Case Background

On January 13,

2025, Peoples Gas System, Inc. (PGS or utility) filed a petition for approval

of modifications to the Swing Service Charges applicable to transportation

customers, Individual Transportation Service (ITS), and Off-System Service

(OSS).

In 2000, the

Commission approved PGS’ Natural Choice Program, which enabled customers to

more easily receive transportation service from the utility by consolidating

and simplifying the existing transportation programs. The Natural Choice Program offered two

types of transportation service: a “pooled” service through the Natural Choice

Transportation Service (NCTS) and “individual” service through the ITS Rider.

NCTS customers are pooled together in groups and are supplied gas by a Pool

Manager, which is a third-party natural gas marketer.

The Pool Manager

is responsible for supplying and managing natural gas for its customer pool as

well as acquiring firm upstream capacity from PGS. While Pool Managers deliver

a fixed daily quantity of gas supply and capacity, the amount of gas actually

consumed by NCTS customers varies. As a result, PGS varies (or swings) the

level of gas and capacity delivered to the utility’s system through operational

purchases and sales in order to balance the system. The cost to swing gas adds

costs to the Purchased Gas Adjustment (PGA) clause, paid for by PGS’ sales

customers.

The Swing

Service Charge is designed to recover the cost to swing gas for transportation

customers and is credited to the PGA clause. The Swing Service Charge is a

cents per therm charge applicable to NCTS customers, who purchase gas from

third party marketers, and therefore do not pay the PGA charge. In 2015, the

Commission approved updated calculations for the Swing Service Charges to

reflect PGS’ then-current cost of providing swing service. In the instant petition, PGS is proposing

to update the methodology and calculations of the costs included in estimating

system balancing costs, resulting in revised Swing Service Charges.

With respect to

the ITS Rider, PGS is proposing to increase the eligibility threshold from

182,500 to 500,000 annual therms and to add a requirement to receive a certain

minimum daily pipeline capacity from PGS (vs. receiving capacity from a third

party). Finally, PGS proposed a change to the sharing mechanism contained in

its OSS tariff, which was first approved in 1994.

PGS currently

has a rate case proceeding in Docket No. 20250029-GU before the Commission

(rate case docket), with the hearing currently scheduled for September 8 – 11,

2025. By Order No. PSC-2025-0090-PCO-GU, the Commission suspended the proposed modifications

for further review by staff. During evaluation of the petition, staff

issued two data requests to the utility for which responses were received April

1 and May 5, 2025. On June 9, 2025, staff held an informal meeting on this

docket with PGS and the Office of the Public Counsel. Furthermore, the utility

provided written responses that have included in the docket file.

The proposed

tariff revisions are shown in Attachment A to the recommendation. The

Commission has jurisdiction over this matter pursuant to Sections 366.04,

366.041, 366.05, and 366.06, Florida Statutes.

Discussion

of Issues

Issue 1:

Should the Commission approve the proposed

modifications to the swing service charge, ITS rider, and OSS sharing mechanism?

Recommendation:

Yes, the Commission should approve the proposed

modifications to the swing service charge, ITS rider, and OSS sharing mechanism.

If the Commission approves the revised OSS sharing mechanism, PGS should be

required to reflect the revised OSS net revenues in its rate case docket

(Docket No. 20250029-GU). The proposed changes, as a whole, are designed to

improve the allocation of costs between transportation and PGA customers. The revised

swing service charges (Tariff Sheet No. 7.101-3) and OSS tariff (Tariff Sheet

No. 7.702-1) should become effective on the date of the Commission’s vote. The revisions

to the ITS rider (Tariff Sheet Nos. 7.805 and 7.805-9) should take effect 12

months after the Commission vote to allow for customer notification. (McClelland)

Staff Analysis:

The utility contends that its

proposed changes to the swing service charge, ITS rider, and OSS sharing

mechanism are designed to improve the allocation of costs between

transportation and PGA customers. Therefore, staff believes it is best to

analyze the utility’s proposed tariff changes as whole.

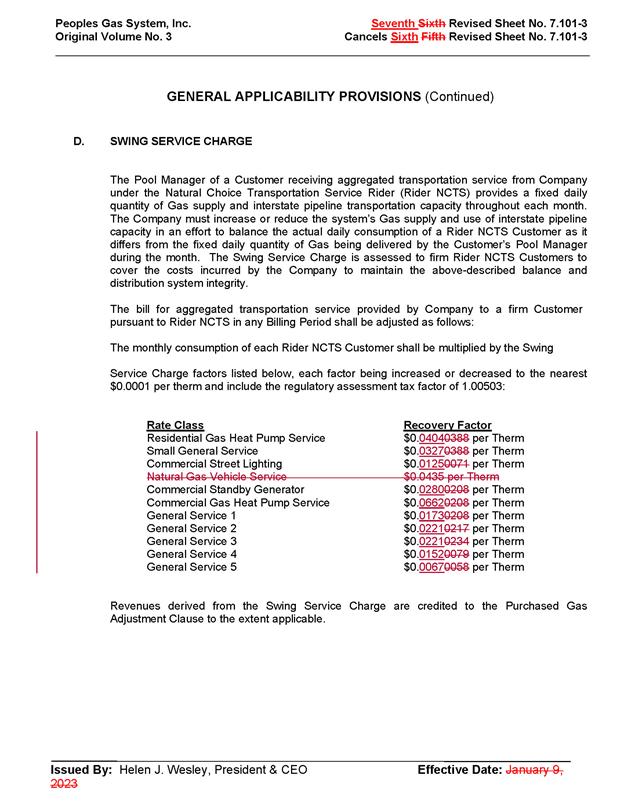

Modifications to the Swing Service Charge

The swing service charge is assessed to all transportation customers

who take service under PGS’s NCTS Rider. Costs to balance the system are calculated

based on six primary tools Peoples uses to balance its system. The six tools

are (1) reserve capacity, (2) swing gas supply, (3) No Notice transportation

service, (4) storage contracts, (5) swing sale agreements, and (6) upstream

pipeline park and loan services. PGS is

proposing to update four of the six tools to estimate system balancing costs.

The four modifications are discussed in more detail below.

Modifications to the Reserve Capacity

Calculation

Reserve capacity is interstate and intrastate pipeline

capacity contracted to be available when customer usage increases. Capacity

cost represent the reservation charges Peoples pays pipeline companies based on

how much capacity Peoples reserves. Peoples provides a monthly release of

upstream pipeline capacity to the NCTS pool managers and charges the pool

managers for released capacity at the weighted average cost of capacity (WACC).

WACC are expressed in dollars per MMBtu and are the weighted average costs per

day of firm transportation rights held by PGS pursuant to contracts with

delivering pipelines.

PGS proposed to modify the calculation of the WACC. The

existing formula divides the total interstate and intrastate capacity cost,

less ITS capacity release credits, by the total interstate and intrastate

capacity quantity, less ITS capacity release quantity. PGS explained that

historically, the utility only used interstate pipelines, such as the Florida

Gas Transmission Company (FGT), to transport natural gas into Florida. About 10

years ago, utilities also began using intrastate pipelines to transport natural

gas.

The proposed change would eliminate intrastate capacity

quantity from the denominator of the formula. PGS explained that the inclusion

of both interstate and intrastate capacity was duplicative and distorted the

WACC formula. Transporting gas on an interstate pipeline and then transporting

that same gas again on an intrastate pipeline would double-count that quantity

in the existing WACC formula. Double-counting the quantity would create a

larger denominator in the WACC formula, which would in turn result

mathematically in a lower WACC. PGS’ justification for the updated formula is

to prevent understating the cost of capacity and under-collecting full capacity

costs from the NCTS pool managers.

Modifications to the Swing Gas Supply

PGS explained in its petition that the utility currently

calculates swing gas supply based off a 30-day rolling average of Platts Gas

Daily FGT Zone 3 prices. PGS has proposed to modify the calculation to account

for recurring purchases of gas from Transco Zone 5. PGS explained the utility

also purchases swing gas supply at the Southern Natural Gas Pipeline and Elba Express

Pipeline, which is priced at the Transco Zone 5 index. The proposed

modifications will more closely reflect actual costs incurred by PGS to

purchase swing gas supply.

Update to No Notice Transportation Service

No Notice Transportation Service (NNTS) is a firm rate

schedule offered by FGT and represents the quantity by which a shipper’s (e.g.,

PGS) actual delivery quantities vary from scheduled deliveries. PGS states in

its petition that the Federal Energy Regulatory Commission (FERC) recently issued

an order regarding the most recent FGT rate case, modifying FGT’s rates. PGS’

proposed changes to the swing service calculation reflect the updated

FERC-approved NNTS rates. Approval of the proposed rates would enable PGS to

pass through all FGT pipeline charges to the customers incurring them.

Storage Contracts – Modification to Add Gas Commodity

Costs

Storage contracts are held with storage facilities,

typically subterranean salt domes, and are used to manage supply and demand

constraints as well as price volatility. In the process of storing gas supply,

PGS typically incurs injection costs, withdrawal costs, and capacity

reservation costs, on top of the cost of gas purchased.

Currently, PGS only recovers capacity reservation fees in

the swing service rider, which are the charges for contracted storage quantity

(i.e., storage space). PGS is seeking to modify the calculation to also recover

injection and withdrawal costs as they contribute to the actual storage

contract expenses the utility incurs. In paragraph 37 of the petition, PGS

states that they would modify the calculation for storage contracts by adding

three components included with “one turn of storage.” “One turn of storage”

refers to one complete cycle of injecting and withdrawing natural gas from a

storage facility.

PGS explained during its meeting with staff that the utility

typically signs a storage contract for anywhere between four and twelve turns

of storage in one year. PGS proposed to allocate one turn of storage to the

swing service rider. PGS explained that the number of turns used varies based

on market conditions and system peaks, and the storage contract only charges

the utility for as many turns as are actually used. PGS believes that one turn

of storage accurately covers the quantities of stored gas demanded by swing

service customers.

Removal of Natural Gas Vehicle Service (NGVS)

from Tariff Sheet

The Swing Service Charge (Tariff Sheet No. 7.101-3) and

NCTS Rider (Tariff Sheet No. 7.803) currently include reference to the NGVS

class, which was terminated in Docket No. 20200051-GU.

PGS has requested to remove mention of the closed NGVS class from the two

existing tariff sheets.

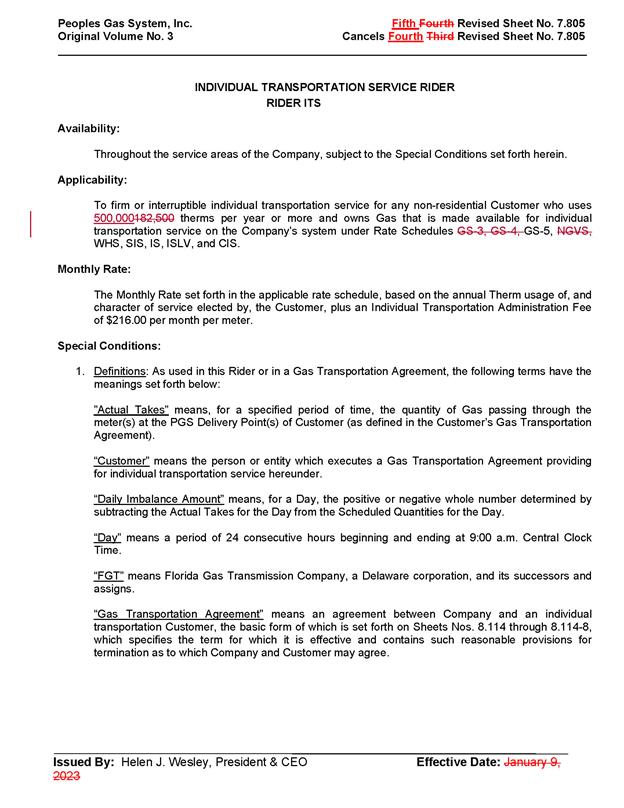

Modifications to ITS Rider

Under PGS’ ITS Rider, commercial and industrial customers

take transportation service on an individual basis and choose their own gas

supplier. Currently, ITS customers are not required to acquire upstream

capacity release from PGS. ITS Rider customers purchase their capacity either

directly from the interstate pipeline, through a third-party marketer, or by receiving

a capacity release from PGS. ITS customers do not pay a PGA or swing service

rider charge as they receive capacity releases and the natural gas commodity

from a third party. When PGS releases capacity to the ITS, the interstate

pipeline handles the transaction. The capacity is released by PGS through the

interstate pipeline’s electronic bulletin board. ITS customers purchase

capacity off the electronic bulletin board and are billed by the interstate

pipeline according to their FERC approved tariff. PGS is then credited for any

revenues by the interstate pipeline. The

revenues are in turn credited to the PGA.

PGS has proposed two modifications to the ITS Rider.

First, PGS has proposed to raise the threshold to qualify for the ITS Rider from

182,500 therms per year to 500,000 therms per year. All current ITS customers

below the threshold will be transferred to the Rider NCTS program. Currently, PGS anticipates transferring 61

out of 174 existing ITS customers to NCTS, leaving 113 customers as ITS Rider customers,

as explained during the utility’s meeting with staff. ITS customers are not

subject to the swing service charge, while NCTS customers are; this transfer

will subject additional customers to the swing service charge, thus increasing

the overall amount recovered through the swing service rider. Revenues

collected through the swing service rider are credited to the PGA. Therefore,

an increase in the revenues collected through the swing service rider would

provide benefits to customers subject to the PGA, primarily residential and

small commercial customers. PGS explained in its responses to staff that examples

of customers that consume more than 500,000 therms annually include paper

mills, citrus processors, or large hospitals.

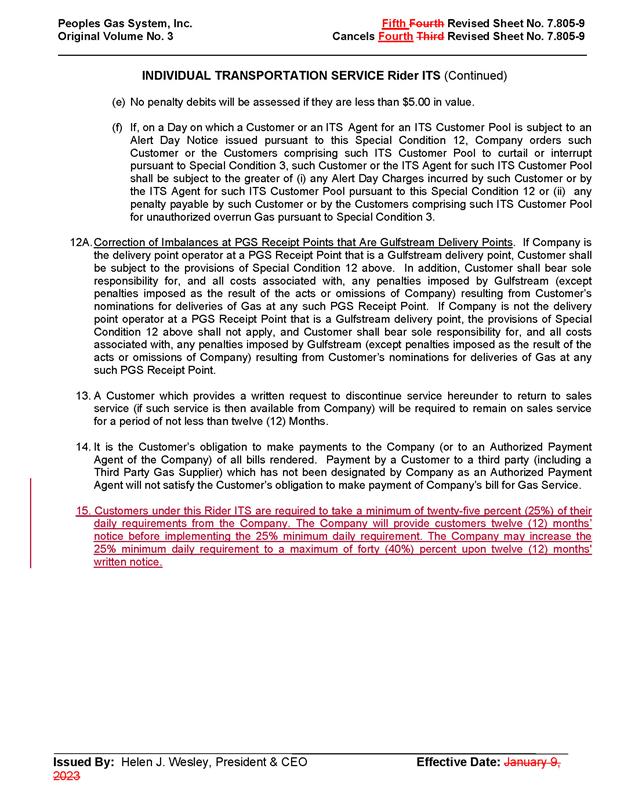

Second, PGS has proposed to modify ITS Rider to require

customers to take a minimum percentage of 25 percent of their daily capacity

release requirement from PGS. PGS stated that currently only 13 percent of ITS Rider

customers take capacity release from PGS. In response to staff’s second data

request No. 9, PGS provided three benefits to an ITS customer to elect to

receive the utility’s capacity vs. the capacity of a third-party marketer:

reliability, price, and flexibility. PGS

stated that increasing the amount of capacity released to ITS customers allows

for recovery of more of the overall capacity costs from those customers

utilizing such capacity and any capacity costs recovered through capacity

release will be directly credited to the PGA. PGS estimated a credit of $3

million to the PGA in 2026 as a result of the proposed change.

The proposed ITS tariff revisions also would allow PGS to

require a minimum of as much as 40 percent capacity release requirement. PGS

explained in its response to staff that it would increase the minimum release

requirement when the utility forecasts having sufficient excess capacity; excess

capacity could not be released through OSS sales; and the release of

incremental capacity would be beneficial to the ITS customers (improved reliability

or reduced costs). PGS further stated that it has the highest scheduling

priority on the interstate pipelines; therefore, the utility’s capacity is the

most reliable. In its petition, PGS committed to providing impacted ITS

customers a minimum of 12 months written notice prior to the effective date of

the tariff change. PGS also committed to continuing to communicate with

impacted ITS customers throughout the period leading up to the change.

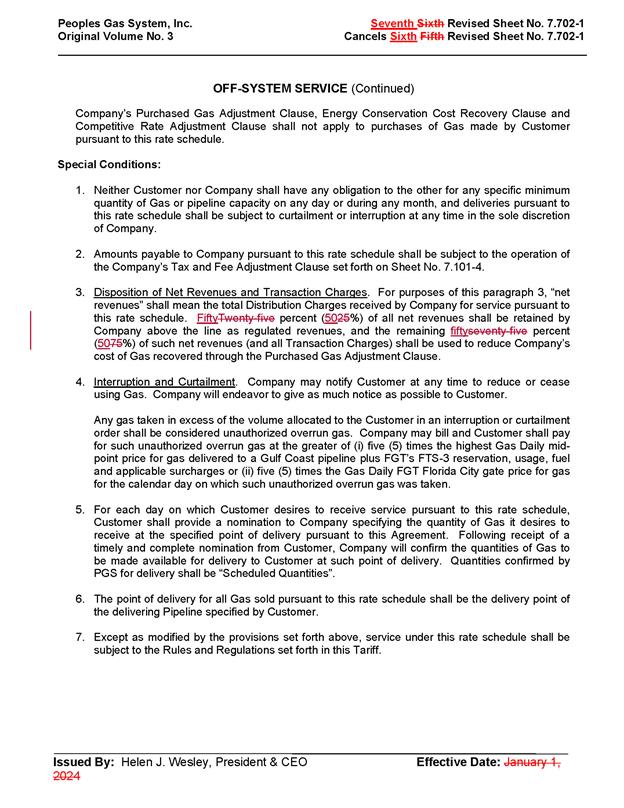

Proposed Revision to OSS Sharing

The Commission first approved the OSS rate schedule in

Order No. PSC-94-1187-FOF-GU.

The original order outlined that the OSS was to allow the utility to make

capacity sales to customers not connected to the PGS distribution system, and

revenues received from off-system sales would be shared 50/50 between PGS as

above the line revenues and as a credit to the PGA. These off-system sales

provide additional revenues to the utility and its general body of ratepayers. The

OSS rate schedule was devised to allow the utility to make interruptible sales

of unused capacity reserved on the interstate pipelines. As the utility paid

for capacity whether or not it was ultimately used, the OSS schedule permitted

the utility to recover costs during times when customers’ gas requirements are below

the capacity reserved by PGS.

In PGS’ 2002 rate case, PGS originally proposed to

maintain the 50/50 OSS sharing mechanism, while including no OSS sales in test

year revenues. In Order PSC-03-0038-FOF-GU, the Commission approved the

proposal to include $500,000 in off-system sales in test year revenues and

amend the sharing to a 25/75 split, with 25 percent of the revenues retained by

the utility as above the line regulated revenues and 75 percent credited to the

PGA. In

PGS’ 2008 rate case, the Commission maintained the 25/75 sharing mechanism and

increased OSS revenues to $1.5 million for the test year to reflect higher OSS

revenues.

In its current 2025 rate case docket, PGS filed MFRs under

the current 25/75 sharing and included $2.6 million (25 percent) in OSS net

revenues in operation revenues. PGS stated that if the Commission approved the

revision to the sharing mechanism in this docket, PGS would increase the OSS

margin from 25 to 50 percent and increase OSS net revenues in the rate case to

$5.3 million. Staff notes that the amount of projected OSS revenues for the

test year is an issue to be determined by the Commission in PGS’ rate case

docket. Any increase in other operating revenues decreases the revenue

requirement to be recovered through base rates.

In the instant petition, PGS has now proposed to modify

the OSS sharing mechanism from a 25/75 to a 50/50 basis, as originally approved

in 1994. Under a 50/50 sharing, 50 percent of net off-system revenues would be

credited to the PGA, and 50 percent included as projected OSS revenues for the

2026 test year in the rate case docket. To support this change, PGS stated that

the 50/50 sharing would align the utility with the off-system sales sharing

mechanism currently used by Florida Public Utilities Company and Florida City

Gas and their respective Commission-approved OSS rate schedules.

Furthermore, the utility stated in their responses to

staff’s first data request that under the proposed 50/50 sharing mechanism, the

utility would be able to “enhance the projected OSS revenue for 2026, thereby

reducing the base revenue requirement in Docket No. 20250029-GU for 2026 and

providing long-term savings embedded within base rates for customers.” Staff notes that the proposed revision to the

sharing mechanism reduces the percentage of OSS revenues allocated to the PGA

(from 50 to 25 percent); however, the changes to the ITS Rider discussed above

would increase the credit to the PGA.

Therefore, as a whole, PGS’ proposal provides a reasonable approach as

to how the utility allocates costs and benefits between transportation and

sales customers.

Conclusion

Based on the above, the Commission should approve the

proposed modifications to the swing service charge, ITS rider tariffs, and OSS

tariff. If the Commission approves the revised OSS sharing mechanism, PGS

should be required to reflect the revised OSS net revenues in its rate case

docket (Docket No. 20250029-GU). The proposed changes, as a whole, are designed

to improve the allocation of costs between transportation and PGA customers.

The revised swing service charges (Tariff Sheet No. 7.101-3) and OSS tariff (Tariff

Sheet No. 7.702-1) should be effective on the date of the Commission’s vote. The

revisions to the ITS rider (Tariff Sheet Nos. 7.805 and 7.805-9) should take

effect 12 months after the Commission vote to allow for customer notification.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If Issue 1 is

approved and a protest is filed within 21 days of the issuance of the order,

the tariffs should remain in effect, with any revenues held subject to refund,

pending resolution of the protest. If no timely protest is filed, this docket

should be closed upon the issuance of a consummating order. (Sandy)

Staff Analysis:

If Issue 1 is approved

and a protest is filed within 21 days of the issuance of the order, the tariffs

should remain in effect, with any revenues held subject to refund, pending

resolution of the protest. If no timely protest is filed, this docket should be

closed upon the issuance of a consummating order.