Discussion

of Issues

Issue 1:

Should the Commission propose the adoption of Rule

25-7.150, F.A.C., Natural Gas Facilities Relocation Cost Recovery Clause?

Recommendation:

Yes. The Commission should propose the adoption of

Rule 25-7.150, F.A.C., as set forth in Attachment A. The Commission should also

certify the rule as a minor violation rule. (Sapoznikoff, Hinton, Guffey)

Staff Analysis:

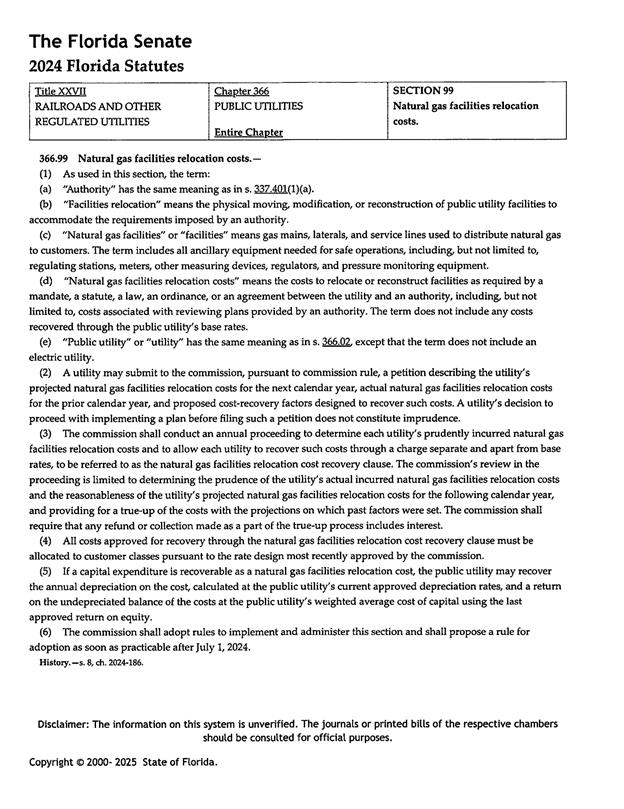

The purpose of this rulemaking is to adopt new Rule

25-7.150, F.A.C., to implement the requirements of Section 366.99, F.S. Staff

recommends that the Commission propose the adoption of Rule 25-7.150, F.A.C.,

as set forth in Attachment A. The rule establishes a cost recovery clause, the

NGFRCRC, as required by the statute. Each section of the rule as recommended by

staff is explained in detail below.

Subsection (1) – Requiring petitions to be

supported by certain testimony

This provision establishes that recovery under the NGFRCRC

must be supported by testimony that provides details of the facilities

relocation activities and associated costs.

OPC submitted comments requesting that the rule should explicitly

state that cost recovery is limited to relocation or reconstruction of existing

facilities, not new construction. Staff believes

that is not necessary. Section 366.99(1)(b), F.S., already defines “facilities

relocation” as “the physical moving, modification, or reconstruction of public

utility facilities to accommodate the requirements imposed by an authority.”

OPC also submitted comments requesting that utilities

should have to affirm that the petition does not seek any double recovery and

explain how the costs are not also included in base rates. A rule cannot

require an affirmation if an affirmation is not required by statute, and Section

366.99, F.S., contains no such requirement. Moreover, Section 366.99(1)(d),

F.S., already prohibits double recovery by excluding recovery through the

NGFRCRC of “any costs recovered through the public utility’s base rates,” so

this provision cannot be duplicated in the rule. Restating statutory language in

a rule is inappropriate pursuant to Section 120.545(1)(c), F.S.

OPC also wanted rule language indicating that neither it

nor the Commission should have to conduct discovery to ensure that there is no

double recovery. Staff does not believe this rule language should be included

because discovery is standard in litigation and staff does not believe this

rule should circumvent standard procedure. The statute imposes the requirement

that there be no double recovery and the burden is already on a utility seeking

cost recovery under the NGFRCRC to abide by that directive.

Subsection (2) – Setting forth what must be

attached to the petition

This section sets forth what information is required to be

submitted to the Commission in support of cost recovery via the NGFRCRC.

Paragraph (2)(a) – Requiring the notification

from the authority

The statute allows for cost recovery via the NGFRCRC when

a specified authority requires the relocation of gas facilities. This paragraph

requires the utility provide the actual notification from the authority

regarding a particular facilities relocation required by an underlying

relationship with the authority.

OPC suggested that the rule should define “authority” as FDOT

and local governmental entities. As Section 366.99(1)(a), F.S., already defines

authority, via reference to Section 337.401(1)(a), F.S., restating the

definition is not required and is inappropriate pursuant to Section

120.545(1)(c), F.S. The definition of authority in Section 337.401(1)(a), F.S.,

includes the Florida DOT and other governmental entities that have jurisdiction

over and control of public roads.

OPC also submitted comments requesting that the rule

explicitly state that cost recovery is limited to facilities relocation

required by FDOT or local governmental entities. Staff believes the Commission

should decline to incorporate this suggestion as Section 366.99(1)(a), F.S.,

already defines “facilities relocation” as being in response to “requirements

imposed by an authority” and Section 366.99(1)(d), F.S., already limits cost

recovery to costs “required by a mandate, a statute, a law, and ordinance, or

any agreement between the utility and an authority.” Accordingly, staff

believes the rule language is clear that cost recovery is only for relocation

projects required by FDOT or other governmental entities.

A comment from PGS requested that the rule address both

“identified” relocation projects and “anticipated” relocation projects, with

“identified” projects being those for which an authority has notified a utility

that “facilities relocation” is required and “anticipated” projects being those

projects that are not currently required, but are likely to be required, based

on FDOT’s five-year plan, long-term forecasts, and the company’s business

knowledge. While staff is cognizant that timing of relocation projects is often

unpredictable, staff believes including “anticipated” projects in cost recovery

is inappropriate. Section 366.99, F.S., explicitly limits cost recovery to

facilities relocation required by an

authority. Thus, staff believes the plain language of the statute excludes cost

recovery for “anticipated” projects that will not occur until some future time

and are not yet mandated.

Paragraph (2)(b) – Requiring a description of

the scope of the facilities relocation

This paragraph requires the utility to disclose the scope

of the facilities relocation to be undertaken per the requirements imposed by

the authority.

OPC submitted comments requiring a description not only of

the scope of facilities relocation, but also identification of the particular

projects and work to be performed. Section 366.99(3), F.S., limits the

Commission’s review to the prudence of costs already incurred and the

reasonableness of projected costs. Unlike other statutes requiring the

Commission to review and approves plans or determine need before costs may be

incurred, Section

366.99, F.S., contains no such grant of authority, and it is not the

Commission’s practice to micromanage how utilities perform their statutory

obligations.

PGS requested including the term “identified” to limit for

which projects the information was required. As the rule already only allows

for cost recovery for facilities relocation projects that would be considered

“identified” (declining to also allow PGS’s request to include “anticipated”

projects, as discussed above), there is no need to specify that only

“identified” projects are addressed in this paragraph.

Paragraph (2)(c) – Requiring an estimate of

associated costs

This paragraph requires the utility seeking cost recovery

through the NGFRCRC provide an estimate of the costs associated with the

relocation of the natural gas facilities. Comments from FPUC and FCG suggested adding

additional language to define costs to include “annual depreciation on the

cost, calculated at the public utility’s current approved depreciation rates,

and a return on the undepreciated balance of the costs at the public utility’s

weighted average cost of capital using the last approved return on equity.”

Staff does not believe that costs need to be defined in

the rule as Section 366.99(5), F.S., already states that costs include “annual

depreciation on the cost, calculated at the public utility’s current approved

depreciation rates, and a return on the undepreciated balance of the costs at

the public utility’s weighted average cost of capital using the last approved

return on equity, along with costs associated with reviewing plans provided by

the authority.” Restating the definition in the rule is not required and is

inappropriate pursuant to Section 120.545(1)(c), F.S.

Subsection (3) – Establishing procedure for review

of costs

This subsection directs how the statutorily mandated

review of incurred and proposed costs will occur and follows the Commission’s established

procedure for its other cost recovery clauses. The rule provides that an annual

hearing to address petitions for recovery of natural gas facilities relocation

costs will be held and will be limited to determining the reasonableness of

projected costs, the prudence of actual costs incurred by the utility, and to

cost recovery factors consistent with the requirements of this rule. The

process set forth in paragraphs (3)(a)-(e) is consistent with that of other

rules pertaining to cost recovery clauses.

Paragraph (3)(a) – Final True-Up for Previous

Year

FPUC and FCG submitted comments to include language clarifying

that the initial filing for cost recovery would include eligible projects

undertaken since July 1, 2024, the effective date of Section 366.99, F.S. Staff

believes such language is unnecessary. First, the Commission’s practice, per

rule making statutes, is for the rule to apply as of the effective date of the

authorizing statute. In addition, this clarification would only be pertinent to

petitions for cost recovery filed in 2025. As utilities are not mandated to

seek recovery under the NGFRCRC, an “initial filing” may not occur in 2025.

Paragraph (3)(b) – Estimated True-Up for

Current Year

PGS submitted comments seeking to clarify that the current

year true-up would be for costs that “have been, will be, and are projected to

be incurred.” The draft language addresses costs that “have been or will be

incurred” and is identical to language the Commission used in the rule

pertaining to the Storm Protection Plan cost recovery clause.

Staff believes the draft rule language is appropriate and the recommended

additions are unnecessary.

Paragraph (3)(c) – Projected Costs for

Subsequent Year

PGS submitted comments that would add language to include

both “identified” and “anticipated” costs, and to add language specifying what

would constitute the basis for costs of “anticipated” projects. As discussed

above (regarding paragraphs (2)(a) and (b)), staff believes the statute only

allows for cost recovery for what PGS calls “identified” projects—facilities

relocation which a utility is required to do per notification from an authority.

Accordingly, as expressed in the discussion of paragraphs (2)(a) and (b), staff

believes including “anticipated” projects in cost recovery is inappropriate.

Section 366.99, F.S., explicitly limits cost recovery to facilities relocation required by an authority. Thus, staff

believes the plain language of the statute excludes cost recovery for

“anticipated” projects that will not occur until some future time and are not

yet mandated.

Paragraph (3)(d) – True-Up Variances

Consistent with other cost recovery clauses, under the

recommended rule language, the utility must report observed true-up variances,

including sales forecasting variances, changes in the utility’s prices of

services and/or equipment, and changes in the scope of work relative to the estimates

provided in the petition. The utility must also provide explanations for

variances regarding the facilities relocation. None of the workshop

participants had any objection to or comment on this provision.

Paragraph (3)(e) – Proposed Natural Gas

Facilities Relocation Cost Recovery Factors

Consistent with other cost recovery clauses, the utility

must provide the calculations of its proposed factors and effective 12-month

billing period. None of the workshop participants had any objection to or

comment on this provision.

Subsection (4) – Setting forth accounting

treatment

Under the recommended rule language, natural gas

facilities relocation cost recovery clause true-up amounts will be afforded

deferred accounting treatment at the 30-day commercial paper rate. This

provision is in accord with the Commission’s other cost recovery clauses. None

of the workshop participants had any objection to or comment on this provision.

Subsection (5) – Subaccounts.

To ensure separation of costs subject to recovery through

the clause, staff recommends that the new rule require the utility filing for

cost recovery must maintain subaccounts for all items consistent with the

Uniform System of Accounts prescribed by this Commission pursuant to Rule 25-7.014,

F.A.C. None of the workshop participants had any objection to or comment on

this provision.

Subsection (6) – Option to include unrecovered

costs in a subsequent rate proceeding

Under staff’s recommended rule language, the NGFRCRC

allows utilities to initiate recovery of required costs with minimal regulatory

lag. However, as the relocation projects covered by this rule are likely large,

capital expenditures, subsection (6) provides the option for utilities to move

costs into base rates at a subsequent rate proceeding, and remove them from

on-going clause proceedings. None of the workshop participants had any

objection to or comment on this provision.

Comments Requesting to Add Language to Allow for

Filing of Mid-Course Corrections.

Due to the unpredictability of when an authority may

require natural gas facilities to be relocated and the variation in cycle times,

both PGS and FPUC/FCG submitted comments to add rule language allowing a

utility to seek a mid-course correction for costs that may vary significantly

over a 12-month period. Comments from PGS included language akin to the language

of Rule 25-6.0424, F.A.C., pertaining to a petition for mid-course correction

to the fuel cost recovery or capacity cost recovery factors. Under the language

suggested by PGS, a utility could request a mid-course correction if the

revised projected costs for the remainder of the period exceeded projected

revenues by more than ten percent, and had filing requirements identical to

that of Rule 25-6.0424, F.A.C. Comments from FPUC and FCG included language

that a utility be required to file for a mid-course correction should the

difference between projected expenses and projected revenues exceed 25 percent,

but allowing a utility to file a petition for a mid-course correction prior to

reaching the 25 percent threshold, if projected expenses exceed projected

revenues by ten percent or more.

Staff believes a mid-course correction provision is not

only unnecessary, but also is prohibited by Section 366.99, F.S. First, Section

366.99(3), F.S., directs the Commission to hold “an annual proceeding” (emphasis added), the plain meaning of which

indicates one proceeding each year. Holding additional proceedings to address

requested mid-course corrections would violate that language. In addition, the

provisions of Section 366.99, F.S., which allow utilities to seek cost recovery

at an annual proceeding, already significantly accelerate their ability to

recover eligible costs. Prior to Section 366.99, F.S., utilities could only

recover facilities relocation costs in base rate proceedings. Under Section

366.99, F.S., and this recommended new rule, utilities may seek to have required

relocation costs assessed annually under a process that accounts for changes

between projected, estimated, and actual costs.

Staff also notes that the rationale underlying the need

for a mid-course correction provision in the fuel cost recovery clause does not

apply to facilities relocation costs. The fuel clause has two components: fuel

cost recovery and capacity cost recovery, both of which may fluctuate

significantly during the year and both of which have such sufficient magnitude

that those fluctuations would cause dramatic over- or under-recovery. The costs

for facilities relocation projects are not of the same magnitude.

Minor Violation Rule Certification

Pursuant to Section 120.695, F.S., for each rule filed for

adoption, the agency head shall certify whether any part of the rule is

designated as a rule the violation of which would be a minor violation. Under Section

120.695(2)(b), F.S., a violation of a rule is minor if it does not result in

economic or physical harm to a person or adversely affect the public health,

safety, or welfare or create a significant threat of such harm. Rule 25-7.150,

F.A.C., should be listed as a minor violation rule by the Commission. This rule

is a minor violation rule because the violation of it would not result in

economic or physical harm to a person, cause an adverse effect on the public

health, safety, or welfare, or create a significant threat of such harm.

Therefore, for the purposes of filing the rule for adoption with the Department

of State, staff recommends that the Commission certify Rule 25-7.150, F.A.C.,

as a minor violation rule.

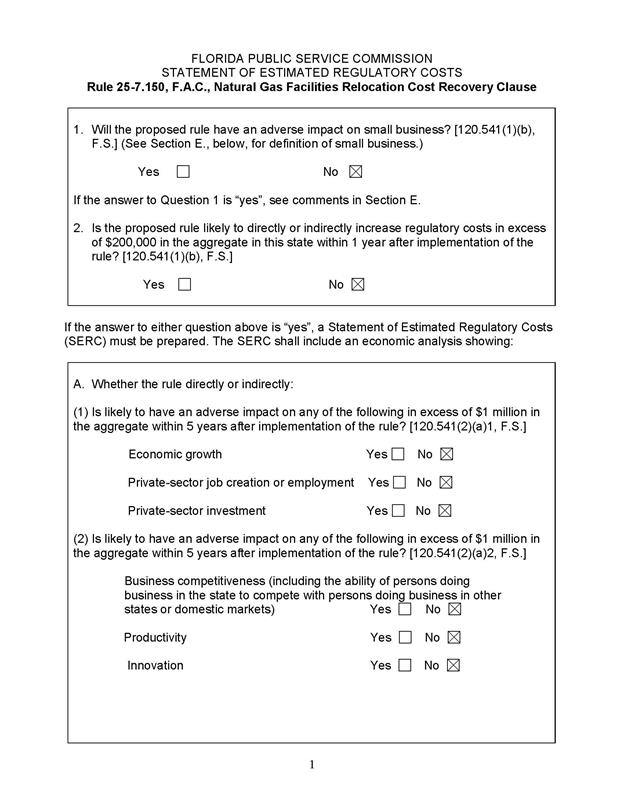

Statement of Estimated Regulatory Costs

Section 120.54(3)(b)1., F.S., encourages agencies to

prepare a Statement of Estimated Regulatory Costs (SERC) before the adoption,

amendment, or repeal of any rule. A SERC was prepared for this rulemaking and

is appended as Attachment B. As required by Section 120.541(2)(a)1., F.S., the

SERC analysis includes whether the rule is likely to have an adverse impact on

economic growth, private sector job creation or employment, or private sector

investment in excess of $1 million in the aggregate within five years after

implementation.

The SERC concludes that the rule will likely not directly

or indirectly increase regulatory costs in excess of $200,000 in the aggregate

in Florida within one year after implementation. Further, the SERC concludes

that the rule will not likely increase regulatory costs, including any

transactional costs, or have an adverse impact on business competitiveness,

productivity, or innovation, in excess of $1 million in the aggregate within

five years of implementation. Thus, pursuant to Section 120.541(3), F.S., the

rule do not require legislative ratification.

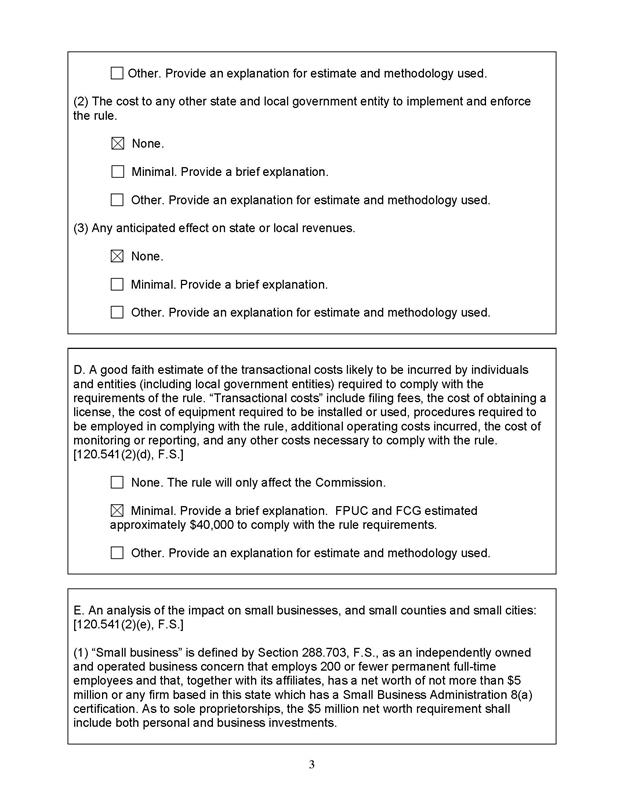

In addition, the SERC states that the rule would have no

adverse impact on small businesses, would have no implementation or enforcement

costs on the Commission or any other state or local government entity, and

would have no impact on small cities or small counties. The SERC states that

there will be no transactional costs likely to be incurred by individuals and

entities required to comply with the requirements. None of the impact/cost

criteria established in Section 120.541(2)(a), F.S., will be exceeded as a

result of the rule.

Conclusion

Based on the foregoing, staff recommends the Commission

should propose the adoption of Rule 25-7.150, F.A.C., as set forth in

Attachment A. Staff also recommends the Commission certify the rule as a minor

violation rule.

Issue 2:

Should the docket be closed?

Recommendation:

Yes. If no request for hearing is made or comments from

the Joint Administrative Procedures Committee (JAPC) are filed, and no proposal

for a lower cost regulatory alternative is submitted pursuant to Section

120.541(1)(a), F.S., the rule should be filed for adoption with the Department

of State, and the docket should be closed. (Sapoznikoff)

Staff Analysis:

If no request for hearing is made or comments from JAPC

are filed, and no proposal for a lower cost regulatory alternative is submitted

pursuant to Section 120.541(1)(a), F.S., the rule should be filed for adoption

with the Department of State, and the docket should be closed.

25-7.150 Natural Gas Facilities

Relocation Cost Recovery Clause.

(1) A utility may file a petition for

recovery of natural gas facilities relocation costs through the annual natural

gas facilities relocation cost recovery clause (NGFRCRC). The petition seeking

such cost recovery must be supported by testimony that provides details of the

facilities relocation activities and associated costs.

(2) As part of the

NGFRCRC or by a separate filing, a utility must seek a determination that

“natural gas facilities relocation costs” are eligible for recovery through the

NGFRCRC by providing the following information:

(a) The notification by the

authority requiring the facilities relocation per section 366.99(1), Florida

Statutes,

(b) A description of the scope

of the facilities relocation to be undertaken per the requirements imposed by

the authority, and

(c)

An estimate of the costs associated with the relocation of the natural gas

facilities.

(3)

Each year, pursuant to the order establishing procedure in the annual NGFRCRC,

a utility must submit the following:

(a)

Final True-Up for Previous Year. The final true-up of natural gas facilities

relocation cost recovery for a prior year must include revenue requirements

based on a comparison of actual costs for the prior year and previously filed

projected costs and revenue requirements for such prior year for each project

determined to be eligible by the Commission. The final true-up must also include

identification of each of the utility’s eligible facilities relocation projects

for which costs were incurred during the prior year, including a description of

the work actually performed during such prior year.

(b)

Estimated True-Up for Current Year. The actual/estimated true-up of natural gas

facilities relocation cost recovery must include revenue requirements based on

a comparison of current year actual/estimated costs and the previously-filed

projected costs and revenue requirements for such current year for each

eligible project. The actual/estimated true-up must also include identification

of each of the utility’s eligible facilities relocation projects for which

costs have been and will be incurred during the current year, including a

description of the work projected to be performed during such current year.

(c) Projected Costs

for Subsequent Year. The projected natural gas facilities relocation cost

recovery must include costs and revenue requirements for the subsequent year

for each eligible project. The projection filing must also include

identification of each of the utility’s eligible facilities relocation projects

for which costs will be incurred during the subsequent year, including a

description of the work projected to be performed during such year.

(d)

True-Up of Variances. The utility must report observed true-up variances,

including sales forecasting variances, changes in the utility’s prices of

services and/or equipment, and changes in the scope of work relative to the

estimates provided pursuant to paragraphs (2)(b) and (2)(c). The utility must

also provide explanations for variances regarding the facilities relocation.

(e)

Proposed Natural Gas Facilities Relocation Cost Recovery Factors. The utility

must provide the calculations of its proposed factors and effective 12-month

billing period.

(4)

Natural gas facilities relocation cost recovery clause true-up amounts will be

afforded deferred accounting treatment at the 30-day commercial paper rate.

(5)

Subaccounts. To ensure separation of costs subject to recovery through the

clause, the utility filing for cost recovery must maintain subaccounts for all

items consistent with the Uniform System of Accounts prescribed by this

Commission pursuant to Rule 25-7.014, F.A.C.

(6) Recovery of

costs under this rule does not preclude a utility from proposing inclusion of

unrecovered natural gas facilities relocation costs in base rates in a

subsequent rate proceeding. Recovery of costs under this rule does not preclude

inclusion of such costs in base rates in a subsequent rate proceeding, provided

that such costs are removed from the NGFRCRC.

Rulemaking

Authority 366.99, FS. Law Implemented 366.99, FS. History–New _____.