Case Background

On November 13,

2024, Peoples Gas System, Inc. (PGS or Company) filed a Petition for approval to create a new regulatory subaccount with a new amortization

rate and to reclassify the plant and reserve balances associated with certain

customer software. (Petition). The Company’s request is in accordance

with Rule 25-7.045(2)(a), Florida Administrative Code (F.A.C.), which provides

that “[n]o utility shall change any existing depreciation rate or initiate any

new depreciation rate without prior Commission approval;” and Rule

25-7.045(3)(a), F.A.C., which requires gas utilities to “maintain depreciation

rates and accumulated depreciation reserves in accounts or subaccounts in

accordance with the Uniform System of Accounts for Natural Gas Companies.”

As stated above,

pursuant to Rule 25-7.045(3)(a), F.A.C., gas utilities are required to maintain

depreciation rates and accumulated depreciation reserves in accounts or

subaccounts in accordance with the Uniform System of Accounts (USOA) for Public

Utilities and Licensees, as found in the Code of Federal Regulations, which is incorporated by reference in Rule

25-7.014(1), F.A.C.

The Company’s

current depreciation and amortization rates became effective January 1, 2024,

pursuant to Order No. PSC-2023-0388-FOF-GU, issued on December 27, 2023, in

Docket No. 20230023-GU.

PGS currently

records its capitalized software in Subaccount 303.01 – Custom Software, which

is a subaccount of FERC Account 303 – Miscellaneous Intangible Plant.

Subaccount 303.01 – Custom Software has a Commission-approved 15-year average

service life for depreciation and amortization purposes. According to the Petition, this existing

subaccount is used to record software that serves various functions within the

Company and also includes the Company’s Work and Asset Management system (WAM).

PGS states that,

after its recent review of the expected life of the WAM software, the Company

determined its investment in the WAM software should be amortized over a

20-year period instead of the 15-year period associated with the Company’s

custom software subaccount. As a result, PGS filed the instant Petition for

approval to establish a new subaccount titled subaccount 303.02 – Customized

Software - 20 Years, as a subaccount for FERC Account 303 − Miscellaneous

Intangible Plant, with a proposed 20-year amortization period.

Additionally,

PGS has proposed an effective date of January 1, 2025, for commencement of the

new subaccount, amortization period, and transfers of investment and reserve

for the WAM software (as of December 31, 2024) from Subaccount 303.01 to the

newly-created Subaccount 303.02.

The Commission has jurisdiction over this

matter pursuant to Sections 366.04, 366.05, and 366.06, Florida Statutes

(F.S.).

Discussion

of Issues

Issue 1:

Should PGS’s request to establish a new subaccount

with a new applicable amortization rate for the WAM software be approved, and

if so, what is the appropriate account classification and the associated

amortization rate?

Recommendation:

Yes. Staff recommends approval of PGS’s petition for

establishing a new subaccount for FERC

Account 303 − Miscellaneous Intangible Plant: Account 303.02 – Customized

Software - 20 Years, with a 15-year amortization period (annual amortization

rate of 5.0 percent). Further, staff believes the Commission should approve

PGS’s request to reclassify its customized software systems/platforms-related

plant and reserve, in the amounts of $40,634,908 and $4,087,761, respectively, from Account 303.01 to the

newly-created Account 303.02. (Kunkler)

Staff Analysis:

PGS’s Work and Asset Management System, referred to

as WAM, is software that manages the company’s assets. In its petition, PGS

explained the WAM software consolidates “the management of new construction,

system reliability, maintenance and compliance into a single interconnected

system.”

PGS further explained that the WAM software, consisting of 13 work types

(modules), was initially planned to be deployed in two phases.

The first phase, consisting of 6 modules, addresses the

needs of the Company’s Engineering, Construction and Technology team, and was

successfully implemented in November 2022. The second phase, consisting of the

remaining 7 modules, addresses the needs of the Company’s Gas and Safety

Operations teams. However,

prior to the release of the second phase, after a readiness review and risk

assessment, PGS identified two modules that were not ready to be implemented –

the Compliance module and the Damage Billing module. The Company decided to

defer the implementation of these 2 modules and deploy the other 5 modules in

May 2023. The Company then made additional modifications and improvements to

the WAM’s Compliance and Damage Billing modules, which were implemented and

placed into service in September 2023, completing the full deployment of the

system.

PGS explained that the WAM’s current 15-year service life

(amortization rate of 6.7 percent per year) is based on the most appropriate

approved depreciation account classification at the time of the Company’s most

recent depreciation study, filed April 4, 2023. PGS stated that at the time of

the aforementioned depreciation study, the WAM software was not yet an “evaluated

and analyzed” asset but rather a “2024 forecasted addition.”

Additionally, according to PGS, the WAM developer’s previous version of its

core enterprise resource planning (ERP) system was on the market for 33 years

(scheduled to end December 31, 2027) and PGS expects the newer version to have

a similar lifespan.

Therefore, in its instant petition, PGS is requesting the Commission’s approval

to create a new subaccount, titled 303.02 – Customized Software – 20 years,

with an amortization rate of 5.0 percent and to transfer the associated plant

and reserve balances of the WAM software to the newly created subaccount,

effective January 1, 2025. PGS maintains this action will “better align cost

recovery for the WAM software investment with the expected life of the

software.” Further,

this plant asset classification and the associated amortization rate are

consistent with the Commission’s prior orders for two other Florida utilities

(Florida Public Utilities Company and Florida City Gas).

When the Company filed its current petition, the expected

amount of plant investment and amortization reserve of the WAM software on the

requested effective date of January 1, 2025, is $40,634,908 and $4,087,761,

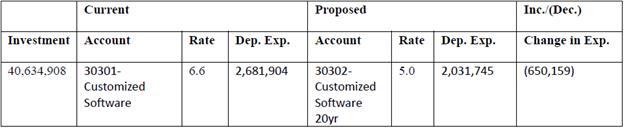

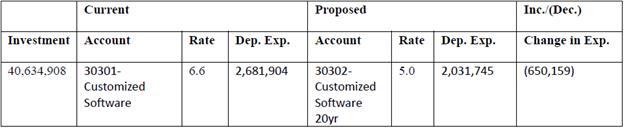

respectively. If

approved, the longer amortization period will reduce the Company’s annual

amortization expense by approximately $650,000 per year as detailed in Table 1

below. PGS claimed that using a 20-year, instead of a 15-year, amortization

period for the WAM software will have the benefit of decreasing the Company’s

revenue requirement when the Company’s base rates are next set.[12] Staff

notes that the Company has submitted a test year letter indicating it plans to

file a petition for a general base rate increase on March 31, 2025, seeking an

effective date of customer rates of January 2026.

Staff also notes that PGS is not required, per Rule 25-7.045, F.A.C., to file

its next depreciation study until April 4, 2028.

Table 1: Change in Amortization Expense – WAM Software

If approved, PGS will book amortization expense for the

WAM software in the newly created Account 303.02 – Customized Software at 5.0

percent annually, with an effective date of January 1, 2025. Staff notes that

PGS’s customers will continue to pay an embedded amortization expense for the

WAM software at the current (higher) rate of 6.7 percent until new customer

base rates are set. PGS acknowledges this fact but maintains that the

over-collection will only occur for a short period (one year), since it has

submitted a test year letter as stated above, requesting new customer base

rates effective January 1, 2026. PGS

does not propose to reduce customer rates or to offer a credit to reflect the

proposed reduction in amortization expense before January 1, 2026, so the amortization

expense reduction in 2025 is expected to help stabilize the Company’s earnings.

PGS stated that it’s expecting to earn below the authorized ROE band in 2025,

and changes such as this amortization reduction will serve to mitigate the need

for interim rates in its rate case filing.

Staff believes, in general, a company’s

depreciation/amortization rates should reflect the most accurate information

available. However, staff also has concerns about significant changes to

the depreciation/amortization rate and

expense for an isolated account, absent consideration of a corresponding change

to customer base rates. Staff requested that PGS calculate what the credit

amount on a residential customer bill at 20 therms would be to recognize the

reduction in amortization expense in 2025 if PGS’s petition were approved and

the Commission required such a credit to be made. PGS’s calculations resulted

in an approximate credit of $0.08 per month, applied during the months of April

2025 to December 2025, or $0.72 total, to account for the expected reduction in

depreciation expense. Given the Company’s primary reason for revising the WAM

asset amortization rate (i.e., the matching of the assets service life with the

cost recovery period), the relatively minor, short-lived customer credit

potential to recognize the reduction in amortization expense, and the various

earnings considerations cited above, staff does not believe a customer credit

in this instance is well-supported.

Staff agrees that

PGS has demonstrated a revision to the amortization rate for WAM software is

supported by the material change in the asset’s estimated service life, thereby

providing an improved match of expected service life to the cost recovery of

the asset. Further, this plant asset classification and the associated

amortization rate are consistent with the Commission’s prior orders.

Therefore, to ensure the most accurate estimated useful

life and associated amortization expense is recorded for the Company’s WAM software,

staff believes the Commission should approve PGS’s petition for establishing a new subaccount for FERC Account 303 −

Miscellaneous Intangible Plant: Account 303.02 – Customized Software - 20

Years, with a 15-year amortization period (annual amortization rate of 5.0

percent). Further, staff believes the Commission should approve PGS’s request

to reclassify its customized software systems/platforms-related plant and

reserve, in the amounts of $40,634,908 and $4,087,761, respectively, from Account 303.01 to the

newly-created Account 303.02.

Issue 2:

If the Commission approves staff’s recommendation in

Issue 1, what is the appropriate implementation date for the new Account 303.02,

as well as the reclassification of PGS’s WAM software from Account 303.01 to

Account 303.02?

Recommendation:

Staff recommends January 1, 2025, as the effective

date for the new Account 303.02, and the transfer of the associated plant and

reserve balances of the WAM software. (Kunkler)

Staff Analysis:

Depreciation and/or Amortization is the recovery of

invested capital representing equipment that is providing service to the

public. This recovery is designed to take place over the related period of

service to the public, which begins with the equipment’s in-service date.

If approved in Issue 1, PGS’s WAM software that is currently booked in Account 303.01, would

be reclassified to newly created Account 303.02, with a 20-year amortization period. Also, based on such approval, the unrecovered

balance of the WAM software would take place in Account 303.02. PGS proposed January

1, 2025 as the effective date for the

new Account 303.02 and the reclassification of the plant and reserve

balances of the WAM software from Account 303.01 to Account 303.02.

Staff believes

that the Company’s proposal of a January 1, 2025 effective date is appropriate

as it is in consistent with the purpose of the amortization.

Issue 3:

Should this docket be closed?

Recommendation:

If no person whose substantial interests are

affected by the proposed agency action, files a protest within 21 days of the

issuance of the order, this docket should be closed upon the issuance of a

consummating order. (Bloom, Crawford)

Staff Analysis:

At the conclusion of the protest period, if no

protest is filed, this docket should be closed upon the issuance of a

consummating order.