Case Background

On April 2,

2024, Tampa Electric Company (TECO or Company) filed its Petition for Rate

Increase, minimum filing requirements (MFRs), and testimony. TECO provides service to approximately

844,000 customers in a 2,000 square mile service territory in Hillsborough and

portions of Polk, Pasco, and Pinellas counties, Florida.

TECO initially

requested an increase of approximately $296.6 million in base rates and charges

effective January 1, 2025. In addition, the Company requested incremental rate

increases of approximately $100 million, effective January 1, 2026, and $72

million, effective January 1, 2027. On August 22, 2024, the Company reduced its

initial request for rates in 2025 to $287.9 million, with the incremental rate

increases also reduced to $92.4 million and $65.5 million, for 2026 and 2027,

respectively.

The Office of

Public Counsel’s (OPC) intervention was acknowledged by Order No. PSC-2024-0048-PCO-EI,

issued February 26, 2024. On April 23, 2024, intervention was granted to Federal Executive Agencies

(FEA); Sierra Club; Florida Rising, Inc. (FL Rising); League of United Latin

American Citizens of Florida (LULAC); Florida Retail Federation (FRF); and

Florida Industrial Power Users Group (FIPUG). On June 3, 2024, intervention was granted

to Americans for Affordable Clean Energy, Inc.; Circle K Stores, Inc.; RaceTrac

Inc.; and Wawa, Inc. (Fuel Retailers). Intervention was granted to Walmart, Inc.

(Walmart) on August 8, 2024, by Order No. PSC-2024-0317-PCO-EI.

An

administrative evidentiary hearing was held August 26–30, 2024. At the December

3, 2024 Special Agenda Conference, the Commission approved an incremental revenue

requirement increase of $184.9 million effective January 1, 2025. The

Commission further approved subsequent year adjustments of $86.6 million,

effective January 1, 2026, and $9.1 million, effective January 1, 2027. The

staff-calculated final 2025 revenue requirement calculation, which reflects the

Commission-approved increase to operating revenues, is contained in Attachment

A to the recommendation.

The 2026 and

2027 subsequent year adjustment calculations are provided in Attachment B to

the recommendation. As approved by the Commission at the December 3, 2024

Special Agenda Conference in Issue 108, TECO will file a petition in September

2025 for proposed rates for January 2026 and another petition in September 2026

for proposed rates for January 2027.

On December 9,

2024, TECO filed revised MFR Schedules A-2, A-3, and the cost of service E

schedules to reflect the Commission vote on the 2025 incremental revenue

requirement increase and cost of service issues. In addition, TECO filed

revised clean and legislative tariffs. The clean tariffs are attached as

Attachment C to the recommendation. MFR Schedule A-2 provides monthly bill

calculations for all major rate classes under current and 2025 approves rates;

MFR Schedule A-3 provides a summary of all current and proposed rates.

The Commission’s

vote on return of equity and cost of service at the December 3, 2024 Special

Agenda Conference also impacts TECO’s 2025 cost recovery clauses. On December 11, 2024, TECO filed revised

MFR Schedule A-2 to reflect the updated 2025 cost recovery clause factors.

TECO’s proposed tariffs also include recalculated Clean Energy Transition Mechanism

(CETM) factors to reflect the Commission’s vote on return on equity and cost of

service.

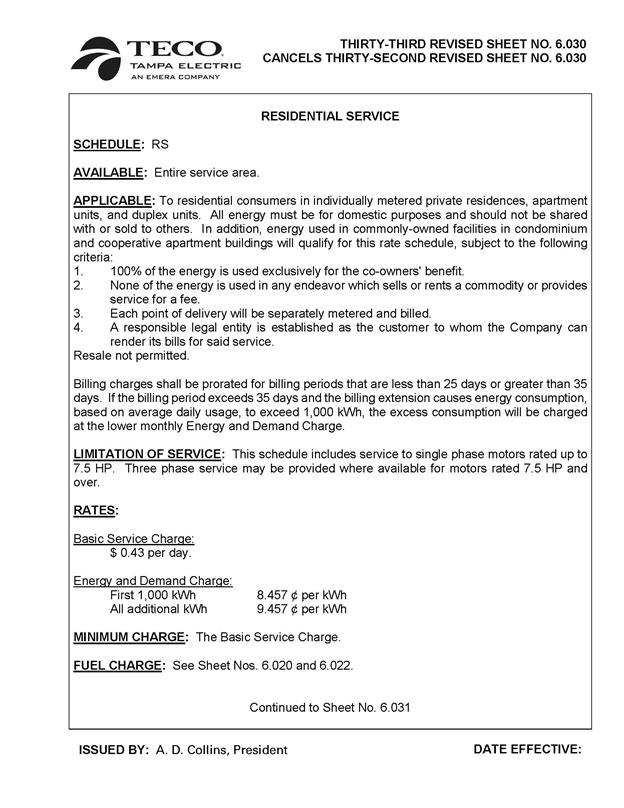

The monthly base

rate portion of a residential customer using a 1,000 kilowatt hours (kWh) would

increase from the current $87.80 to $97.47, effective with the first billing

cycle in January 2025, an increase of $9.67. The total monthly residential

bill, which includes all cost recovery clauses, including fuel and Gross

Receipts Tax, for 1,000 kWh would increase from $136.44 to $145.58, an increase

of $9.14. TECO’s MFR A-2 schedules, filed on December 11, 2024, also includes

bill comparisons for various usage levels for commercial and industrial customers.

This recommendation

addresses the issues that were not addressed at the December 3, 2024 Special

Agenda Conference: Issue 78 (basic service charges), Issue 79 (demand charges),

Issue 80 (energy charges), Issue 81 (lighting charges), Issue 82 (standby

service), Issue 93 (approval of tariffs), Issue 117 (effective date), and Issue

121 (close docket).

The Commission

has jurisdiction over this matter pursuant to Chapter 366, including Sections

366.06 and 366.076, Florida Statutes (F.S.).

Discussion

of Issues

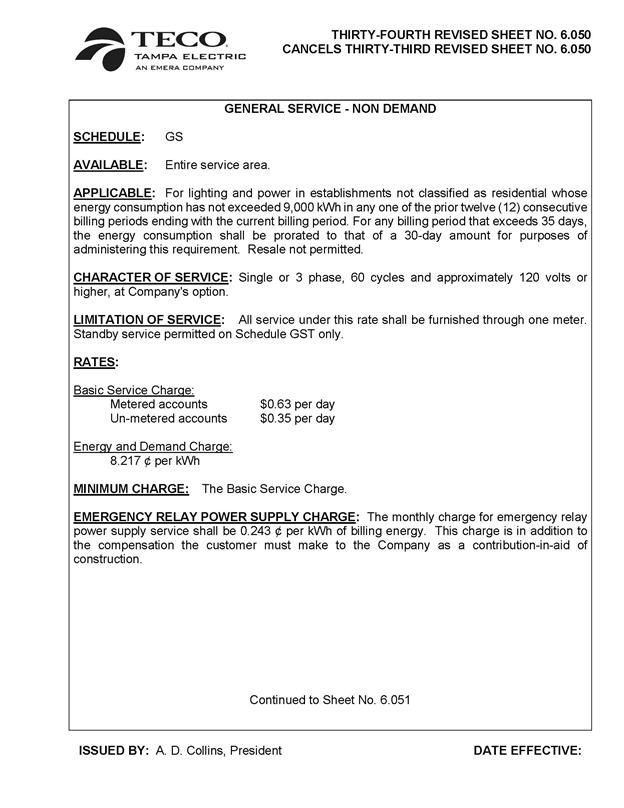

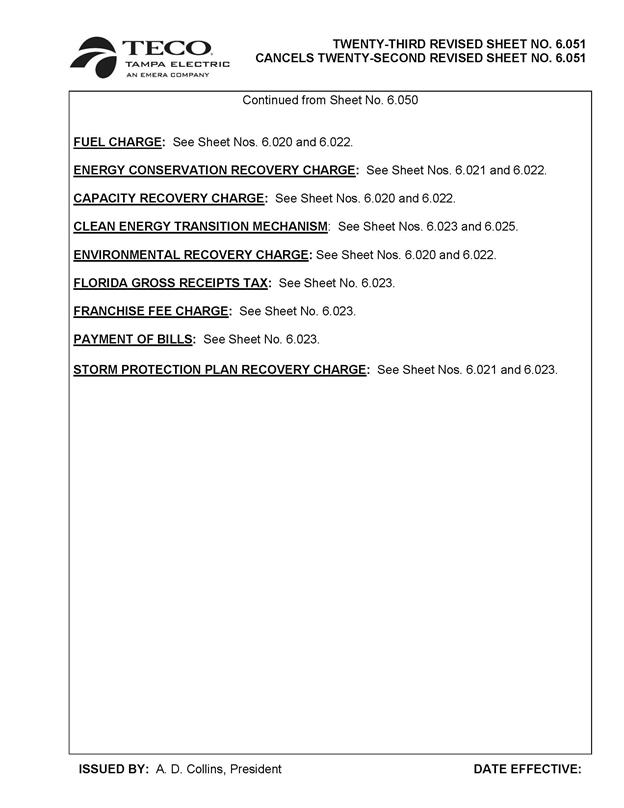

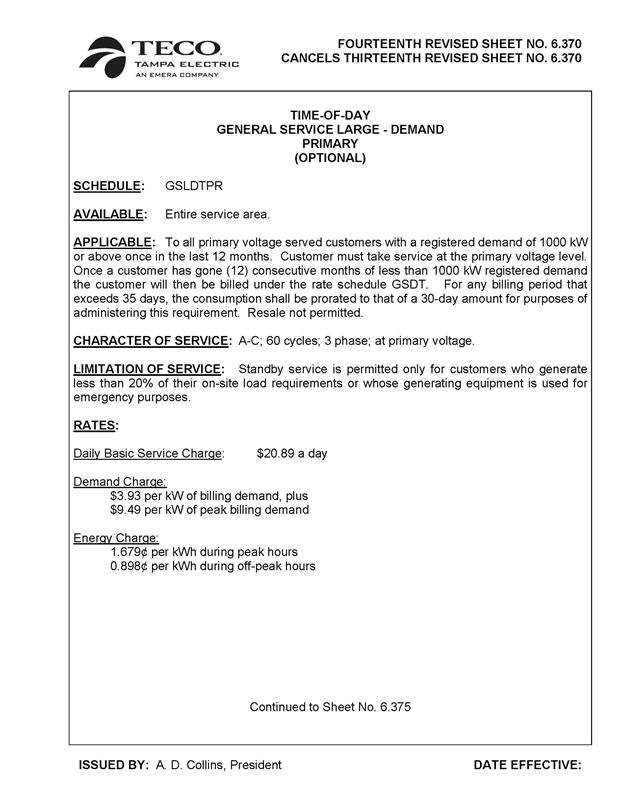

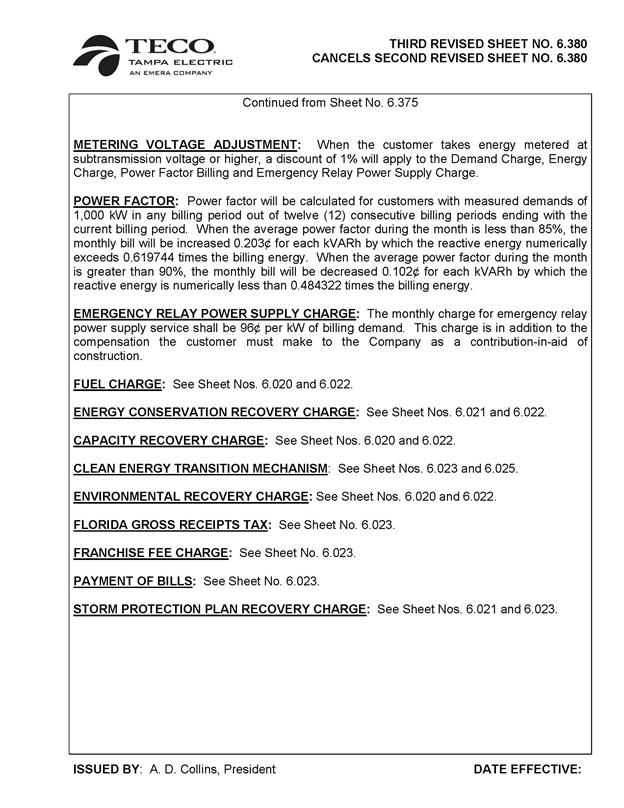

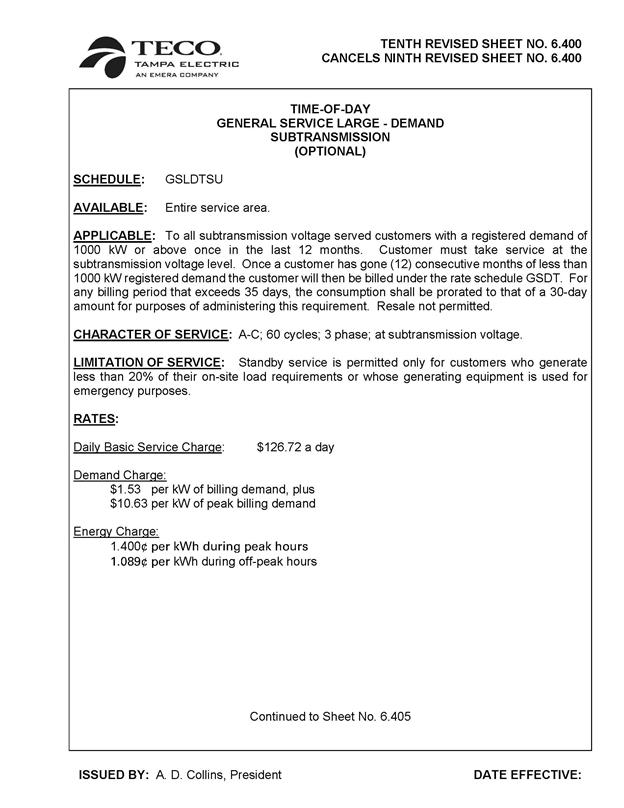

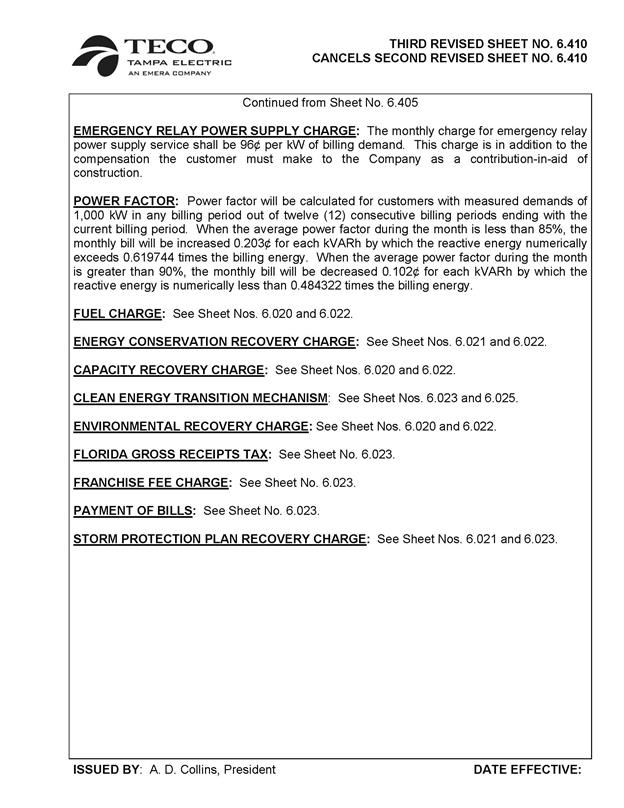

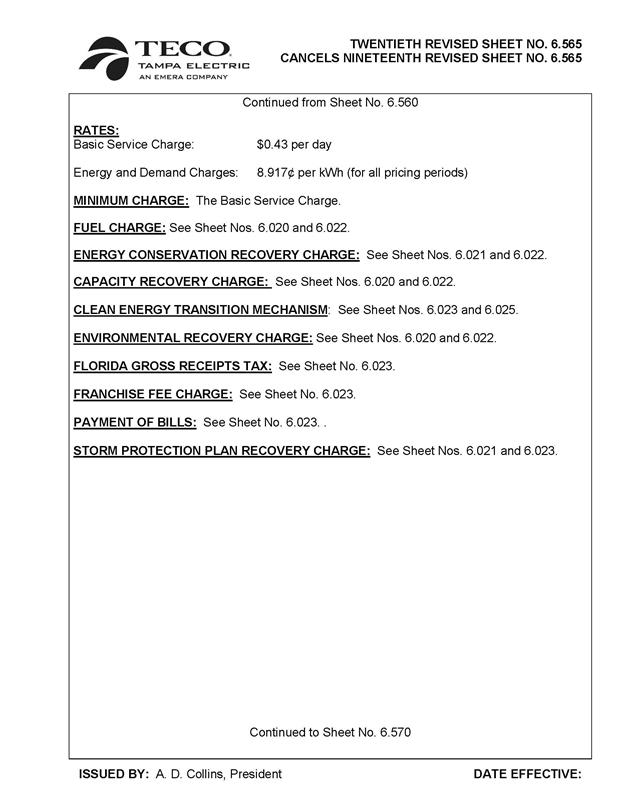

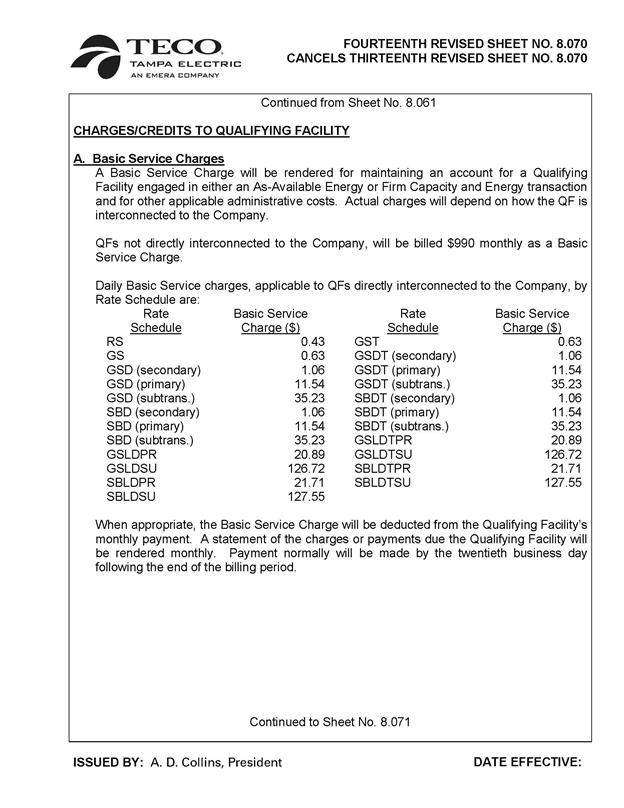

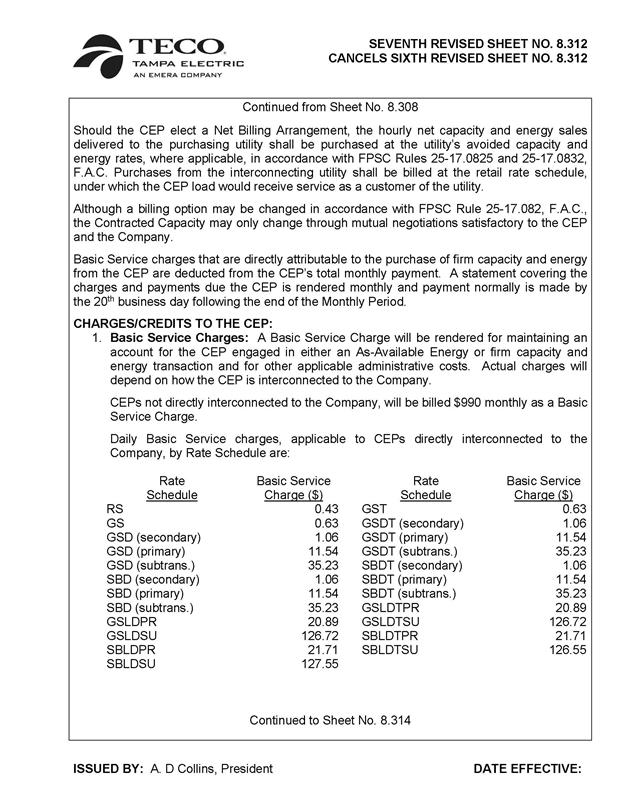

Issue 78:

What are the appropriate basic service charges?

Recommendation:

The proposed basic service charges as provided in

the tariffs in Attachment C to the recommendation should be approved.

(McClelland, Vogel)

Position of the Parties:

TECO:

The appropriate basic service charges

are shown in MFR Schedule E-13c.

OPC:

The basic service charges

should reflect all the adjustments recommended by OPC.

FL

RISING/

LULAC:

TECO’s basic service charge for

residential customers should be no more than $0.43 per customer per day or no

more than $13.08 per customer per month for residential customers.

FIPUG:

The adjustments recommended by OPC

should be adopted.

FEA:

The GSLDPR demand charges

should be increased, and the energy charges reduced.

SIERRA

CLUB:

Sierra Club has no position on this

issue.

FRF:

The FRF does not oppose

TECO’s proposed cost of service study or its proposed revenue allocation

methodology.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart

adopts and incorporates herein FRF's positions and incorporates herein FRF's

arguments and references to record evidence as to the following Issues: 1, 3,

68-74, 78-83, 107-110, 116, 117, 119, 120, 121.

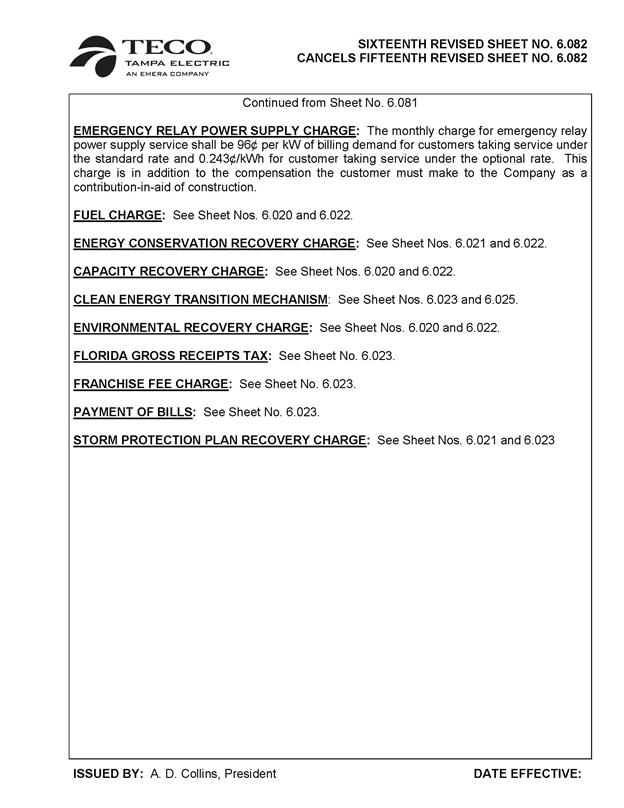

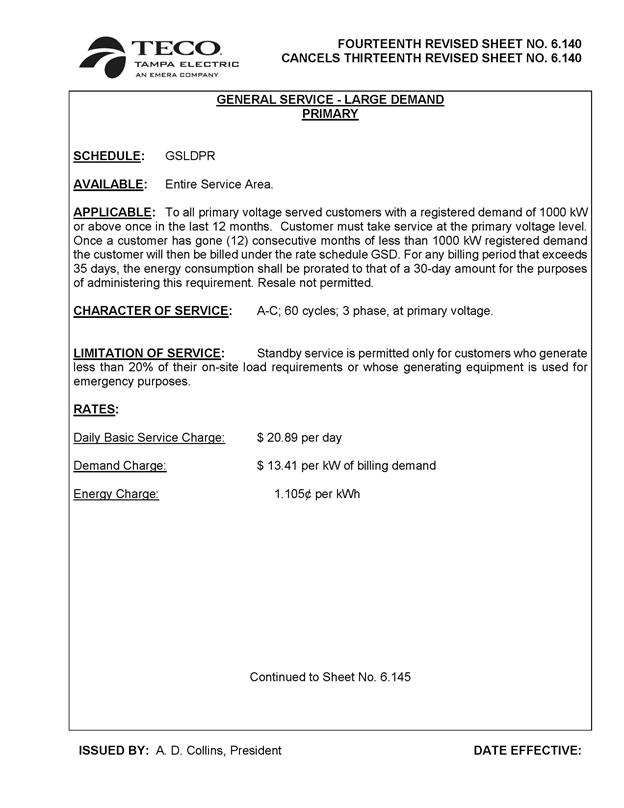

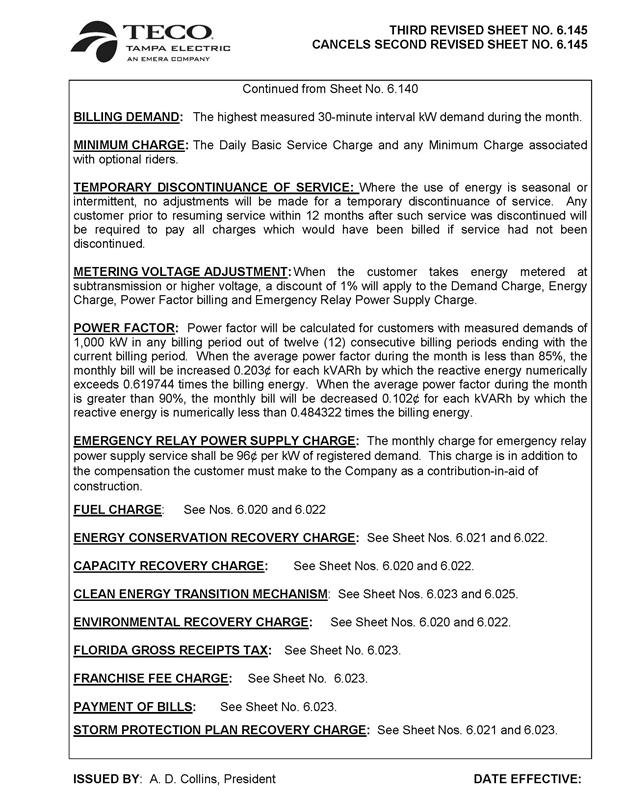

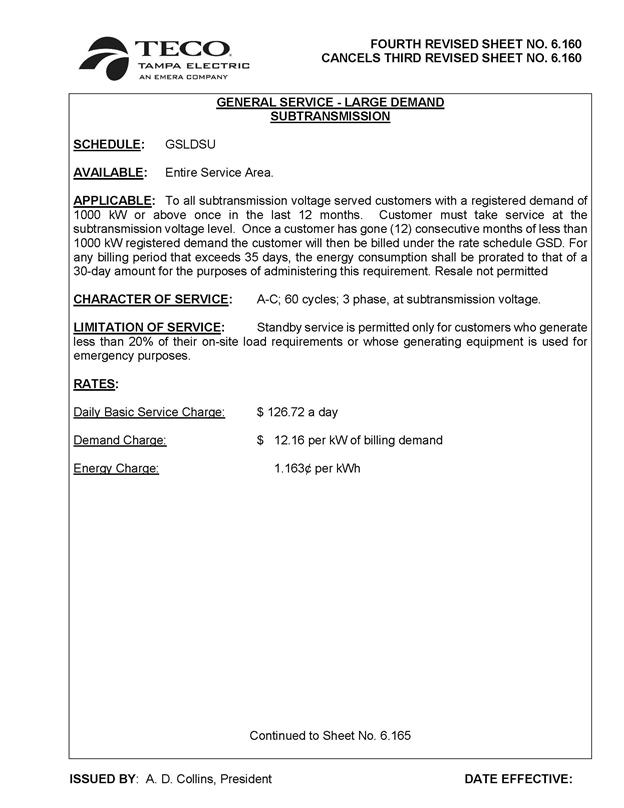

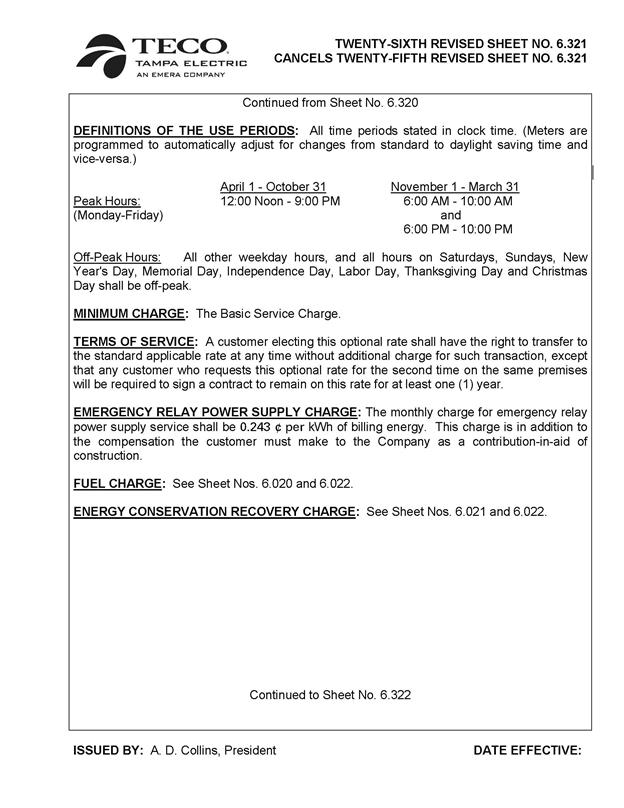

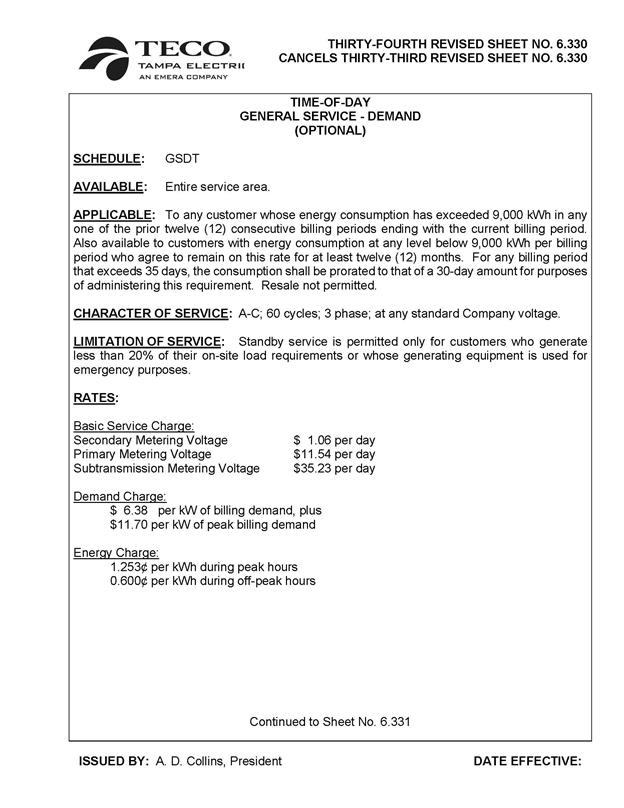

Staff Analysis:

ANALYSIS

The basic service charges, in combination with the demand

charges and the energy charges, are designed to allow TECO to recover the total

Commission-approved revenue requirement. The proposed basic service charges

reflect the approved revenue requirement and cost of service methodology;

therefore, the proposed charges provided in the tariffs in Attachment C to the

recommendation should be approved.

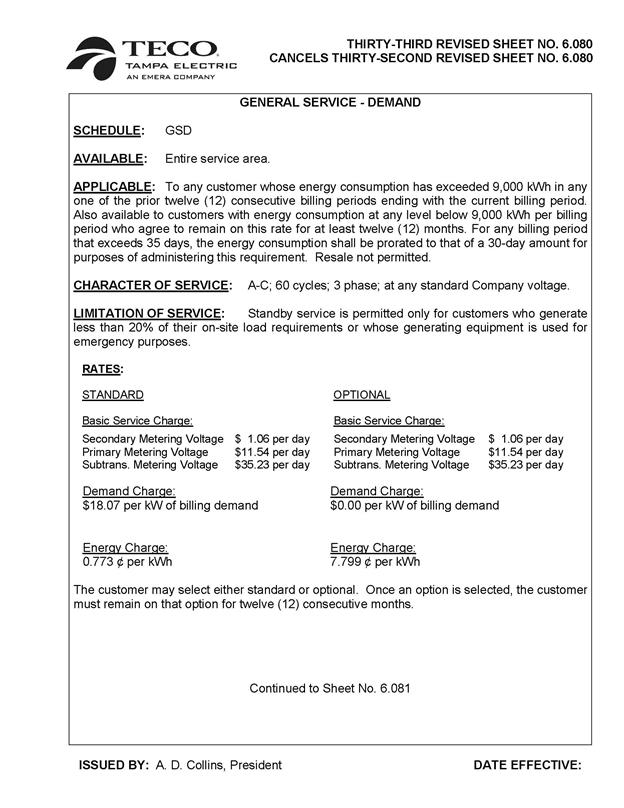

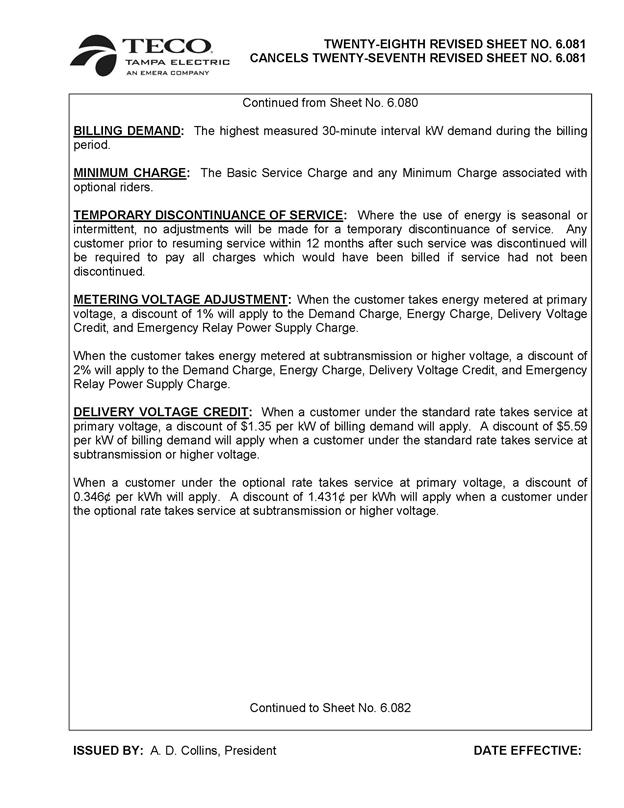

Issue 79:

What are the appropriate demand charges?

Recommendation:

The proposed demand charges as provided in the

tariffs in Attachment C to the recommendation should be approved. (McClelland,

Vogel)

Position of the Parties:

TECO:

The

appropriate demand charges are shown in MFR Schedule E-13c.

OPC:

The

demand charges should reflect all the adjustments recommended by OPC as approved

by the Commission.

FL RISING/

LULAC:

The

appropriate residential energy and demand charge should be no more than 8.59

cents/kWh for the first 1,000 kWh and no more than 9.52 cents/kWh for all

additional kWh of usage and reduced to reflect the reduced rate base from the

disallowance of TECO’s proposed investments as reflected in other issues.

FIPUG:

The

adjustments recommended by OPC should be adopted.

FEA:

See

Issue 78 concerning demand charge for GSLDPR rate class.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

The

FRF does not oppose TECO’s proposed cost of service study or its proposed revenue

allocation methodology.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart adopts and incorporates herein

FRF's positions and incorporates herein FRF's arguments and references to

record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110, 116,

117, 119, 120, 121.

Staff Analysis:

ANALYSIS

The demand charges, in combination with the basic service

charges and the energy charges, are designed to allow TECO to recover the total

Commission-approved revenue requirement. The proposed demand charges reflect

the approved revenue requirement and cost of service methodology; therefore,

the proposed charges provided in the tariffs in Attachment C to the

recommendation should be approved.

Issue 80:

What are the appropriate energy charges?

Recommendation:

The proposed energy charges as provided in the

tariffs in Attachment C to the recommendation should be approved. (McClelland,

Vogel)

Position of the Parties:

TECO:

The

appropriate energy charges are shown in MFR Schedule E-13c.

OPC:

The

energy charges should reflect all the adjustments recommended by OPC as approved

by the Commission.

FL RISING/

LULAC:

The

appropriate residential energy and demand charge should be no more than 8.59

cents/kWh for the first 1,000 kWh and no more than 9.52 cents/kWh for all

additional kWh of usage and reduced to reflect the reduced rate base from the

disallowance of TECO’s proposed investments as reflected in other issues.

FIPUG:

The

adjustments recommended by OPC should be adopted.

FEA:

See Issue 78 concerning energy charge

for GSLDPR rate class.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

The

FRF does not oppose TECO’s proposed cost of service study or its proposed revenue

allocation methodology.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart adopts and incorporates herein

FRF's positions and incorporates herein FRF's arguments and references to

record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110, 116,

117, 119, 120, 121.

Staff Analysis:

ANALYSIS

The energy charges, in combination with the basic service

charges and the demand charges, are designed to allow TECO to recover the total

Commission-approved revenue requirement. The proposed energy charges reflect

the approved revenue requirement and cost of service methodology; therefore,

the proposed charges provided in the tariffs in Attachment C to the

recommendation should be approved.

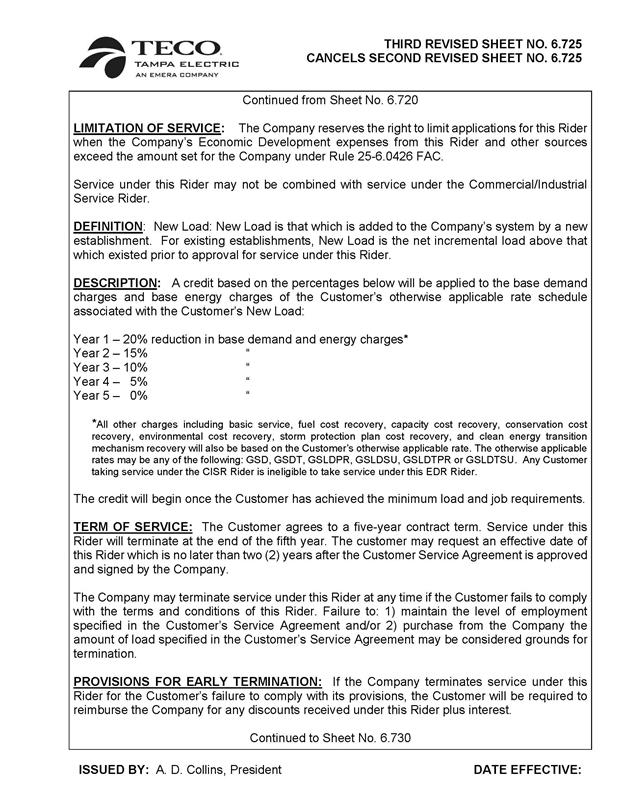

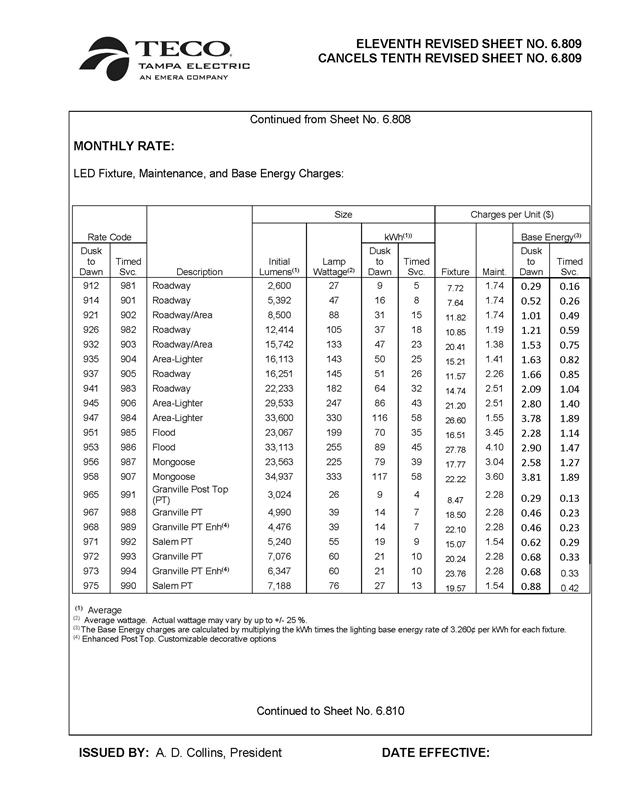

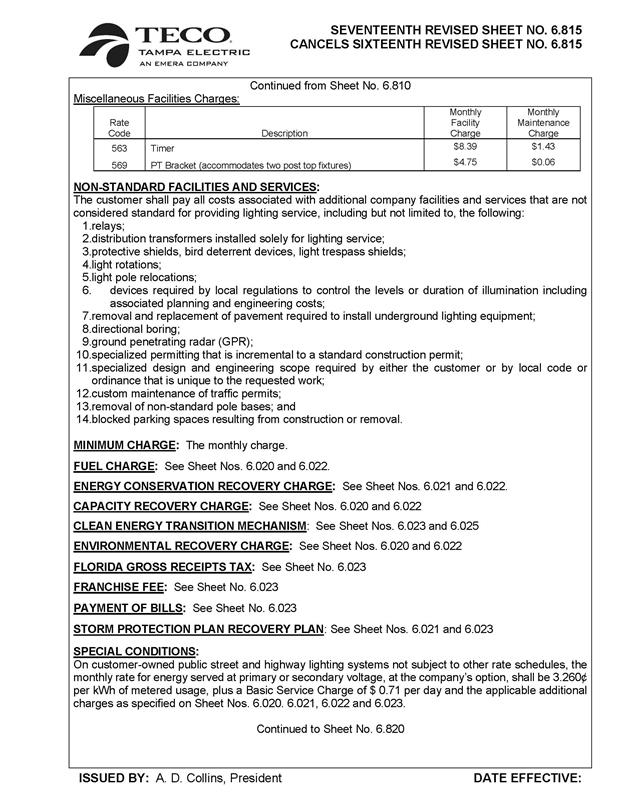

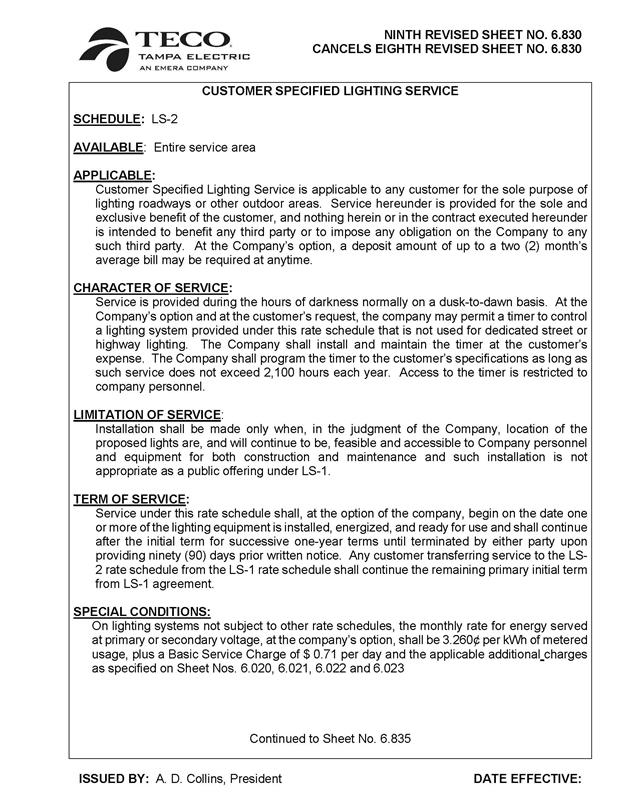

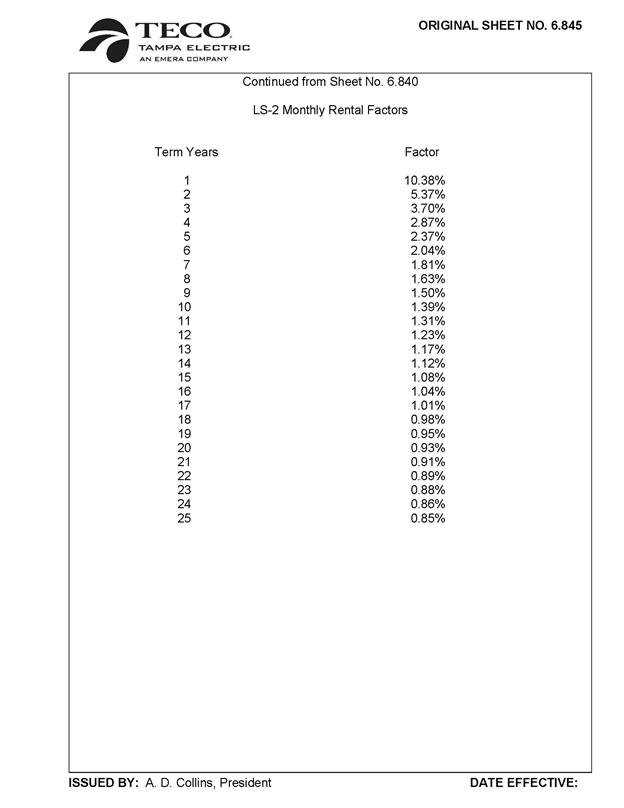

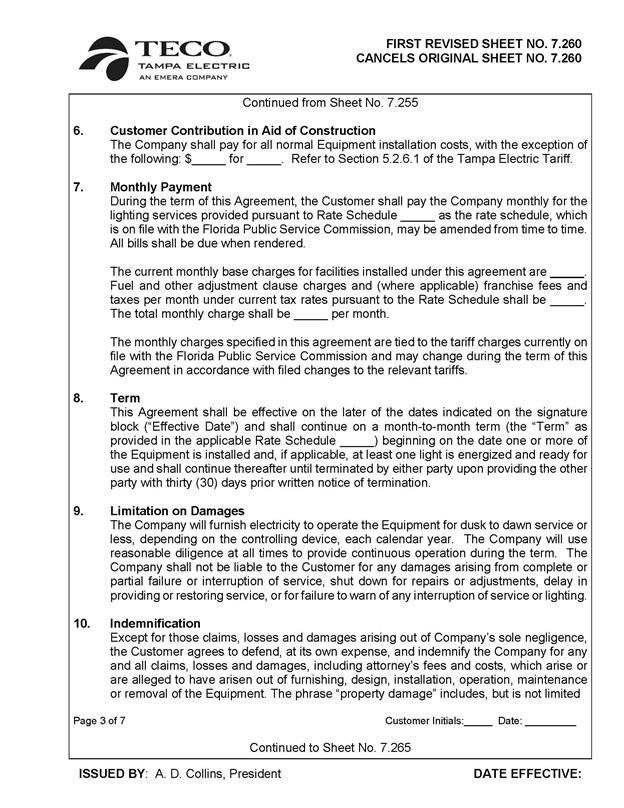

Issue 81:

What are the appropriate Lighting Service rate schedule

charges?

Recommendation:

The proposed Lighting Service charges as provided in

the tariffs in Attachment C to the recommendation should be approved.

(McClelland, Vogel)

Position of the Parties:

TECO:

The

appropriate Lighting Service charges are shown in MFR Schedule E-13c and E-13d.

OPC:

No

position.

FL RISING/

LULAC:

No

position.

FIPUG:

No

position at this time.

FEA:

No

position. Sierra Club has no position on this issue.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

The

FRF does not oppose TECO’s proposed cost of service study or its proposed

revenue allocation methodology.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart adopts and incorporates herein

FRF's positions and incorporates herein FRF's arguments and references to

record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110, 116,

117, 119, 120, 121.

Staff Analysis:

ANALYSIS

The proposed Lighting Service rate schedule charges

reflect the approved revenue requirements and cost of service methodology;

therefore, the proposed charges provided in the tariffs in Attachment C to the

recommendation should be approved.

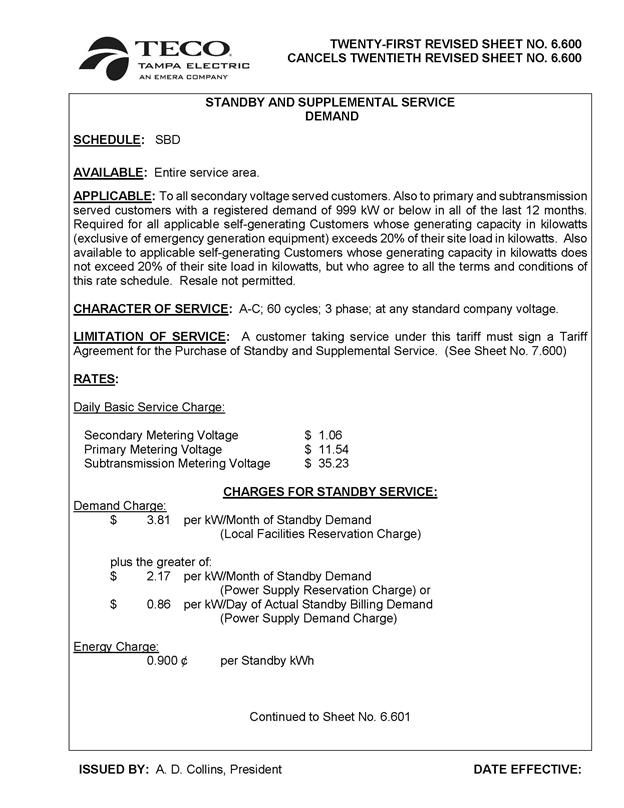

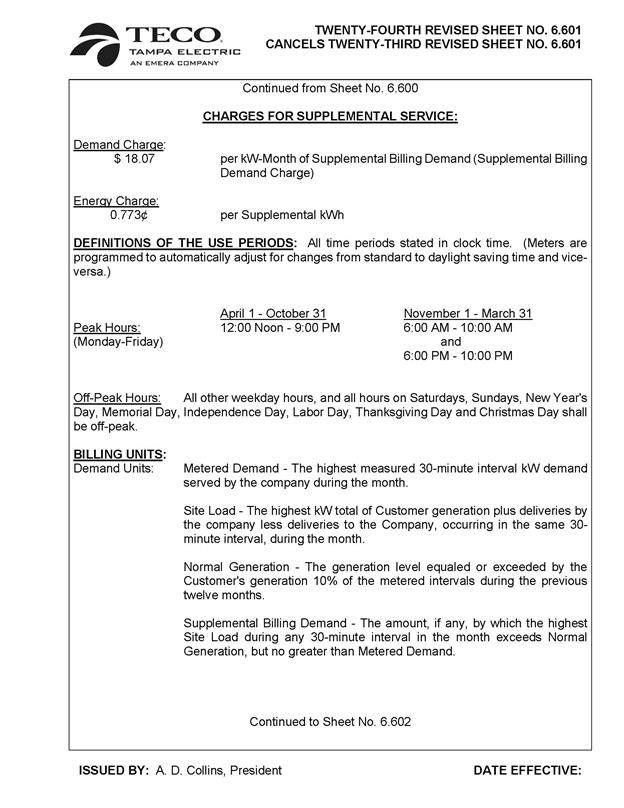

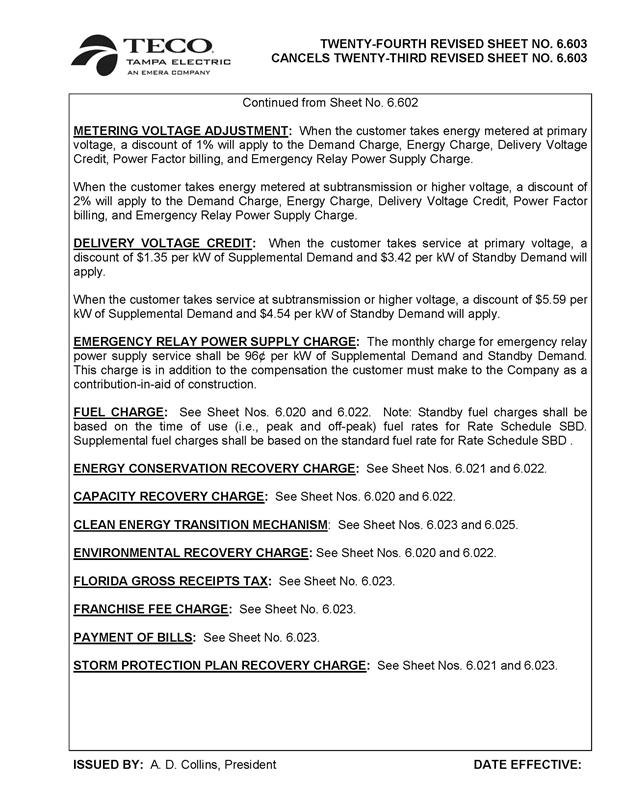

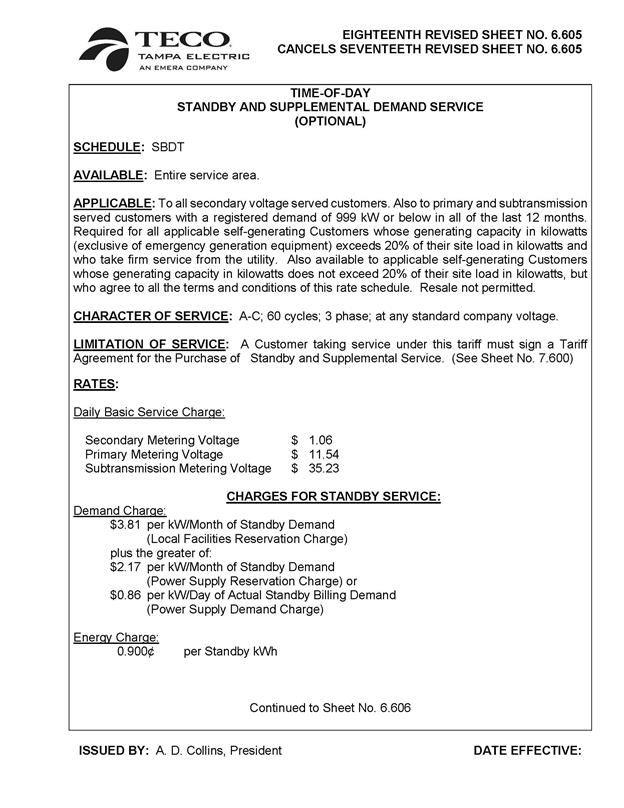

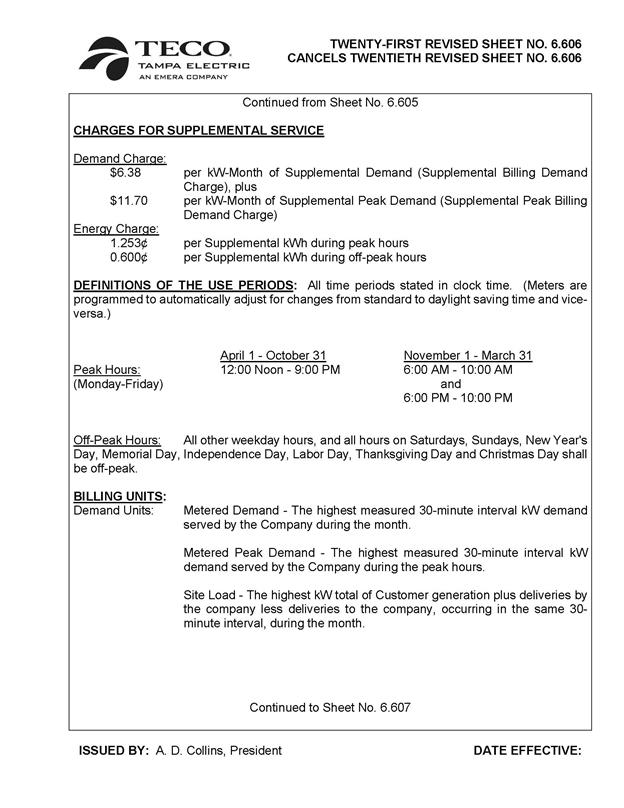

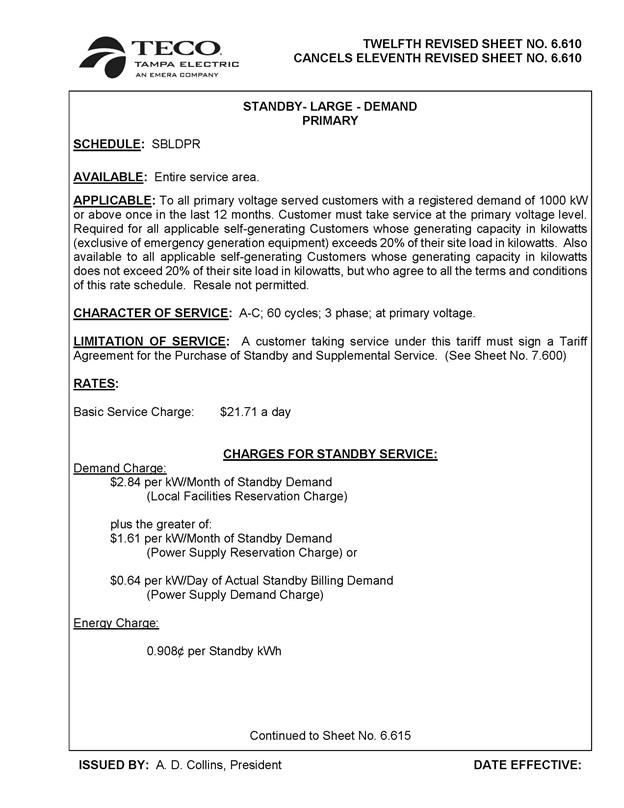

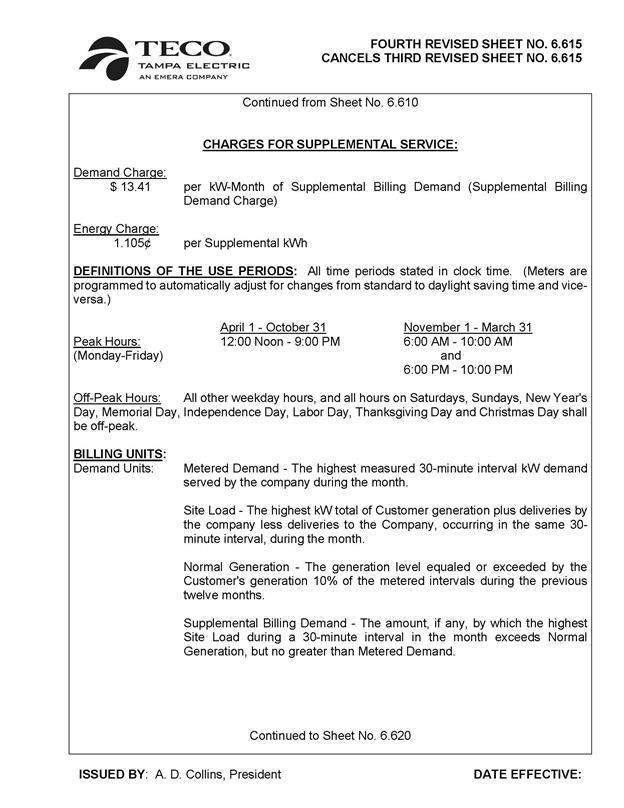

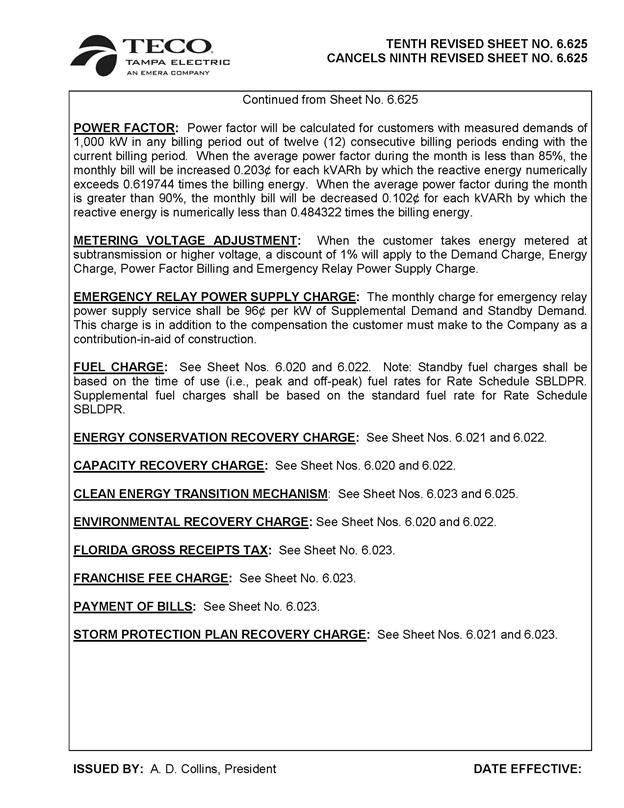

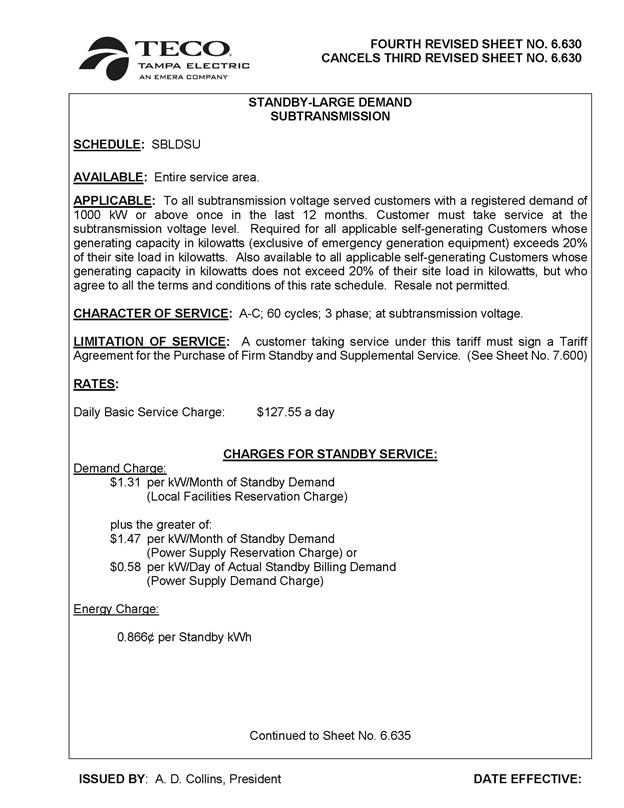

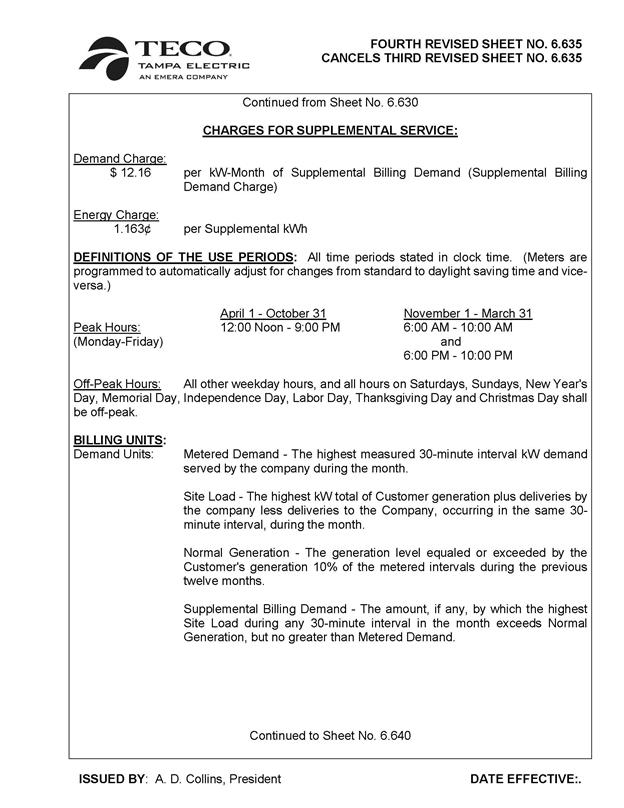

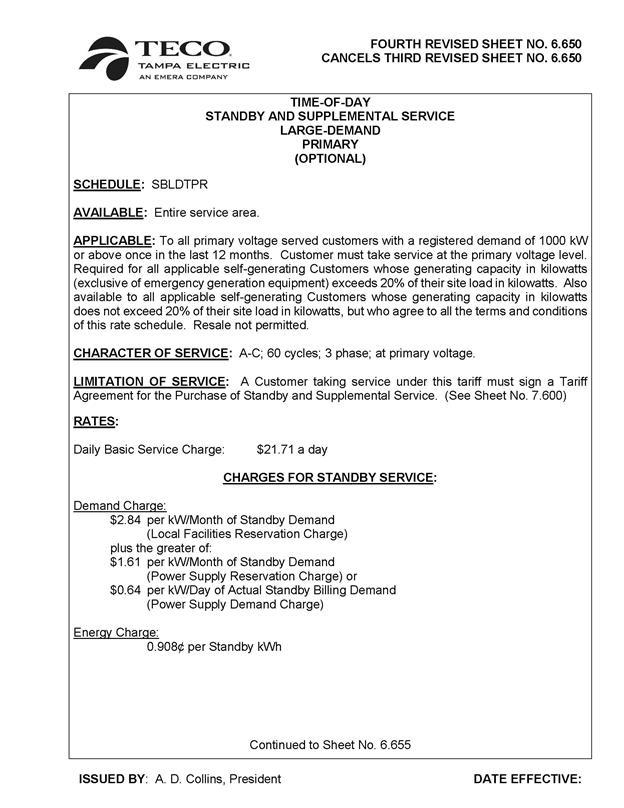

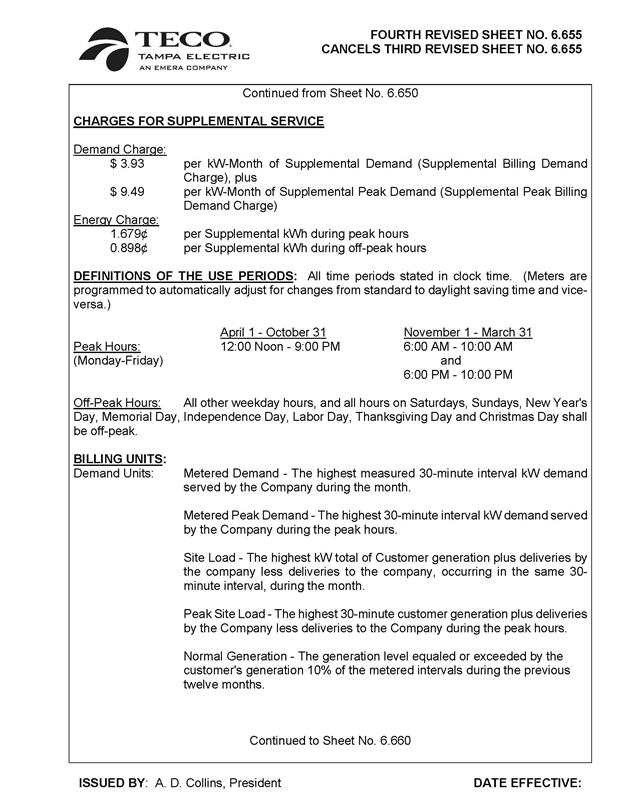

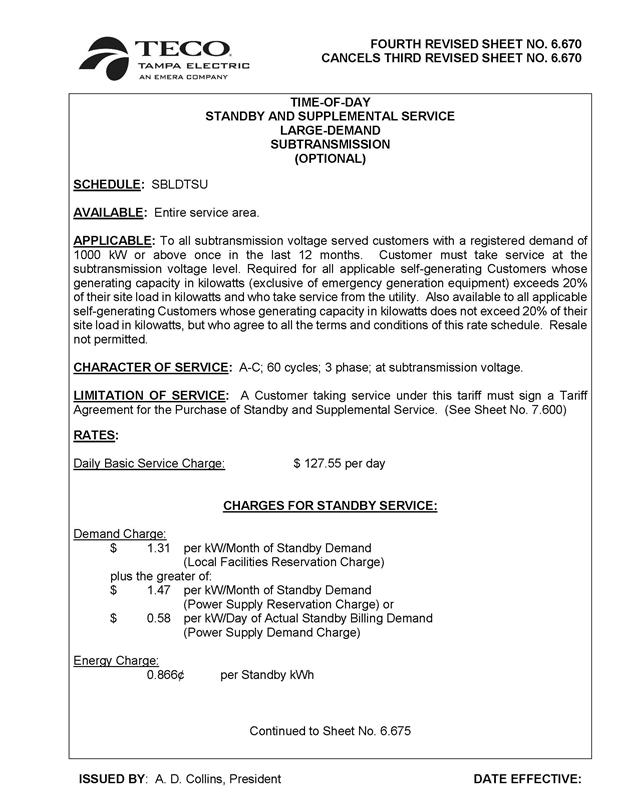

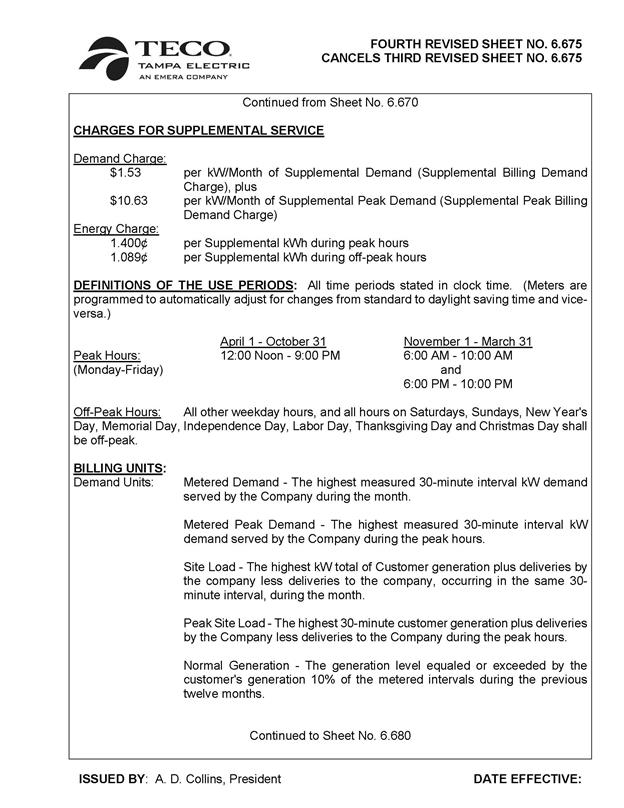

Issue 82:

What are the appropriate Standby Services (SS-1,

SS-2, SS-3) rate schedule charges?

Recommendation:

The proposed Standby Services charges as provided in

the tariffs in Attachment C to the recommendation should be approved. (McClelland,

Vogel)

Position of the Parties:

TECO:

The

appropriate Standby Services rate schedule charges are shown in MFR Schedule

E-13c.

OPC:

No

position.

FL RISING/

LULAC:

Even

though the rate increase should be denied, these rates should be increased to reflect

a 12CP and 50% AD cost of service.

FIPUG:

No

position at this time.

FEA:

No

position.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

The

FRF does not oppose TECO’s proposed cost of service study or its proposed

revenue allocation methodology.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart adopts and incorporates herein

FRF's positions and incorporates herein FRF's arguments and references to

record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110, 116,

117, 119, 120, 121.

Staff Analysis:

ANALYSIS

The proposed Standby Services charges reflect the approved

revenue requirements and cost of service methodology; therefore, the proposed

charges provided in the tariffs in Attachment C to the recommendation should be

approved.

Issue 93:

Should the Commission give staff administrative

authority to approve tariffs reflecting Commission approved rates and charges?

Recommendation:

Yes. The Commission should approve the tariffs as

shown in Attachment C to the recommendation. (Guffey)

Position of the Parties:

TECO:

Yes.

OPC:

No

position.

FL RISING/

LULAC:

No.

FIPUG:

Yes.

FEA:

No

position.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

Yes.

FUEL

RETAILERS:

Yes.

WALMART:

Walmart takes no position on the following

Issues in this Docket: 13, 14, 21, 23, 24, 28, 46-51, 53-57, 61, 75-77, 84-86,

88-93, 115, 118.

Staff Analysis:

ANALYSIS

Staff has reviewed the revised cost of service study and

associated tariffs, which were revised to reflect the final Commission-approved

revenue requirement. The documentation provided by TECO is in accordance with

the Commission vote from the December 3, 2024 Special Agenda Conference. The

Commission should approve the proposed tariffs as provided in Attachment C to

the recommendation.

Issue 117:

What is the appropriate effective date for TECO’s

revised 2025 rates and charges?

Recommendation:

Staff recommends that the rates and charges should

be effective with the first billing cycle in January 2025. (Guffey)

Position of the Parties:

TECO:

The

company’s revised 2025 rates and charges should be approved to be effective with

the first billing cycle in January 2025.

OPC:

The

2025 rates and charges should not become effective any sooner than the first

billing cycle in 2026.

FL RISING/

LULAC:

No

effective date should be applicable because the Commission should deny TECO’s

petition for rate increase. If the

Commission does not outright deny the petition, then January 1, 2025.

FIPUG:

Adopt

position of OPC.

FEA:

No

position.

SIERRA

CLUB:

Sierra

Club has no position on this issue.

FRF:

Any

change in rates for the 2025 test year should be effective for service rendered

on the first day of the first billing cycle of January 2025.

FUEL

RETAILERS:

No Position.

WALMART:

[. . .] Walmart adopts and incorporates herein

FRF's positions and incorporates herein FRF's arguments and references to

record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110, 116,

117, 119, 120, 121.

Staff Analysis:

ANALYSIS

TECO provided notice of its proposed 2025 rates to

customers with the first billing cycle of December 2024. TECO will post the

Commission-approved rates on its website after the vote on December 19, 2024.

Staff recommends that the rates and charges approved by

the Commission should become effective the first billing cycle in January 2025.

Issue 121:

Should this docket be closed?

Recommendation:

After the final order is issued, this docket should

be closed. (Marquez, Sparks, Harper)

Position of the Parties:

TECO: Yes.

OPC: No

position.

FL RISING/

LULAC:

Yes, after the Commission

denies TECO’s petition for rate increase.

FIPUG: Yes,

after the Commission takes final agency action.

FEA: No

position.

SIERRA

CLUB:

Sierra Club has no position

on this issue.

FRF: When

a final Commission order has been issued and either (a) all appeals of such

order (or orders) have been finally resolved, or (b) the time for filing any

further appeal has passed, this docket should be closed.

FUEL

RETAILERS: Not until all actions are concluded,

including any appeals.

WALMART: [. . .] Walmart adopts and incorporates

herein FRF's positions and incorporates herein FRF's arguments and references

to record evidence as to the following Issues: 1, 3, 68-74, 78-83, 107-110,

116, 117, 119, 120, 121.

Staff Analysis:

ANALYSIS

After the final order is issued, this docket should be

closed.