|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

January 24February 3,

2025

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Division of Accounting and Finance (Vogel,

D. Buys, Mason, Norris)

Division of Economics

(Hampson, Hudson, McClelland)

Division of Engineering

(P. Buys, Ramos, Smith II)

Office of the General Counsel

(Dose)

|

|

RE:

|

Docket No. 20240173-EI – Petition for

limited proceeding for recovery of incremental storm restoration costs

related to Hurricanes Debby, Helene and Milton, by Duke Energy Florida, LLC.

|

|

AGENDA:

|

02/04/25 – Regular Agenda – Interested Persons May Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Clark

|

|

CRITICAL DATES:

|

None

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

On December 27,

2024, Duke Energy Florida, LLC (DEF or Company) filed a petition for a limited

preceding seeking authority to implement an interim storm restoration recovery

charge to recover $1.09 billion for the incremental restoration costs related

to Hurricanes Debby, Helene, and Milton (collectively, the Storms), as well as

the replenishment of its retail storm reserve. Included in the $1.09 billion is

interest charged on unrecovered costs for Hurricanes Debby, Helene, and Milton.

Pursuant to the 2024 Settlement Agreement (2024 Settlement) approved by the

Commission in Order No. PSC-2024-0472-AS-EI, the recovery of storm costs from

customers will begin, on an interim basis, 60 days after the filing of a cost

recovery petition and tariff with the Commission. DEF requested a 12-month recovery period,

applied to all bills from March 2025 through February 2026.

On January

31, 2025, DEF submitted updated rate calculations for all rate classes

(Appendix A) and revised tariffs (Appendix B), as well as an updated response

to staff’s first data request. The updated calculations reflect revised cost

allocation factors, resulting in minor changes to the storm cost recovery

factors for all customers. Specifically, in the petition, DEF had included a

distribution allocation factor for customers taking service at transmission

level, overstating the allocation of distribution storm costs to

transmission-level customers. The revised rate calculation is consistent with the

calculation of previous storm cost recovery charges approved in Order No. PSC-2024-0377-FOF-EI. The updated rate calculations do not

change the total $1.09 billion incremental storm costs proposed for recovery. The

updated tariff is included as Attachment A to this recommendation.

The Commission has

jurisdiction over this matter pursuant to Sections 366.04, 366.05, 366.06, and

366.076, Florida Statutes.

Discussion

of Issues

Issue 1:

Should the Commission authorize DEF to implement an

interim storm restoration recovery charge?

Recommendation:

Yes. The Commission should authorize DEF to

implement an interim storm restoration recovery charge, subject to refund. Once

the total actual storm costs are known, DEF should be required to file

documentation of the total actual storm costs for Commission review and true-up

of any excess or shortfall. (Mason)

Staff Analysis:

As stated in the Case Background, DEF filed a petition

for a limited proceeding seeking authority to implement an interim storm

restoration charge to recover an estimated total of $1.09 billion for

incremental storm restoration costs for the Storms and to replenish its storm

reserve. In its petition, DEF requested to replenish the storm reserve to

$131.9 million.

The petition was filed pursuant to the provisions of the

2024 Settlement approved by the Commission in Order No. PSC-2024-0472-AS-EI.

Pursuant to the 2024 Settlement, DEF can begin recovery of storm costs 60 days

following the filing of a petition for recovery.

In its petition, DEF asserted that it incurred approximate

recoverable costs in the amounts of $61.0 million for Hurricane Debby, $372.5

million for Hurricane Helene, and $769.7 million for Hurricane Milton. The

Company further asserted that all amounts were calculated in accordance with

the Incremental Cost and Capitalization Approach methodology prescribed in Rule

25-6.0143, Florida Administrative Code.

The approval of an interim storm restoration recovery

charge is preliminary in nature and is subject to refund pending further review

once the total actual storm restoration costs are known. After the actual costs

are reviewed for prudence and reasonableness, and are compared to the actual

amount recovered through the interim storm restoration recovery charge, a

determination will be made whether any over/under recovery has occurred. The

disposition of any over or under recovery, and associated interest, will be

considered by the Commission at a later date.

Based on a review of the information provided by DEF in

its petition, staff recommends that the Commission authorize the Company to

implement an interim storm restoration recovery charge subject to refund. Once

the total actual storm costs are known, DEF should be required to file

documentation of the storm costs for Commission review and true-up of any

excess or shortfall.

Issue 2:

What is the appropriate security to guarantee the amount

collected subject to refund through the interim storm restoration recovery

charge?

Recommendation:

The appropriate security to guarantee the funds

collected subject to refund is a corporate undertaking. (Ferrer, D. Buys)

Staff Analysis:

Staff

recommends that all funds collected subject to refund be secured by a corporate

undertaking. The criteria for a corporate undertaking include sufficient

liquidity, equity ownership, profitability, and interest coverage to guarantee

any potential refund. DEF requested a 12-month collection period beginning with

the first billing cycle in March 2025 through February 2026 for Interim Storm

Recovery Charges of $1.09 billion related to Hurricanes Debby, Helene, and

Milton. Staff reviewed DEF’s three most recent annual reports filed with the

Commission (2021, 2022, and 2023) to determine if the Company can support a

corporate undertaking to guarantee the funds collected for incremental storm

restoration costs related to the subject weather events. DEF’s financial

information indicates the Company’s financial position to support a corporate

undertaking of $1.09 billion is marginal, but satisfactory. DEF’s average net

income over the last three years is $889 million, which is less than the

requested interim amount. The Company’s net income in 2023 was $1.019 billion,

slightly less than the requested storm cost recovery interim amount. DEF’s profitability,

equity ownership, current ratio, and interest coverage for 2022, and 2023 are

sufficient to support a potential refund up to $510 million. Staff’s corporate

undertaking guidelines indicate that the maximum that should be allowed for a

corporate undertaking is one-half DEF’s 2023 net income, or $510 million.

However, DEF participates in Duke Energy Corporation’s (DEF’s parent company)

money pool and has access to additional funds if needed. In addition, it is

improbable DEF will be required to refund the entire requested amount of $1.09

billion. Historically, DEF has supported its requested interim storm cost

recovery amounts through a hearing process and the Commission has approved

those cost amounts with only minor adjustments. Further, the storm cost

recovery mechanism is a surcharge for the sole purpose of recovering the costs

incurred for storm restoration and any potential refund would be applied to the

funds already collected and effectuated by reduced charges on future customer

bills.

Accordingly,

staff believes DEF has adequate resources to support a corporate undertaking in

the amount requested. Based on this analysis, staff recommends that a corporate

undertaking of $1.09 billion is acceptable. This brief financial analysis is

only appropriate for deciding if DEF can support a corporate undertaking in the

amount requested and should not be considered a finding regarding staff’s

position on other issues in this proceeding.

Issue 3:

Should the Commission approve DEF’s proposed interim storm

restoration recovery charge tariff as shown in Attachment A to the

recommendation?

Recommendation:

Yes, the Commission should

approve DEF’s proposal to revise the interim storm restoration recovery tariff

and associated surcharges, as shown in Attachment A to this recommendation. The

tariff should become effective the first billing cycle of March 2025. The

interim storm restoration surcharges should be subject to final true-up once

the total actual storm costs are known. (McClelland)

Staff Analysis:

DEF calculated the interim storm surcharge for the

12-month period of March 1, 2025, through February 28, 2026, subject to true-up

once the final total recoverable storm amount is known and determined. In paragraph

21 of the petition, DEF states that the proposed surcharges are allocated to

the rate classes consistent with the rate design approved in the 2021 and 2024

Settlements. Staff has reviewed the allocation to rate classes provided in

Appendix A to the petition and the derivation of the surcharges provided in

Appendix B to the petition. Staff believes that the surcharges have been

calculated correctly, using projected kilowatt hour (kWh) sales for March 2025

through February 2026.

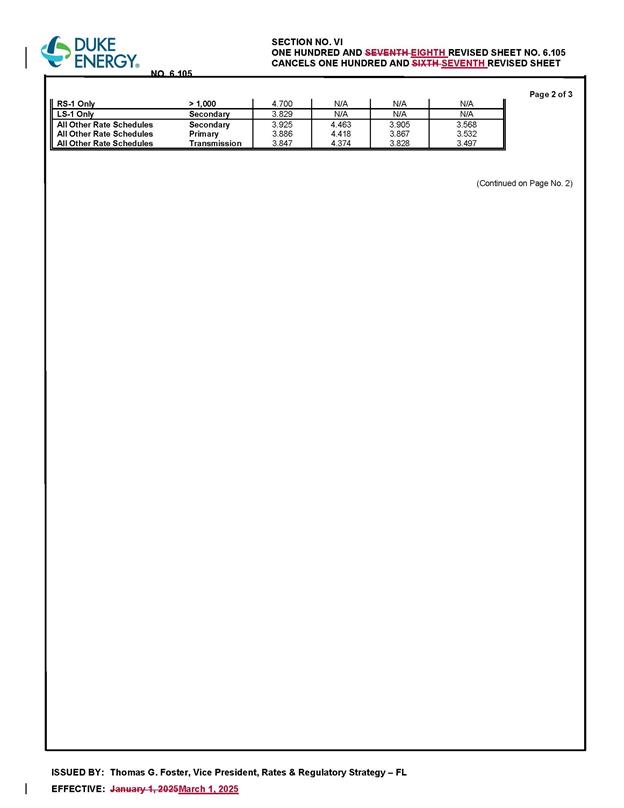

The proposed interim storm restoration surcharges are

shown on One Hundred and Eighth Revised Tariff Sheet No. 6.105, provided in

Appendix B to the petition.

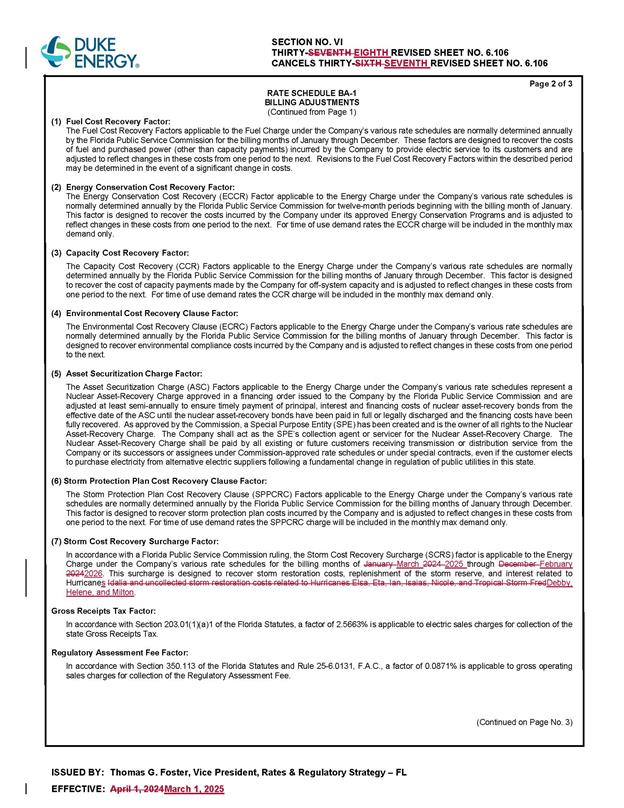

For residential customers, the proposed surcharge would be 3.1183.240

cents per kWh, which equates to a total surcharge of $31.1832.40

for a 1,000 kWh monthly bill. The storm cost recovery surcharge would be

included in the non-fuel energy charge on customer bills.

In response to staff’s first data request, DEF stated that

its decision to use a 12-month recovery period (March 2025 – February 2026) is

based upon DEF’s 2021 Settlement approved in Order No. PSC-2021-0202-AS-EI.

Interim recovery of storm costs is governed by Paragraph 30c of the 2021

Settlement, which provides that “recovery from customers for storm damage costs

will begin, subject to Commission approval on an interim basis, sixty (60) days

following the filing of a cost recovery petition with the Commission, and

subject to true-up pursuant to further proceedings before the Commission, and

will be based on a 12-month recovery period.” Similar language is included in

the 2024 Settlement approved in Order No. PSC-2024-047-AS-EI. Staff concurs

with DEF’s intepretation of the settlement with respect to its petition. DEF

further states that even if the 12-month recovery period was not required by

the 2021 and 2024 settlements, extending recovery beyond 12 months has several

negative impacts and risks. In the revised response to staff’s first

data request, DEF stated if a 22-month billing period were adopted, the

recovery period would extend through December 2026 and would result in a bill

impact of $17.7306 per 1,000 kWh on a monthly residential bill.

Staff recommends that the Commission approve DEF’s

proposed interim storm restoration recovery tariff and associated surcharges,

as shown in Attachment A to this recommendation. The tariff should become

effective the first billing cycle of March 2025. The interim storm restoration

surcharges should be subject to final true-up once the total actual storm costs

are known.