), F.S.

However, FPL suggests in its post-hearing brief that its

provision of HVAC units is not a sale because title to the HVAC unit would not

pass to the participant at the time the HVAC unit is delivered. (FPL BR 18) FPL

relies upon section 672.401(2), F.S., which provides that “[u]nless otherwise

explicitly agreed title passes to the buyer at the time and place at which the

seller completes her or his performance with reference to the physical delivery

of the goods.” Staff disagrees that the mere separation in time of the distinct

acts of HVAC installation and title transfer render the transaction not a sale.

Section 672.401(1), F.S., specifies that “under

a contract for sale, . . . title to goods passes from the seller to the

buyer in any manner and on any conditions explicitly agreed on by the parties.”

(emphasis added) Thus, the timing of title transfer within a contract does not

appear to have any bearing on the existence or validity of a contract for sale.

In other words, a transaction is still a

sale when the contract provides that seller reserves title to the goods

until certain conditions are met by the buyer. See, e.g., Suburbia Fed. Sav.

and Loan Ass’n v. Bel-Air Conditioning Co., 385 So. 2d 1151, 1152-53 (Fla.

4th DCA 1980) (construing a “contract for the sale of air conditioning

equipment” and holding that a provision conditioning title transfer upon

seller’s “payment of the entire purchase price” created a “security interest”

under Florida law). The inclusion of contract provisions requiring that customer

payments must occur prior to FPL passing the HVAC title to the customer appear

to be nothing more than a condition precedent within the underlying contract

for sale under Florida law.

FPL also offers a variation on the above argument,

suggesting that there is no sale under the HVAC On-Bill option because title to

the HVAC unit would not transfer until “the end of the contract term,” after

the participant had fulfilled all obligations under the agreement. (FPL BR 19)

FPL states that the participant’s option to take title to the HVAC “is a future

option” that is “not operative until the expiration, assignment, or early

termination of the agreement.” (FPL BR 20) However, the provisions in the HVAC

On-Bill agreement itself would obligate FPL to transfer the title upon certain

conditions. Thus, the agreement between FPL and the participant remains intact

from start to finish, and does not “expire” until after FPL discharges its

duties thereunder by transferring the HVAC title to the participant.

Finally, FPL argues that under Generally Accepted

Accounting Principles (“GAAP”), the HVAC On-Bill option is a “service

contract,” rather than a sale or a lease, because FPL would “use and maintain

the asset to deliver service to the customer while retaining control of that

asset.” (FPL BR 20) However, FPL’s argument does not refute the fact that under

the HVAC On-Bill option’s “Optional HVAC Services Agreement” tariff, title to

the HVAC unit would eventually pass to the participating customer in exchange

for a price. See (EXH 156) Therefore,

even if the agreement is considered a service contract under GAAP, the

transaction still appears to include the sale of HVAC units under Florida law.

2. Section 366.05(2), F.S., and the HVAC On-Bill

Option

Florida law requires that if a public utility engaged in providing

ordinary public utility services also engages in the sale of appliances or

other merchandise, certain restrictions apply. Section 366.05(2), F.S.,

provides:

Every public utility, as defined in s. 366.02, which

in addition to the production, transmission, delivery or furnishing of heat,

light, or power also sells appliances or other merchandise shall keep separate

and individual accounts for the sale and profit deriving from such sales. No profit or loss shall be taken into

consideration by the commission from the sale of such items in arriving at any rate to be charged for

service by any public utility. (emphasis added)

As the Commission has previously stated, section

366.05(2), F.S., does not ban the sale of appliances by public utilities, but

rather, “instructs public utilities which also sell appliances on the proper

and separate accounting for such sales.” Order No. 24570-EI, issued May 22,

1991.

There is no question that FPL is a public utility as

defined by section 366.02(8), F.S., that supplies electric power to the public

in Florida. As discussed above, FPL’s conduct under the HVAC On-Bill option appears

to include a “sale” as defined by Section 672.106(1), F.S. As such, if any of

the rates FPL proposes to charge customers under the program would take into

consideration any profit or loss from the sale of HVAC units, section

366.05(2), F.S., would appear to prohibit the HVAC On-Bill option.

In utility regulation, a return on equity is the amount

collected above all costs and thus is, in essence, the utility’s “profit.”

Additionally, if FPL recovers more or less than the original cost of an HVAC unit,

that over- or under- recovery would constitute profit or loss, respectively.

Under the HVAC On-Bill option, FPL would recover a rate of

return, including a return on equity, from both the participant, through the

monthly program service charge, and from the general body of ratepayers,

through the ECCR clause charge. (TR 122; EXH 151, MPN E151;

EXH 154, MPN E290;

EXH 228, MPN E4161-63, E4187) Additionally,

FPL would recover any potential over- or under-recovery on an individual HVAC

On-Bill agreement by “adjust[ing] pricing

for new program participants,” and would collect the adjusted payments in

both participant charges and ECCR charges. (TR 122; EXH 154, MPN E237-38) In

other words, under the HVAC On-Bill option as proposed, FPL would calculate

four separate customer charges that would account for profit and loss from the

sale of HVAC units: (1) the monthly payments of each participant would include a

return on equity on their HVAC unit; (2) the ECCR charge collected from the general

body of ratepayers would include a return on equity on all HVAC units; (3) the

monthly payments of future participants would be adjusted for over- or

under-recovery from prior agreements; and (4) ECCR charges of the future

general body of ratepayers would account for over- or under-recovery from prior

agreements. As such, the plain language of section 366.05(2), F.S., appears to

prohibit the HVAC On-Bill option.

FPL suggests that even if the HVAC On-Bill option includes

a “sale,” it does not implicate section 366.05(2), F.S., because “there is no

profit or loss to recognize when

ownership transfers to the participant since all costs will be recovered

from the participant during the term of

the agreement.” (FPL BR 21) (emphasis added) Staff disagrees. FPL’s

argument hinges on the notion that there is no recognized profit and loss

throughout the course of the agreement. Yet, as discussed above, the revenue

requirement collected from both the general body of ratepayers and from participants

during the course of the agreement would recover more than the original cost of

the HVAC unit, including a return (profit) on the capital cost of the HVAC unit

as well as any potential over- or under-recovery from past participants, as

discussed above. FPL’s argument does not nullify the fact that, as proposed by

FPL, the program accounts for profit and loss in rates charged to customers.

FPL also argues that the HVAC On-Bill option is similar to

other, Commission-approved utility programs that provide equipment to customers

and recovers the capital costs through rates. (FPL BR 22-23) However, each of FPL’s

examples involve equipment that is directly used in the production or delivery

of electricity or natural gas and thus appears to be expressly allowable under

section 366.05(2), F.S. Section

366.05(2), F.S., provides that its restrictions on accounting for profit and

loss on appliance sales apply to a utility that “in addition to the production, transmission, delivery or furnishing of

heat, light, or power, also sells appliances or other merchandise.”

(emphasis added) Thus, by its own terms, the statute appears not to apply to the

type of equipment involved in the Commission-approved utility programs

identified by FPL. By contrast, the HVAC units at issue in the HVAC On-Bill

option do not serve to produce or supply energy, and thus do not fall into the

category of equipment section 366.05(2), F.S., appears to expressly allow.

3. FEECA In Relation to Other Provisions of Chapter

366, F.S.

FPL argues

that because the HVAC On-Bill option is proposed as a FEECA program, “there is

no need to look beyond FEECA” to consider section 366.05(2), F.S., or the

broader context of Chapter 366. (FPL BR 6, 17-18) FPL argues that “DSM measures

and programs that satisfy the requirements of FEECA are, and logically must be,

regulated utility activities,” and that “if the Commission finds a DSM measure

or program is appropriate under FEECA, it becomes a regulated activity under

the Commission’s jurisdiction upon its approval.” (FPL BR 9) Staff disagrees.

It is a

well-established principle of statutory construction and interpretation that

related statutes should be interpreted together, as though they were one law.

As the Florida Supreme Court has stated, “the doctrine of in pari materia requires that statutes relating to the same subject

or object be construed together to harmonize the statutes and to give effect to

the Legislature’s intent.” Sierra Club v.

Brown, 243 So. 3d 903, 911 n.8 (Fla. 2018). Therefore, FEECA cannot be

interpreted in isolation from the rest of Chapter 366, F.S.

The HVAC

On-Bill option appears to conflict with not only section 366.05(2), as

discussed above, but also other provisions of Chapter 366, F.S. In fact, section

366.05(2), F.S., is just one of several provisions in Chapter 366, F.S.,

emphasizing that a utility’s ratepayers should not be required to subsidize

non-jurisdictional activity. For example, the Commission is granted the power

to “require such reports or other data necessary to ensure that a utility’s

ratepayers do not subsidize nonutility activities.” Section 366.05(9), F.S.; see also Section 366.093(1), F.S.

(requiring that the Commission shall have access to “such records necessary to

ensure that a utility’s ratepayers do not subsidize nonutility activities”).

Additionally, the Commission may deny a utility’s request to issue or sell a

security if the security is for “nonutility purposes,” and the Commission is

required to deny the issuance or sale of a security if the utility’s “ability

to provide reasonable service at reasonable rates is jeopardized.” Section

366.04(1), F.S.

FPL argues

that the HVAC On-Bill is authorized by FEECA because the distinct activities of

HVAC-related services and load control are “inextricably intertwined as a

single service offering.” (FPL BR 11) Staff disagrees that the act of

“bundling” certain distinct, non-jurisdictional services with jurisdictional

services somehow makes the otherwise distinct, non-jurisdictional services

jurisdictional.

Although

load control is clearly jurisdictional under FEECA, the Commission has long

considered the sale of appliances to be a non-utility activity, describing it

as “non-jurisdictional” or “non-utility investment,” and removing such

investments from common equity in utility base rate cases. See Order No. PSC-99-1047-PAA-EI, issued May 24, 1999, in Docket

Nos. 990250-EI and 990244-EI;

Order No. 5688, issued April 2, 1973, in Docket No. 72344-GU;

Order No. 23573, issued Oct. 3, 1990, in Docket No. 891345-EI. Additionally,

Florida law does not appear to grant the Commission power to regulate

non-jurisdictional activity merely because a utility and a customer agree to

bundle it together with a jurisdictional activity. See United Tel. Co. of Fla. v. Pub. Serv. Comm’n, 496 So. 2d 116,

118 (Fla. 1986) (stating that “[p]arties to a contract . . . can never confer

jurisdiction”). In light of the broader context of Chapter 366, F.S., the

doctrine of in pari materia suggests

that the jurisdictional activity of load control be separated from the

non-utility activity of HVAC sales for purposes of Commission jurisdiction and

ratemaking. If the two activities are by design “inextricably intertwined” into

one program, as FPL characterizes the HVAC On-Bill option, then the provisions

of Chapter 366, F.S., cited above appear to require the Commission, at a

minimum, to ensure that ratepayers are not required to subsidize the non-utility

activity through their rates. See Sections

366.05(2), (9), 366.093(1), F.S.

FPL also argues

that the HVAC On-Bill option is within the jurisdiction of the Commission under

Chapter 366, F.S., because it involves the generation of electricity, claiming

that “the HVAC On-Bill option specifically involves the generation of

electricity, as both the load control and avoided cost benefits from this

program are factored into FPL’s integrated resource plan.” (FPL BR 12) However,

staff disagrees for two reasons. First, staff suggests that an HVAC unit consumes energy rather than generates

it. Second, while Florida law specifically considers conservation activity an alternative to or avoidance of generation

for resource planning purposes, there is no persuasive basis for concluding

that conservation activity falls under the category of “generation” for

purposes of determining the Commission’s jurisdiction. See Section 403.519, F.S.

It is

staff’s view that Florida law requires the Commission to consider FEECA as part

of Chapter 366, F.S., and not as an isolated exception to it. The broader

context of Chapter 366, F.S., taken as a whole, appears to prohibit utilities

from mixing jurisdictional activity, such as FEECA conservation investments, with

non-jurisdictional investments such as appliance sales, for ratemaking purposes.

As proposed, the HVAC On-Bill option appears to conflict with this statutory

directive.

4. Conclusion

As discussed above, staff’s view is that FPL’s proposed

HVAC On-Bill option is not within the jurisdiction of the Commission because it

appears to include the sale of HVAC units as defined by Florida law and would

consider profit and loss from such sales in rates charged to customers. It is

also staff’s view that FEECA does not override the rest of Chapter 366, F.S.

Thus, Florida law appears to not allow non-jurisdictional appliance sales to be

bundled with jurisdictional FEECA investments for ratemaking purposes. As such,

staff recommends that the Commission find the HVAC On-Bill option is not a

regulated activity within the jurisdiction of the Commission, and that the

estimated savings associated with the measure be removed from FPL’s

conservation goals.

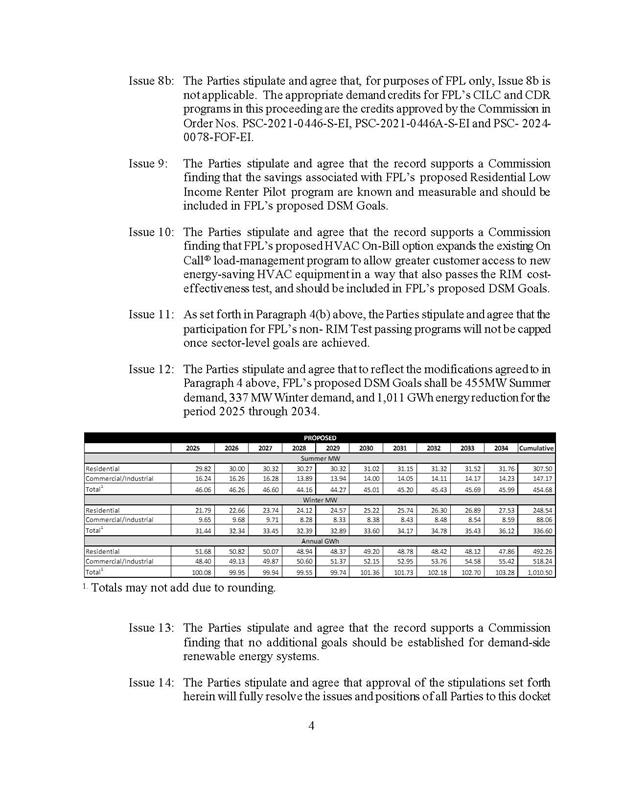

Issue 12:

What residential and commercial/industrial summer

and winter megawatt (MW) and annual Gigawatt-hour (GWh) goals should be

established for the period 2025-2034?

Recommendation:

If the Commission approves staff’s recommendation on

Issue 10, then the Commission should approve conservation goals for FPL as

shown in Table 12-1. However, if the Commission does not approve staff’s

recommendation on Issue 10, no further decision is necessary on Issue 12 due to

the stipulated goals already approved by the Commission at the hearing.

Staff Analysis:

If the Commission approves staff’s recommendation

on Issue 10, then the Commission should approve conservation goals for FPL as

shown in Table 12-1. In doing so, the Commission would modify the goals

approved for FPL by bench vote at the August 8, 2024, hearing to remove the

savings associated with FPL’s HVAC On-Bill option and HVAC Services Agreement

in accordance with the decision on Issue 10. However, if the Commission does

not approve staff’s recommendation on Issue 10, no further decision is

necessary on Issue 12 due to the stipulated goals already approved by the

Commission at the hearing, shown in Table 12-2.

Table 12-1

FPL’s Annual Residential

Conservation Goals Without HVAC On-Bill

|

Year

|

2025

|

2026

|

2027

|

2028

|

2029

|

2030

|

2031

|

2032

|

2033

|

2034

|

Total

|

|

Summer

(MW)

|

29.22

|

28.99

|

28.81

|

28.61

|

28.49

|

29.01

|

28.94

|

28.88

|

28.84

|

28.81

|

288.60

|

|

Winter

(MW)

|

20.64

|

20.75

|

20.87

|

20.97

|

21.10

|

21.41

|

21.54

|

21.68

|

21.81

|

21.95

|

212.72

|

|

Annual

(GWh)

|

51.68

|

50.82

|

50.07

|

48.94

|

48.37

|

49.20

|

48.78

|

48.42

|

48.12

|

47.86

|

492.26

|

Source: EXH 5, MPN C1-155; DN 08228-2024.[35]

Table 12-2

FPL’s Annual Residential

Conservation Goals With HVAC On-Bill

|

Year

|

2025

|

2026

|

2027

|

2028

|

2029

|

2030

|

2031

|

2032

|

2033

|

2034

|

Total

|

|

Summer

(MW)

|

29.82

|

30.00

|

30.32

|

30.27

|

30.32

|

31.02

|

31.15

|

31.32

|

31.52

|

31.76

|

307.50

|

|

Winter

(MW)

|

21.79

|

22.66

|

23.74

|

24.12

|

24.57

|

25.22

|

25.74

|

26.30

|

26.89

|

27.53

|

248.54

|

|

Annual

(GWh)

|

51.68

|

50.82

|

50.07

|

48.94

|

48.37

|

49.20

|

48.78

|

48.42

|

48.12

|

47.86

|

492.26

|

Source: DN 08228-2024.

Issue 14:

Should this docket be closed?

Recommendation:

Yes. If no party files a timely request for

rehearing or an appeal, the docket should be closed. Within 90 days of issuance

of the final order, FPL should file a demand-side management plan designed to

meet the Utility’s approved conservation goals.

Staff Analysis:

If no party files a timely request for rehearing or

an appeal, the docket should be closed. Within 90 days of issuance of the final

order, FPL should file a demand-side management plan designed to meet the

Utility’s approved conservation goals. See

Section 366.82(7), F.S.; Rule 25-17.0021(4), F.A.C.